BTCFi'nin Oyunun Sonu: @satlayer

+ Bitcoin LST'lerinin evi

+ BABY Sıvı Staking Çözümü Olarak

+ Bitcoin Onaylı Hizmetler

🧵

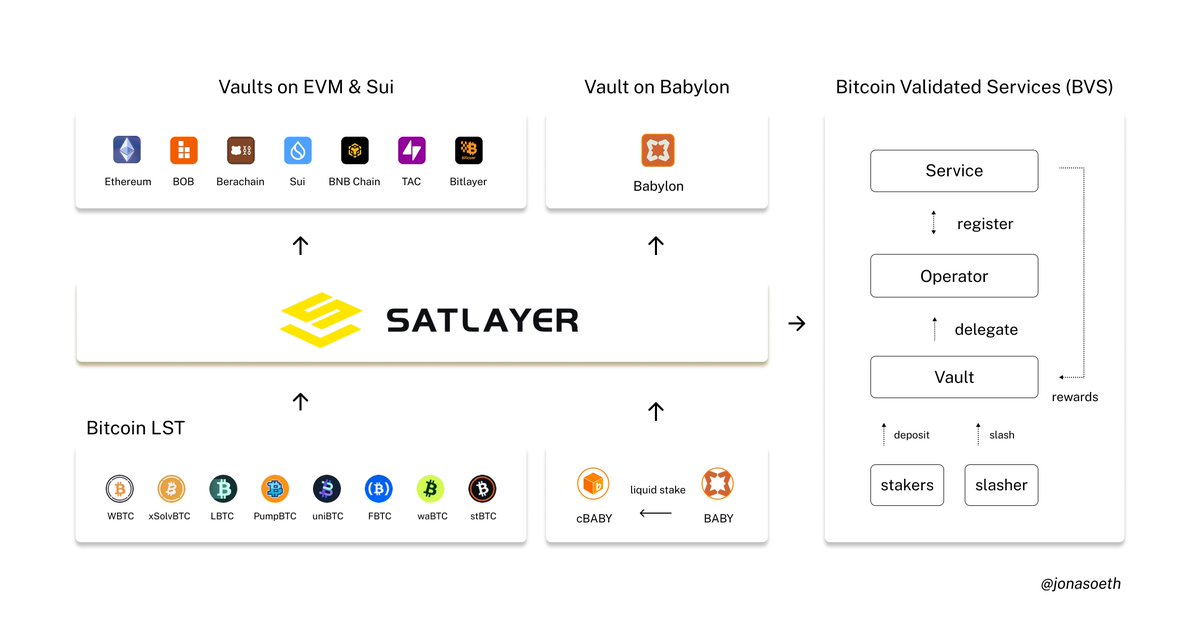

1 - Babylon Ekosistemindeki Satlayer'ın Temel Direkleri

Satlayer, Babylon ve EVM ekosistemleri için temel altyapıyı oluşturuyor

+ Bitcoin LST'nin Evi: Zincir üstü likiditeyi artırmak için hem EVM hem de EVM olmayan ekosistemlere Bitcoin LST sağlamak

+ BABY'yi Stake Etme: Güvenli kasalar aracılığıyla yeniden stake etme desteği ile cBABY'yi basmak için CUBE aracılığıyla BABY'nin likit stake edilmesini etkinleştirme

+ Bitcoin Onaylı Hizmetler: Babylon üzerine inşa edilen dApp'lerin güvenliğini ve ademi merkeziyetçiliğini geliştirmek için Bitcoin staking'den yararlanma

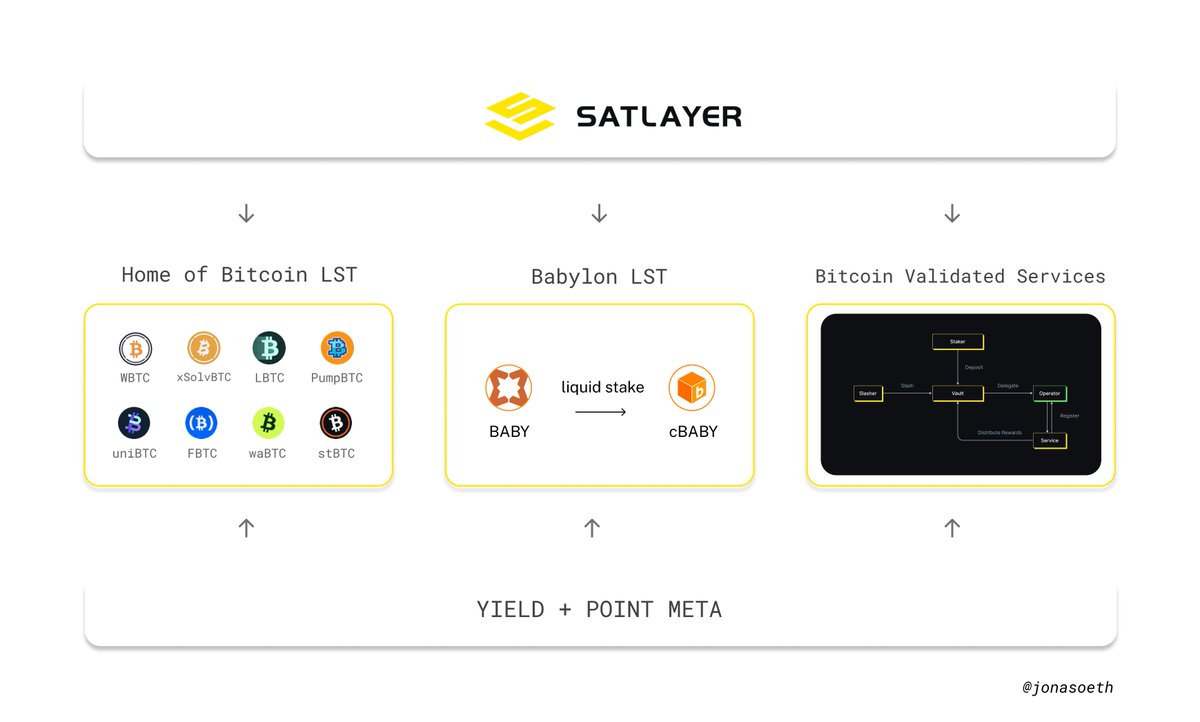

2 - Satlayer, Bitcoin LST'lerinin evidir

Satlayer, getiri ve puan metasından yararlanarak yeniden başlatma yoluyla Bitcoin LST'lerinin getirisini artırıyor

$WBTC & $LBTC gibi en iyi Bitcoin LST'lerini destekler

Ayrıca EVM zincirleri ve Sui ve Berachain gibi EVM olmayan platformlarla da uyumludur

400 milyon doların üzerinde Bitcoin değeri şu anda Satlayer'da bulunuyor ve bu da onu DeFi'deki en büyük Bitcoin kasalarından biri haline getiriyor

Src:

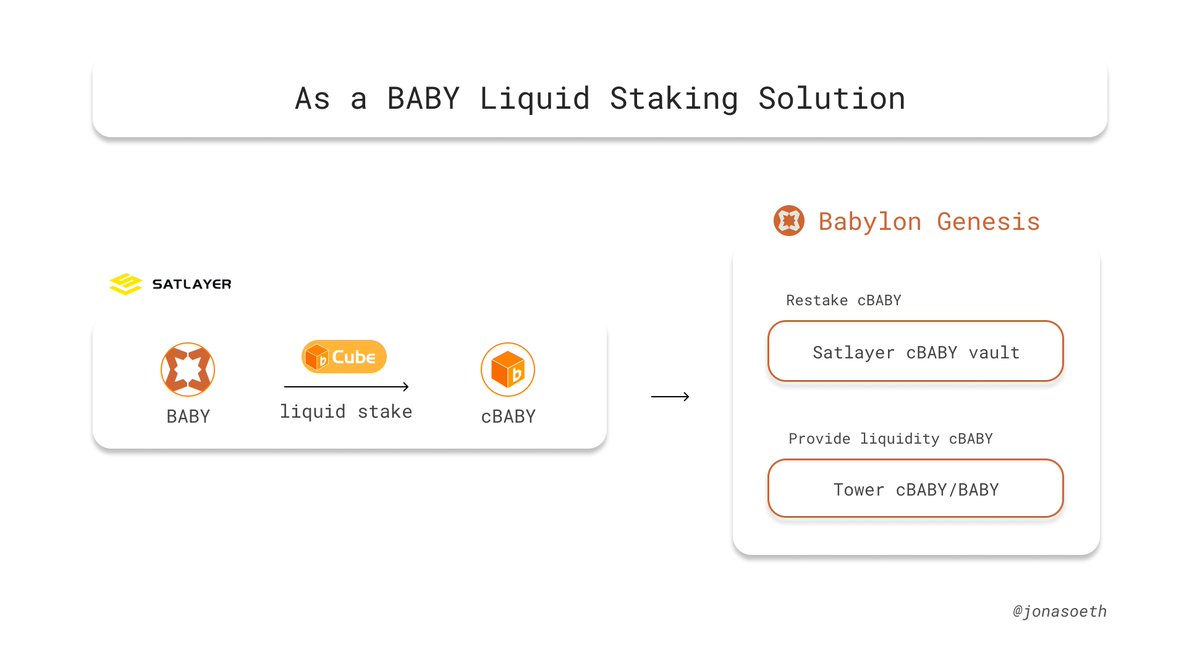

3 - BABY Sıvı Staking Çözümü Olarak

SatLayer's Cube, @babylonlabs_io Genesis üzerine inşa edilmiş, $BABY tokenize eden ve yeniden alım kasası aracılığıyla verimi artıran BABY için bir platformdur

Hızlı kılavuz:

+ BABY stake edin, cBABY alın

+ DeFi'de cBABY kullanırken staking ödülleri kazanın

+ Ekstra getiri elde etmek ve BVS'yi güvence altına almak için cBABY'yi yeniden stake edin

+ Babil'e özgü, köprüleme gerekmez

cBABY/BABY'ye likidite sağlayarak daha fazla @Tower Puanı kazanın

Src:

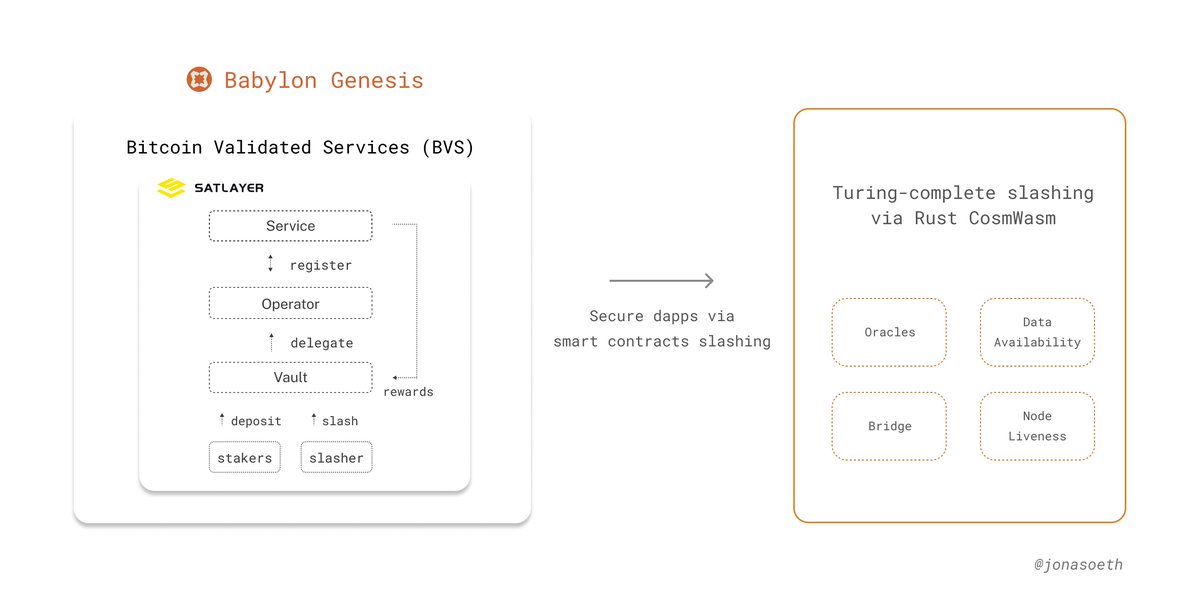

4 - Bitcoin Onaylı Hizmetler (BVS)

SatLayer, Babylon'da aktif bir güvenlik ilkeli olarak Bitcoin'in kilidini açar ve BVS, SatLayer'ın II. Aşamasında Stratejik Bir Üründür

+ Amaç: Yeniden yapılandırılmış Bitcoin ve programlanabilir slashing kullanarak zincir dışı hizmetleri güvenli hale getirin

+ Mekanizma: Staker'lar BTC'yi kilitler → BTC, SatLayer aracılığıyla yeniden başlatılır → Operatörler hizmetleri çalıştırır → Yanlış davranış özel eğik çizgi ile cezalandırılır

Çekirdek Katılımcılar ↓

+ Hizmet: Bitcoin destekli güvenlik kullanan hizmetler

+ Operatörler: Hizmetleri çalıştıran ve doğrulayan varlıklar

+ Staker'lar: BTC'yi yeniden stake eden ve ödüller kazanan kullanıcılar

SatLayer, Babylon Genesis'in üzerine akıllı sözleşme tabanlı bir eğik çizgi ve yeniden alım katmanı oluşturarak güvenlik ve programlanabilirlik boşluğunu doldurur

+ CosmWasm akıllı sözleşmeleri ile oluşturulmuştur

+ Özel eğik çizgi ve programlanabilir teşvikler sağlar

+ Köprüler, oracle'lar ve DA katmanları gibi daha karmaşık hizmetleri destekler

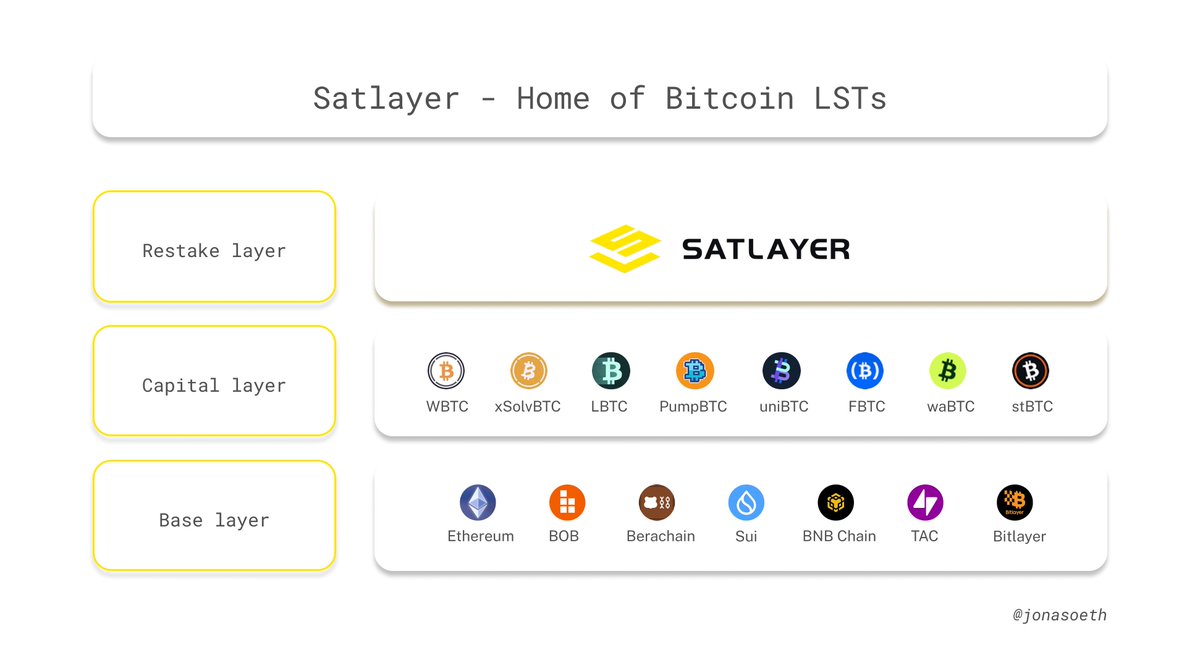

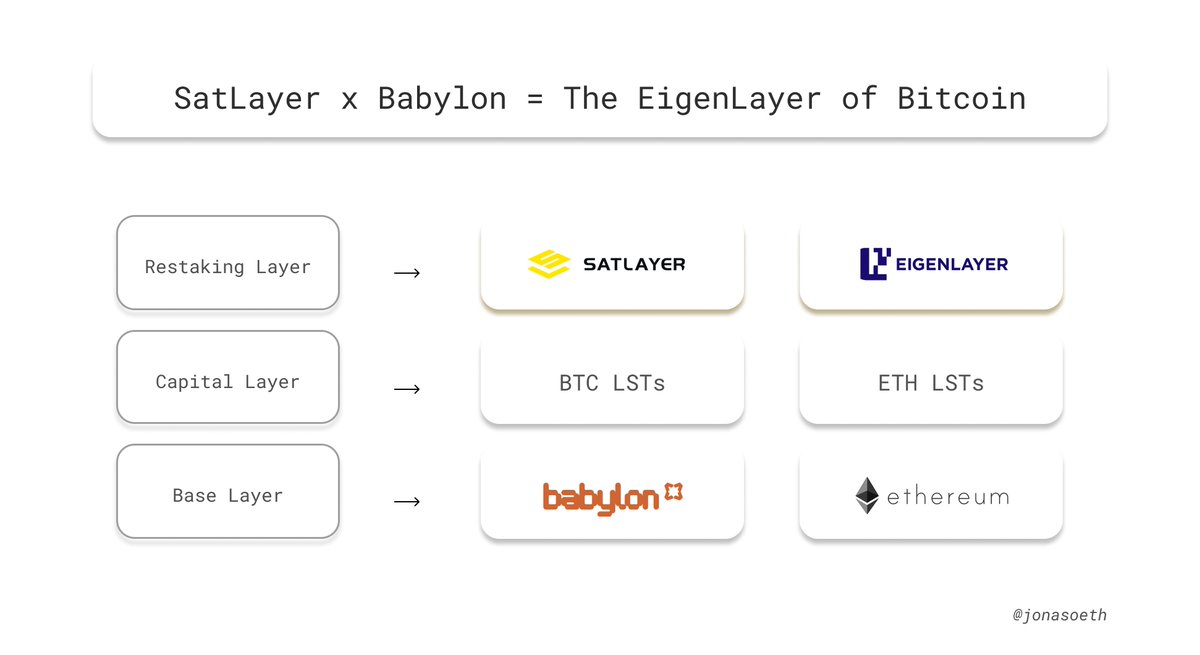

5 - SatLayer x Babylon = Bitcoin'in ÖzKatmanı

Katman Dağılımı ↓

Temel Katman: Babylon (SatLayer) ↔ Ethereum (EigenLayer)

→ Her ikisi de ekonomik ve güvenlik ilkellerini mümkün kılan temel PoS zincirleri olarak hizmet eder.

Sermaye Katmanı: BTC LST'ler ↔ ETH LST'ler

+ SatLayer, LBTC, uniBTC, xSolvBTC gibi Bitcoin LST'yi kullanır

+ EigenLayer, stETH, rETH gibi ETH LST kullanır

Yeniden Yerleştirme Katmanı: SatLayer ↔ EigenLayer

→ Her ikisi de, stake edilen varlıkların harici hizmetleri (oracle'lar, DA katmanları, köprüler) kesme koşullarıyla güvence altına almak için yeniden yapılandırılmasına izin verir.

Aynı Tasarım Felsefesi, Farklı Varlık Tabanı

SatLayer, BTC sermayesinin Babylon aracılığıyla zincir dışı hizmetleri güvence altına almasını sağlamak → EigenLayer'ın Bitcoin'e özgü eşdeğerini oluşturuyor

EigenLayer, ETH LST'lerini yeniden alırken, SatLayer, CosmWasm'da tam programlanabilirlik ile BTC LST'lerini yeniden alır

6 - Uydu Katmanı CT'leri izleme listesi

▸ @Lukex

▸ @0xniccomi

▸ @standotsui

▸ @DoggfatherCrew

▸ @Seymirel

▸ @YashasEdu

▸ @_SirJoey

▸ @eli5_defi

▸ @solashenone

▸ @defi_mago

▸ @shannholmberg

▸ @0x_xifeng

Satlayer güncellemelerinden haberdar olmak için bu hesapları takip edin

105,43 B

81

Bu sayfadaki içerik üçüncü taraflarca sağlanmaktadır. Aksi belirtilmediği sürece, atıfta bulunulan makaleler OKX TR tarafından kaleme alınmamıştır ve OKX TR, bu materyaller üzerinde herhangi bir telif hakkı talebinde bulunmaz. İçerik, yalnızca bilgilendirme amaçlı sağlanmıştır ve OKX TR’nin görüşlerini yansıtmaz. Ayrıca, sunulan içerikler herhangi bir konuya ilişkin onay niteliği taşımaz ve yatırım tavsiyesi veya herhangi bir dijital varlığın alınıp satılmasına yönelik davet olarak değerlendirilmemelidir. Özetler ya da diğer bilgileri sağlamak için üretken yapay zekânın kullanıldığı durumlarda, bu tür yapay zekâ tarafından oluşturulan içerik yanlış veya tutarsız olabilir. Daha fazla ayrıntı ve bilgi için lütfen bağlantıda sunulan makaleyi okuyun. OKX TR, üçüncü taraf sitelerde barındırılan içeriklerden sorumlu değildir. Sabit coinler ve NFT’ler dâhil olmak üzere dijital varlıkları tutmak, yüksek derecede risk içerir ve bu tür varlık fiyatlarında büyük ölçüde dalgalanma yaşanabilir. Dijital varlıkları alıp satmanın veya tutmanın sizin için uygun olup olmadığını finansal durumunuz ışığında dikkatlice değerlendirmelisiniz.