The Endgame of BTCFi : @satlayer

+ Home of Bitcoin LSTs

+ As a BABY Liquid Staking Solution

+ Bitcoin Validated Services

🧵

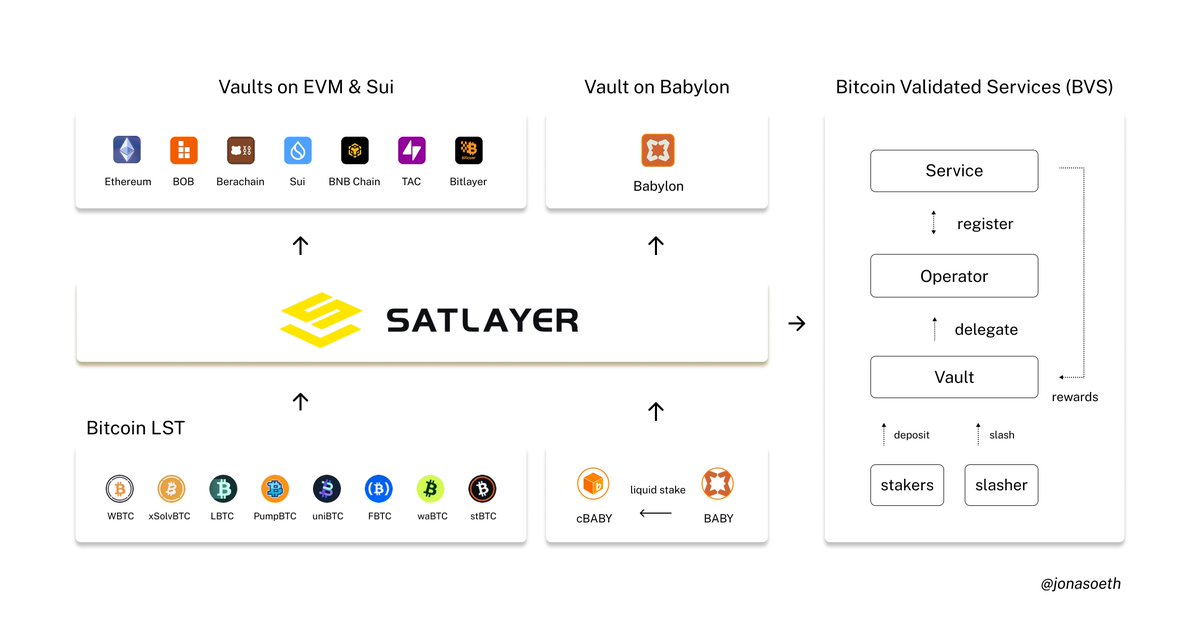

1 - Core Pillars of Satlayer in the Babylon Ecosystem

Satlayer is building the foundational infrastructure for Babylon and EVM ecosystems

+ Home of Bitcoin LST: Providing Bitcoin LST to both EVM and non-EVM ecosystems to boost on-chain liquidity

+ Staking BABY: Enabling liquid staking of BABY via CUBE to mint cBABY, with support for restaking through secure vaults

+ Bitcoin Validated Services: Leveraging Bitcoin staking to enhance the security and decentralization of dApps built on Babylon

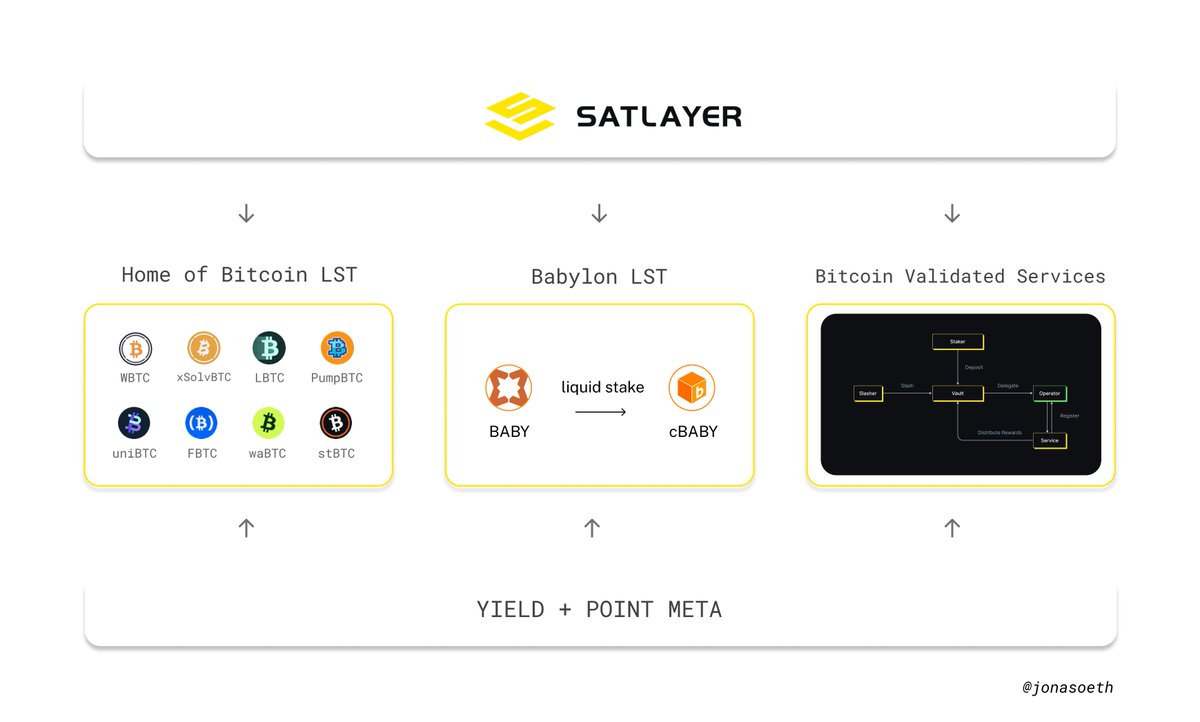

2 - Satlayer is the home of Bitcoin LSTs

Satlayer boosts Bitcoin LSTs' yield via restaking, leveraging yield and point meta

It supports top Bitcoin LSTs like $WBTC & $LBTC

Also compatible with EVM chains and non-EVM platforms like Sui & Berachain

Over $400M in Bitcoin value is now restaked on Satlayer, making it one of the largest Bitcoin vaults in DeFi

src:

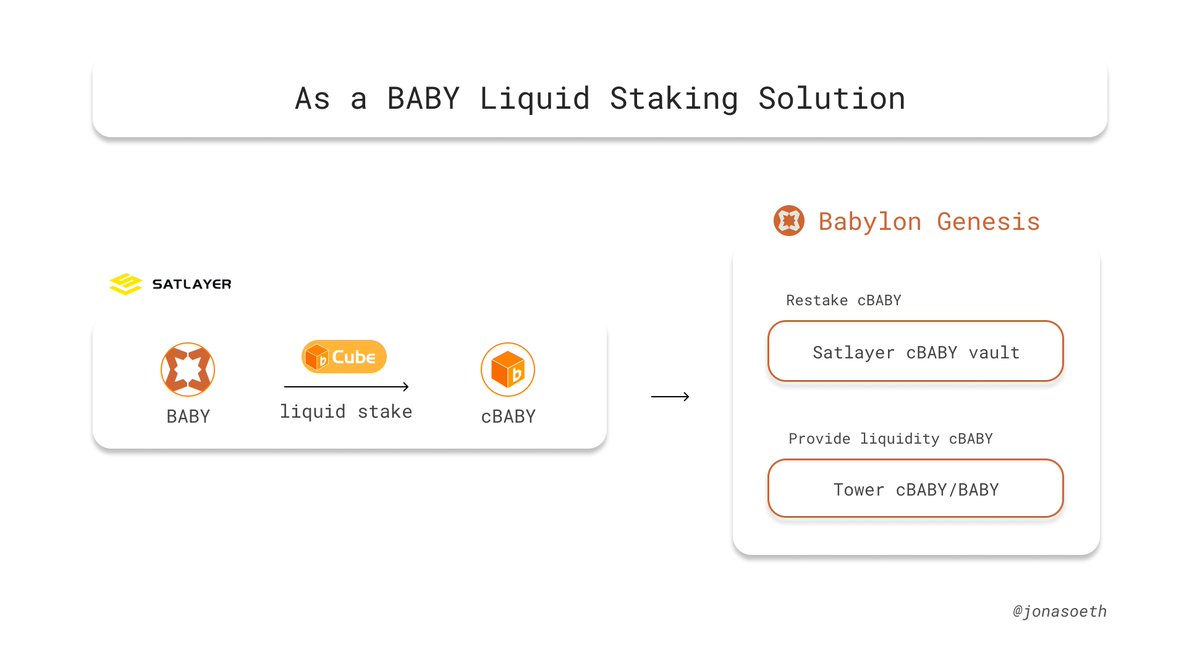

3 - As a BABY Liquid Staking Solution

SatLayer's Cube is a platform for BABY, built on @babylonlabs_io Genesis, that tokenizes $BABY and boosts yield through its restake vault

Quick guide:

+ Stake BABY, receive cBABY

+ Earn staking rewards while using cBABY in DeFi

+ Restake cBABY to earn extra yield and secure BVS

+ Native to Babylon, no bridging needed

Earn more @Tower Points for providing liquidity to cBABY/BABY

src:

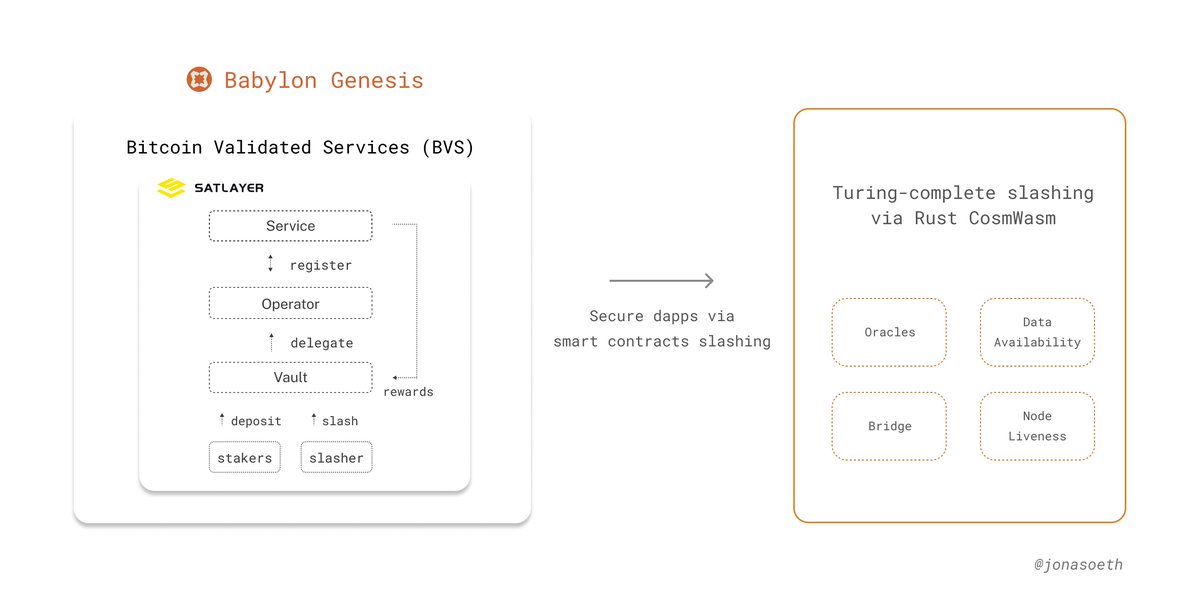

4 - Bitcoin Validated Services (BVS)

SatLayer unlocks Bitcoin as an active security primitive on Babylon and BVS is Strategic Product in Phase II of SatLayer

+ Purpose: Secure off-chain services using restaked Bitcoin and programmable slashing

+ Mechanism: Stakers lock BTC → BTC is restaked via SatLayer → Operators run services → Misbehavior is penalized via custom slashing

Core Participants ↓

+ Service: The services using Bitcoin-backed security

+ Operators: Entities running and validating services

+ Stakers: Users who restake BTC and earn rewards

SatLayer fills the security and programmability gap by building a smart-contract-based slashing and restaking layer on top of Babylon Genesis

+ Built with CosmWasm smart contracts

+ Enables custom slashing and programmable incentives

+ Supports more complex services like bridges, oracles, and DA layers

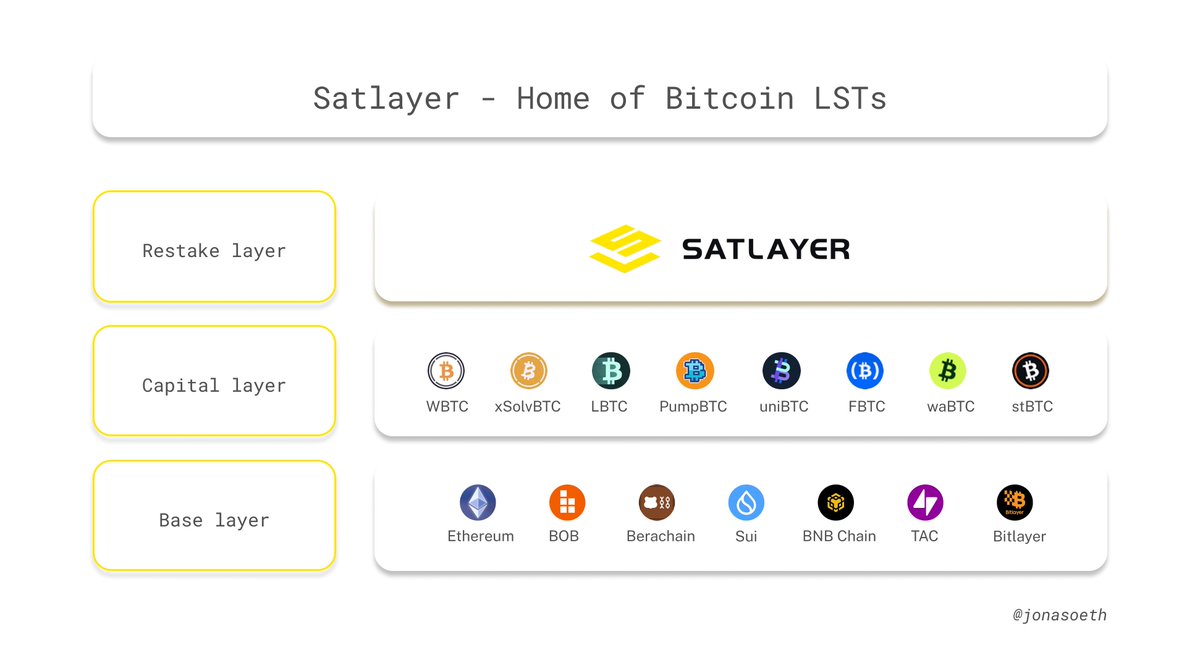

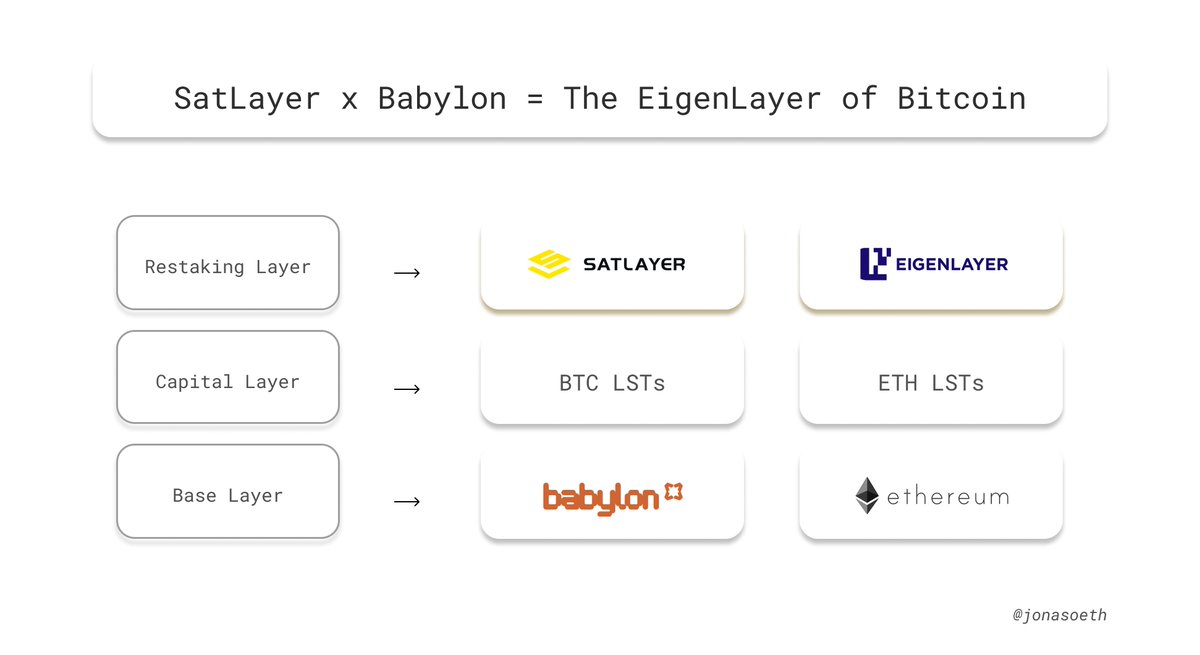

5 - SatLayer x Babylon = The EigenLayer of Bitcoin

Layer Breakdown ↓

Base Layer: Babylon (SatLayer) ↔ Ethereum (EigenLayer)

→ Both serve as foundational PoS chains enabling economic and security primitives.

Capital Layer: BTC LSTs ↔ ETH LSTs

+ SatLayer uses Bitcoin LST like LBTC, uniBTC, xSolvBTC

+ EigenLayer uses ETH LST like stETH, rETH

Restaking Layer: SatLayer ↔ EigenLayer

→ Both allow staked assets to be restaked to secure external services (oracles, DA layers, bridges) with slashing conditions.

Same Design Philosophy, Different Asset Base

SatLayer is building the Bitcoin-native equivalent of EigenLayer → enabling BTC capital to secure off-chain services via Babylon

While EigenLayer restakes ETH LSTs, SatLayer restakes BTC LSTs with full programmability on CosmWasm

6 - Satlayer CTs watchlist

▸ @Lukex

▸ @0xniccomi

▸ @standotsui

▸ @DoggfatherCrew

▸ @Seymirel

▸ @YashasEdu

▸ @_SirJoey

▸ @eli5_defi

▸ @solashenone

▸ @defi_mago

▸ @shannholmberg

▸ @0x_xifeng

Following these accounts to stay informed about Satlayer updates

105.43K

81

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.