What is Numeraire (NMR)?

The Numeraire cryptocurrency is the product of the hedge fund company Numerai, which helps researchers to predict stock market behavior by issuing a cleaned, regularized, and obfuscated data set. The organization utilizes a blend of data science, AI, machine learning, and cryptography to crowdsource effective machine learning models without forfeiting the secrecy of information.

The platform hosts Numerai Tournaments and Signals that data scientists can participate in by building machine learning (ML) models that predict stock market behavior. Users can stake their models to be used for trading decisions. The Erasure protocol incentivizes users to create effective ML models.

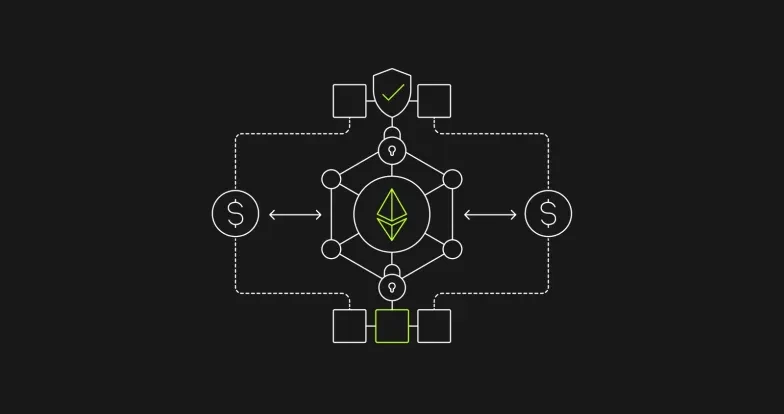

So, what is Numeraire (NMR)? NMR is an ERC20 token that is based on the Ethereum blockchain that powers Numerai. Users stake their model with NMR cryptocurrency to earn rewards based on their performance. NMR is also the native token of the Erasure Protocol.

What is Numeraire (NMR): Key Takeaways

- The Numeraire cryptocurrency is the product of the hedge fund company Numerai, which helps researchers to predict stock market behavior.

- It issues a cleaned, regularized, and obfuscated data set which is at the core of the Numerai Tournament.

- Numerai hosts Numerai Tournaments and Signals that data scientists can participate in by building machine learning (ML) models and staking them with NMR.

- The Erasure protocol incentivizes users to create effective ML models as opposed to flooding the network with spam models.

- NMR is an ERC20 token that is based on the Ethereum blockchain that powers Numerai.

How Numeraire Works?

Numeraire crowdsources data intelligence and analysis to aid Numerai in making trading decisions by predicting stock market behavior. They achieve this through two user models i.e. Numerai Tournament and Signals. Users must make ML models based on the training data set that is provided or acquired and stake it with NMR. Users are rewarded based on the performance of their models.

Hedge Fund

The Numerai hedge fund is at the root of all of this. It is a traditional quantitative hedge fund operated in and regulated by the United States. They take long and short positions on stocks of real-world companies in conventional financial markets, just like any hedge fund. The Numerai fund is market neutral with an aim to profit in any market conditions by becoming immune to market swings and risks.

The Hedge Fund itself has nothing to do with cryptocurrency or blockchain. However, Numeraire was created to help Numerai figure out the best stocks to buy and sell at any given moment. Most hedge funds rely on analysts, quants, and third-party traders to give them this information. Numerai devised Numeraire to help develop ML models that predict stock market behavior.

User Models

AI, data sciences, and machine learning form operative parts of the User Models. Participants are required to provide signals or numerical predictions on the performances of individual stocks in the next few days. These signals or predictions are crowdsourced from participants who are required to create ML models that can evaluate and predict thousands of stocks weekly.

These ML models help the platform rank stocks relative to each other rather than predicting their specific values. Once these ML models are submitted, Numerai combines them into a big Meta Model. The Meta Model makes trading decisions for the Numerai Hedge Fund. Numerai has devised two ways for users to participate and provide signals:

- Numerai Tournament

- Numerai Signals

The Numerai Tournament has been around for several years and has undergone several major transformations. Its model stabilized around mid-2019 and has been maintained until today, albeit with adjustments to the rules and data set. Numerai Signals is much younger and was first launched in 2020 and has been developed with rapid changes and constant improvements since then.

The difference between the Numerai Tournament and Signal is that a large data set is provided for the former but not for the latter. In Numerai Signal, users have to create ML models based on a data set that they have access to or have the capacity to acquire it on their own. However, both Signals and Tournament have much of the same structure.

Its cleaned, regularized, and obfuscated data set is at the core of the Tournament. Users use this data to make ML models capable of predicting unseen data of the same format. A new batch of data sets is released every week.

The data set is obfuscated so that it can be freely distributed to the users for making ML models. High-quality financial data is very expensive and is restricted by licenses. That’s why it cannot be given away freely.

However, Numerai found a way to work around this by obfuscating the data set to an extent where the users have no way to discover the features of the data or which real-world stocks they represent. Obfuscation of the data set allows Numerai to have its cake and eat it too.

Rewards/Staking

The reward system needed to be designed to achieve three things:

- There has to be a reward for accurate predictions.

- There should be a way for Numerai to know which predictions it can trust before it is relied upon to make trading decisions.

- The system must be made immune or highly resistant to abuse by bad actors.

Staked models were introduced as an indicator to Numerai about which predictions they can trust. Since the staked NMR will be burned if the models are not accurate, it prevents scam predictions from flooding the market and incentivizes users to make effective ML models.

The Erasure protocol implemented on the Ethereum blockchain allows this staking mechanism to be adopted across the web. It allows a stranger you interact with to destroy your staked money for a period of time. Because of this, a stranger might be more willing to pay attention and trust you because you have something to lose.

Staking is optional. You don’t have to stake your model to submit your predictions to Numerai. Newcomers are recommended to stake little or nothing on their model. Unstaked models are evaluated and scored like any other model. However, the hedge fund does not use them to make trading decisions.

Where is NMR used

- NMR is an ERC20 token that is used for staking and burning during Numerai Tournaments and Signals i.e. participants (data scientists) stake their models with NMR.

- Erasure Bay is an information marketplace that is built on top of the Erasure Protocol. NMR is the native token of Erasure Bay. Sellers must put their money at stake to fulfill a request. The staked tokens enable the buyers to enforce the sellers' honesty by burning their staked NMR tokens as punishment for non-performance.

- Users need to stake NMR to make predictions on the network such as which model is the high-performing or accurate.

- NMR is the Numeraire network’s digital asset token that pays for services.

- NMR may be purchased and traded in exchange for fiat money or other digital currencies.

Numeraire Founders/History

Based in San Francisco, California, Numerai is the company that launched the Numeraire token. Numerai was founded in 2015 by Richard Craib.

Craib is a Cornell University graduate in mathematics and economics. Before Numerai, he worked as a data scientist at an asset management firm. Along with Geoffrey Broadway, Joey Krug, and Xander Dunn, he launched the platform's whitepaper on February 20, 2017. Craib also released the whitepaper of the Erasure Quant in August 2019 along with James Geary and Jason Paryani.

According to official documents, the project raised over $26.5 million through five rounds of funding from 2016 to 2021. However, the project didn’t conduct an initial coin offering (ICO) and launched its NMR token on the Ethereum mainnet in 2017. On the contrary, the project issued one million tokens and distributed them to various data scientists based on their contributions to the platform.

Numeraire Tokenomics

Let’s learn about Numeraire Tokenomics.

Since its release in 2017, Numerai has only raised capital from selling NMR tokens, not company equity, to crypto investors including Paradigm, Placeholder, USV, and Pantera Capital.

All minted Numerai are sent to Numerai. The total supply of NMR was initially capped at 21 million, with a limit of 100,000 new tokens released per week. One million Numeraire was sent to the data scientists based on their historical ranking on the Numerai’s leaderboard.

After the initial distribution, the smart contract will mint a fixed number of Numeraire each week until the maximum is reached. Data scientists become eligible to earn Numeraire on an ongoing basis based on how their machine learning model performs.

On May 9, 2018, Numerai announced that 4 million NMR were minted as it did not need the weekly allowance. Of these 4 million, 3 million were locked up until 2028 by staking it in a tournament with a 2028 resolve date. The remaining 1 million NMR was intended for new airdrops and partnerships with investors.

In July 2019, Numerai made final contract changes to Numeraire which reduced the maximum supply of NMR to 11 million and burned the key. This means that the NMR token contract can no longer be controlled or upgraded by Numerai - NMR cannot be minted but only burned. NMR is a deflationary asset. By reducing the total maximum supply, the network secures the increase in NMR value and NMR price in the long run.

Tokens are currently burned every week through the Numerai tournament. Additionally, the Erasure protocol is expected to start burning tokens in the coming months. However, it must be noted that NMR tokenomics can be updated using external contracts such as staking modules or integrations in new protocols.

How to earn NMR?

The platform allows staking on its two user models - Signal and Tournament i.e. the machine learning models can be staked with NMR. The participants who build models that provide reliable trading strategies and predictions are scored and rewarded with NMR tokens based on their performance.

In the Tournament, Numerai releases a large training data set based on which users have to make machine learning models. These models should be competent to analyze unseen data of the same format accurately. New batches of training data are released every week.

The ability of the user to serve up accurate predictive models will result in them earning high rewards. However, if your predictions are wrong, the staked NMR is burned. As of March 2022, Numerai has paid out $64 million in crypto to data scientists.

Further, the network combines the staked models to form a Meta Model that will control Numerai’s capital. That’s why users with models that maximize the metal model’s correlation score and have a high feature neutral correlation (FNC) will earn higher rewards.

What is Numeraire’s competition?

Numeraire’s major competitors include QuantConnect, Quantiacs, and WorldQuant. Like Numeraire, they have a working model of crowdsourcing machine learning models from data scientists to predict stock market behavior. However, there are a few differences between them and Numeraire.

Numeraire’s ecosystem is built on smart contracts. This effectively makes it trustless as these self-executing codes receive stakes and dole out payments in a timely manner without having to trust the hedge funds.

This is not the case for its competitors. Since they do not use smart contracts, contributors would have to place their trust in the hedge fund with the hope that they will pay them for their contribution.

Numeraire sports a staking mechanism that ensures that the participants have skin in the game. This will incentivize them to serve up effective ML (machine learning) models and not flood the market with spam predictions. This is done in addition to rewarding them for their contribution.

However, the competitors operate on a traditional reward system for scientists who make accurate data models. The risk of spam predictions is avoided by a thorough selection process of the data scientists where they are vetted. This means that not everyone can participate or join them. On the other hand, Numeraire’s model allows anyone and everyone to participate and join its ecosystem.

By using self-executing smart contracts to burn stakes and reward participants, Numeraire’s trustless model is highly resistant to abuse by bad actors and incentivizes users to submit their best ML models.

Numeraire Investors

Numerai received a total of $26.5 million through five rounds of funding from 2016 to 2021. Its prime investors included Playfair Capital, Peter Linvingston, Nurzhas Makishev, Howard Morgan, Union Square Ventures, First Round Capital, Placeholder, among others.

- $1.5mil Seed:April 2016 led by Howard Morgan,

- $6mil Series A:November 2016 led by Union Square Ventures

- $11mil non-equity funding:March 2019 co-led by Paradigm, Placeholder

- $3mil non-equity funding:June 2020 co-led by Union Square Ventures,Placeholder

- $5mil non-equity funding:April 2021 led by Pantera Capital

Numeraire SWOT Analysis

What is Numeraire’s strength?

Numerai has combined the power of artificial intelligence with the resilience and immutability of blockchain technology to predict stock market behavior. Each week, Numerai hosts a tournament using the unique Erasure protocol where hundreds of thousands of data scientists participate by making machine learning models and staking their NMR on them.

Numerai’s setup helps in improving the way hedge funds operate by revolutionizing data analytics and predictive behavior models. By opening it up to anyone willing to participate and having a well-thought-out incentive mechanism in place, Numerai garners sophisticated machine learning models that it can add to its Meta Model.

What is Numeraire’s weakness?

Machine learning algorithms are difficult for non-experts to develop. This means that it will restrict participation in the tournament only to those who have sophisticated computer science abilities.

However, it should be noted that many people participate in tournaments with the aim of learning how to build machine learning models. Since staking is optional, new users pitch their models to be evaluated and receive constructive feedback on how to improve their skills.

The rise of competitors in the market could prove to be another weakness. Numerai’s algorithm-based prediction and investment techniques are rivaled by entities such as Quantconnect and Quantiacs.

What opportunities does Numeraire offer?

Numeraire crowdsources its machine learning technology to help anticipate financial models utilizing encrypted data. The fusion of artificial intelligence and blockchain technology has the potential to transform many financial sectors.

DeFi is an emerging financial ecosystem that can highly benefit from blockchain-powered AI technology. If the Numeraire’s team chooses to develop its model and use it to provide robust outcomes for the purposes of financial security, supply chain logistics, creating diverse datasets, etc, it would garner wide usage which would positively affect the NMR price in the long run.

What threats does Numeraire pose?

Numerai uses the Erasure protocol to solve the problem of flooding and ensure high-quality predictions. Erasure has a griefing mechanism which is like a review system i.e. if the buyer is unsatisfied with the seller’s prediction feed, they pay an amount to tell the other buyers to stay away.

Buyers will not always be willing to spend money to tell people they are unhappy with the prediction. This means that the sellers will not have their stake at risk and will continue to flood the market with spam predictions.

This not only crowds the network but also threatens good prediction sellers. If someone sees that your feed is doing well, they will be incentivized to grieve you and signal others to stay away for profit.

Numeraire Roadmap

Craib launched erasure in 2019 as a marketplace where users can buy, sell, and request specific information. In June 2019, Numerai cut down the total supply of NMR from its original 21 million to 11 million. This was done to decentralize the platform further.

In late 2020, Numerai announced the development of Numerai Signals. The project was in its development phase. Signal is an important part of Numerai’s master plan to build the world’s last hedge fund.

Numerai’s master plan forms a high-level guide to what they will be trying to achieve in the next several years. It involves the following:

- Monopolize intelligence

- Monopolize data

- Monopolize money

- Decentralize the monopoly

Numeraire News

Numeraire is one of the top 5 AI & Big Data Tokens by Market Capitalization in June 2022

Advanced analytics and information streamlining underlie the field of artificial intelligence. The worldwide AI market will be worth $390.9 billion by 2025, potentially affecting every significant business, including blockchain technology.

Numerai is one of the few hedge funds that heavily relies on AI-generated data projections to predict and analyze stock market behavior. By tapping into the potential of blockchain’s open source technology and fusing it with AI, Numerai has become a pioneer in developing a novel approach to stock trading.

Signals Staking on True Contribution enabled

True Contribution (TC) computes the value of adding a new signal/prediction into Numerai’s Meta Model. Numerai recently released TC on Numerai Signals. This means that the true contribution of users towards Numerai Signals can now be calculated with respect to all stake-weighted predictions.

The Signals model has been in development and has undergone several changes since its launch in late 2020. Previously, TC was only enabled for the Numerai Tournament. By building TC into Numerai Signals, data scientists can maximize rewards for their Signal contributions to the Meta Model.

Where can I buy NMR?

OKX is the best cryptocurrency exchange platform to buy NMR. By signing up for an OKX account, NMR can be bought on OKXs Spot Trading and Margin Trading markets against the trading pair NMR/USDT and NMR/USDC.

How to store NMR?

NMR can securely store NMR on your OKX wallet and access it anytime through the OKX website or the OKX mobile app. Storing NMR on the OKX wallet is the most user-friendly option. OKX gives NMR complete control over your NMR holdings so that NMR can buy, sell, or trade anytime and anywhere.

You can also use the official Numeraire wallet or hardware wallets such as Ledger or Trezor.

FAQ

Can I stake NMR?

You can stake NMR and use it to bet on the prediction models you believe to be most accurate, while you can also earn NMR and source an extra income through the two Numerai apps, Signals and Tournament.

Is staking on predictions the only way to earn NMR?

No. The team also offers various other NMR-earning opportunities such as translating technical material into other languages, creating or contributing to open-source packages like Numerox and reporting vulnerabilities.

How many NMR coins are left?

The current circulating supply of NMR is at 5.9 million NMR out of the total 11 million NMR. Numeraire has a limited supply of tokens. The finite supply acts as a mechanism against inflation and means that no new NMR tokens can be minted once the supply is exhausted.

What gives Numeraire value?

The value of Numeraire is contained in the project’s working model and NMR tokens. Trustless smart contracts and double incentive mechanisms allow the Numeraire project to have expansive utility, broad technical capability, and universal participation.

By allowing just about anyone to participate, the project stands to gain from the ML models developed by unique talents. It also allows people to learn to make ML models by evaluating and giving feedback to newcomers.

The NMR tokens derive value from their function and use cases:

- It incentivizes participation in the ecosystem through a staking/reward mechanism

- It is a digital asset token that is used to pay for services and applications in the ecosystem.

If I obtain NMR, am I buying into the Numerai Hedge Fund?

No. Numeraire is an ERC20 utility token. Only suitable institutional and accredited investors can allocate funds to the Hedge Fund for management. Tournament operations and Numeraire are separate entities from the Hedge Fund.

© 2025 OKX TR. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state:"This article is © 2025 OKX TR and is used with permission." Permitted excerpts must cite to the name of the article and include attribution, for example "Article Name, [author name if applicable], © 2025 OKX TR." Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.