USD1 güçlendirilmiş hareket, artış size en sıcak "Trump konsepti" hedefinin kim olduğunu söylüyor?

22 MAYIS 2025'TE PIYASA YÜKSELMEYE DEVAM ETTI, BITCOIN TÜM ZAMANLARIN EN YÜKSEK SEVIYESI OLAN 110.000 $'I KIRDI VE "GENIUS ACT"IN GEÇIŞI BAĞLAMINDA, "BEKLENMEDIK" BIR STABLECOIN OLAN USD1 SESSIZCE PIYASANIN ODAK NOKTASI HALINE GELDI.

Resmi bilgilere göre Binance, stablecoin World Liberty Financial USD'yi (USD1) bugün saat 20'de listeleyeceğini duyurdu ve HTX ve MEXC'den sonra USD1'i destekleyen üçüncü ana akım borsa oldu. USD1'in güçlü çıkışıyla birlikte, piyasa aynı zamanda bir "dolar sıcak para + Trump etiketi" bağlantı piyasası dalgasını da başlattı.

Bugün, Binance Alpha platformundaki B (BUILDon) tek bir günde %192 arttı ve Binance Alpha listesindeki LISTA ve STO gibi tokenler de önemli ölçüde yükseldi ve topluluğun "WLFI konsepti" ve "Binance sistemi" projelerine olan güveni büyük ölçüde arttı.

WLFI, BUILDon'a desteğini ve B tokenlerinin satın alındığını resmi olarak duyurdu ve Binance'den USD1'e doğrudan destek vermesi, topluluğun genel olarak Binance'in ana stablecoin'i olarak FDUSD'nin yerini alacağına inanmasına yol açtı.

BUILDon'un "USD1 ateşi" dalgası yatırımcıların alfa fırsatını koklamasına neden olduğuna göre, Binance ekosistemindeki USD1 ve WLFI ile ilgili diğer kavramlar nelerdir? BlockBeats bunun basit bir taramasına sahiptir.

USD1, World Liberty Financial (WLFI) tarafından Mart 2025'te çıkarılan ve ABD doları için 1:1 değişim hedefiyle USD'ye sabitlenmiş bir sabit paradır ve dayanak varlıklar %100 kısa vadeli ABD tahvilleri, ABD doları mevduatları vb. tarafından desteklenir ve emanetçisi BitGo Trust Company'dir. Trump ailesinin güçlü desteğiyle, kurucu ortaklar arasında Eric Trump da yer alan USD1, lansmanından bu yana kendi trafiğini getirdi.

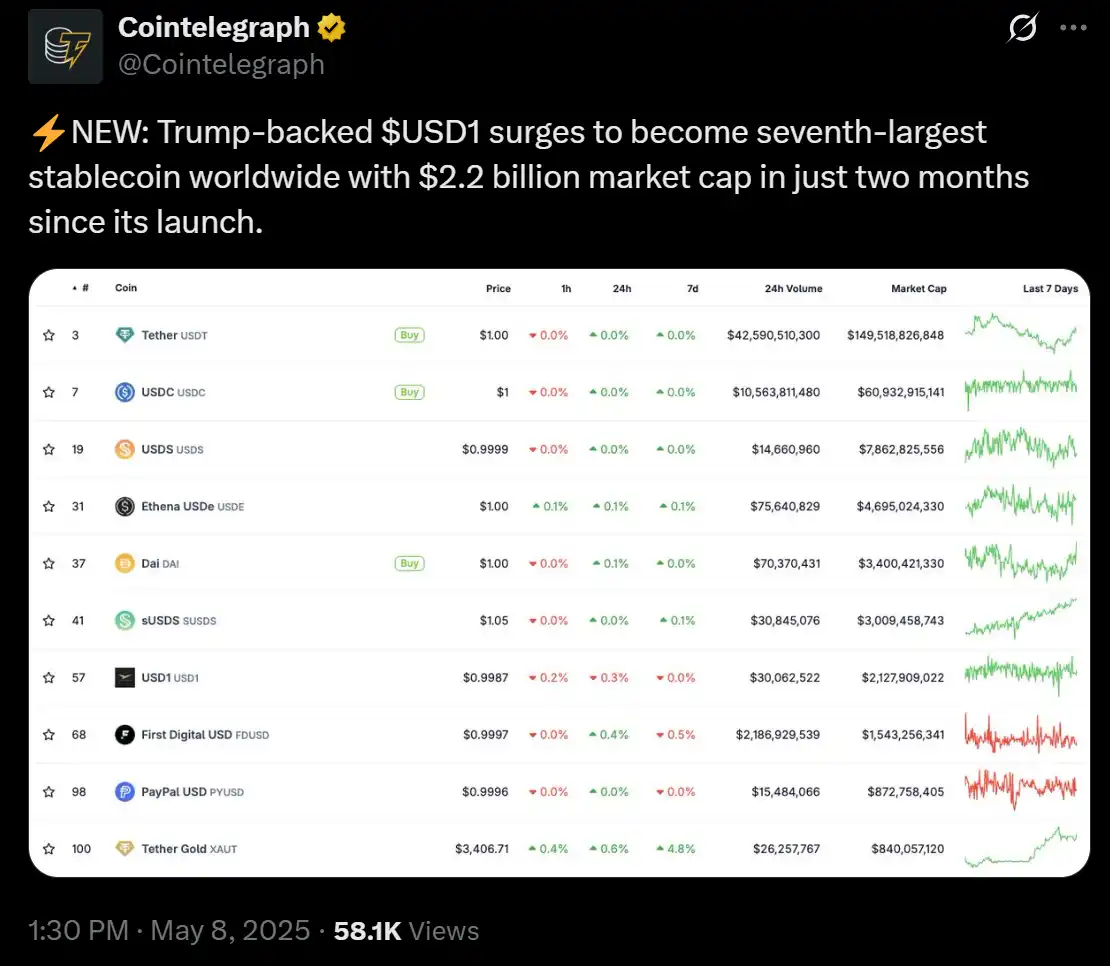

Sadece iki ay içinde, USD1 piyasa değeri 128 milyon dolardan 2,1 milyar dolara yükseldi ve bu da onu dünyanın en iyi yedi stablecoin'inden biri haline getirdi. BNB Chain'deki dolaşımın %90'ını oluşturur ve ilk olarak HTX gibi ana akım borsalarda listelenmiştir.

Ayrıca, şu anda Ethereum ve BNB Chain'i destekleyen Chainlink'in CCIP protokolü aracılığıyla çok zincirli bir dağıtıma sahiptir. USD1 Mayıs ayında ısınmaya devam etti ve Abu Dabi MGX, USD1 aracılığıyla Binance'e 2 milyar dolar enjekte etti.

İlgili okuma: "BUILDon'un 40 Kat Artışının Arkasında, Trump ve CZ 2 Milyar Dolarlık Bir Madeni Para Spekülasyonu "Yang Şeması"

Hatta bazı kullanıcılar, Binance'in Alpha platformu aracılığıyla USD1'in "sularını test ettiğini" ve onu BNB Chain'in temel stablecoin'i haline getirmeyi amaçladığını iddia etti.

Trump konseptinin en sıcak hedeflerini

sıralayarak, şu anda piyasada en sıcak olan "Trump konsepti" hedeflerinden birkaçına bir göz atalım.

USD1 Concept

BUILDon (6 saatlik pull-up %480)

Token B, 21 Mayıs'ta Binance Alpha'da listelendi ve BUILDon'un piyasa değeri tek bir günde 220 milyon doları aşarak 6 saat içinde %480 artışla tüm zamanların en yüksek seviyesine ulaştı.

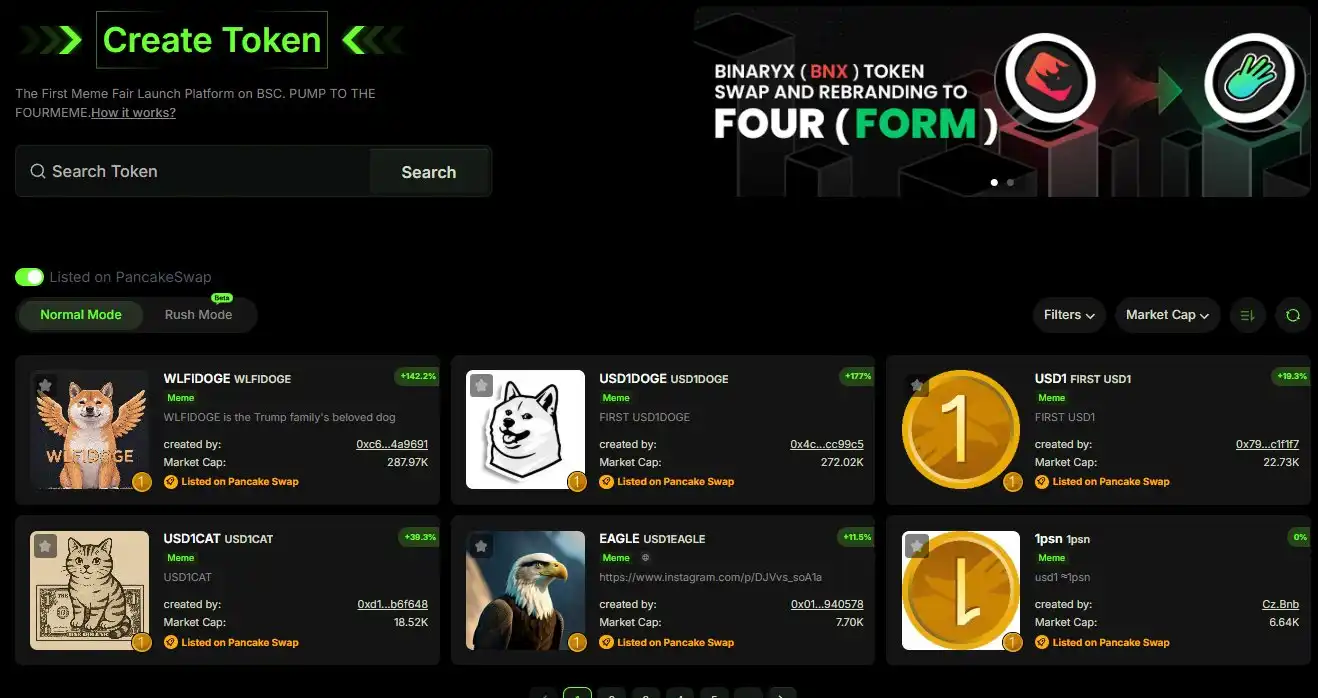

BUILDon, Four.meme platformu aracılığıyla adil bir şekilde piyasaya sürülen bir tokendir ve çekirdeği, BSC'nin bina kültürünü destekleyen bir maskottur ve stablecoin USD1'in gelişimini daha da teşvik etmek için yakın gelecekte USD1 inşaat planını resmi olarak başlatacaktır.

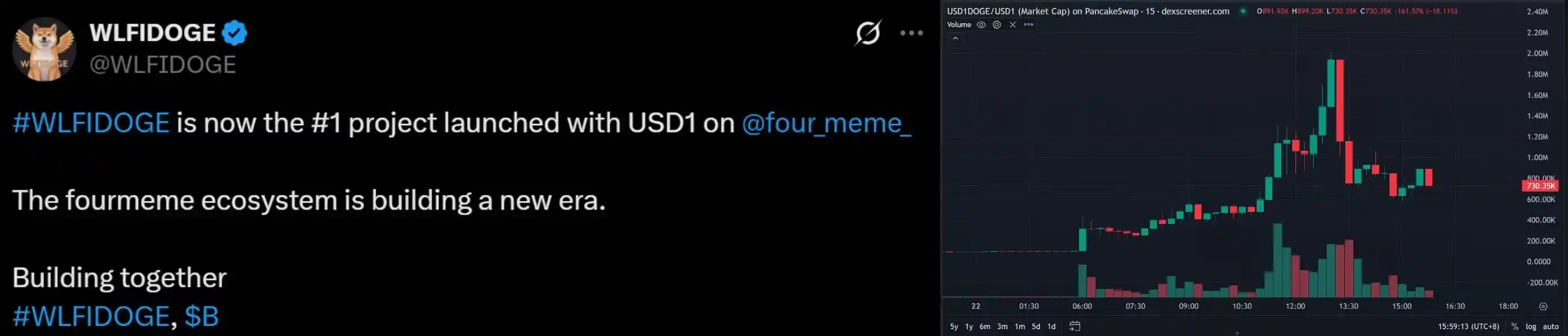

USD1doge (10 kat artış) &wlfidoge (4 kat artış).

22 Mayıs 2025'te USD1DOGE, 24 saat içinde 10 kat fırladı, piyasa değeri 130.000 dolardan 2 milyon dolara yükseldi ve ardından hemen 730.000 dolar civarındaki mevcut piyasa değerine geri döndü ve yeterli piyasa momentumu oluşturamadı.

EAGLE (%1067 en yüksek gün içi kazanç)

EAGLE, Ethereum zincirindeki ilk USD1 bağlantılı tokendi, ancak yine de, meme piyasa değeri 1,79 milyon dolara düşmeden önce hızla 3,74 milyon dolarlık bir zirveye yükseldi. Güncel fiyat 0,018 dolar.

Aşağıdaki tokenlerin tümü Four.Meme platformunda başlatılan projelerdir ve USD1 ekosisteminin bir parçasıdır, ancak bu memler düşük bir piyasa değerine sahiptir ve piyasa ısısı oluşturmamıştır.

konseptini

(%46,62 artış)

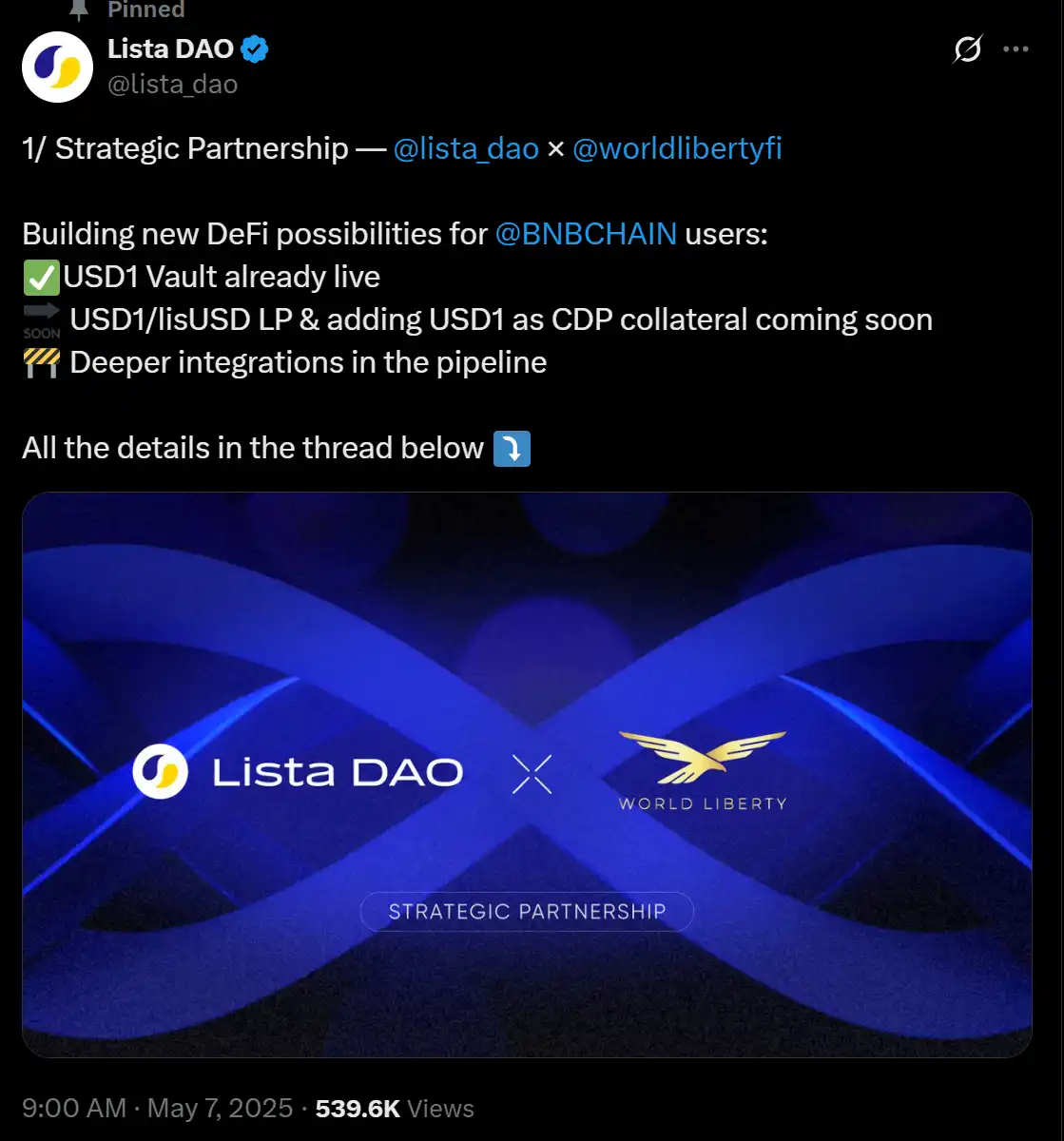

22 Mayıs'ta LISTA %46,62 yükseldi ve 7 Mayıs gibi erken bir tarihte, resmi haberler WLFI ve Lista DAO'nun stratejik bir işbirliğine ulaştığını, USD1'in resmi olarak Lista DAO ekosistemine girdiğini ve USD1'in artık ListaDAO kasasında yayında olduğunu duyurdu.

LISTA, merkezi olmayan kredilendirmeye odaklanıyor ve WLFI ekosistemi genişlerse, likiditesi önemli ölçüde iyileştirilecek ve Lista DAO'nun borç verme ürünü Lista Lending, BNB Chain'de USD1'in ilk uygulaması olan USD1Vault'u piyasaya sürdü.

STO (gün içinde %20 artış).

Resmi STO sürüm planı, daha esnek bir zincirler arası gelir deneyimi yaratmak için STONE ve USD1'e dayanmaktadır. Tam zincir likiditesine odaklanan bir altyapı olarak StakeStone, 20+ zincir ve 100+ protokolü entegre etmiştir ve getiri tokeni STONE, likiditeyi korurken USD1 kullanıcıları için varlık kullanımını iyileştirebilir. Şu anda, yalnızca resmi işbirliği duyurusu olmasına rağmen, büyük ölçekli bir satın alma olmamıştır.

StakeStone, 9 Mayıs'ta yaptığı açıklamada, 6 Mayıs'ta USD1'in resmi emanet adresinden 10.000 USD1 test transferi alan Trump'ın kripto projesi WLFI ile entegrasyonunu tamamladığını duyurdu.

"WLFI Satın Al" ConceptWorld

Liberty Financial, geçen yıl Aralık ayında kripto varlıkları satın almaya başladı ve işte satın aldığı bazı önemli varlıkların bir dökümü:

Related Reading: "4500 atmak Dolar Karşılığında Madeni Para Satın Almak: Trump Projesi WLFI'nin Arkasında Kim Var?

21 Ocak 2025'te WLFI, 4,7 milyon dolar değerinde TRX, yaklaşık 19,58 milyon TRX

30,1 milyon TRX

·24 Ocak 2025 WLFIWLFI, toplam satın alma miktarı yaklaşık 40,99 milyon TRX olmak üzere 2,65 milyon

10,61 milyon TRX daha satın aldı.

18 Mart'ta WLFI, BTC, ETH, TRX, LINK, SUI ve ONDO'nun stratejik rezerv varlıklarına dahil edildiğini resmen duyurdu. Kurucu ortak Zack Witkoff, 1 Mayıs'ta Cointelegraph ile yaptığı röportajda USD1'in gelecekte Tron zincirinde yerel olarak konuşlandırılacağını ve çoklu zincir düzenini daha da genişleteceğini açıkladı.

Vaulta(A)

14 Mayıs'ta orijinal EOS, EOS olarak yeniden adlandırıldı ve token, 1:1 aşınmasız değişimi destekliyor ve token değişikliği yok. Trump ailesinin kripto projesi WLFI, BSC ekosistemi DEX protokolü Pancake aracılığıyla 3 milyon dolar değerinde EOS satın aldı ve aynı zamanda exSat ekosistemi DEX protokolü 1DEX aracılığıyla 3 milyon dolar değerinde Vaulta(A) satın aldı.

WLFI, toplamda yaklaşık 6 milyon USDT (yaklaşık 6 milyon $) değerinde yaklaşık 7.386 milyon Vaulta(A) (3.636 milyon EOS ve 3.75 milyon Vaulta A dahil) satın aldı.

LINK·

12 Aralık 2024'te WLFI, 1.000.000 USDC

LINK satın aldı·13 Aralık 2024'te WLFI, 1.000.000 USDC harcayarak ek 37.052 LINK satın aldı

21 Ocak 2025 tarihinde,

4,7 milyon USDC değerinde toplam LINKWLFI, toplam değeri yaklaşık 6,7 milyon USDC olan toplam yaklaşık 256.314 LINK satın aldı.

12 Aralık 2024'te WLFI, 1 milyon USDC harcayarak 3.357 AAVE satın aldı

ve21 Ocak 2025'te WLFI,

4,7 milyon USDCWLFI, toplamda 5,7 milyon USDC değerinde yaklaşık 17.730 adet AAVE satın aldı.

SEI

547.990 SEI satın almak için 125.000 USDC harcayın

• 15 Mart 2025'te 541.242 SEI

13 Nisan 2025'te 775.000 $ SEI alımı.

Son 3 ayda WLFI, 3 işlemde ortalama 0,167 $ fiyatla 5,983 milyon SEI satın almak için yaklaşık 1 milyon USDC harcadı.

AVAX

16 Mart 2025'te WLFI, 103911 AVAX satın almak için 2 milyon USDT harcadı.

MNT

MNT, Mart 2025'te 16'sında 2 milyon u ve 23'ünde 3 milyon u olmak üzere toplam 5.99 milyon MNT olmak üzere toplam 5 milyon U değerinde toplam iki kez satın alınacak.

ENA

, 21 Ocak 2025'te ENA'ya 2 milyon USDC harcadı.

21

Ocak 2025'te WLFI, ONDO'yu satın almak için 2 milyon USDC harcadı.

MOVE

29 Ocak 2025'te WLFI, MOVE'da 1,9 milyon USDC ve Şubat 2025'te MOVE'da 286.000 USDC harcadı.

Piyasa duyarlılığı yüksek. BUILDon, usd1doge ve wlfidoge gibi USD1 ekolojik tokenleri kısa sürede piyasadan büyük ilgi gördü ve aynı zamanda WLFI ile işbirliği yapan veya USD1 uygulamalarını entegre eden LISTA ve STO gibi projeler de ilgi görmeye başladı.

Şu anda, USD1 ve WLFI etrafında yeni bir anlatı şekilleniyor, potansiyel alfa fırsatlarını önceden pusuya düşürüyor ve bir sonraki sıcak nokta turunda öncü oluyor.