İnternet Sermaye Piyasaları: Yeni Bir Trend mi, Başka Bir Meme Hype mı?

Kelimeler: Mario @IOSG

TL; DR:

İnternet Sermaye Piyasaları (ICM), girişimcilerin risk sermayesi ve ilk halka arzlar (IPO'lar) gibi bürokrasi prosedürlerini atlayarak tokenizasyon yoluyla doğrudan çevrimiçi topluluktan fon toplamasına olanak tanıyan geleneksel sermaye piyasalarına (TCM) kriptoya özgü bir alternatiftir. Believe App (eski adıyla Clout) gibi platformlar, Solana zincirindeki bu devrime öncülük ediyor ve kullanıcıların sadece X'te (eski adıyla Twitter) @平台 yaparak bile projeleri kolayca başlatmalarına ve yatırım yapmalarına olanak tanıyor.

Düzenleme eksikliği, düşük giriş engelleri ve yanıltıcı tokenler çıkarma eğilimi gibi eleştirilere rağmen, ICM, özellikle Web3'ü temiz bir kullanıcı deneyimi, fiat ödeme rampası ve viral anlatı yoluyla Web2 kullanıcılarına tanıtmada kitlesel benimseme için güçlü bir potansiyele sahiptir. Uzun vadeli büyüme elde etmek için Believe gibi platformların, kurucuların hesap verebilirliğini sağlamak, token ekonomik modelini optimize etmek, DAO yönetişimi oluşturmak ve ICM'yi bir meme patlamasından yeni bir sermaye oluşumu paradigmasına gerçekten dönüştürmek için gerçek fayda sağlamak için kısa vadeli yutturmacanın ötesine geçmesi gerekiyor.

Geleneksel Sermaye Piyasalarının Arka PlanıGeleneksel

sermaye piyasalarında (TCM'ler), girişimciler genellikle ilk halka arzlar (IPO'lar) veya risk sermayesi gibi pahalı ve zaman alıcı finansman yöntemlerine güvenirler. Bu yaklaşım kendi zorluklarını ortaya koymaktadır.

Bir fundan'ın bakış açısına göre, girişimciler uzun başvuru süreçleri, karmaşık yasal formaliteler ve sürekli olarak yatırımcı tercihlerine hitap etmekle uğraşmak zorundadır, bu da onları genellikle ürün geliştirmeye veya topluluk oluşturmaya odaklanmaktan alıkoyar.

Yatırımcılar açısından bakıldığında, erken yatırım fırsatları temel olarak riskten korunma fonları ve yatırım fonları gibi büyük kurumlar tarafından tekelleştirilmektedir. Sıradan yatırımcıların hisseleri çok azdır veya hiç yoktur ve genellikle piyasaya girmeden önce proje değerlemelerinin fırlamasını beklerler.

Bu model yalnızca verimsiz ve açık olmakla kalmaz, aynı zamanda içerik oluşturucular ve destekçiler arasında teşviklerde önemli bir yanlış hizalamaya yol açar. Bu yapısal sorunlar, İnternet Sermaye Piyasalarının (ICM) ele almaya çalıştığı şeyin merkezinde yer alan finansmana yönelik daha açık, doğrudan ve katılımcı bir yaklaşıma olan acil ihtiyacı yansıtmaktadır.

Şekil 3: LaunchCoin Fiyat zaman çizelgesi (yazarın notuyla birlikte),

ekran görüntüsü kaynağı: Dexscreener [3].

Her şey Forbes'un 30 Yaş Altı listesinde yer alan Web2 girişimcisi Ben Pasternak ile başladı. Tokeni $Pasternak [14] bu yılın Ocak ayında Clout platformu aracılığıyla piyasaya sürdü ve piyasa değeri bir noktada yaklaşık 77 milyon dolara yükseldi, ancak teknik sorunlar nedeniyle - koşullar karşılansa bile token "mezun olamadı" - proje sonunda çöktü. [15]

Nisan ayının sonlarında, platform resmi olarak Clout'tan Believe'e yeniden adlandırıldı ve temel odağı "Kişisel" den "Fikirler ve Projeler" e kaydırıldı ve gerçekten ICM yönünde hareket etti. $Pasternak aşamalı olarak kaldırıldı ve platform yeni bir çekirdek token $launchcoin başlattı. Platformun gelişimi, Nikita Bier ve Solana'nın kurucu ortağı Toly gibi tanınmış kurucular tarafından retweetlendikten sonra hızla ilgi gördü. Daha sonra, $GOON ve $NOODLE gibi çeşitli projelerin tokenleri Believe'de başarılı oldu ve yüksek piyasa değerlerine ulaştı ve bu virallik ve kullanıcı büyümesi, platformun genel piyasa değerini bir noktada 314 milyon dolara itti. [16]

Clanker vs. Believe: Believe Neden Başarılı

Clanker, kullanıcıların sosyal medya etkileşimleri yoluyla, öncelikle tweet atarak veya bir Web3 Twitter türü olan Farcaster'ı kullanarak kendi tokenlerini oluşturmalarına da olanak tanıyan başka bir token ihraç platformudur. Clanker ve Believe "dağıtım yöntemleri" açısından benzer görünse de, Believe'in kullanıcı deneyimi, anlatı yapısı ve kalabalığın arasından sıyrılmasını sağlayan büyüme potansiyeli açısından birçok belirgin avantajı vardır.

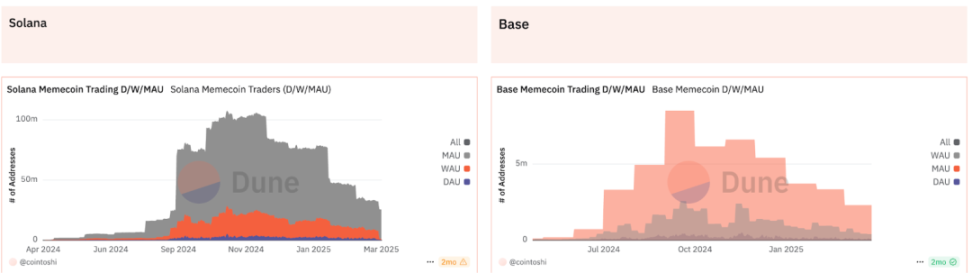

Aşağıdaki grafikten de görebileceğiniz gibi, Solana zinciri, işlem hacmi ve aktif tüccar sayısı açısından Base zincirini çok geride bırakıyor ve bu da Believe'in genişlemesi için daha büyük bir ivme sağlıyor. Ayrıca Alliance DAO'nun desteğinin yanı sıra Nikita Bier ve Toly'nin retweetleri de büyümesini daha da hızlandırdı.

Şekil 4: Solana zincir üstü meme coin alım satım metrikleri

(Kaynak: Cointoshi, Dune Analytics) [4]

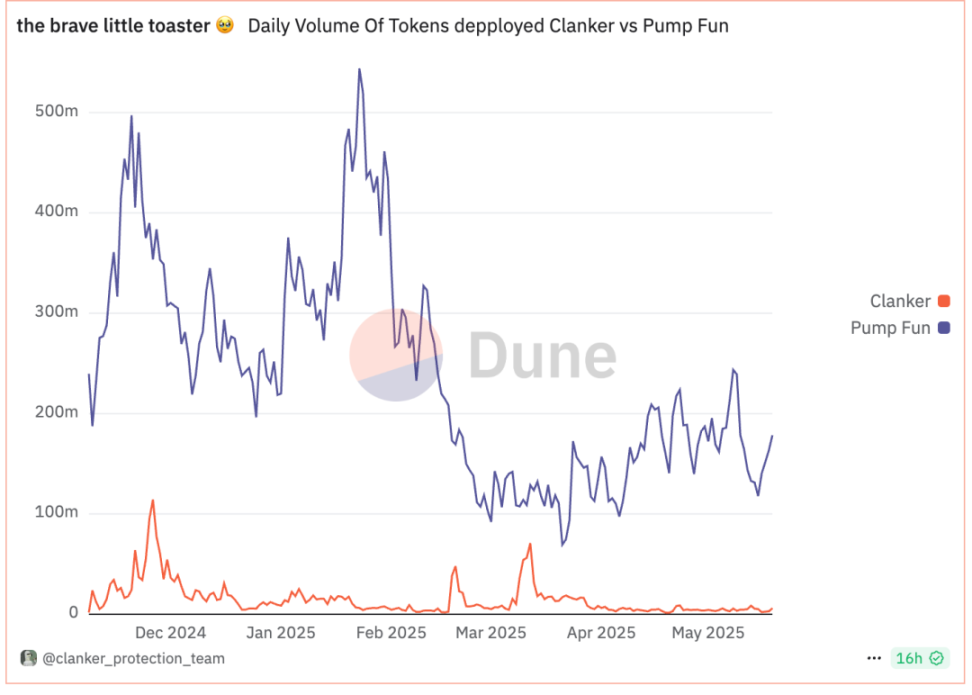

5: Günlük olarak çıkarılan tokenler Hacim Karşılaştırması: Clanker vs. Pump Fun

(Kaynak: Clanker Koruma Ekibi, Dune Analytics) [5]

Kullanıcı Deneyimi

Şekil 6: Rifqi Saputra (@denyosapone adlı kullanıcı, Clanker (2025) aracılığıyla X hakkında token ihraç bilgilerini yayınlıyor [6]

7: Pata van Goon (@basedalexandoor) adlı kullanıcı tarafından Believe (2025) aracılığıyla yayınlanan vitrin [7]

Gördüğümüz gibi, Believe'de yayınlamak çok daha kolaydır - kullanıcıların yalnızca bir belirteç kısaltması doldurmaları ve X'e @Believe yapmaları gerekir; Clanker'da isim, simge vb. gibi ek bilgiler gereklidir.

Buna ek olarak, Believe'in kullanıcı arayüzü daha sezgisel ve özlüdür. Ayrıca bir mobil uygulama geliştirdiler ve kullanıcıların token varlıklarını doğrudan cüzdanları veya kredi kartları aracılığıyla satın alabilecekleri App Store'u başlattılar. Öte yandan Clanker, şu anda yalnızca web tabanlıdır ve geleneksel Web3 launchpad'lerine benzer şekilde yalnızca cüzdanlar kullanılarak satın alınabilir.