American‑made crypto ETF knocks on the SEC’s door

While the world of cryptocurrencies and blockchain is rather global, President Donald Trump's "America First" agenda seems to have struck a chord with many in the industry.

Trump has vowed to turn the U.S. into the "Bitcoin superpower" and "the crypto capital of the world," and a lot of firms are taking the cue.

Prominent asset manager Canary Capital filed an S-1 form with the Securities and Exchange Commission (SEC) on Aug. 25, requesting to launch a new crypto exchange-traded fund (ETF) called the "Canary American-Made Crypto ETF."

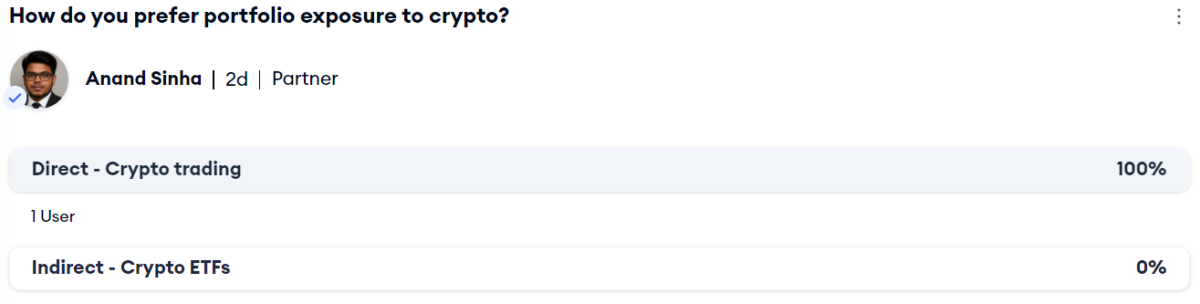

A crypto ETF is a financial product that is traded on traditional stock exchanges and gives investors exposure to crypto assets without the need for traders to directly own the cryptocurrency.

As per Canary's statement, the fund aims to invest in a crypto portfolio that tracks the "Made-in-America Blockchain Index." This index tracks crypto assets that were either originally created in the U.S. or have a majority of the tokens minted in the U.S. or a majority of the protocol’s operations based in the U.S.

Though the asset manager didn't specify which crypto assets it will target, on-chain data suggests XRP, SOL, ADA, XLM, SUI, and AVAX are counted among the virtual assets made in the U.S.

Canary Capital has earlier applied for crypto ETFs tied to XRP, LTC, TRX, INJ, SUI, and Pudgy Penguins. Even an ETF linked to the Official Trump meme coin is on the cards.

Though Bitcoin and Ethereum ETFs made their debut during the Joe Biden era, Trump's second term has witnessed the fund managers going all in on crypto ETFs.