Holding ETH + DeFi mindlessly for the past month has been the most comfortable.

Basically, you don't have to do anything to outperform most cryptocurrencies.

So far, it still hasn't turned weak.

I believe it will continue until the buying power of companies holding ETH slows down.

$ETH price rise -> The most effective source supporting TVL data -> Good data, revenue data comes up -> DeFi flywheel ☑️

If we can also leverage tradfi resources or differentiate projects with protocols that have various product aspects, the differences between projects will be even greater.

Understanding how the hot money in the market operates, where the PMF is, and how protocols earn revenue makes it easy to ambush DeFi tokens.

$ZORA is really beyond imagination.

$ENA and $PENGU have actually been visibly strong recently, while on Base, $KTA and $AERO are quite eye-catching.

($VIRTUAL and $KAITO should be moving too.)

The AI track continues to focus on whether there are any interesting things emerging in DeFi.

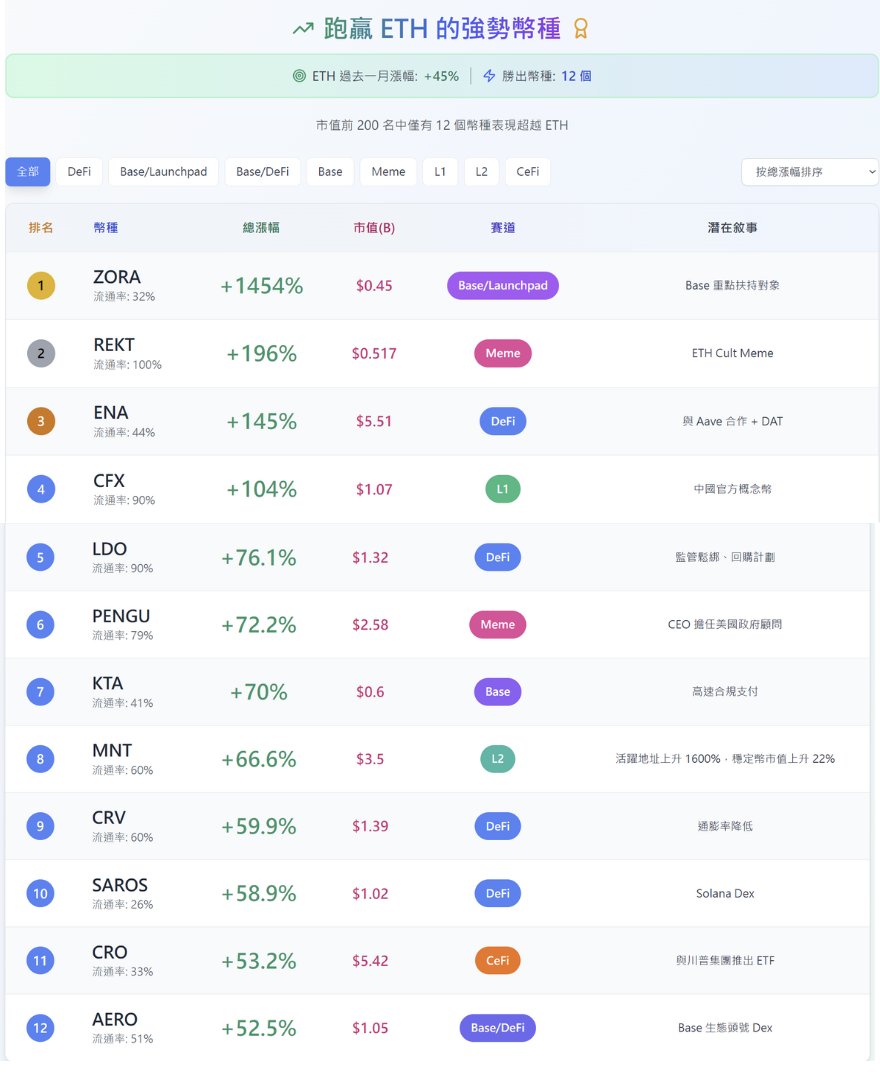

【Is the Altcoin Season Coming? A Review of the Strong Coins that Outperformed $ETH in the Past Month】

$ENA $LDO $PENGU $MNT $CRV $CRO $ZORA $REKT $CFX $KTA $SAROS $AERO

TL;DR

- In the past month, only 12 coins among the top 200 by market cap have outperformed ETH, indicating that it is not a widespread rally.

- The strong performers are concentrated in DeFi and the Base ecosystem, mostly driven by events or mechanism reforms.

- There is a clear centralization of funds, with a lack of liquidity spillover, and traditional altcoin season characteristics have not yet appeared.

------

In the past month, Ethereum has risen over 45%, breaking through $4300, outperforming Bitcoin by 3.5%. The significant increase in Ether can mainly be attributed to institutional buying frenzy.

Currently, DAT company holds over 300,000 ETH (valued at approximately $13B), with a growth rate exceeding 126% in the past month. The largest holding is $BMNR, and the chairman @fundstrat has even set a target price of $17,000 for $ETH.

Ethereum's price increase is driven by continuous institutional accumulation, which logically differs from past altcoins that enjoyed ETH's liquidity premium, as the funds from institutional buying have not spilled over to other altcoins.

Statistics from the past month show that among the top 200 cryptocurrencies by market cap, only 12 coins have outperformed ETH, and a widespread rally has not occurred.

The rarity of coins outperforming ETH makes them more valuable for research and potential alpha generation. Which coins are stronger than ETH? What is the underlying buying power behind them?

It can be observed that strong altcoins are mostly centered around DeFi and @base.

High Certainty in DeFi:

Among the 12 coins that outperformed ETH, 5 belong to the DeFi sector (ENA, LDO, CRV, SAROS, AERO), and most have clear fundamental support and innovative mechanisms:

- ENA: Collaborating with @aave and receiving backing from DAT, enhancing both funding and protocol aspects.

- LDO: Dynamic buyback plans and regulatory easing boost market confidence.

- CRV: Decreasing inflation rate alleviates supply pressure.

- SAROS, AERO: Benefit from increased on-chain trading activity.

These projects share a commonality of having clear business models, capturing better value compared to other projects as on-chain activity increases.

The Rise of the Base Ecosystem

Recently, Coinbase CEO @brian_armstrong announced that @coinbase will become a "Universal Exchange," planning to move all assets, including stocks, derivatives, and prediction markets, to blockchain trading, which directly activates the overall activity of the Base ecosystem.

Since the Base blockchain currently has no official token, funds are concentrated on projects closely related to Base's official initiatives:

- ZORA: Frequently promoted by Base officials and designated as the center of the Base ecosystem.

- AERO: The largest Dex in the Base ecosystem, capturing ecosystem trading flow.

- KTA: Focused on high-speed compliant payments, aligning with Coinbase's international expansion and compliance strategy.

This wave of outperforming ETH is not widely spread but is highly concentrated on specific events and sectors, particularly the Base ecosystem and specific mechanism reforms in DeFi projects. Rather than expecting a traditional "altcoin season," it is better to focus on event-driven dynamics and fund flows, targeting assets with external resources, policy endorsements, or ecosystem support.

How the protocol earns revenue -> How the protocol generates income

牛市找奶牛 s/t to @dyorcryptoapp

33.49K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.