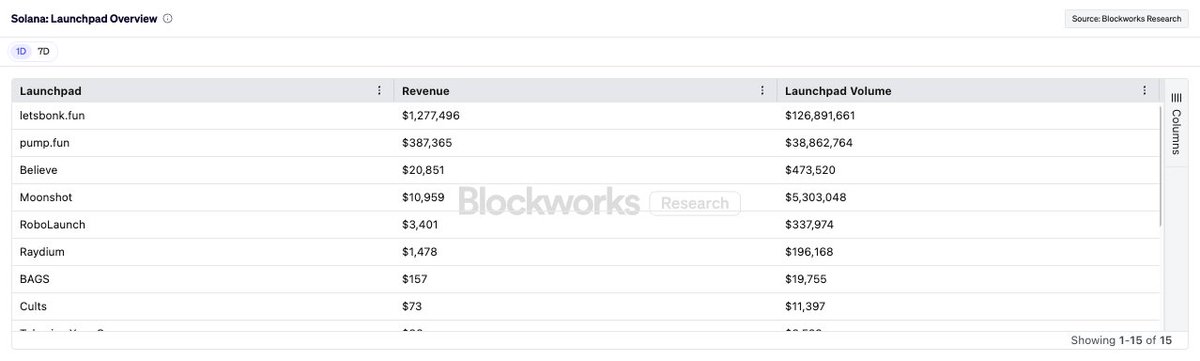

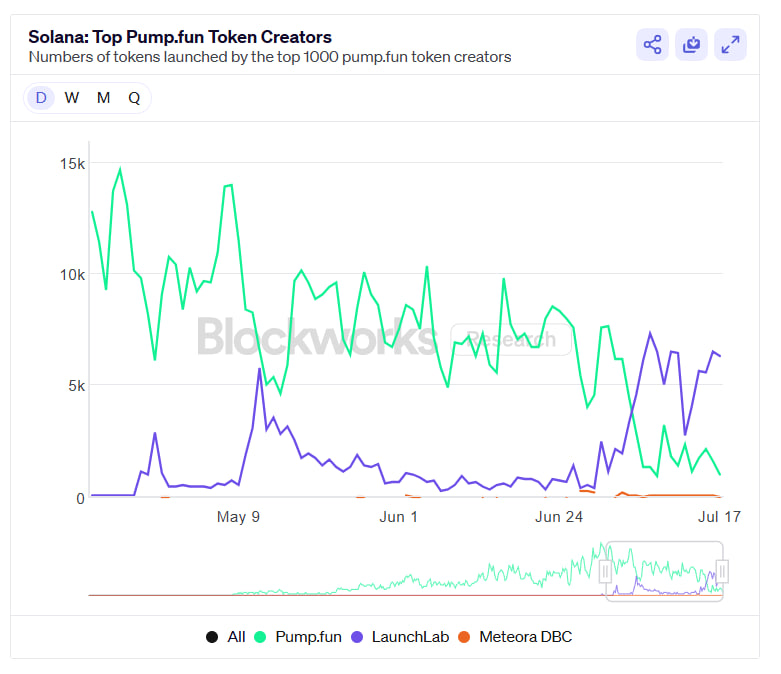

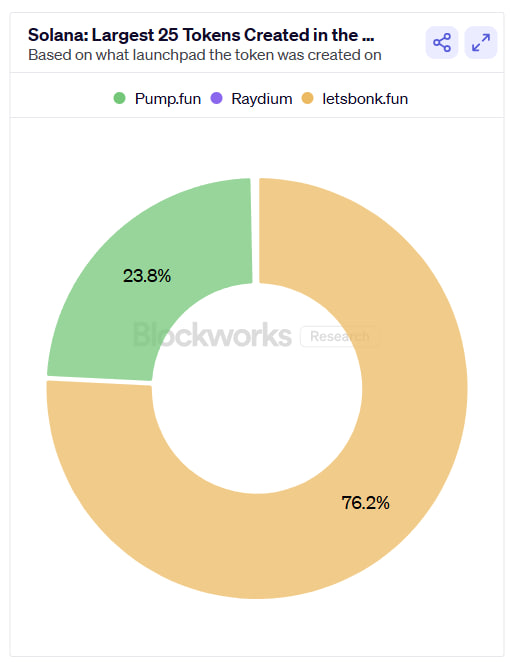

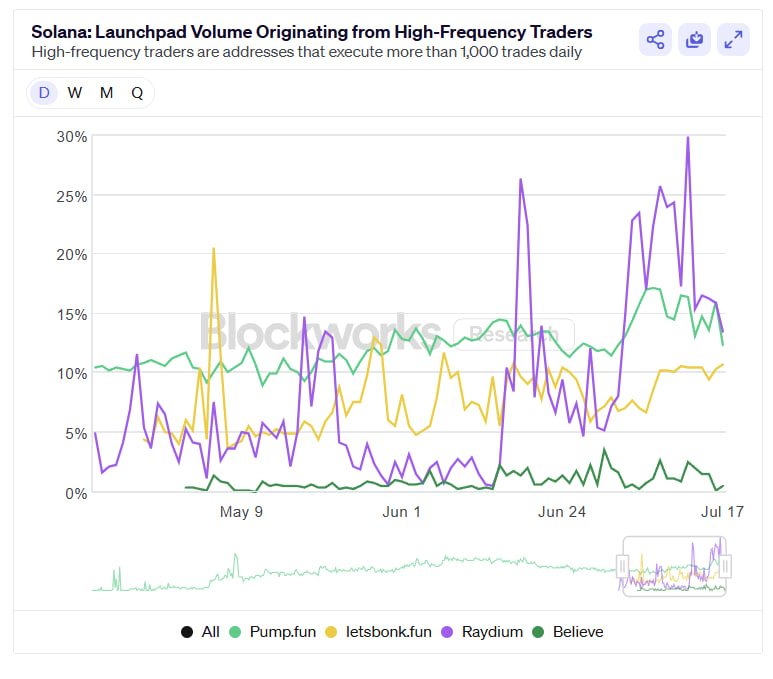

Didn’t take long for this tweet to age. Quick little update: BTC broke through ATHs and ranged a little. ETH started moving too, but has slowed down a bit. SOL IS FINALLY BACK. I’m currently positioned in $BONK, $RAY, and also ($JUP, $JTO) the infra betas. Take a look at the charts. I’m focusing more on $BONK and $RAY because it’s similar to investing in business models like $HYPE: strong fundamentals, buybacks, growing platforms, and ATH revenue (but not ATH prices just yet). Of course, you can’t really make these bets without also believing in the teams behind them. I’ll leave you with some charts to study. Look into Raydium; powering the launchpad currently hold over 80% market share. That’s a significant chunk of SOL’s decentralized trading volume. What happens when stability in majors brings on-chain mania again? Don’t forget how wild SOL betas get when things heat up. BONK and Raydium are fundamentally strong plays if you believe that trenches are going to do well over...

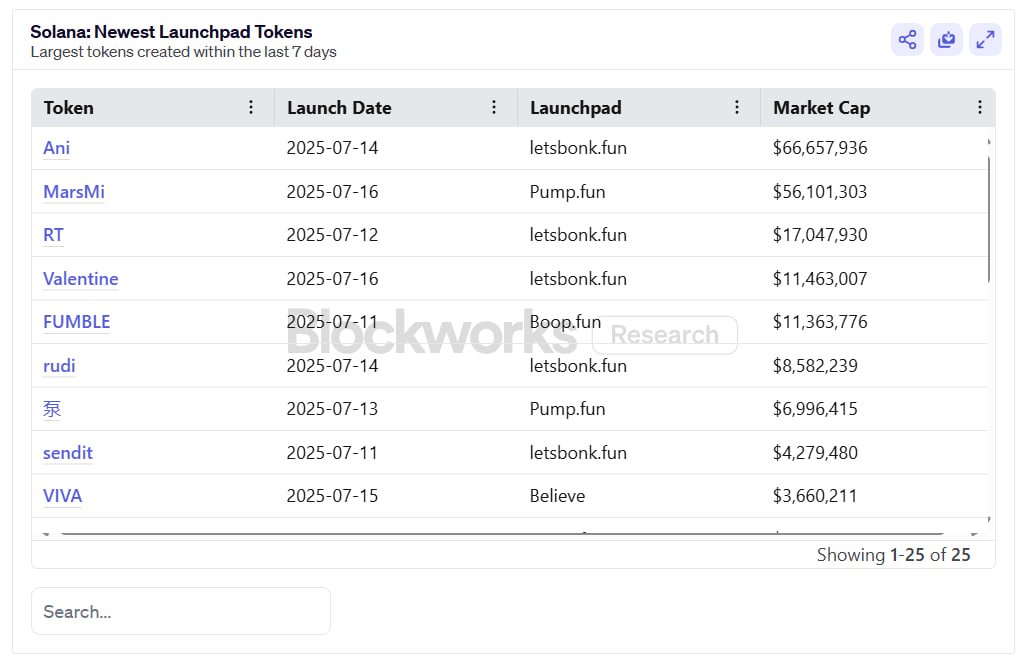

Some Mid-Year Thoughts It’s two weeks into July, and unexpectedly, this month has been incredibly strong. To be honest, I thought we’d just be getting Bonk Szn for the rest of the summer and that general equities would start running in Q4. But it seems like this year, BTC treasury companies are front-running seasonality, fueling this run-up. BTC has been an absolute beast, making new ATHs supported by constant high inflows into the BTC ETF, mainly from BlackRock. This ATH run-up brought alts and trenches running together. Although volume in trenches still isn’t what it was pre-Trump era, with the Bonk Launchpad coming in hot, things are heating up. Surprisingly (or not, really—seems like the worst of summer is behind us), we’re getting multi-million-dollar runners daily. Just last week, trenches sentiment was lukewarm while waiting for the $PUMP public sale. Very interesting now seeing how the raise sold out almost instantly yet we're still seeing @bonk_fun dominance more than...

40.67K

53

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.