OKTC Token price

in TRYCheck your spelling or try another.

About OKTC Token

OKTC Token’s price performance

OKTC Token on socials

Guides

OKTC Token FAQ

Developers seeking high transaction speeds, low fees, and a robust DApp development kit will find OKT Chain and its native token, OKT, incredibly valuable. With OKT, you can enjoy fast and affordable transactions while leveraging the platform's dedicated resources for building decentralized applications. Additionally, staking your OKT tokens provides an opportunity to earn attractive yields.

Easily buy OKT tokens on the OKX TR cryptocurrency platform. Available trading pairs in the OKX TR spot trading terminal include OKT/USDT, OKT/USDC, OKT/ETH, and OKT/BTC.

You can also buy OKT with over 99 fiat currencies by selecting the "Express buy" option. Other popular crypto tokens, such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and USD Coin (USDC), are also available.

You can also swap your existing cryptocurrencies, including XRP (XRP), Cardano (ADA), Solana (SOL), and Chainlink (LINK), for OKT with zero fees and no price slippage by using OKX TR Convert.

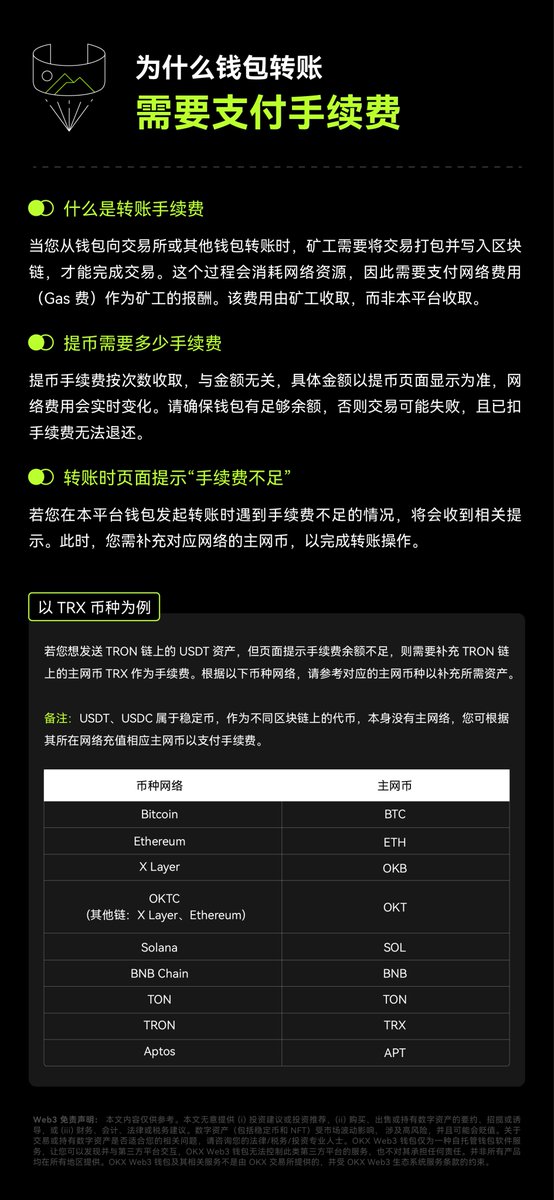

To view the estimated real-time conversion prices between fiat currencies, such as the USD, EUR, GBP, and others, into OKT, visit the OKX TR Crypto Converter Calculator. OKX TR's high-liquidity crypto exchange ensures the best prices for your crypto purchases.

Dive deeper into OKTC Token

OKT Chain (OKT) is a Layer-1 blockchain built on the Cosmos chain, with a strong emphasis on optimizing blockchain performance and promoting interoperability. The platform provides robust marketing support, developer-friendly resources, and a comprehensive array of technical tools to empower builders in the Web3 ecosystem.

What is OKT Chain?

OKT Chain is an Inter-Blockchain Communication Protocol (IBC) and Ethereum Virtual Machine (EVM) compatible blockchain that provides a robust infrastructure and ample resources for decentralized applications (DApp) developers. With a transaction capacity of nearly 6,000 transactions per second (TPS), OKT Chain offers efficient and high-speed transaction processing. Both users and developers are charged a nominal fee of $0.01 per transaction. OKT Chain is fully open-source and features Oracle support, enabling seamless integration across multiple chains.

The OKT Chain team

The OKT Chain initiative is spearheaded by a dedicated team within OKX TR. The development team is pivotal in scaling the DApp infrastructure, ensuring the platform's growth and efficiency.

It's important to note that OKT Chain and OKB Chain are distinct projects, each with its own token. OKT serves as the token for the OKT Chain, while OKB is the utility token for the broader OKX TR ecosystem, which includes the exchange and related services.

How does OKT Chain work?

OKT Chain provides a developer-friendly environment for building decentralized applications (DApps), alleviating concerns about high fees and slow transaction speeds. Its Oracle support spanning multiple chains enables seamless integration with diverse data sources, enhancing the capabilities of these DApps.

Furthermore, OKT Chain offers auditing support for smart contracts, ensuring the security and reliability of DApps building. This feature is crucial for maintaining trust and mitigating potential vulnerabilities. OKT Chain adopts the Delegated Proof-of-Stake (PoS) algorithm, empowering validators to verify node conditions and transactions efficiently. This consensus mechanism enhances the scalability and overall performance of the network.

OKT Chain native token: OKT

OKT, the native token of OKT Chain, has multiple use cases within the ecosystem. It serves as staking rewards for validators, incentivizing participation in securing the network. Additionally, OKT token holders can vote on important decisions and proposals within the OKT Chain governance system, allowing for community-driven decision-making.

Furthermore, OKT tokens find utility in various DeFi protocols specific to the OKT Chain, enabling users to access and participate in decentralized finance activities. The token also holds value in other Web 3.0 sectors, such as GameFi and NFTs, providing opportunities for engagement and value creation in these emerging areas of the blockchain ecosystem.

OKT tokenomics

OKT has a maximum supply cap of 21 million tokens, with 10 million OKT tokens included in the Genesis block. The current circulating supply is approximately 17.85 million tokens. As of early June, about 6.3% of the total OKT token supply is locked, indicating a portion of tokens being held or staked by participants.

The OKT Chain implements a reward-halving mechanism, which occurs every nine months. This approach contributes to a disinflationary issuance of tokens, gradually reducing the rate at which new tokens enter circulation over time. Based on calculations, it is projected that the entire OKT token supply will become liquid by 2028, aligning with the halving schedule and the decreasing rate of token issuance.

How to stake OKT?

OKT holders can participate in staking through the OKT Chain's liquid staking platform. Staking OKT tokens allows users to earn stOKT as a reward. By the end of May 2023, staking yields reach an attractive 8.4% APY. Staking also grants users validator access to approve transactions on the network. Additionally, stOKT holders benefit from gaining voting rights within the ecosystem.

OKT distribution

The initial distribution of the 10 million OKT tokens from the genesis block was allocated to early OKB holders. Subsequently, the annual issuance of OKT tokens is evenly distributed among the block validators.

The future of OKT Chain

The future of OKT Chain looks promising, as evidenced by its substantial following with over 140 million approved transactions and 5.93 million staked OKT tokens.

Disclaimer

OKX TR does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX TR and its affiliates (“OKX TR”) are not in any way associated with the owner or operator of the TPW. You agree that OKX TR is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.