When Binance comes to work, it is OK not to be free

Written by: Saye

It is a contradiction that CEXs are all doing on-chain trading tools, wallets, and Perp DEXs, and on the other hand, they actually vet CEX users to complete compliance.

In our time, everyone has to be driven crazy.

Artificially created a crisis, the currency circle Rome

Compared with Romans, which was made out of time by the 3Cs, the problem with OKX is that there is a lack of internal checks and balances, and it is entirely up to the founders to play their own role.

Artificially creating a crisis of public opinion will not speed up the compliance process.

OKX Xu Xingxing's "imperative" speech, excluding "online lending" users, shocked the entire Crypto practitioners, this is not the familiar and responsible Xu Xingxing of the past.

In popular memory, the early OK was a very responsible existence:

-

In 2020, OK encountered supervision, and the term "private key manager" gave the public a deep understanding of encryption, Not you Keys, Not you Money;

-

In 2025, OK encountered supervision, and the MiCA license had to be compliant, and it took the initiative to temporarily suspend the DEX aggregator in the OKX wallet, resulting in being stolen by Binance and losing market share.

Of course, there can be different interpretations of this, if you suspend your own services for supervision, the money that OK doesn't earn can also be earned by other service providers, but this time it's OKX that launched a special regulatory action against users, which is extremely confusing.

In order to go public, this is untenable, from Didi's surprise listing being urgently ordered to rectify, to Binance's payment of CZ jail + fine + withdrawal from Binance + Binance rectification, and even stopping the issuance of BUSD, it is only necessary to stop when it is discovered.

But OK is different from everyone else, and will directly say to everyone in advance, "I'm going to take action against you", the core is not that there is a problem with compliance, but that the attitude towards users is out of shape.

Caption: OK Acknowledging that there was a misjudgment in compliance, image source: @star_okx

In the end, it is also fermented from the field of public opinion, and it is also necessary to start from public opinion, OK has a global compliance team of 600 people, and it must also be dynamically adjusted according to market conditions.

In the final analysis, it is not a compliance issue, let alone a question of whether it should be accepted to speculate on online loans, and the discussion of the latter is actually a problem of self-trams, and the best response is not to respond.

This is a public relations crisis with very distinct characteristics, and the most difficult thing is that the founders themselves initiate it.

Compared with Binance, which is driven by dual cores, the real controller of OK is only Xu Xingxing himself, and for many rumors that have been spread in the wind, the company will be involuntary when it becomes bigger, and it is difficult to say who is more innocent than whom, which is not the core element that affects business competition.

Xu Xingxing's will is OKX's will, OKX has no will of its own, and in the founder's strong corporate culture, no executive can raise objections, let alone dissenting opinions.

-

Jingdong Liu Qiangdong can let executives line up to report, directly dismantle the brand department, and assign it to a more market-oriented marketing department;

-

After CZ is released from prison, he cannot re-manage Binance, but he can "influence" Binance, and Binance will accept the market influence, and the lawyer will ensure compliance.

It is self-evident which plan is higher, and the problem of OK now is that the founder is obviously not suitable for being on the front line of public relations, but he has to interact with the market by himself, and detonate public opinion crises again and again.

Here you can make a prediction, if OK does not isolate the founder, then the public opinion storm will appear again, and it is really better to leave it to the professional manager to be responsible.

Professional managers seek no fault, and it is even more terrible for the founder to want to make contributions.

Binance continues to lie down to win, and the crypto circle Liu Xiu

Liu Xiu is different from Liu Bang, he is lucky enough, Liu Xiu is different from Liu Bei, he is lucky enough.

If luck can be synonymous with a person, then it must be the opponent who has contributed his own misfortune.

The current exchange is actually not having a good time, Bybit is struggling to survive after being stolen, Bitget is criticized by retail investors, Gate/Matcha is the child's table, Huobi belongs to Brother Sun, and Coinbase and Kraken are rooted in the United States.

Not to mention that Deribit has been sold to Coinbase, and a new round of integration of exchanges has begun, at a time when everyone's enthusiasm for trading is not high, the competition is to make fewer mistakes and stabilize customers, rather than embarking on a new journey.

The only ones that have any hope of competing with Binance are the centralized OKX and the "decentralized" Hyperliquid, but it seems that only the latter is the only one left.

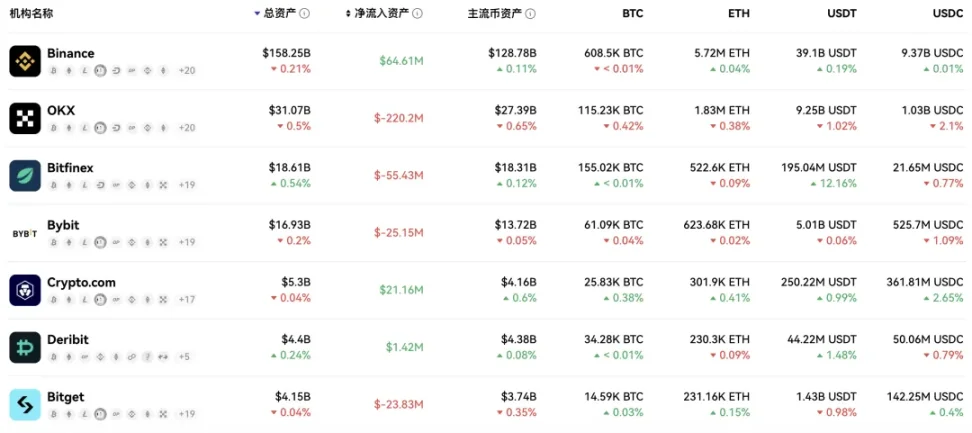

Caption: Exchange 24H Money Flow, Image Credit: @OKLink_CN

Instead of using DeFillama's data, OKLINK's own data also shows that OKX is outflowing assets, although the withdrawal movement has only killed FTX, but it is the famous FTX.

Binance has been criticized by the market, and other competitors have also made extra efforts, such as Bybit's active participation in the Solana ecosystem, and its own Perp DEX Byreal uses the Solana technology stack to support xStocks for the first time.

That is, all exchanges have to consider the problem of how to operate under compliance, which is not an easy task.

Compliance issuesStarting in 2022, BitMEX, FTX, and Binance have high leverage issues as ethical issues, money laundering as legal issues, and offshore as operational issues.

Today, only Binance retains the poise of an old artist, FTX is gone, BitMEX is dead in name only, and if you think compliance is just lip service, you're obviously underestimating the stakes.

Previously, Binance revoked the Hong Kong exchange license application because it could not include mainland customers, and Hong Kong was really about compliance, and a large number of offshore exchanges chose to "protect the market and abandon the license", and there was also OKX HK that revoked the license application at that time.

In this era, exchanges are anxious, on the one hand, they have to comply with the license to land, and on the other hand, they have to deal with the real impact of DEXs.

The pain of the latter, the regulators of the former will not understand at all, and can even predict that the next thing for licensed CEXs is to launch attacks on unlicensed DEXs, and believe me, Coinbase, which can launch Stand With Crypto, can target members of Congress and can also target Hyperliquid.

Binance is engaged in Alpha, stabilizing the wallet market that was just grabbed from OK, and also expanding BSC, and sneaking up on a Hyperlqiuid from time to time to outperform everyone.

The tactical success of OK wallet and product ultimately contributed to Binance's strategic win.

epilogue

With a scientific and rational attitude, we can explain the movement of the universe and the rise and fall of the tides, but it is difficult to explain why a certain currency rises and why OKX is working with users.

I can only sigh, it's not that the opponent is too strong, but that the peer is too stupid.