Sister Mu switches COIN, Coinbase is about to be "value discovered"?

In the Crypto market in June, the hottest thing was not Bitcoin, not Copycat or Meme, but Circle (CRCL). Since its IPO, it has soared by more than 7 times, breaking the circle worldwide, and becoming a rare "currency stock leader" in the U.S. stock market. However, just as hot money from the traditional financial and cryptocurrency markets poured into Circle, Cathie Wood, who is known for betting on technology growth, chose to reverse the trend and reduce her holdings in CRCL and increase her position in Coinbase (COIN).

According to Ark Invest Daily, Cathie Wood's ARK Invest reduced its holdings of 415, 844 shares of CRCL on June 23, with a total value of about $109.5 million based on the day's closing price. At the same time, a total of 20, 701 shares of Coinbase were added in one day, which is now worth about $7.14 million. On the 23rd and 24th, it added its position in Shopify, which has deep cooperation with Coinbase, for two consecutive days, buying a total of 146, 487 shares, which are now worth about $16.76 million.

Ark Invest currently has close to $900 million in Coinbase and around $500 million in Shopify. Together, these two account for about 12% of ARK's portfolio.

List of ARK's increase and decrease in holdings on June 23, source: Ark Invest Daily

Although the skyrocketing price of CRCL reflects the long-term optimism about the stablecoin payment track, Coin, as the intersection of its underlying settlement ecology, on-chain network and user traffic, seems to be closer to the "ontology" of this round of narrative. Not only that, Coinbase is also one of the largest shareholders of Circle, holding about 50% of the latter's shares, is Coinbase undervalued by this combination of "advantages"?

Comparison of the increase in CRCL (top) and COIN (bottom).

Partnering with 200 financial institutions?

On June 24, at the just-concluded hearing of the U.S. House Financial Services Committee's semi-annual monetary policy report, the Fed finally relented, with Chairman Jerome Powell saying that "banks can provide banking services and conduct related business to the cryptocurrency industry, provided that the financial system is safe and sound."

On the 25th of the next day, Coinbase's founder and CEO Brian Armstrong announced Coinbase's new infrastructure Crypto-as-a-Service, CaaS "Crypto-as-a-Service", and said that it has cooperated with about 200 banks, brokerages, fintech companies and payment institutions around the world.

This CaaS system covers the entire process from asset custody, trading, lending, stablecoin integration to on-chain tokenization. For banks, Coinbase offers a regulatory-compliant, scalable, and flexible wallet system and asset management tools with vault-level security and the ability to self-manage private keys.

At the transaction level, Coinbase provides access to CFTC-regulated crypto perpetual contracts, helping banks build compliant spot and derivatives businesses. What's more, Coinbase provides trade finance capabilities without upfront funds, and provides a complete range of upstream and downstream services in the use of stablecoins, from payment to foreign exchange settlement to on-chain issuance.

For brokerage firms and exchanges, Coinbase also provides institutional-grade custody services and one-stop trade execution capabilities, allowing partners to access cross-platform liquidity through Coinbase Prime, and provide real-time quote services and RFQ trading. It also supports trade finance, stablecoin integration, and staking yield infrastructure, as well as a white-glove help desk to provide customized execution services for high-net-worth and complex orders.

Base Chain and USDC, Coinbase's right-hand man

Earlier this month, on June 13, Coinbase announced a number of positive announcements at the same time. First of all, it announced its cooperation with Shopify to support USDC payment on the Base chain in more than 30 countries around the world, which is the first time to truly open up the settlement scenario of stablecoins on mainstream e-commerce platforms. At the same time, Coinbase officially integrated the DEX router on Base into the main application, allowing users to complete on-chain transactions without leaving their CEX accounts.

Coinbase is currently one of Circle's largest shareholders, holding nearly 50% of the company, and is the sole issuer of USDC. Coinbase is standardizing the use of USDC as a settlement tool for cross-border and local payments. With real-time settlement, floating money management tools, and fiat onboarding, Coinbase is helping traditional payment institutions upgrade to a next-generation platform that supports crypto payments. It is particularly noteworthy that Coinbase's integration of USDC is not limited to the asset level, but also has reached cooperation with leading e-commerce platforms such as Shopify, which has substantially promoted the implementation of USDC in the real e-commerce system.

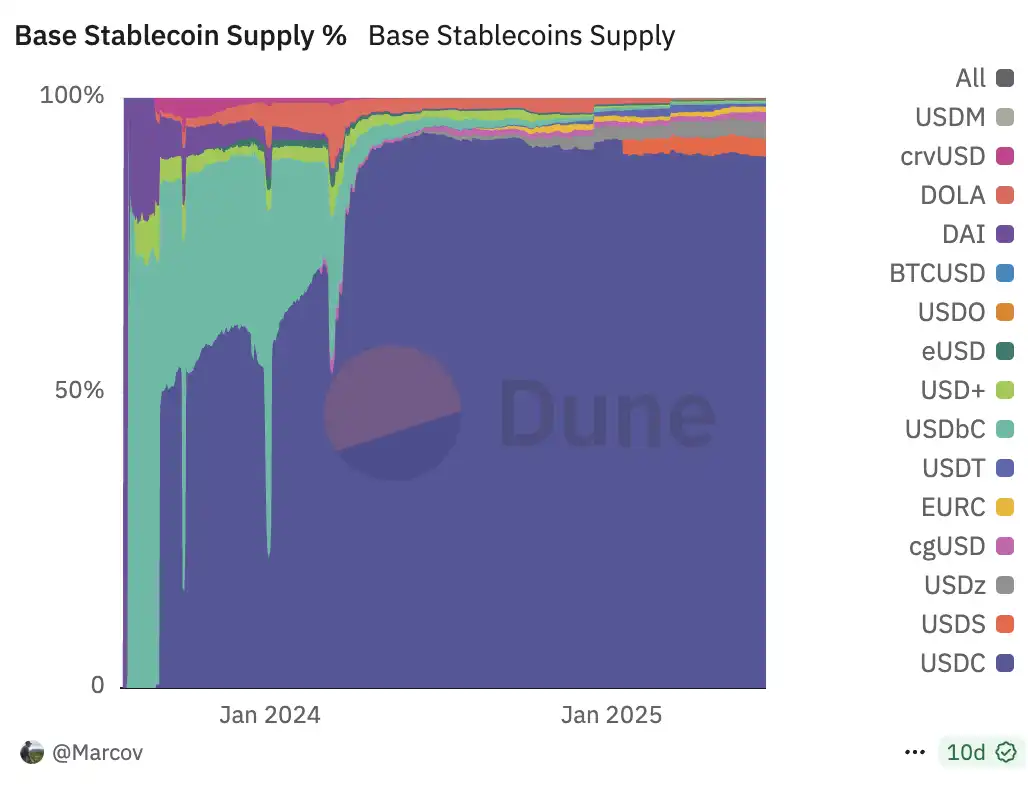

The basis of all the above layouts is Coinbase's Ethereum Layer 2 underlying public chain Base. Coinbase's initiatives encourage customers to deploy tokenized assets and DeFi applications on Base, backed by compliant exchanges, low fees, and support for fast, round-the-clock settlement, providing an ideal environment for traditional institutions to test the waters of on-chain business, and USDC accounts for 90% of the total stablecoin supply on the Base chain, so the more active the Base chain, the wider the adoption of CIRCLE.

Base's stablecoin proportion, USDC exceeds 90%, source: DUNE

And as Coinbase is reintegrating on-chain liquidity, compliant payments, and high-frequency trading into a complete ecosystem, combining them in a "regulatory permission" manner. Therefore, the current Coinbase may not be just a compliant exchange or ETF target, it is building an operating system that is gradually adopted by mainstream finance with CaaS and Base.

Deribit + CFTC perpetual license, spending a lot of money to do big things "derivatives" compliance

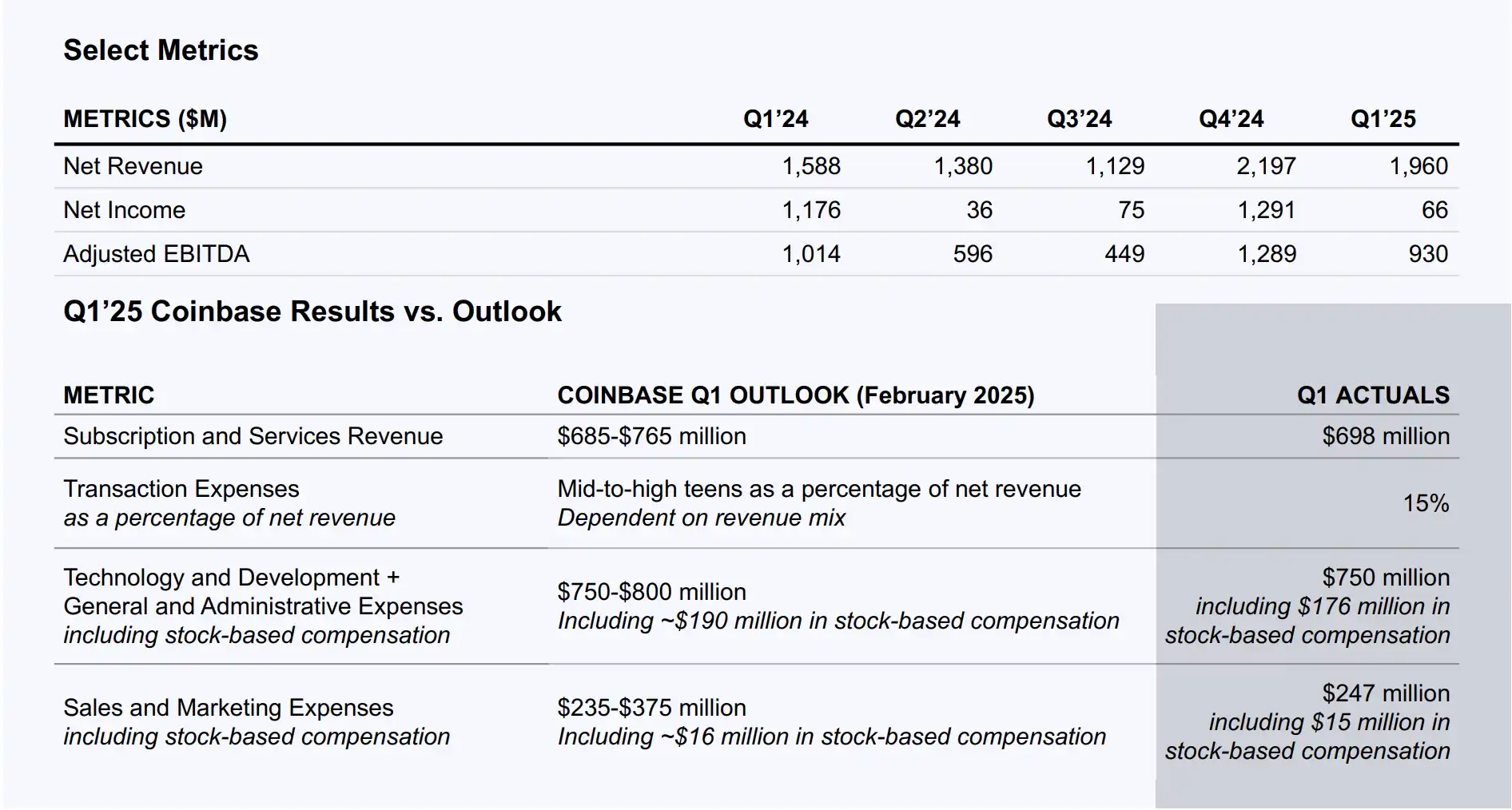

Due to the high cost of compliance, the decline in transaction fees and institutional business in the last quarter was a given fact for Coinbase, which has a limited revenue model. But derivatives, especially "legal U.S. market perpetual contracts", are incremental markets that have not yet been fully opened.

As a result, Coinbase has taken a number of steps, most notably announcing in June that it will launch a 24/7 CFTC-compliant perpetual futures contract feature in the U.S. by the end of this year, following its announcement on May 9 through its CFTC-regulated exchange, Coinbase Derivatives, LLC (formerly known as the CFTC-regulated derivatives trading platform). FairX) initially launched Bitcoin and Ethereum futures trading in the United States. Also in May, Coinbase completed the acquisition of Deribit, one of the world's largest crypto options exchanges, and Coinbase began to join the ranks of the top derivatives market.

Deribit has a strong presence in non-US markets, particularly in Asia and Europe, and the acquisition gives it Deribit's dominance in Bitcoin and Ethereum options trading "accounts for about 80% of global options trading volume, with daily trading volume remaining above $2 billion." At the same time, 80-90% of Deribit's customer base are institutional investors, and its professionalism and liquidity in the Bitcoin and Ethereum options markets are favored by institutions.

The U.S. market has not had an exchange launch compliant derivatives for a long time after the compliance cleanup a few years ago, and the U.S. market has always been a "sweet spot" in the eyes of exchanges, but for "U.S. players", on-chain protocols such as Hyperliquid, which can bypass regulation and take away about 20% of Binance's derivatives market as an institution and Binance cannot be compliant, are the main choice for most U.S. traders today. But the market may also be "swallowed" by Coinbase, as the only U.S. platform with user scale, compliance credentials, and technology stack, making it the exclusive channel for truly "legally opening contract trading" in the U.S. market.

This series of operations is its response to the decline in its earnings last quarter, its earnings per share (EPS), revenue, and platform earnings all collectively declined in the last quarter, and contract trading is a more "stable" source of income compared to spot trading, which is more affected by the market.

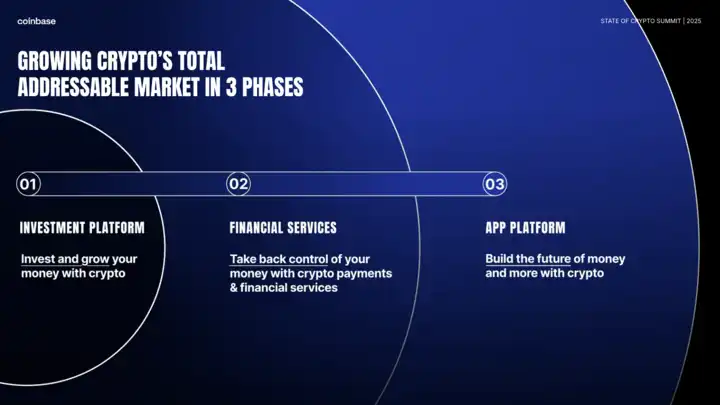

The value of Coinbase lies not in the current price, but in the structure

Although Coinbase only receives a small percentage of USDC's 60% interest income (about 34%), the on-chain settlement, payment on-ramp and DEX routing behind it cover a much broader economic territory than CRCL. ARK's rebalancing behavior also confirms this logic, reducing CRCL is to settle for safety, and increasing the position of Coinbase and other surrounding ecosystems is to bet on its on-chain ecological integration capabilities. Coinbase also announced its next phase of goals a few days ago "focused on driving mass adoption of cryptocurrency" and divided its development into three phases.

The first stage is to look at cryptocurrencies as a new type of investment platform, starting with Bitcoin and gradually expanding the list of assets.

The second phase is a complete update of existing financial services, no longer just replacing the old system with a new interface, but rebuilding a new financial system with crypto-native as the core from the bottom, including DeFi lending and lending secured by Bitcoin, and services such as cross-border payments based on stablecoins, emphasizing the freedom and power of users to regain control of their assets.

In the third phase, Coinbase wants to evolve the platform into the infrastructure for the next generation of Internet applications, so that value flows "directly" to real creators and users.

When Base is responsible for the traffic entrance, DEX provides asset flow, USDC is bound to the payment scenario, and perpetual contracts catch the high frequency of transactions, Coinbase's form has gone beyond the exchange itself, and now it is more like a "compliant on-chain App Store".

Value discovery is often not because it is cheap, but because the structure is right. Coinbase, on the other hand, may be the right asset.

Link to original article