Reducing costs and increasing efficiency = layoffs + selling ETH? What signals are being sent by the new EF Treasury Deal?

On June 4, the Ethereum Foundation (EF) officially released its latest Treasury Management Policy, which systematically elaborates on its financial expenditure policy, asset allocation strategy and long-term vision of "Defipunk". The policy aims to enhance the Foundation's financial resilience, support DeFi innovation, and strengthen its value position in the direction of privacy protection and self-custody.

Ethereum Foundation's Treasury Management Policy page

treasury role is to support the foundation's long-term autonomy, sustainability, and legitimacy. The Ethereum Foundation (EF) is expected to continue to be the long-term steward of the ecosystem, but its mandate will gradually narrow.

the

new policy, EF will determine the allocation ratio of fiat currency to ETH based on the "operating expenditure ratio × buffer period" model, and maintain the annual expenditure at a high level of 15%. The Foundation pointed out that 2025-2026 will be a critical stage for the ecosystem, and resources need to be concentrated to promote the implementation of technologies at the protocol layer, including L1 scaling, blob technology, and UX optimisation.

EF said that 2025–2026 will be a key window to move forward with the implementation of the protocol, and it is expected to maintain 15% of annual spending and set a 2.5-year fiat buffer. This means that the Foundation will need to convert about 37.5% of its coffers into fiat currency to support short- to medium-term investments.

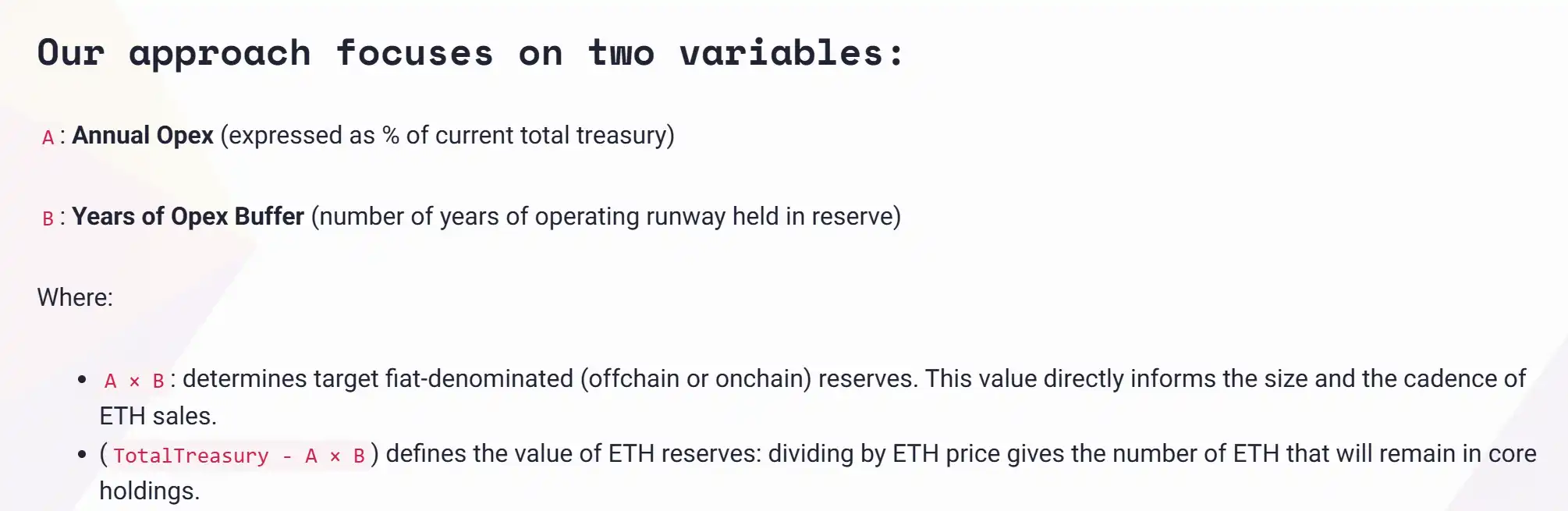

According to EF's new Treasury Management Policy, A is the annual operating expenditure (as a percentage of the current total treasury) and B is the operating buffer period (the number of years in the reserve that can support operations).

Amount calculation and execution.

Layer 1: Structural Model, which sets the asset allocation ratioThe

Foundation first uses a structural model to determine its asset allocation framework. The model multiplies the annual operating expenditure as a percentage of the treasury (A) by the desired operating buffer period (B) to arrive at a target fiat currency ratio:

A × B: determines the target reserve size denominated in fiat currency. This value determines how often and how much ETH is sold.

This layer of the model does not focus on the specific amount, but emphasises how the foundation should maintain a long-term asset structure and reduce the short-term decision-making pressure caused by currency price fluctuations, which is suitable for the formulation of governance framework or asset allocation policy.

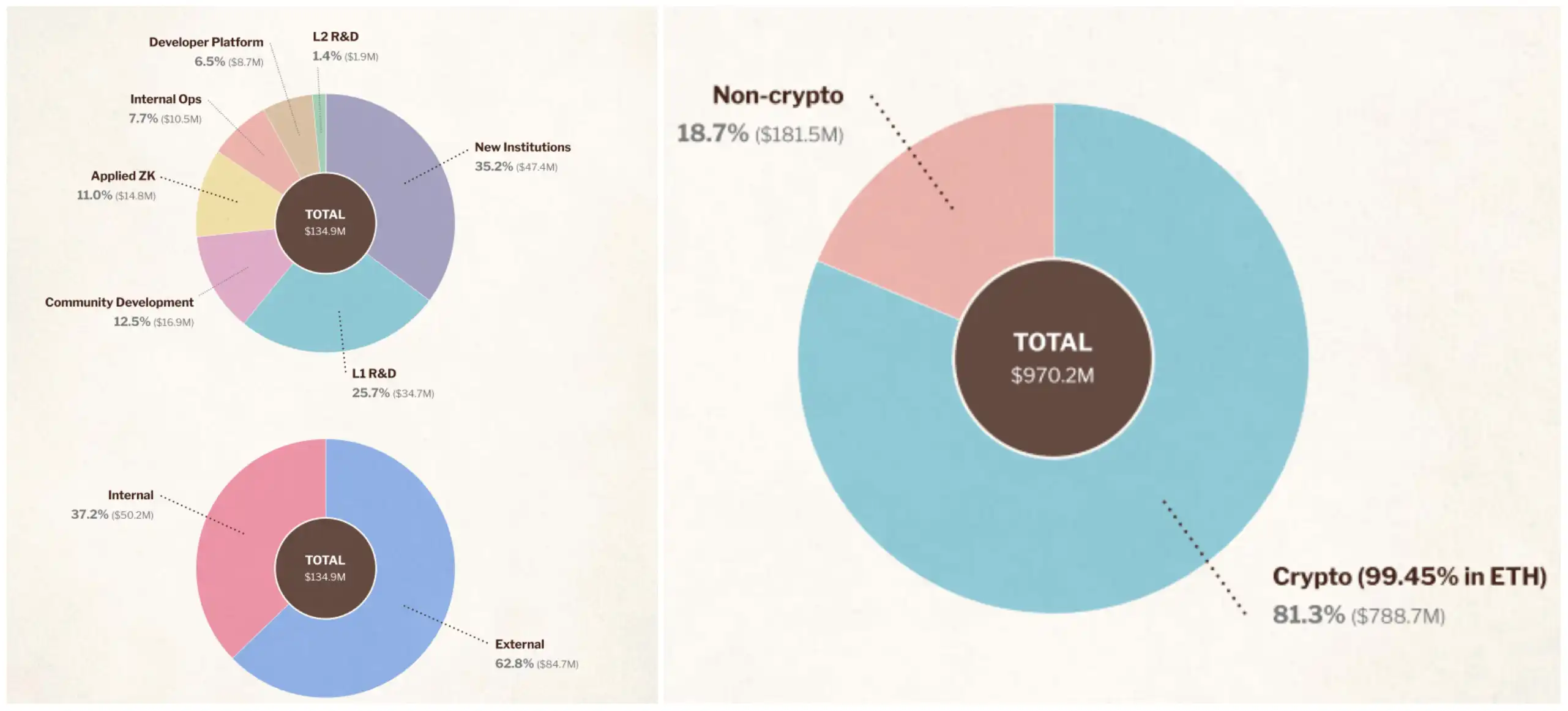

According to the data disclosed in the 2024 Ethereum Foundation Report, the total value of the Ethereum Foundation treasury is $970.2 million, a decrease of 39% from the previous disclosure. Of this amount, operating expenses in 2023 will be approximately $134.9 million, or 13.9% of the total value of the treasury.

Based on the standard of 15% of annual operating expenses and a 2.5-year buffer period of the new fiscal revenue, EF's target fiat currency reserve ratio is 15% × 2.5, or 37.5%. At present, the foundation's crypto assets account for 81.3%, and under the new standard, the foundation may need to reduce its holdings of nearly 30% of ETH.

According to EF's financial report, the Ethereum Foundation's operating expenses in financial year 2023 (left) and the proportion of treasury asset allocation in October 2024 (right), according to the new fiscal standard, EF needs to reduce nearly three-thirds of its crypto asset holdings

The second layer: the amount model, calculates how much fiat currency should be raised

After the structure ratio is set, the Foundation applies the target ratio to the current total value of the treasury and translates it into a specific fundraising target:

target fiat currency reserves = A × B × The current total value

corresponds to the actual amount, so its target fiat currency reserves are about $363 million。 This amount model is used to assess the sufficiency of the current fiat currency reserves and whether ETH needs to be sold to raise the difference, which is an important basis for decision-making at the executive level.

Layer 3: Execution model, inverting how much ETH

Finally, in order to implement the allocation goal of fiat currency and ETH, the Foundation will consider the remaining part of the vault (i.e., 1 - A × B) as the ETH reserve value, and divide it by the current ETH unit price, so as to deduce the amount

TotalTreasury - A × B: The target value of the ETH reserve (divided by the ETH unit price to get the amount of ETH held by the core).

Target ETH amount = (1 - A × B) × total treasury ÷ current ETH price

This step translates the strategy model into actual position requirements. Corresponding to the actual amount, the foundation treasury is $970 million, A × B=37.5%, and based on the ETH price of $2,500, the foundation should keep about 242,000 ETH as a core long-term holding asset.

Compared with the traditional budget system, this model provides a more flexible asset allocation method: in a bull market, fiat currency can be cashed out in a timely manner to enhance the ability to resist cyclicality; It can also maintain long-term belief in currency holding during market downturns. EF said the board will regularly evaluate two parameters, A and B, to dynamically adjust the asset structure and ensure that resource allocation is synchronised with the strategic cadence.

next two and a half years are considered a critical period for the ecosystem by the Ethereum Foundation, so it is necessary to focus resources on promoting the delivery of important technologies. In 2025, EF will spend about 15% of treasury funds (37.5% of fiat currency reserves) and plans to maintain a legal buffer for spending for 2.5 years. The company plans to reduce annual operating expenses roughly linearly over the next five years, eventually reaching a baseline level of 5% over the long term.

Related reading: Ethereum Foundation 2030 Plan: Slash ETH Spending to 5%, Actively Support Defipunk "

Optimizes Asset Management,

in Asset Allocation, Ethereum Foundation (EF) Further Clarifies Its Asset Allocation Framework in the New Policy, Aiming to Balance Security, Liquidity and Long-Term Robustness.

In terms of crypto assets, EF said it will seek stable financial returns without violating Ethereum's principles of decentralisation and openness. The Foundation prioritises deployment to audited, permissionless, and transparently structured DeFi protocols, emphasising protection against potential risks such as smart contracts, governance, stablecoins, and oracles, and avoiding excessive pursuit of high-risk returns.

On-chain funds will be flexibly allocated based on market conditions, risk exposure, and yield opportunities, which currently includes independent staking and providing wETH liquidity to mainstream lending protocols. In the future, it is also planned to introduce stablecoin lending and some high-security on-chain RWA products as a complement. In addition, EF evaluates the deviation between actual fiat reserves and operational buffer targets on a quarterly basis, decides whether to sell ETH, and makes a strategic choice between off-chain swaps or on-chain swaps.

Compared with the previous strategy of focusing on on-chain returns, EF has explicitly introduced tokenised real-world assets (Tokenized RWAs) as an important component of fiat assets. Its allocation structure is divided into three tiers: immediate liquid assets that cover daily expenses, low-risk assets that match medium- and long-term obligations, and tokenised real-world assets (Tokenized RWAs) that are integrated into a unified strategy management system.

This change sends a clear signal: the fund is starting to think more about the stable income tools of the fiat world, with the aim of supporting the sustainability of higher expenses in the short to medium term, rather than relying on market conditions or the fortuitous nature of on-chain returns.

It is worth noting that only RWA protocols that meet the conditions of on-chain transparency, auditability, and decentralised governance may be included in the foundation system. Conversely, traditional RWA projects with closed structures that rely on legal trust paths will face a higher barrier.

Such adjustments not only improve the robustness of the treasury structure, but also reserve institutional space for further expansion of on-chain asset management paths in the future. At this time, the details of the deployment have not been disclosed.

promulgating the "New Standard for Entrepreneurship"

, EF has set out clear goals for Cypherpunk in its new fiscal policy, and based on this, it has built a set of evaluation frameworks called "Defipunk", which aims to promote the construction of more decentralised, privacy-friendly, and technology-self-sufficient financial infrastructure. The framework emphasises six core values: security, open source, financial autonomy, technology instead of trust, freedom through cryptographic tools, and privacy, with a particular focus on privacy at the transaction and on-chain data levels.