Private equity financing is in vogue, and 4 crypto reserve companies may face downward pressure on stocks

Author: Steven Ehrlich

Compiler: Deep Tide TechFlow

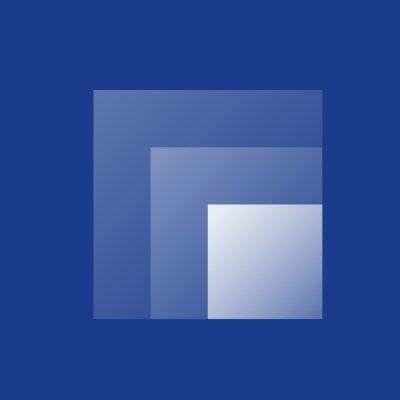

Las Vegas, Nevada-based bitcoin mining company BitMine Immersion Technologies (BMNR) had a market capitalization of less than $30 million in June, which is in the middle of the pack in a highly competitive industry. But that all changed on June 25, when the company announced a shift to a crypto funding strategy focused on Ethereum. As part of its transformation, the company raised $250 million through a private equity investment (PIPE) and appointed Tom Lee of Crypto Bulls as chairman of the board.

The stock immediately surged more than 1,300%. Currently, the stock has a market capitalization of $4.6 billion and is trading at 17.23 times book value.

(Chronological chart)

But this success story comes with some important terms. As Bitmine has chosen to raise capital through a PIPE (Private Investment Public Offering of Shares), there will be a wave of selling pressure in the near future. If history is any guide, the stock would have fallen by at least 60%. This could happen when the shares sold to wealthy institutional clients in a $250 million funding round can be sold to the public, and it's likely to happen sometime this summer.

How big is the oversupply we're talking about? Prior to the capital raise, Bitmine had a circulating supply of just 4.3 million shares. To raise $250 million, it had to sell an additional 55.56 million shares. This equates to a 12.92-fold increase in the number of shares.

Bitmine isn't alone in this challenge.

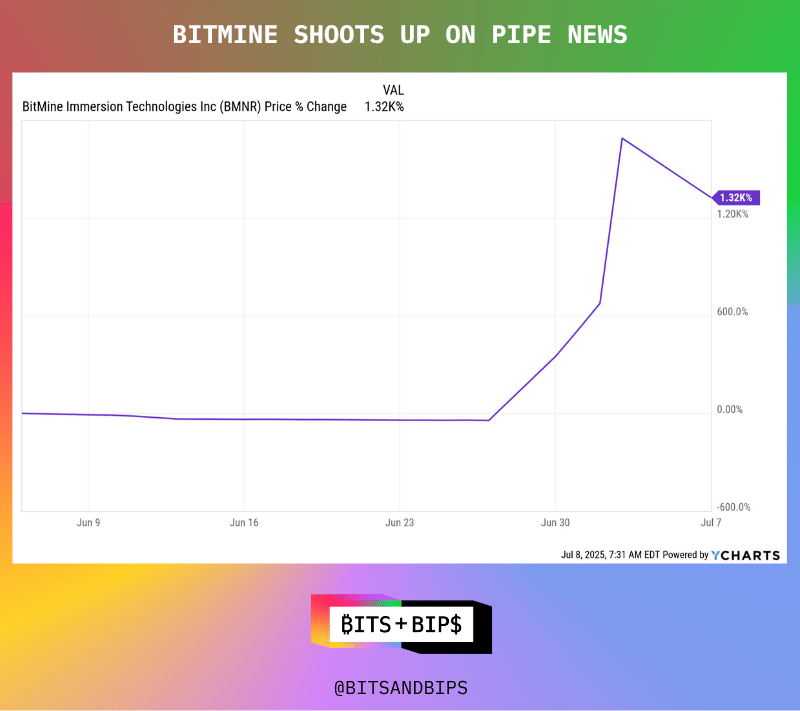

Asset Entities (ASST), a social media marketing company based in Dallas, Texas, faced similar challenges. At the beginning of May, the company had a market capitalization of just under $10 million and a supply of just 15.77 million shares. That also changed on May 27, when the company raised $750 million through PIPE and merged with Strive Asset Management, owned by former presidential candidate Vivek Ramaswamy. Its share price has also risen by more than 1,300%.

(Chronological chart)

But like Bitmine, the company is also facing significant selling pressure. The PIPE transaction increased Asset Entity's outstanding shares from 15.77 million to 361.81 million shares, an increase of 21.94 times.

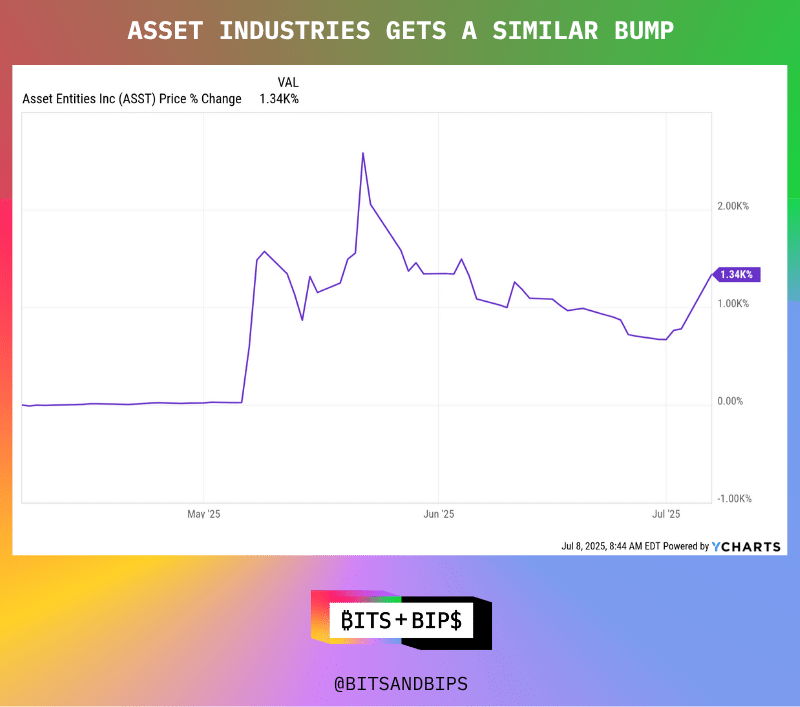

Justin Sun's SRM Entertainment faces similar challenges. After striking an agreement to transform the souvenir design company into Tron Finance, the company's stock price soared 902.5%. As part of the $100 million PIPE financing, SRM Entertainment's original stock base of 17.24 million shares was expanded 11.6 times to accommodate 200 million newly issued shares.

(Chronological chart)

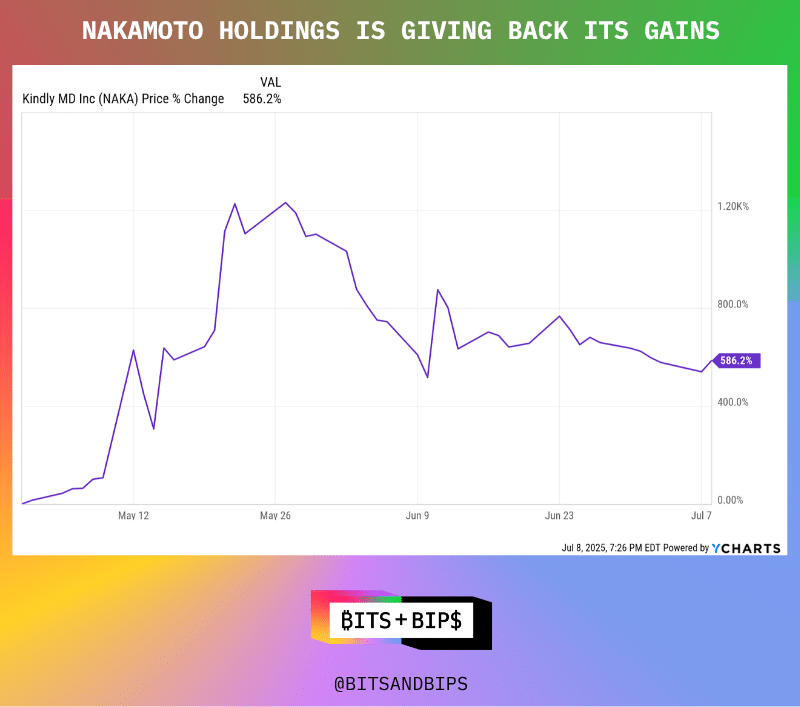

Finally, take Bitcoin Magazine's David Bailey, for example, who raised $563 million through a private equity investment (PIPE) to merge Nakamoto Holdings with KindlyMD (NAKA) as part of a $763 million investment round that also included debt financing. On May 12, 2025, the company announced a merger with an 18.7-fold increase in the number of shares, from 6.02 million shares to 112.6 million shares. The stock surged more than 1,200% after the announcement, but has since given up half of its gains, perhaps because the deal hasn't been completed yet and the company hasn't really started to add to its Bitcoin holdings. Despite this, its share price has risen by 586.2% since the merger was announced.

(Chronological chart)

These companies are a prime example of the risks that come with the latest trends in cryptocurrency, and these funding companies are actually leveraged hedge funds that trade on the open market. If investors are not careful, they may be stuck in the dilemma of providing exit liquidity to institutions that participate in these transactions at reasonable prices before cryptocurrencies rise sharply.

In fact, one investor who has been involved in several of these trades said anonymously in an interview with Unchained: "It's a tricky game that most retail investors shouldn't be in. It's a game between institutional investors and hedge funds. ”

PIPE Financing Dream

Not all such transactions will raise the same alarms as BitMine, Asset Entities, Satoshi Nakamoto, and SRM. There are several factors that need to be taken into account in trading. For example, companies participating in trading must typically resemble outstanding shares (the number of shares available for sale on the open market) and penny shares with a low total supply. All four of these companies meet this criterion.

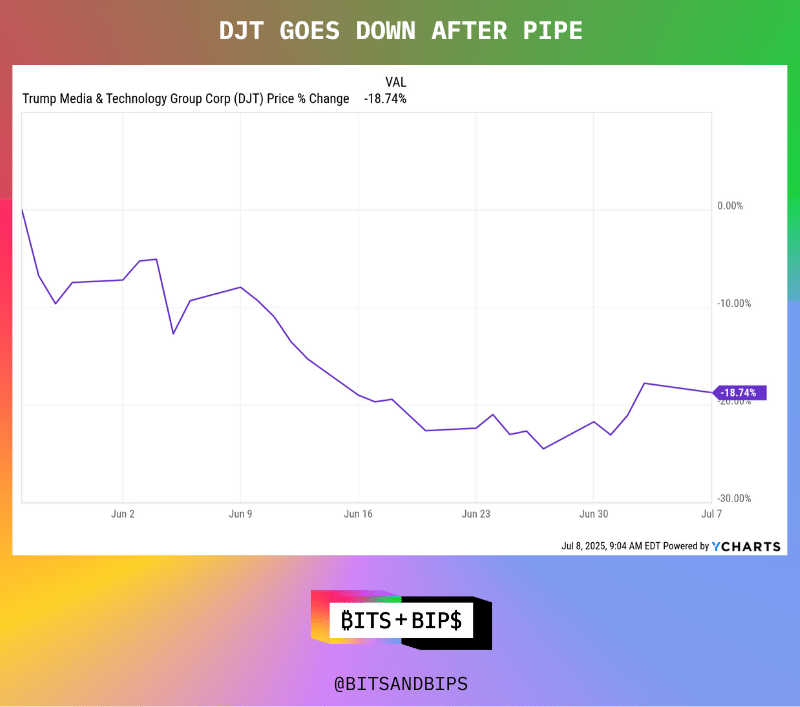

Then, the PIPE trade needs to show up and let both numbers rise significantly. As shown in the chart below, not all financings meet the criteria. For example, the Trump Media Group (DJT) raised $1.5 billion through PIPE on May 27 (as part of a $2.5 billion deal, which included $1 billion in non-convertible debt), but its share price was barely affected. In fact, it also fell. Compared to the previous three companies, the new issue of 55.86 million shares represents only a 25.32% increase from its existing 220.62 million shares.

(Chronological chart)

(Company press release and SEC filing)

When these stocks meet the conditions for sale, lighting the fuse becomes the key. Unlike stocks sold through a typical IPO, shares sold through a PIPE are not immediately liquid because they do not require registration with the Securities and Exchange Commission (SEC). The registration process is when a company submits a registration form, usually an S-1 or S-3 document, to the regulator that contains all the information an investor needs to make an informed purchase decision, such as the company's prospects, use of earnings, risk factors, etc.

For PIPE companies, especially those based in the United States (foreign companies have slightly different requirements and forms), the typical route is to file Form S-3 because these companies are already public companies and have less work to fill out the form.

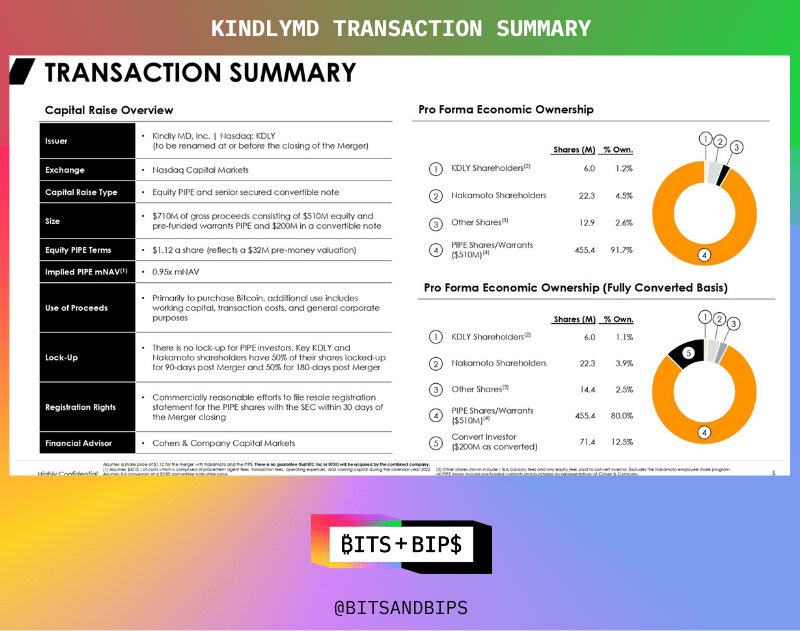

Most of the time, companies that raise money through PIPE promise investors to file a registration statement as soon as possible. After all, what investor wants their assets locked up? Take, for example, this company presentation from Nakamoto/KindlyMD. In the slide below, the company promises that potential investors will file S-3 documents as soon as possible, noting that there is no lock-up period for PIPE investors. The Company was unable to file a registration statement prior to the completion of the merger, which is expected to close in the current quarter.

(Nakamoto/KindlyMD)

An unfortunate encounter in the history of PIPE

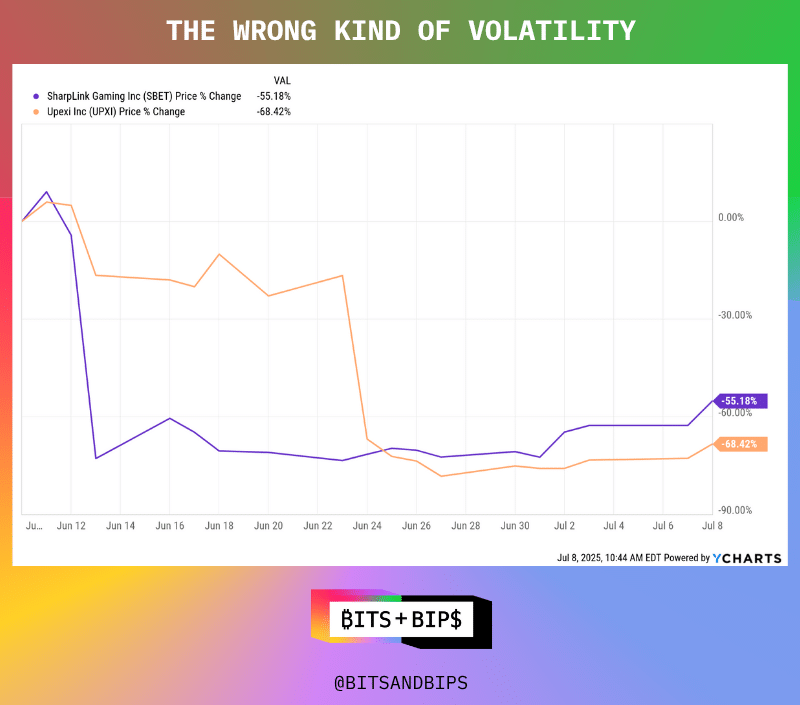

Two important cautionary tales that investors need to be aware of are Solana's money management company Upexi (UPXI) and Ethereum-focused Sharplink (SBET). Both companies raised huge sums of money through PIPE, and their share prices fell significantly after they went public.

(Chronological chart)

Sharplink raised $425 million and issued an additional 58.7 million shares, an increase of 8,893%, on top of its existing 659,680 shares. On June 12, the company filed a form called S-ASR, which caused the stock price to plummet. The S-ASR is a type of S-3 registration form, but with a slight twist – since the company is a well-known Established Issuer (WKSI), the shares can be sold immediately, which essentially allows the company to make private investment sales, such as PIPEs.

A similar story happened to Upexi, a company that had previously been in the proptech business that repositioned itself as Solana's finance company this spring. The company raised $100 million through PIPE and subsequently increased its outstanding share capital from 1.34 million shares to 35.97 million shares, an increase of 25.69 times. The company's S-1 filing, which went into effect on June 23, is clearly illustrated by the drop in the share price in the chart above.

Sharplink executives did not respond to requests for interviews about the drop in stock prices, but Upexi scheduled an interview with Brian Rudick, the new chief strategy officer. When asked if he expected such a drop after the effective notice was issued, he replied that it was always a possibility. "For us, when we go out to raise PIPE, it's not clear if everybody is going to be holding on or if the market is just worried about a potential sell-off (from almost all of PIPE's 15 crypto VC firms)," Rudick said, "We know there's always a possibility." But in order to get into the market as quickly as possible, I think for us the possibility of a sell-off is a trade-off that we obviously want to make. ”

In fact, this sell-off may be necessary in order to inject sufficient liquidity into the market for actual price discovery of the stock.

What finance companies and investors can do

Given the precedents of Sharplink and Upexi, it seems inevitable that Bitmine, Asset Entities, and SRM will need to go through a similar transition period. And it looks like they can't help stop that from happening.

A lawyer familiar with such deals, who spoke to Unchained on condition of anonymity, said: "You can [make an agreement to prohibit people from selling]. I think the reason you're doing this is to avoid this superficiality. Some people may say, 'We don't want to sell anyway, we agree to be locked up for a while', and maybe on the surface, it will give people peace of mind. When you have a large group like this, it can be difficult to manage. Actually, would anyone do that? I doubt it, but if that reassures the market, you probably can. ”

So, perhaps the next best hope is for investors to hold these shares in order to avoid paying income taxes in favor of more favorable capital gains taxes. An investor in Upexi and Sharplink, who also spoke on condition of anonymity and claimed that he did not sell his stake in the two companies, laid out his thoughts this way: "From a tax point of view, it is inefficient to constantly buy and sell. You'll only lose short-term capital gains, so you'll be liable for 40% of the tax. If you're directed long and think the NAV premium will remain roughly at current levels, then you'll probably only save 20% on taxes. ”

But there are also two problems with this theory. First, investors may panic sell if they think someone else might start selling stocks. In other words, they may not want to be the first to sell the stock, but they also don't mind the second one. Second, if a company has built a large position based on the few shares previously outstanding, it doesn't take everyone to sell the stock to drive down the stock price.

Perhaps the best option is to diversify the sources of funding when companies issue these bonds. Each option has its pros and cons. PIPE provides an easy way to raise a large amount of money in a short period of time. This helps to kickstart an overweight strategy. But it also has the potential to create a huge selling barrier. Issuers can try different ways to sell their shares, such as pre-registering their shares with the Securities and Exchange Commission (SEC), but this may take longer to raise the necessary funds. Today, more and more companies are taking a hybrid approach, where they may raise a third of their capital through PIPE, with the rest coming from convertible bonds or credit facilities. These can delay selling pressure, but they also increase balance sheet leverage, which can be problematic if stock prices plummet.

But in this world where scale is paramount, companies will always feel the pressure to raise capital as quickly as possible, which can mean going all-in on PIPE. The market will continue to present a "Wild West" situation, so investors should follow the advice of institutional investors. "Wait until you have enough liquidity before buying. One should not speculate how much the premium will rise relative to the net asset value. They should wait for full liquidity and market pricing efficiency. ”

Representatives from Sharplink, Bitmine, Asset Industries, Nakamoto/KindlyMD, and SRM Entertainment either did not answer questions or were not interviewed.