Peter Thiel personally "saved" Erebor and wanted to be a "replacement" for Silicon Valley Bank

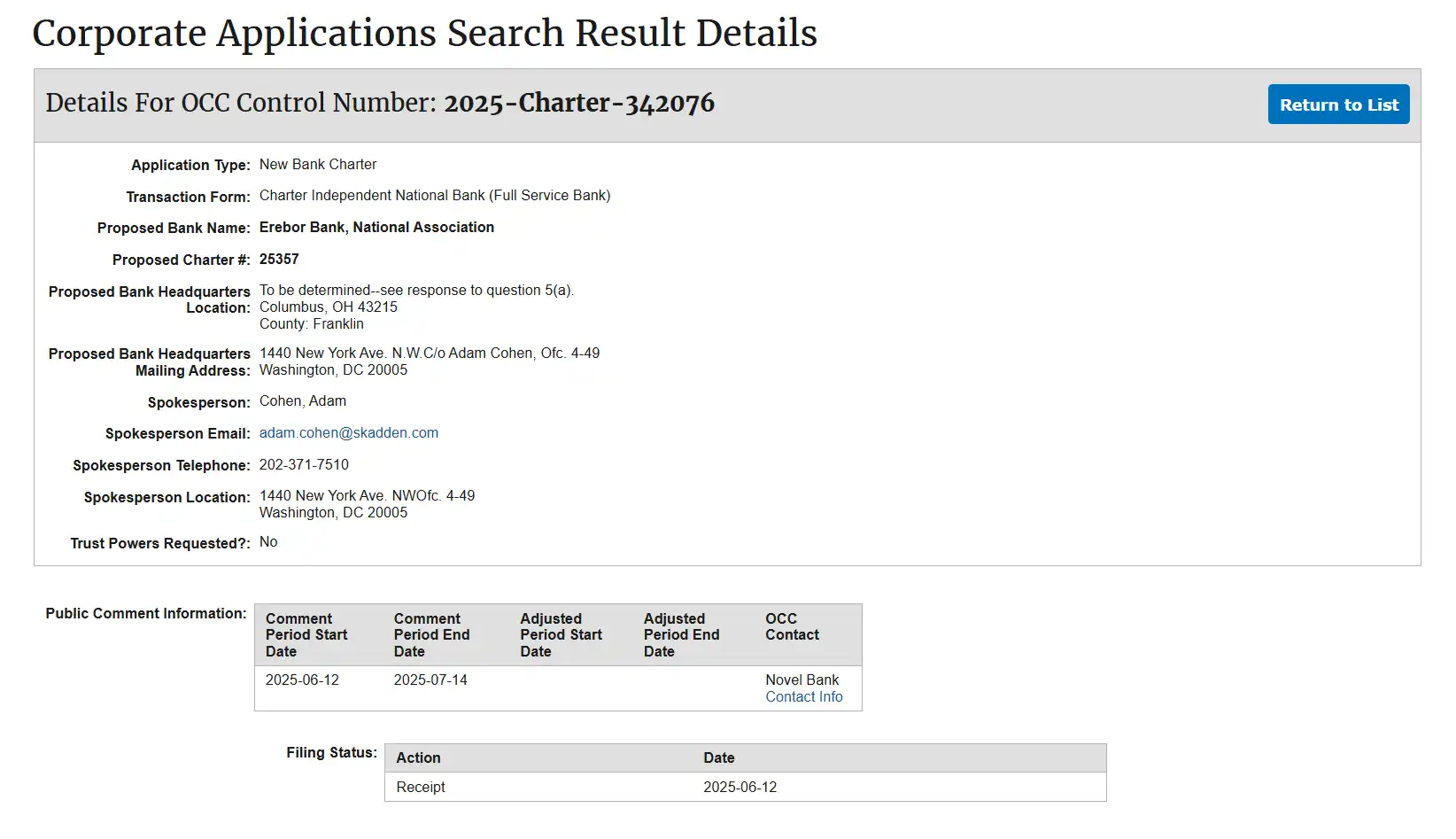

On July 3, a number of mainstream financial media confirmed that Peter Thiel (Peter Thiel) is co-launching a new bank called Erebor with tech billionaires Palmer Luckey and Joe Lonsdale, and has formally applied for a national bank license from the OCC, the Office of the Comptroller of the Monetary Office. The bank's target customers are crypto, AI, defense and manufacturing start-ups that "mainstream banks don't want to serve" in an attempt to become a replacement for Silicon Valley Bank's collapse.

OCC discloses Erebor's application for a new banking license

Behind the "Lonely Mountain", who is in charge?

In Tolkien's canon, Erebor, or "Lonely Mountain", is an underground kingdom founded by dwarves that contains a lot of gold and treasure that was later overrun by the dragon Smaug. Throughout The Hobbit's story, the lonely mountain is not only a symbol of wealth, but also a struggle for order, sovereignty, and reconstruction

The image of the crystal ball from the movie "The Lord of the Rings" and the logo of Palantir

It is no coincidence that "Erebor" was chosen as the name of the new bank. It continues Peter Thiel's preferred naming system: his investment firm Palantir, which means magic crystal ball, is from The Lord of the Rings, and Valar Ventures' counterpart "Vera Protoss" and Rivendell Capital "Rivendell", both of which are references to Middle-earth.

The composition of the bank's promoters also has a distinct "Silicon Valley political capital intersection" characteristic:

Peter Thiel (PayPal & Palantir, Founders Fund Leader)

Palmer Luckey (Oculus Founder, Anduril Co-Creator)

Joe Lonsdale (Co-creator of Palantir & Founder of 8VC)

All three are important political donors to Trump in the 2024 U.S. presidential election and have close ties to the GENIUS Act, which is currently being pushed forward by Congress.

According to Erebor's application to the Office of the Comptroller of the Currency (OCC), the Founders Fund will participate in the investment as the main capital backer, and the three founders will not be involved in the day-to-day management and will only be involved in the governance structure as directors. The bank's management team is the former CEO of Aer Compliance, a Circle advisor and compliance software company, with the aim of clearly drawing the line between politics and operations and highlighting its position as an institutionalized financial institution.

Under this multiple nesting of naming, capital, and politics, Erebor's setting is not only a choice of cultural symbols, but also a signal that it wants to be seen as an asset hub in the new financial order, which is not only in line with the mainstream regulatory system, but also retains the independence of technical capital within institutional boundaries.

Related Read: Silicon Valley Turns Right: Peter Thiel, A16Z, and Crypto's Political Ambitions

After SVB, Erebor rose again

In March 2023, Silicon Valley Bank (SVB) declared collapse due to asset mismatch and liquidity crisis, becoming the second-largest bank failure in U.S. financial history. After the accident, the deposits of several crypto companies such as Circle, BlockFi, and Avalanche were frozen, triggering a systemic panic, and the price of Bitcoin fell below $20,000 at one point. The SVB incident became a turning point in the financial ecosystem rupture in Silicon Valley, and it also prompted several of Erebor's promoters to launch an independent banking program.

SVB's assets were subsequently acquired by First Citizens, and some of its executives moved to HSBC in the US, partially continuing its service capabilities. However, for a large number of early-stage technology companies, the original account services, credit support and risk tolerance mechanisms are difficult to reproduce. Erebor's bank application documents clearly state that its target customers include technology companies that have been "rejected by mainstream banks due to the collapse of SVB", including cryptocurrency companies (including trading, custody, and settlement), AI startups, defense technology companies, and mid-to-high-end manufacturing start-ups, as well as employees, investors, and foreign legal entities of these companies.

Unlike the SVB model, Erebor proposes a 1:1 reserve system and limits the loan/deposit ratio to less than 50% to avoid maturity mismatch and credit inflation risks. According to its documents, stablecoins will be one of the core businesses, and USDC, DAI, RLUSD, etc. are all within the scope of potential custody, with the goal of becoming the "most well-regulated stablecoin trading institution", providing fiat currency access and asset custody services under the premise of compliance.

In addition, Erebor's three main sponsors — Palmer Luckey, Joe Lonsdale, and Peter Thiel — are key funders of the 2024 Trump campaign and have made donations to several Republican political action committees. Their direct political connection to the core promoters of the GENIUS Act also gives the Erebor project a clear institutional endorsement as the policy window opens. This triple structure of "financial vacancy + policy expectation + high-risk customer" provides a realistic motivation and path design for Erebor's application.

S.394 - GENIUS ACT 2025

Crypto bank, Thiel has been planning for a long time

One of the most noteworthy forces behind Erebor is the Founders Fund, a veteran venture capital firm led by Peter Thiel and one of the direct investors in the bank's initiative.

Peter Thiel with the Founders Fund

Founded in 2005 by Peter Thiel, Ken Howery and Luke Nosek, Founders Fund was one of the first venture capital firms in Silicon Valley to adopt "non-consensus investing" as its strategic direction. The fund's early-stage investments include Facebook, SpaceX, Palantir, Stripe, Airbnb and Lyft, leaving a strong mark on the Web2 and deep tech tracks.

Unlike most mainstream venture capitalists, Founders Fund explicitly advocates "dystopian technological idealism", preferring to invest in areas where policies and institutions have not yet been established, especially regulatory gray areas such as defense technology, artificial intelligence, bioengineering, and crypto assets.

In the crypto sector, the fund has invested in infrastructure projects such as Anchorage Digital (the first digital asset custodian licensed by the National Bank), LayerZero, BitGo, Ramp Network, EigenLabs, etc., and is a typical representative of the "institutional crossover" in the path of crypto financialization in the United States.

The Founders Fund has also been noted for its strong political stance. Founder Peter Thiel has long been a supporter of American conservatives, a key patron of Trump's 2016 and 2024 campaigns, and is active in the policy discourse of anti-regulation and anti-mainstream central banking systems. The fund is not only a direct investor in Erebor, but also a key intermediary in connecting it with the political bloc behind the GENIUS Act.

The emergence of Erebor is seen as a financial hub extension of this network: it not only provides digital asset settlement and custody services, but also tries to legally take on a number of emerging enterprise customers under the framework of the federal system "turned away by mainstream banks" - a considerable number of which are the long-term support of the Founders Fund system, including AI, defense, biotechnology and high-volatility crypto industries. Looking deeper, in the context of the GENIUS Act and the new SEC chairman's promotion of "stablecoin re-regulation", Erebor is very likely to strive to become the first batch of "US dollar relay banks" that custody USDC, RLUSD and other mainstream stablecoins in a compliant capacity, providing a federal clearing path for stablecoins.

This is not just the birth of a new bank, but more like a "built-in-the-system" dominated by venture capital logic: Founders Fund is not betting on a financial institution, but building a controllable interface to the financial order, building an independent stable fulcrum that can cross the existing financial structure for its dominant technological empire system. If Erebor is licensed and operates smoothly, it could become the first financial middle platform built by venture capital, penetrating through the policy window, and serving "enterprises inside and outside the institutional boundaries".

Competitive landscape and future challenges of crypto banks

The competition for Erebor is not easy. With the gradual clarity of the regulatory environment in the United States, the crypto industry is ushering in a new round of "compliant banking", and a group of players with different positioning are accelerating their layout:

Anchorage Digital is the first crypto custodian licensed by Bank Negara, focusing on government partnerships and institutional-grade asset services;

Circle has applied for a trust bank license, focusing on USDC reserve custody and circulation clearing;

Ripple plans to build a new cross-border settlement network with the RLUSD stablecoin and apply for a federal banking license at the same time;

In addition, state-level trust banks such as Custodia Bank and Paxos Trust are also exploring stablecoin financial services pegged to the US dollar in different ways.

In contrast, Erebor's differentiator is that it applies for a full-featured national banking license and explicitly includes "stablecoin trading and custody" in its main business scope. This makes it naturally qualified to operate across state lines and be fully compliant, and its service targets are no longer limited to the digital asset industry, but have expanded to AI, defense, biotechnology, and other customer groups that are "considered high-risk by traditional banks". Compared with Anchorage's institution-focused custody model, Erebor is more like a "commercial banking middle office" that supports crypto and high-tech companies. Compared with the role of B2B circulation markets such as Circle and Ripple, Erebor tries to establish a financial node with a higher regulatory level and higher entry threshold within the federal system.

In short, Erebor is not a "fill-in" in the crypto banking landscape, it is an "institutional-level rush" that strives to be different from the selection of licenses, asset structures, and target customers. In the future, it may not only compete with other crypto banks for customer resources, but also deeply intersect with the Fed-led payment system and stablecoin legislative process, becoming one of the most symbolic attempts in this round of "digital dollar" system evolution.

Thiel's Erebor doesn't just want to help AI companies manage money, it wants to become a "transfer interface" for the future of finance - between traditional banks and crypto assets, between state regulation and technological autonomy.

If it succeeds, it will not just host stablecoins – it will host a portion of the future channel for "digital power".

After all, in Middle-earth, dwarves can indeed fight their own kingdoms.