The hidden war between L2 and L1, who can be the winner of dApp revenue?

Original Title: The L2 vs L1 Battle that Nobody is Talking About

Original Author: 0x taetaehoho, Chief Security Officer, EclipseFND

Original compilation: zhouzhou, BlockBeats

Editor's note: L2 has an operational cost advantage over L1 because L2 only pays for a single sequencer, while L1 pays for the security of all validators. L2 is uniquely positioned for speed and MEV reduction, and enables innovative economic models to maximise dApp revenue. Although L2 cannot compete with L1 in terms of liquidity, its potential in the dApp economy will drive the crypto industry's transformation from infrastructure to a profit-driven, long-term business model.

Here's the original text (edited for ease of comprehension):

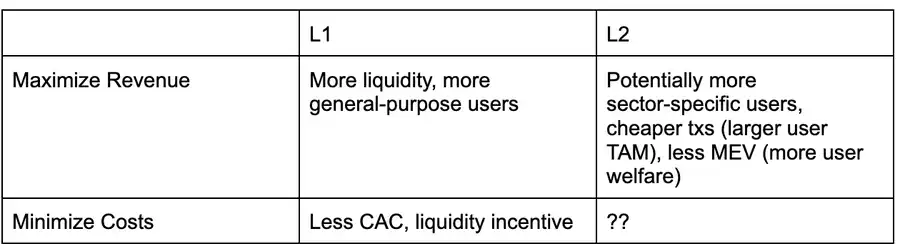

Here's a decision matrix from a dApp perspective that analyses whether to deploy to L1 or L2 in the current environment, assuming that both support similar types of applications (i.e., L1/L2 are not tailored for a specific application type).

L2 has not yet taken full advantage of its strengths, except for the relatively low MEV (Maximum Extractable Value) due to the centralisation of block producers. For example, despite the potential for lower transaction costs and faster throughput, Solana is still ahead of L2 in the EVM ecosystem in terms of performance and transaction costs.

As Solana continues to increase throughput and advance MEV tax regimes such as ASS and MCP, L2 will need to explore new ways to help dApps maximise revenue and reduce costs. My current view is that L2 is structurally superior to L1 and can execute dApp revenue maximisation strategies more quickly.

One of the key roles of the execution layer in maximising application revenue is how fees/MEV are allocated.

Currently, MEV tax or fee sharing is only possible with "honest block proposers", i.e., proposers who are willing to follow prioritisation rules, or share revenue with the app according to preset rules. Another way is to allocate a portion of the base fee of EIP 1559 to the dApp that the user interacts with, a mechanism that Canto CSR and EVMOS seem to employ. At the very least, this will allow dApps to increase their ability to bid on their own MEV yields, making them more competitive in the deal inclusion market.

In the L2 ecosystem, if a block proposer is run by a team (i.e., a single block proposer), then it is inherently "honest" and can guarantee the transparency of the block construction algorithm through reputation mechanisms or TEE (Trusted Execution Environment) technology. Currently, there are two L2s that have adopted fee sharing and prioritisation block construction, and Flashbots Builder is able to provide similar functionality to the OP-Stack ecosystem with minor changes.

In the SVM (Solana Virtual Machine) ecosystem, Jito-like infrastructure can redistribute MEV revenue to dApps on a pro-rata basis (e.g., in terms of CUs, Blast uses a similar mechanism).

This means that L2 can enable these features sooner while L1 is still working on MCP and built-in ASS options (which Solana may be working on, but there are no CSR-like renaissance plans in the EVM ecosystem). Because L2 can rely on trusted block producers or TEE technology, there is no need to enforce OCAproof, so the MRMC (Revenue, Cost, MEV Competition) model of the dApp can be adjusted more quickly.

But the advantage of L2 is not just the speed of development or the ability to redistribute fees, they are also subject to fewer structural constraints.

Thesurvival conditions of the L1 ecosystem (i.e., the conditions under which the validator network is maintained) can be described by the following equation: total number of validators × validator operating costs + staking capital requirements × capital costs < TEV (inflation + total network fees + MEV tips)

From a single validator's perspective: validator operating costs + staking capital requirements × capital costs > inflation gains + transaction fees + MEV earnings

In other words, there's a hard constraint on L1s wanting to lower inflation or reduce fees (by sharing with dApps) – validators must remain profitable!

This limitation will be more pronounced if validator operating costs are high. For example, Helius points out in his SIMD 228 related article that if inflation is reduced according to the proposed issuance curve, at 70% stake, 3.4% of current validators may exit due to declining profitability (assuming REV maintains volatility levels in 2024).

REV (MEV Share in Staking Yield) is extremely volatile: On the day of the TRUMP event, the REV share was as high as 66% · On November 19, 2024, the REV share is 50% Currently, at the time of writing, the REV share is only 14.4%

This means that in the L1 ecosystem, there is a ceiling on reducing inflation or adjusting fee allocations due to the earning pressure on validators, while L2 is not subject to this constraint and is therefore able to explore optimisations more freely Strategies for dApp monetisation.