Detailed explanation of AAVE V4 upgrade: Reshaping lending with modularity, can old coins usher in another spring?

Original title: "Detailed Explanation of AAVE V4 Upgrade: Reshaping Lending with Modularity, Can Old Coins Usher in Another Spring?"

evening of the 25th, the post of AAVE founder Stani announcing the upcoming launch of AAVE V4 quickly attracted a lot of attention and discussion, and the recent controversy between AAVE and WLFI over the 7% token distribution proposal has also been stirring up in the market.

– >

– >

for a while, the market's attention has focused on AAVE, an established lending protocol.

Although the dispute between AAVE and WLFI has not yet reached a final conclusion, behind this "farce", it seems that a different picture is shown - "new coins in flowing water, iron-clad AAVE".

With the emergence of more and more new coins, stimulated by the demand for fixed token lending on the chain, AAVE undoubtedly has good fundamentals and catalysts.

This V4 update may allow us to see its strong competitiveness in the future in the DeFi field and the root cause of its rising business volume.

From Lending Protocols to DeFi Infrastructure

When we discuss AAVE V4, there is a key question to understand first, why is the market expecting this upgrade?

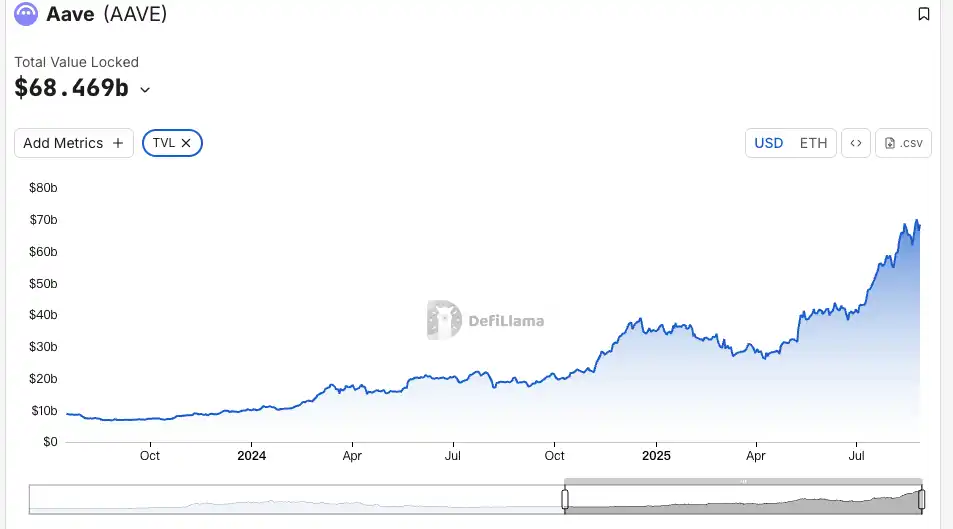

From ETHLend in 2017 to today's DeFi giant with a TVL of $38.6 billion, as an established protocol, AAVE has actually optimized every version update in the past and can affect the liquidity and gameplay of on-chain assets to varying degrees.

The version history of AAVE is actually the evolution history of DeFi lending.

early 2020, when V1 went live, the entire DeFi lock-up volume was less than $1 billion. AAVE uses liquidity pools instead of the P2P model, allowing lending to change from "waiting for matchmaking" to "instant dealing". This change helped AAVE gain market share quickly.

V2 was launched in late 2020, and the core innovations are flash loans and debt tokenization. Flash loans have spawned arbitrage and liquidation ecosystems, becoming an important source of revenue for protocols. Debt tokenization allows positions to be transferred, paving the way for subsequent yield aggregators. V3 in 2022 focuses on cross-chain interoperability, allowing more on-chain assets to enter AAVE and become a connector for multi-chain liquidity.

What's more, AAVE has become a benchmark for pricing. DeFi protocols refer to AAVE's supply and demand curve when designing interest rates. When choosing a collateral ratio, new projects also benchmark AAVE's parameters.

However, despite being an infrastructure, V3's architectural limitations are becoming more and more apparent.

The biggest problem is liquidity fragmentation. Currently, AAVE has a TVL of $60 billion on Ethereum, while Arbitrum has only $4.4 billion and even less Base. Each chain is an independent kingdom, and funds cannot flow efficiently. This not only reduces capital efficiency, but also limits the development of small chains.

The second problem is innovation bottlenecks. Any new feature requires a complete governance process, often taking months from proposal to implementation. In the rapidly iterative environment of DeFi, this speed obviously cannot keep up with market demand.

The third problem is that customization needs cannot be met. RWA projects require KYC, GameFi requires NFT collateralization, and institutions need segregated pools. But V3's unified architecture struggles to meet these differentiated needs. Either all support or not all support, no middle ground.

This is the core problem that V4 aims to solve: how to transform AAVE from a powerful but rigid product into a flexible and open platform.

V4 Upgrade

According to publicly available information, the core improvement direction of V4 is to introduce a "Unified Liquidity Layer" and adopt the Hub-Spoke model to change the existing technical design and even business model.

Image Source @Eli5DeFi

Hub-Spoke: Solve both the necessary and necessary problems

In simple terms, the Hub brings together all the liquidity, and the Spoke is responsible for the specific business. Users interact through Spoke forever, and each Spoke can have its own rules and risk parameters.

What does this mean? This means that AAVE no longer needs to serve everyone with a set of rules, but can allow different Spokes to serve different needs.

For example, Frax Finance can create a dedicated Spoke that only accepts frxETH and FRAX as collateral and sets more aggressive parameters. Meanwhile, an "institutional spoke" might only accept BTC and ETH, requiring KYC but offering lower interest rates.

Two Spokes share the liquidity of the same Hub, but are risk-isolated from each other.

The subtlety of this architecture is that it solves the "both want and want" problem. it must have both deep liquidity and risk isolation; It should be managed in a unified manner and flexibly customized. In the past, these were contradictory in AAVE, but the Hub-Spoke model allows them to coexist.

Dynamic Risk Premium Mechanism

In addition to the Hub-Spoke architecture, V4 also introduces a dynamic risk premium mechanism, revolutionizing the way borrowing interest rates are set.

Unlike V3's flat rate model, V4 dynamically adjusts interest rates based on collateral quality and market liquidity. For example, highly liquid assets like WETH enjoy base interest rates, while more volatile assets like LINK pay an additional premium. This mechanism is automated through smart contracts, which not only improves the security of the protocol but also makes borrowing costs more equitable.

Smart Account

V4's Smart Account feature allows users to operate more efficiently. In the past, users needed to switch wallets between different chains or markets, making it time-consuming and laborious to manage complex positions. Smart accounts now allow for the management of multi-chain assets and lending strategies through a single wallet, reducing operational steps.

A user can adjust WETH collateral on Ethereum and borrowing on Aptos within the same interface, eliminating the need for manual cross-chain transfers. This streamlined experience makes it easier for both small users and professional traders to participate in DeFi.

Cross-Chain and RWA: Expanding DeFi Boundaries

V4 enables second-level cross-chain interactions through Chainlink CCIP, supporting non-EVM chains such as Aptos, allowing more assets to seamlessly access AAVE. For example, a user can stake assets on Polygon and borrow and borrow on Arbitrum, all in one transaction. Additionally, V4 integrates real-world assets (RWAs) such as tokenized Treasury bonds, opening up new avenues for institutional funds to enter DeFi. This not only expands AAVE's asset coverage but also makes the lending market more inclusive.

Market reaction

Although AAVE experienced a sharp decline in the crypto market this week, its rebound today was significantly stronger than that of other leading DeFi targets.

The AAVE token experienced a network-wide trading volume of $18.72 million within 24 hours after experiencing a crypto market crash this week, significantly higher than Uni's $7.2 million and LDO's $3.65 million, reflecting a positive investor response to protocol innovation, while increased trading activity further enhanced liquidity.

Compared to early August, AAVE's TVL magnitude soared 19% this month to a record high near the $70 billion mark, and it currently ranks first in TVL on the ETH chain. This growth far exceeds the DeFi market average, and the increase in TVL also validates the effectiveness of AAVE V4's multi-asset backing strategy on the other hand, perhaps suggesting that institutional funds have quietly entered the market.

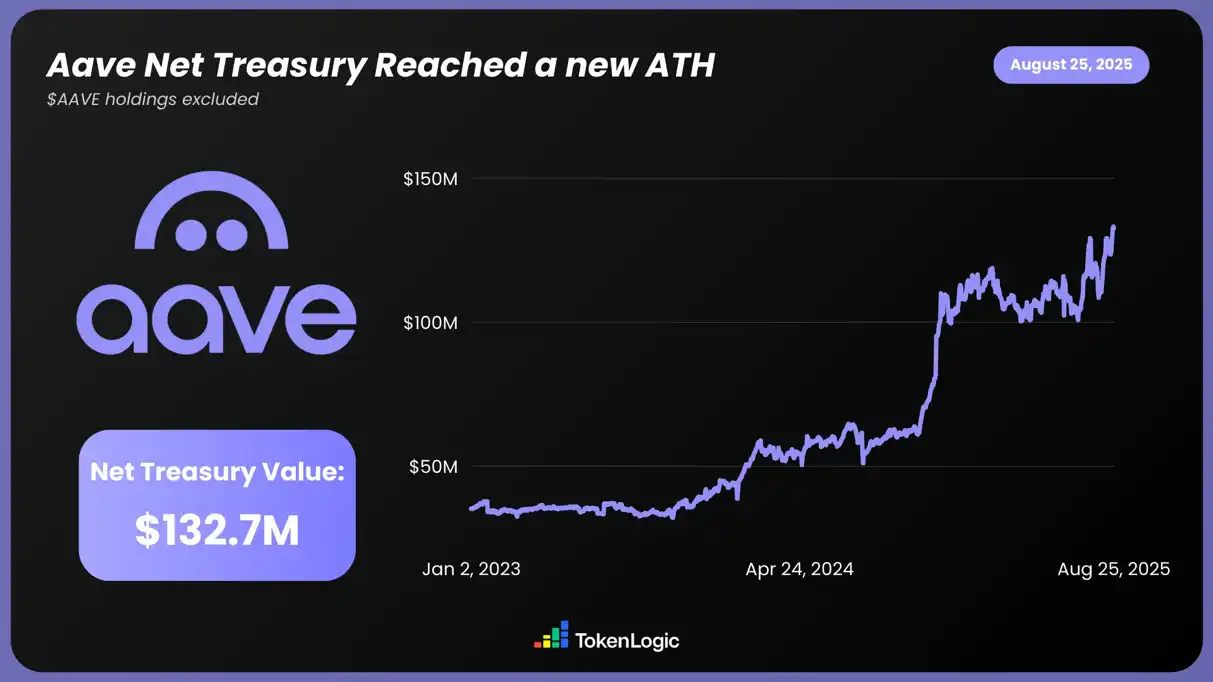

According to TokenLogic data, AAVE's total net assets have reached a new high of $132.7 million (excluding AAVE token holdings), an increase of about 130% in the past year.

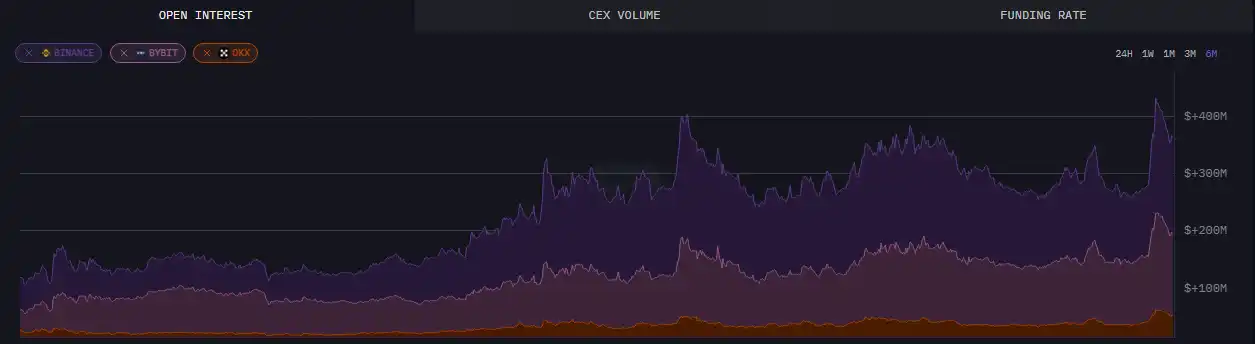

on-chain data, as of August 24, the open interest on AAVE exceeded $430 million, a six-month high.

In addition to intuitive data, AAVE's upgrade has also aroused widespread discussion in the community, and the current front-end information released by V4 has also received a lot of support and recognition, especially in terms of fund utilization and composable DeFi, allowing the market to see more possibilities and potential.

Make DeFi great again

Combined with the updates that have been disclosed so far, AAVE's upgrade is likely to lead the DeFi market to a higher level. It also drove the price and TVL up.

And its founder Stani seems to be confident in the impact of the V4 upgrade on the DeFi track.

Perhaps in the near future, AAVE will take advantage of the liquidity "east wind" of the crypto bull market to soar and open up infinite possibilities.

Original link