I love Pudgy but the same thing I told everyone was the problem over a year ago on the run up might be worse now.

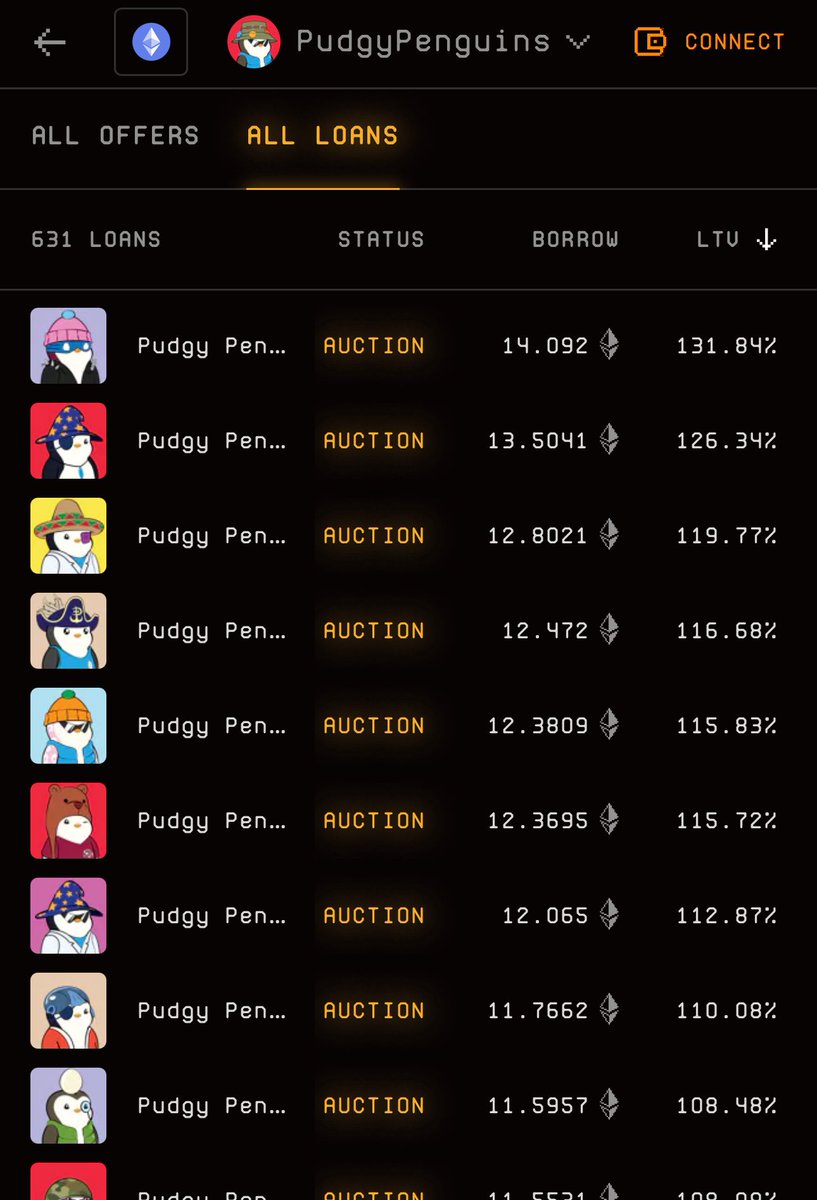

Most people pumped the Pudgy floor by sweeping on loans. Then they took the money from loans on top of those and bought $PENGU. The issue is these loans were in ETH and ETH was $1500-2000. So now that they are getting called the price to pay these back in most cases is over 200% of what they borrowed. Some got $PENGU gains to offset it and some don’t. It’s a zero sum game here but paying them back now gets much riskier to longevity.

Not sure if someone comes in and saves it like last time but would assume we see more dips here from Pudgies and from $PENGU to solve this.

Best project in the space but like last time when it happened… this is just math… except this time it’s a deeper hole.

150 that got called of 631 and as the 150 expire expect another 200+ triggered.

Great for those giving loans as they got high APRs to collect AND most got a 200-300% bonus on ETH value in USD. Good week to be the banks

43.79K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.