Great explanation of the forces affecting Bittensor subnet prices. My two cents:

The maintakeaway is "the sum of ALPHA prices could fall below 1 if there is enough selling pressure". It is already clear that there is structural selling in Bittensor mainly from miners.

There is a few ways to address this imo:

(1) Buying pressure from subnet owners who channel revenues into token buybacks. Some teams are already doing this, but there needs to be more explicit claims from other teams that future revenues will be attributable to tokenholders. Effective Communication re a roadmap to revenue is critical to give alpha holders confidence that this will come to fruition.

(2) Miners need to be incentivised to hold on to their subnet tokens. (1) is critical for this, along with adding utility to tokens. Enabling lending/borrowing pools for alpha tokens will also assist in reducing sell side pressure as miners can borrow against their alpha rather than sell it down. They will only do this if they believe alpha tokens have long term value.

(3) Bringing external capital to buy alpha. This is the chicken and the egg problem - why would external capital buy alpha tokens given the above equilibrium of net selling pressure? But if external capital isn't coming in, how can the net selling pressure dissipate? Addressing (1) and (2) above would alleviate concerns that the structural selling is a constant and attract new capital.

Some will say 'this is the same as BTC miners selling, people will eventually buy $TAO and alpha in the same way they bought BTC'. This is not the case because Bittensor subnets are actually developing a product. BTC is and was an ideology: That it is a superior SoV than fiat or gold. This will almost definitely not be replicated ever.

Bittensor needs to address the above structural issues to attract more capital --> increase $TAO price so that the notional value of emissions is larger --> attract better teams & competition --> better products --> flywheel.

Easier said than done ofc.

I've seen a lot of confusion about the subsidy mechanism, especially with the upcoming TAO halving, and thought it might be worth literally "dumping" some of my understanding and insights I have gathered recently.

This will be a long one... 🥱

Where does the idea of the mechanism come from? We could argue it comes from the earlier DTAO designs where the sum of ALPHA prices had a convergence at 1, but that's not something we know for certain.

It began with ALPHA downscaling. Some of you might ask what that is. The ALPHA being injected into the pool every block is calculated as:

ALPHA_in = TAO emission / ALPHA price

The problem here is that if the ALPHA price would be less than TAO emissions, then ALPHA_in would exceed the ALPHA block emission (which is 1). For example: 1 / 0.5 = 2 ALPHA.

If there were no mechanism to limit/stop that, one could try to manipulate the ALPHA price and TAO emissions to emit more ALPHA than should be allowed. Because of this, we need to "downscale" ALPHA to its maximum value of 1 (based on the current ALPHA block emission).

What happens when ALPHA is downscaled? Let's see:

- ALPHA price: 0.10 TAO

- TAO emissions: 0.15 TAO (15% of emissions)

- ALPHA_in: 0.15 / 0.10 = 1.5 ALPHA 👀

This exceeds the ALPHA block emission, so ALPHA_in has be set to 1

Resulting in a injection of 0.15 TAO per 1 ALPHA. This would inject more TAO per ALPHA (than the price neutral 0.10 TAO per 1 ALPHA) and push the ALPHA price upwards from 0.10 -> 0.15 TAO.

Initially, OTF didn't implement it this way (on testnet/pre-launch). The TAO_in would have also been "downscaled", and there would not have been any upside pressure from the chain. This was in line with not wanting to "manipulate" the ALPHA prices.

Why did TAO downscaling get removed then? We don't know exactly, but my understanding is that it could have been to not delay the TAO halving or impact the TAO block emission. If the sum of ALPHA prices would have been at 0.5, then the TAO block emission would have been as well (that's already a halving in that sense). So to keep the TAO block emissions at 1 all the time, the TAO downscaling was likely removed, and the "buying pressure" from the chain was "born".

This initial version worked differently than it does now, so I'd like to clarify this as well. Because this ALPHA downscaling would only trigger when the ALPHA price fell below the TAO emissions, if the TAO emissions would halve during a halving, this mechanism would "trigger" at a later point in time. Let's revisit the old example but post-halving:

- ALPHA price: 0.10 TAO

- TAO emissions: 0.075 TAO (15% of emissions)

- ALPHA_in: 0.075 / 0.10 = 0.75 ALPHA

After the first halving, we would only inject 0.075 TAO per 0.75 ALPHA, resulting in 0.10 TAO per ALPHA. So the upside pressure in this case would not happen yet because there would be no need to downscale ALPHA anymore after the TAO emissions got halved below the ALPHA price.

NOTE: The ALPHA block emission remains at 1 until the ALPHA halving of the subnet.

Even though this mechanism looks at each subnet individually, we can extrapolate that if the sum of ALPHA prices fell below the sum of TAO emissions, then there would be subnets where this mechanism would trigger and would push the ALPHA prices of these subnets up until they summed to the TAO block emission again.

Given that the TAO emissions would halve, so would this version of the mechanism. After the first TAO halving, it would only happen when the sum of ALPHA prices would be below 0.5, then 0.25, and so on.

So what changed since then? OTF revised this mechanism, which is now referred to as the "subsidy" mechanism. The largest change is that it doesn't "halve" with the TAO halvings. This means no matter when, if the ALPHA price of a subnet falls below the percentage ratio of TAO emissions (X% of TAO emission), then it will get subsidized.

What happens when a subnet gets "subsidized" though? Let's use the same example as prior:

- ALPHA price: 0.10 TAO

- TAO emissions: 0.075 TAO (15% of emissions)

- ALPHA_in: 0.075 / 0.10 = 0.75 ALPHA

First, the ALPHA_in is set to TAO block emission, so 0.5 ALPHA, and the TAO emission is then downscaled to the ALPHA price * TAO block emission (0.10 * 0.5). This results in 0.05 TAO per 0.5 ALPHA. To bring in the upward pressure in a Uniswap V3 compatible way, the chain will look at the difference between TAO emissions and the default TAO emissions (0.075-0.05) and will buy ALPHA for 0.025 TAO/block, with the resulting ALPHA from the swap being recycled. While the chain provides buying pressure/subsidizes a subnet, the root selling pressure for it is effectively disabled and the ALPHA instead recycled.

Maybe you've noticed that the ALPHA_in now has to scale with the TAO block emission, unlike before when it scaled with the ALPHA block emission. That means post-halving, the ALPHA_in on subnets could not go beyond 0.5 ALPHA injected.

NOTE: This could be subject to change, given there is currently a bug with the subsidy post-halving.

With all of that in mind, if the sum of ALPHA prices were to fall below the sum of the TAO emissions % (which total 1.0), thus the subsidy would always "trigger" when the sum of ALPHA prices falls below 1.0 and wouldn't lose it's convergence point like in the previous version.

The TAO halvings still affect the buying pressure potential from the chain. Let's assume our above example would happen pre-halving in the same manner, the ALPHA price would be 0.10 TAO and the TAO emissions 0.15 (15%), the resulting buying pressure here would be (0.15-0.10) 0.05 TAO/block, so twice of what it would be post-halving. As the TAO block emission gets halved, the potential buying pressure is also halved, ultimately resulting in zero buying pressure on the final TAO halving. Until then the chain will still provide support when needed, but less with each halving.

Great, we finally got to what I would say is the interesting part: "Will the sum of ALPHA prices fall below 1.0?"

Short answer: We don't know...

Long answer: It could, and that's probably one of the largest misunderstandings of this mechanism.

This mechanism does NOT guarantee that the sum of ALPHA prices can't fall below 1.0. It tries to ensure/provide support to bring it back up though and helps counter the selling pressure on ALPHA prices.

To help explain this, let's play through a scenario to show how it would look:

- ALPHA price: 0.15 TAO

- TAO emissions: 0.15 TAO (15% of emissions)

We begin with a subnet that has its ALPHA price at the TAO emissions, all things looking good.

NOTE: For simplicity we assume that for this subnet the TAO emissions remain roughly the same. Nor do we account for slippage. View this as a simplified example.

In this scenario we assume that there is no buying pressure from the market, and miners are selling 361 ALPHA (all their incentives) each epoch (72 minutes).

After the first 72 minutes this results in ~54.15 TAO selling pressure, and reduces the ALPHA price by approximately 0.11% to 0.1498 TAO (given the pool reserves I have chosen for this example). The chain's subsidy would now trigger and cause a buy of 0.00016 TAO/block. Even though the buying pressure from the chain would not remain exactly constant, for the simplicity when extrapolating during the 72 minutes until the next "sell-off" from the miners would occur the chain would provide ~0.058 TAO buying pressure.

Without having to go through all the numbers, we can see that the buying pressure from the chain is much lower than the selling pressure, thus the ALPHA price will continue to fall until those pressures cancel each other out.

With the decreasing ALPHA price, two things happen:

- The buying pressure becomes stronger as the difference between TAO emissions and the ALPHA price becomes larger

- The selling pressure becomes weaker as the ALPHA is worth less TAO from the decreasing ALPHA price

The pressures would cancel each other out if the TAO emissions were to remain at 0.15 TAO, and the ALPHA price were to fall to 0.075. The (extrapolated) buying pressure would be ~27.075 TAO, with the selling pressure also being ~27.075 TAO. From this point on, the ALPHA price could not decrease further without increasing the constant selling pressure. Should miners, for example, stop selling for just one of the 72-minute intervals though, the buying pressure would push the ALPHA price up.

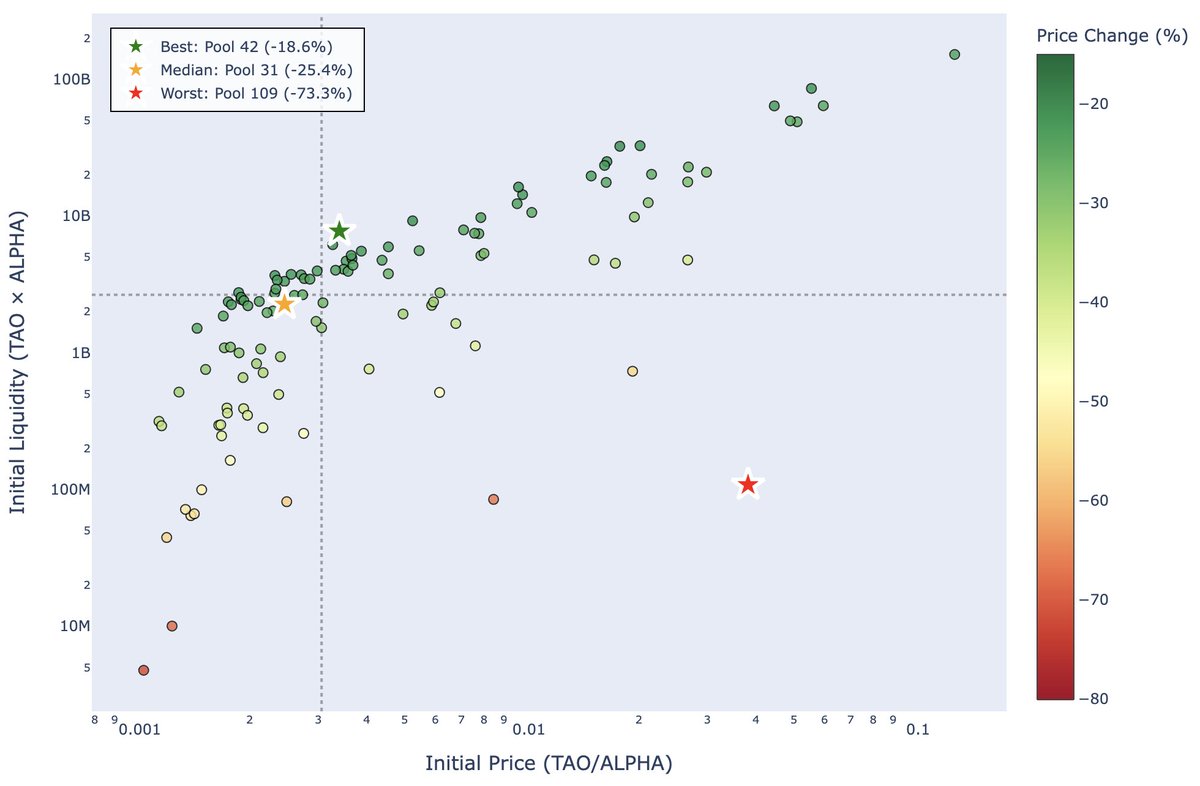

Given this understanding, I've run some simulations to see how the ALPHA prices of the current subnets could behave in such a scenario. Those were the results of a ~6 months long simulation until the TAO halving (with a sum of ALPHA prices at 0.74):

To understand what this graph shows we have to first clarify:

- Each subnet/pool is a dot on the graph with its color depending on the price change that it has gone through since the beginning of the simulation.

- The X-axis shows the initial ALPHA price for each of the subnets

- The Y-axis shows the initial liquidity for each of the subnets (TAO * ALPHA = k)

Out of the X/Y-axes 4 zones can be formed:

- Upper-Left: High Liquidity, Low ALPHA price

- Upper-Right: High Liquidity, High ALPHA price

- Bottom-Left: Low Liquidity, Low ALPHA price

- Bottom-Right: Low Liquidity, High ALPHA price

According to those results the "best-performing" subnets in such a situation would be the ones with the highest liquidity and lowest ALPHA price (18-20%). The second-best would be the subnets with a high liquidity and a high ALPHA price (20-23%). The "worst" subnets would be those with a high ALPHA price and low liquidity (60-70%) because of the much higher price impact and volatility of the selling pressure. This shows that even though the sum of ALPHA prices could drop further, subnets with a high liquidity would in general be the ones to experience the lowest price change given their depth and resistance.

"Equal selling pressure doesn't result in equal price changes."

Long story short, even though the subsidy mechanism exists, the sum of ALPHA prices could fall below 1 if there is enough selling pressure. Is it likely for that to happen, given that we had to consider the chain's buying pressure with only selling pressure from the market (nobody buying other than the chain itself)? Probably not, yet I hope I was able to help showcase how this could look, and explain how the subsidy mechanism works.

Should I have missed something, or potentially made a mistake. I would love to correct myself in the comments.

1.95K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.