In the past few days, discussions around @solana's 100K TPS have increased, mainly because @cavemanloverboy has indeed achieved over 100,000 TPS on the Solana mainnet. However, most people do not understand the significance behind this data:

1) First, this experiment by cavey is essentially a limit test under "ideal conditions." This means that this is not the normal performance of the Solana mainnet and differs from laboratory data in a testnet environment, but not by much.

He used a noop (no operation) testing program, which, as the name suggests, only performs the most basic signature verification and directly returns success without executing any calculations, changing any account states, or calling other programs. Each transaction is only 200 bytes, far below the normal transaction size of 1KB+.

This means that the 100K TPS test was calculated under non-normal transaction conditions; it tests the extreme throughput of the Solana network layer and consensus layer, rather than the actual processing capacity of the application layer.

2) Another key to the success of this experiment is the Frankendancer validator client. Simply put, Frankendancer is a "hybrid test version" of the Firedancer validator being developed by Jump Crypto—integrating the high-performance components of Firedancer into the existing Solana validator.

It essentially reconstructs Solana's node system using Wall Street's high-frequency trading technology stack, achieving performance improvements through fine memory management, custom thread scheduling, and other low-level optimizations. Just replacing some components can achieve a performance increase of 3-5 times.

3) This test experiment shows that Solana can achieve TPS of over 100K under ideal conditions. So why is it only 3000-4000 TPS on a daily basis?

In summary, there are roughly three reasons:

1. Solana's POH consensus mechanism requires Validators to continuously vote to maintain, and these voting transactions occupy more than 70% of the block space, narrowing the performance channel left for normal transactions;

2. There are often a large number of state competition behaviors in Solana's ecosystem, such as when minting new NFTs or releasing new MEMEs, where thousands of transactions may compete for write permissions to the same account, leading to a high failure rate of transactions;

3. Arbitrage bots in the Solana ecosystem may send a large number of invalid transactions to seize MEV benefits, resulting in resource waste.

4) However, the upcoming full deployment of Firedancer and the Alpenglow consensus upgrade will systematically address these issues.

One key point of the Alpenglow consensus upgrade is to move voting transactions off-chain, effectively releasing 70% of the space for normal transactions, while also reducing confirmation times to 150 milliseconds, making Solana's DEX experience infinitely closer to CEX. Additionally, the activation of a local fee market can avoid the embarrassing situation of network congestion caused by the FOMO of a single program.

The benefits of Firedancer, aside from performance optimization, are crucially the realization of client diversity, allowing Solana to have multiple clients like Ethereum's Geth and Nethermind, directly improving decentralization and single-node failure issues.

That's all.

Therefore, those who understand the discussion about Solana's 100K TPS actually see it as confidence in the future upgrades of the client and consensus protocol. Those who do not understand are trying to give Solana a sense of presence through a TPS arms race (even though TPS competition is outdated). However, if one understands the significance behind the experiment, there are quite a few gains to be had. Just a bit of popular science, sharing with everyone.

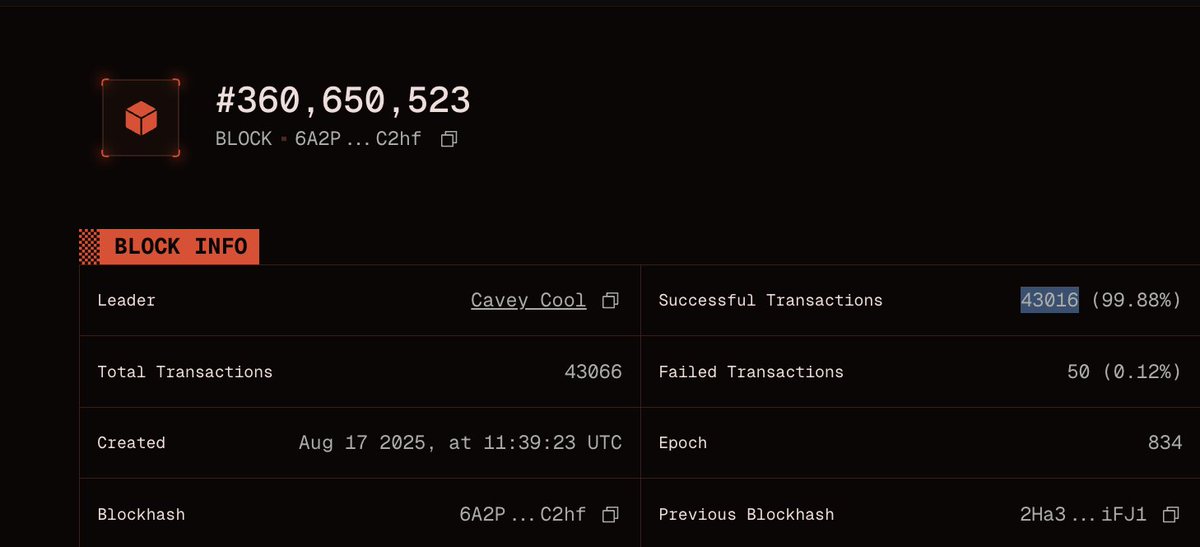

Solana just did 107,540 TPS on mainnet

yes, you read that correctly

over 100k TPS, on mainnet

good luck bears

17.48K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.