$BTC is currently fluctuating around 119,000. If it doesn't break through this level, it is very likely to dip down before continuing to rise to fill the CME gap below.

Watch the 120,000 level above and the 116,500 level below. Retail investors can't push BTC's price up; only when funds flow back from ETH will we see a significant rise. We're just 3.2% away from the previous high.

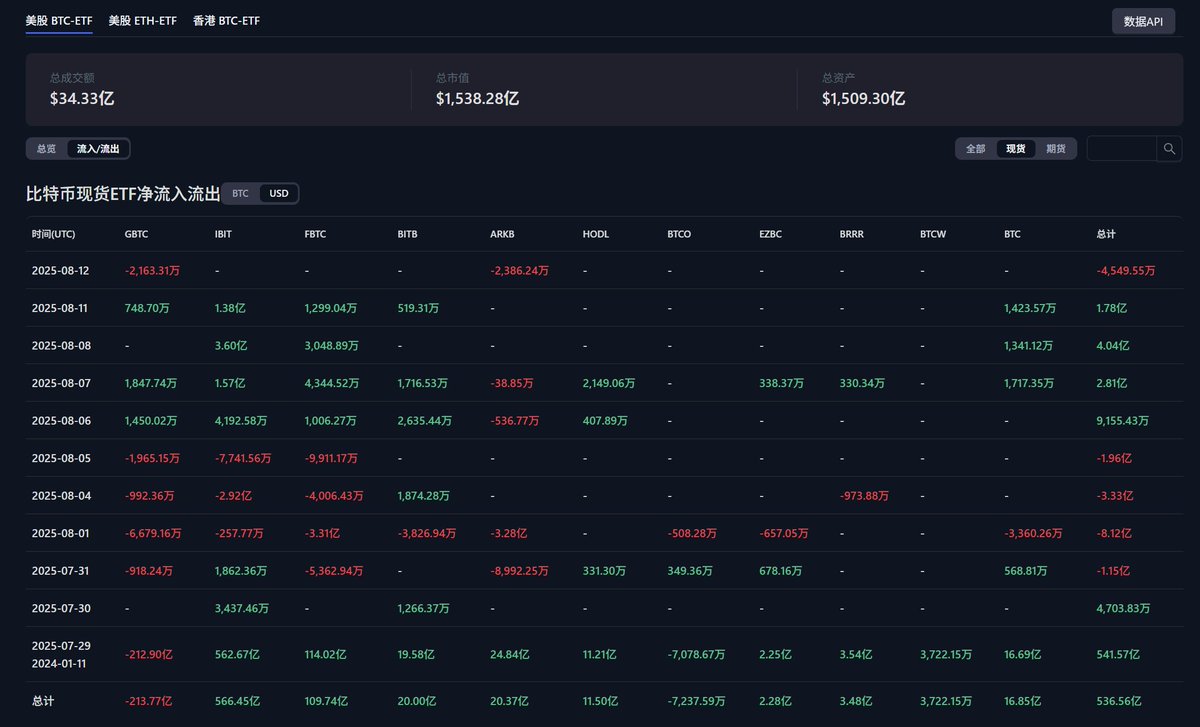

BTC ETF saw outflows last night, but the market absorbed it all. Only when the tide goes out do we know who has been swimming naked.

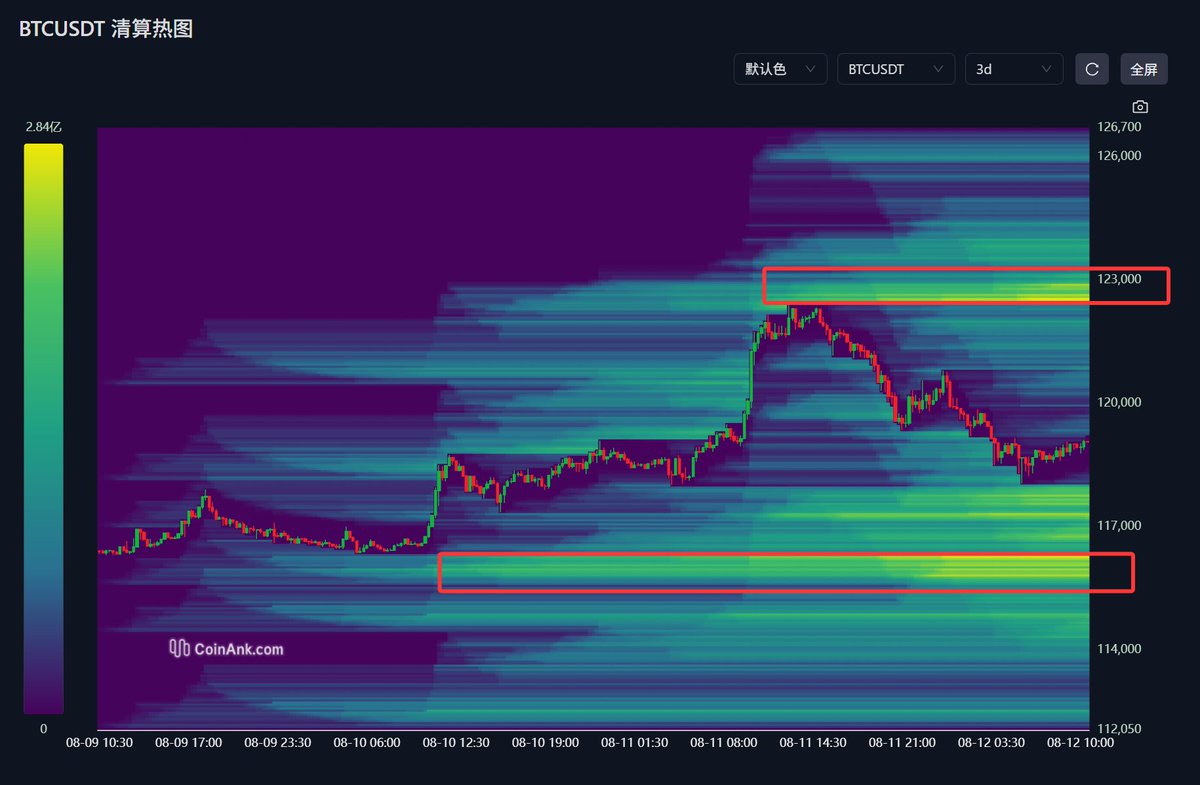

$BTC has encountered significant selling pressure at the 12.2 level.

The daily chart shows a long upper shadow candlestick, indicating that the adjustment has already taken place after the downward spike this morning. It will first rebound to around 119800 before consolidating, waiting for the CPI data to be released tonight.

It is expected to test the previous high of 123200 again. Before the market ends, it’s best to focus on buying low. While there is significant selling pressure, buying interest is also strong. This situation is suitable for some swing trading (for those with good technical skills).

Now, the shorts have become smarter; the liquidation price for the shorts has risen to 123000, with over 175 million in liquidations. The liquidation price for the longs has dropped to 116200, with 211 million.

Looking at this, there are still more people shorting...

95.95K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.