The more I interact with @hyperlendx, the more I think that it might just be the most powerful lending primitive on-chain right now

Built on @HyperliquidX, it brings speed & next-level capital efficiency to DeFi lending

Let’s dive into why it's worth interacting with 🧵👇

To begin with, what exactly is @hyperlendx?

HyperLend is a DeFi lending protocol designed for traders, quants, and market makers, built to maximize capital efficiency without compromising speed/security

It’s everything crypto lending should be: fast, flexible, and fully transparent

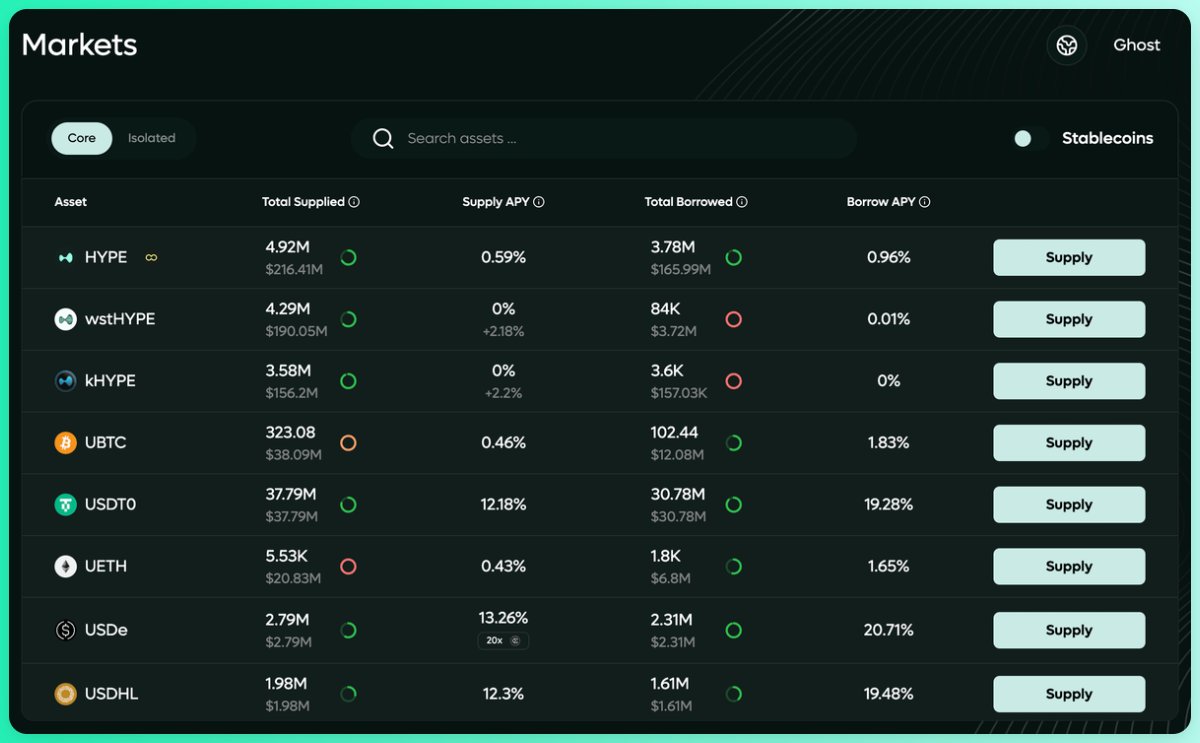

At its core, @hyperlendx lets you:

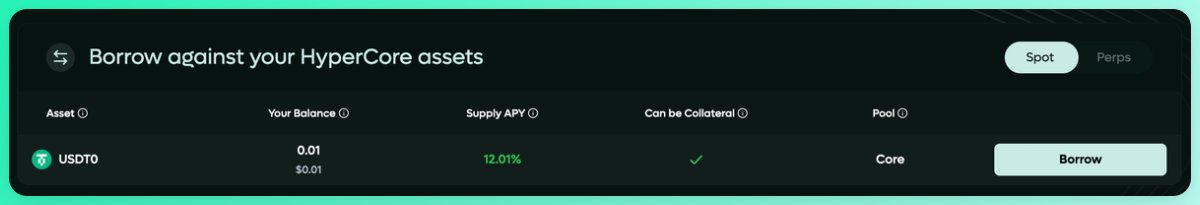

→ Earn passive yield by supplying assets

→ Borrow against your crypto without selling

→ Use leverage through isolated or core lending pools

→ Loop positions with one-click leverage

→ Claim rewards & earn points daily

All on @HyperliquidX

As for some of the features that matter:

◆ Core & Isolated Pools: Pick capital-efficient multi-asset pools/safer two-asset markets

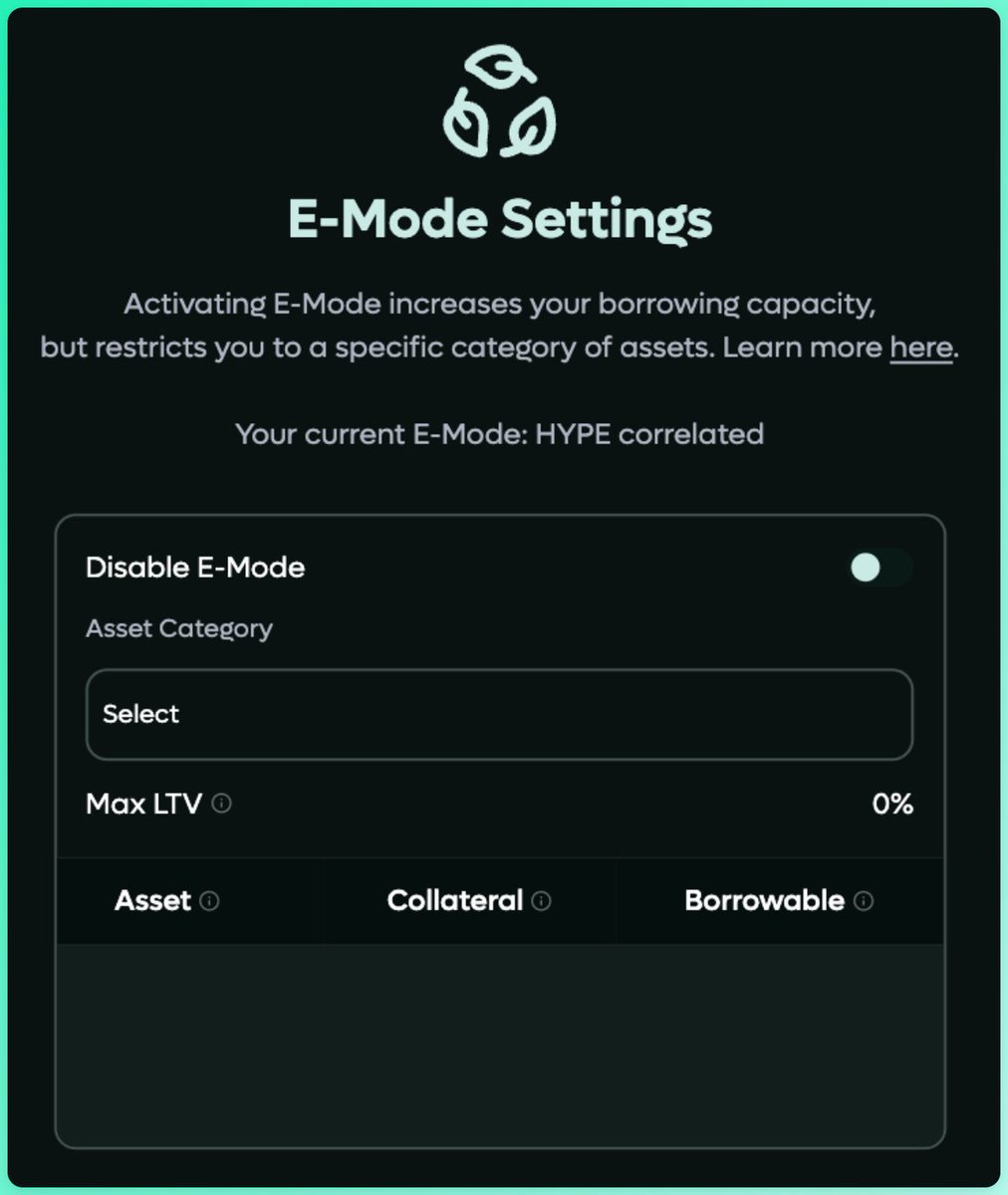

◆ E-Mode: Borrow with higher LTV using correlated assets like stablecoins for more efficiency

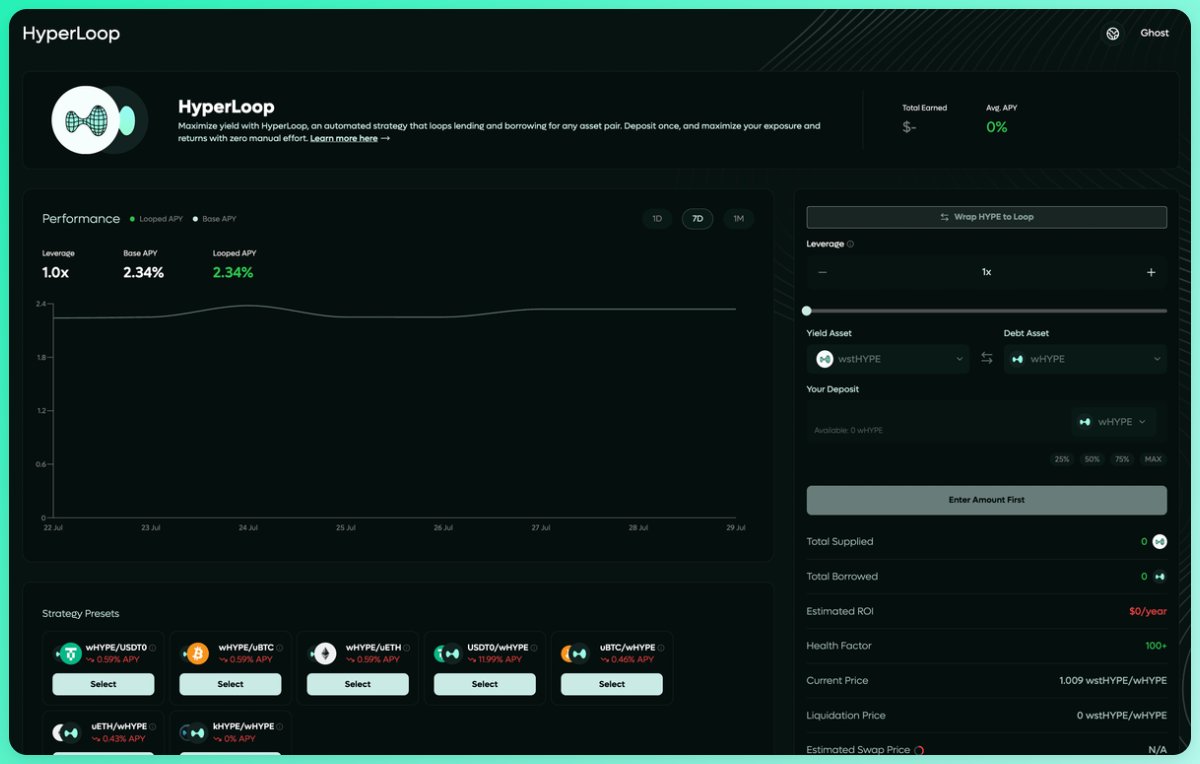

◆ HyperLoop: Use flashloans for instant leveraged positions in one step

◆ Borrow Against L1 Assets: Use tokens like $HYPE or uBTC as collateral without bridging issues

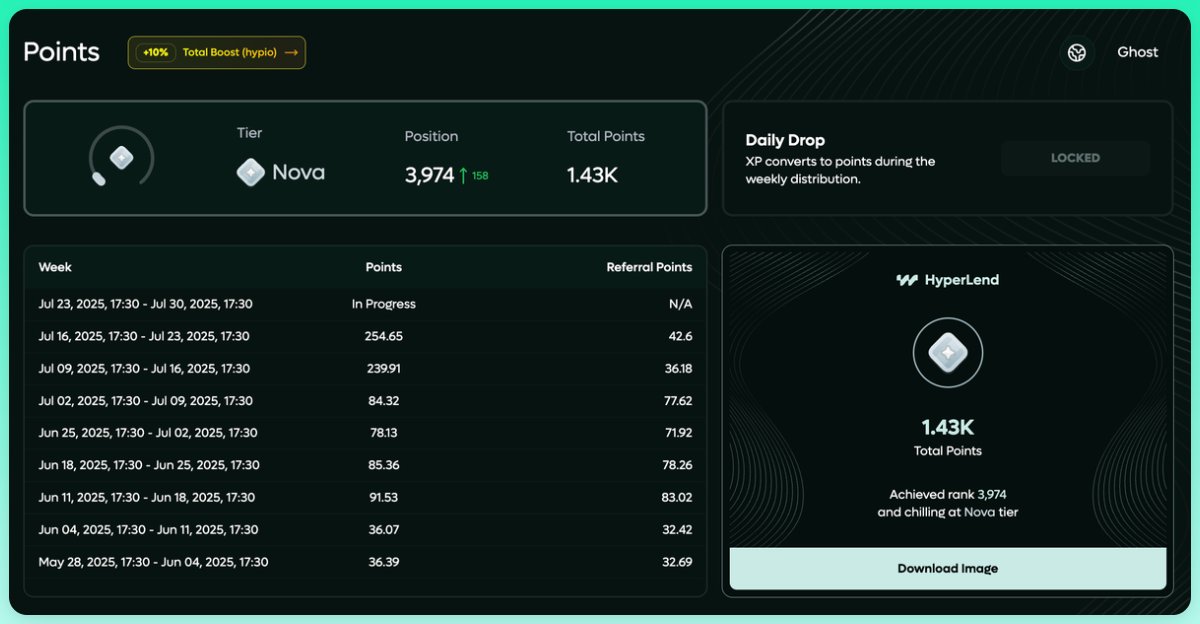

Moving on to their rewards & points system 👇

Users earn points on @hyperlendx through:

→ Daily Claims (based on rank)

→ Lending/Borrowing assets

→ Depositing assets in HLP vaults

→ Looping with HyperLoop

→ Hypio NFT multipliers

→ Testnet OG multipliers

→ Referral boosts

The best part?

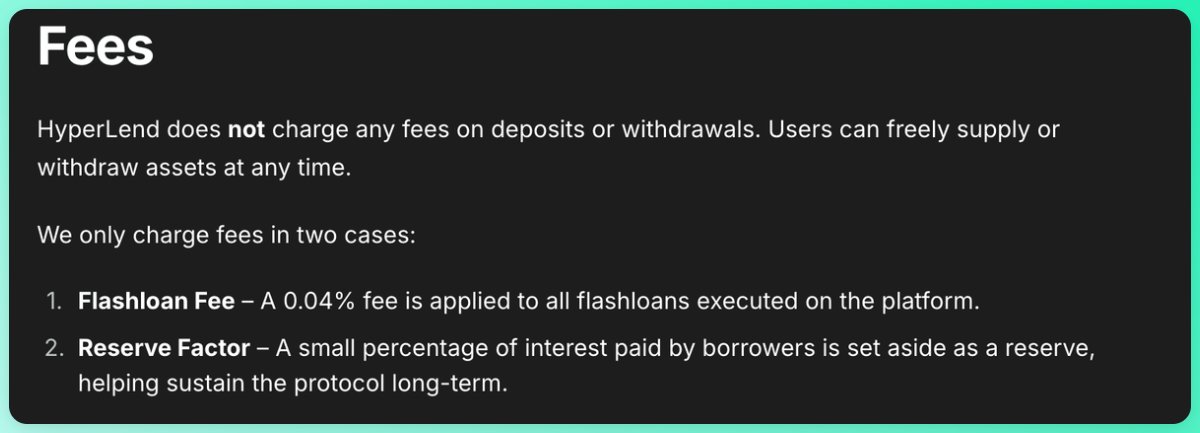

Zero Fees on Deposits + Withdrawals

@hyperlendx takes no cut from the user directly when depositing or withdrawing.

Instead, protocol revenue comes from:

→ Reserve fees (from interest)

→ Liquidation fees

→ Flash loan fees (0.04%)

Now that we've covered most of what's important and must knows, let's get to the juicy part:

✦ How to earn points & passive APY while having exposure to $HYPE

✦ How to loop

✦ How to earn points & passive APY while having exposure to $HYPE

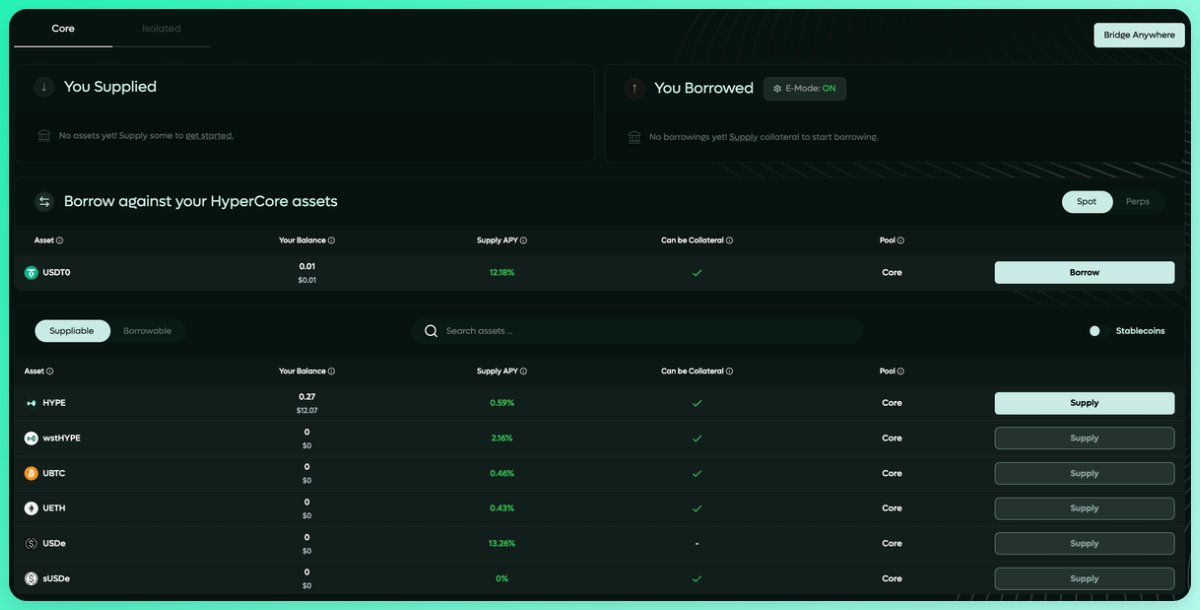

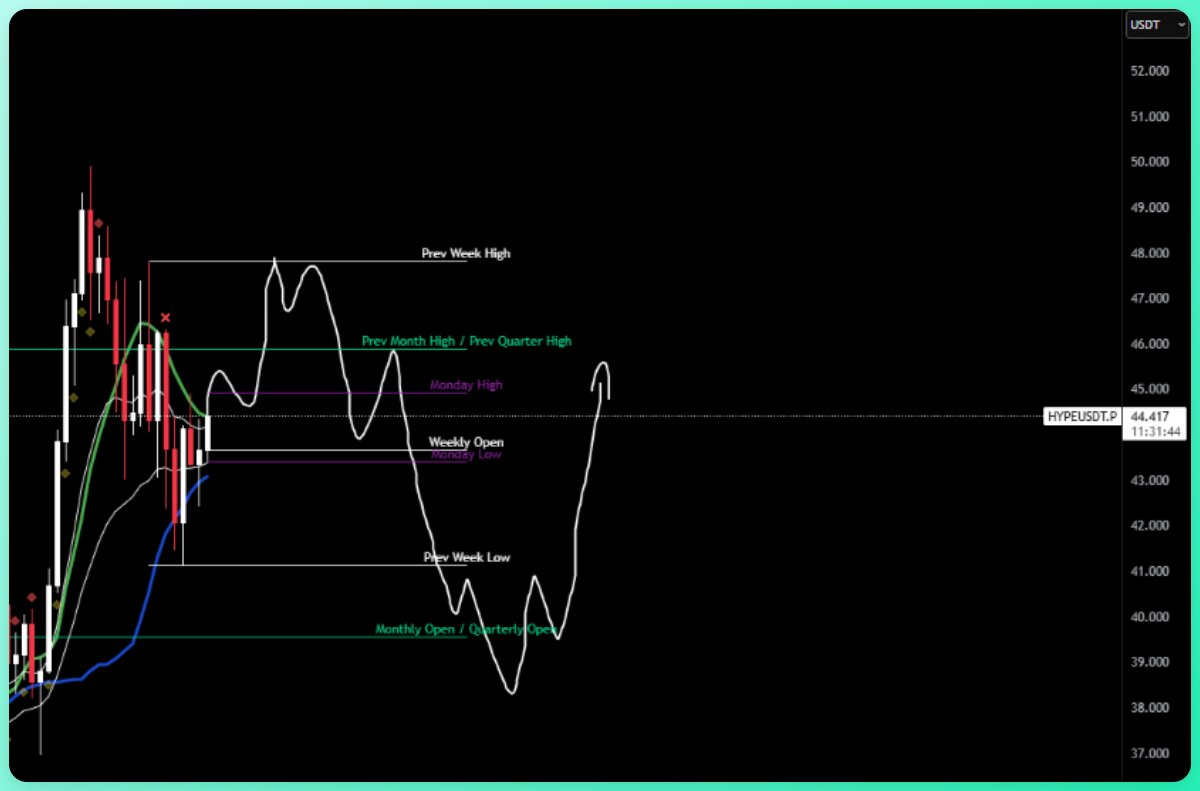

One of the strategies I use is basically lending/borrowing $HYPE & $USDT0 based on where I see the markets going

For reference, let's assume that $HYPE is likely to head to $48-50s before $38-40s

In this case 👇

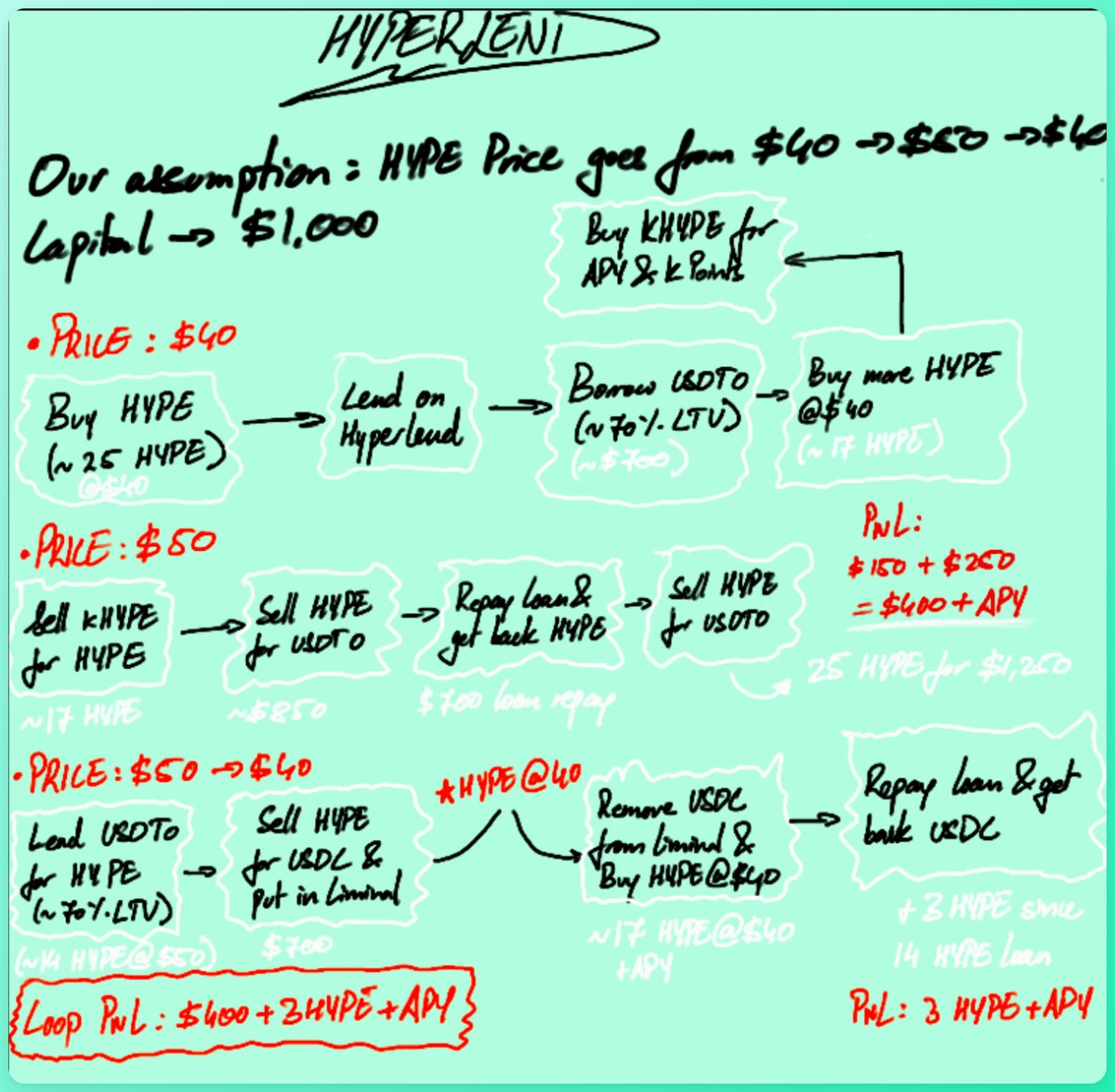

So my plan would be to:

→ Head to:

→ Buy & Lend $HYPE at CMP on @hyperlendx -> borrrow $USDT0 -> buy more $HYPE -> Buy $kHYPE (or lend it back on Hyperlend for more points + better LTV ratio + APY)

→ Around $48-50s: I swap back $kHYPE to $HYPE -> repay USDT0 debt -> Get back my $HYPE (+ upside) -> Swap all for USDT0

Now assuming I want to trade it to the downside as well:

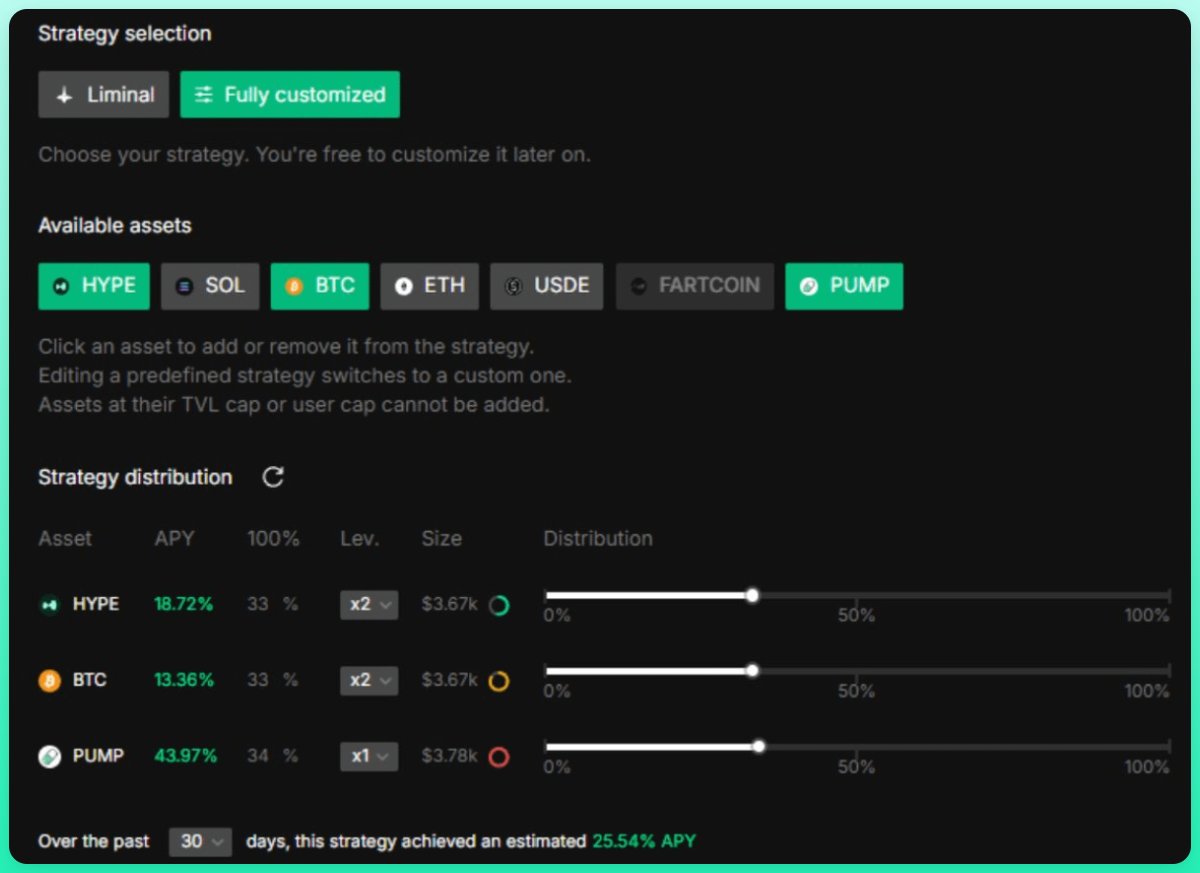

→ Lend USDT0 -> Borrow $HYPE -> Swap for USDC -> Lock that in @liminalmoney

→ Once price is around $38-40s: Remove funds from Liminal (+ APY) -> Swap back to $HYPE (for cheaper) -> Repay debt to get back USDT0 (+ upside)

After this, I can just buy more $HYPE around those levels & repeat the same loop for upside, or use it for something else

Now that @kinetiq_xyz is live, here's exactly what I'm doing and making the best of it (with a complete video guide):

Started off by staking HYPE for kHYPE on Kinetiq (likely counts towards kPoints but can use others like @prjx_hl or @HyperSwapX to swap HYPE + other assets for kHYPE)

Now, how I split those (Assuming you're putting in $1K):

👉 $250: LPing HYPE/kHYPE on @prjx_hl

👉 $150: Borrowing HYPE against kHYPE (borrow 80% of your lending amount) on @felixprotocol, @HypurrFi, @hyperlendx, or @0xHyperBeat

👉 $300-500: Keeping some aside to lock into @ValantisLabs

👉 $200-500: Staking in @0xHyperBeat in wHYPE vault

PS: You can also hold some funds in kHYPE and/or use borrowed hype to farm protocols like @hyperunit if you want to stick to a few rather than too many

Found this to be the best possible way to get exposure while farming various dApps at once (Assuming all you have is $1K)

While there's a lot more that I'm doing, I've covered most of it in the video below, and if you're farming and interacting with @HyperliquidX eco as well, let me know what you're doing with your kHYPE in the comments 👇

Links/referrals:

- @kinetiq_xyz:

- @prjx_hl: (10% bonus points)

- @felixprotocol:

- @HypurrFi: (Extra 5% points)

- @hyperlendx:

- @0xHyperBeat:

- @ValantisLabs:

Complete breakdown video with steps 👇

✦ How to loop

There are various ways to loop this with other protocols, and while we've covered 2 of those (one above and one in 🧵 below), let's take a look at some other options 👇

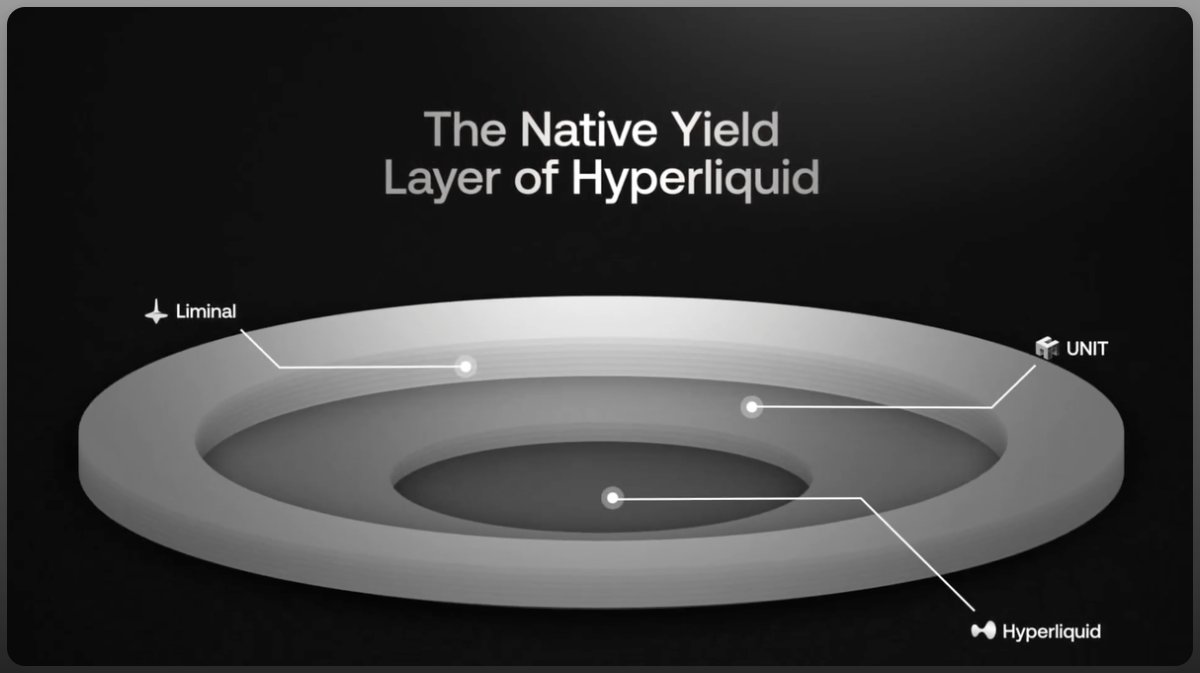

→ @liminalmoney x @hyperlendx x @kinetiq_xyz loop: Use the strategy shared above

→ @prjx_hl x @kinetiq_xyz x @HyperSwapX x @hyperlendx loop: In the 🧵 above

→ @felixprotocol x @liminalmoney x @hyperunit x @hyperlendx loop: Lend HYPE & borrow wHYPE on Hyperlend (90% LTV) -> Lend wHYPE on Felix to borrow USDT0 -> Swap USDT0 on Hyperliquid for USDC -> Use 50% on Liminal pool (strategy in 🧵 below) + 50% to farm UNIT

6.06K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.