What trading opportunities 👀 will the CLARITY Act bring?

1⃣ Basic facts

-/ Timeline:

The CLARITY bill has been passed in the House of Representatives, coordinated and deliberated in the Senate in August ~ September, and is expected to be signed and taken effect by Trump at the end of September.

-/Key Regulatory Changes:

from SEC→CFTC conversion unclear to automated, objective standards;

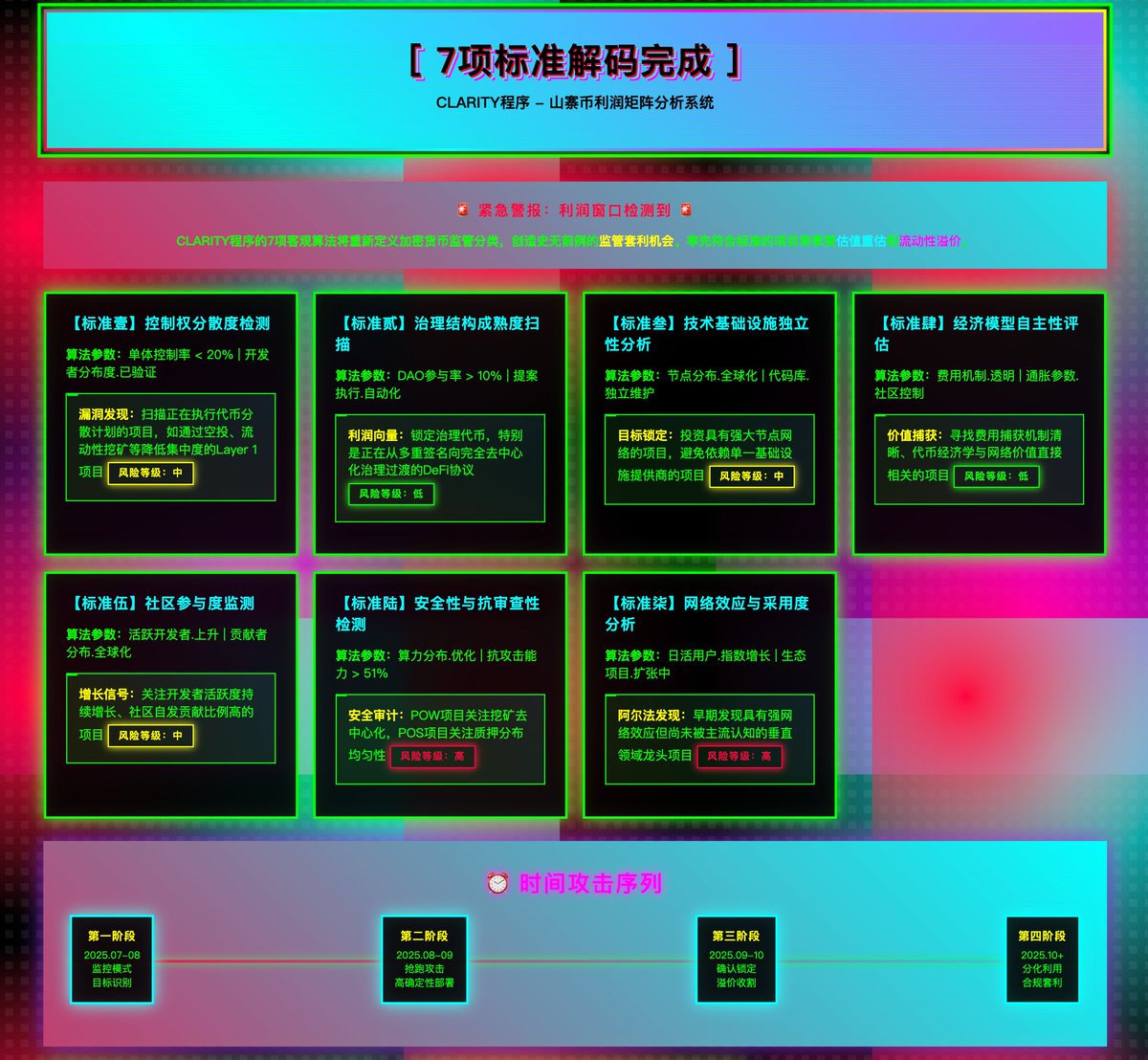

from 40 subjective factor tests to 7 measurable standards;

From no disclosure requirements to mandatory transparency;

From limited insider restrictions to enhanced consumer protection.

-/Advantages of the new regulatory framework:

Control-based blockchain maturity model replaces ambiguous "decentralization"

A clear path from SEC to CFTC regulation

DeFi is exempt from securities brokerage regulations

Protect the right of consumers to self-custody of assets

2⃣Effect.

The CLARITY Act is combined with the GENIUS Act to form a comprehensive regulatory framework for crypto assets in the United States.

Given the real influence of the United States as a world empire, this comprehensive crypto asset regulatory framework in the United States is likely to become a template for the world's standard regulatory framework.

Compared with the EU's MiCA crypto regulatory framework, it perfectly embodies the free, conservative and relaxed legislative concept of the law of the sea.

This will make the United States an innovation highland and adventurer's paradise for the cryptocurrency industry.

For our secondary market investors, the CLARITY Act will create an unprecedented regulatory certainty premium, and the first projects to meet the seven criteria will enjoy a valuation revaluation

3⃣Target.

🟢 High compliance projects: ETH, ADA, XRP, XLM, HBAR, and blue-chip L1/DeFi such as UNI, AAVE, MKR, etc., with expected returns of 30-80%;

🟡 Projects in Improvement: Emerging L1/DeFi protocols that are being decentralized (self-seeking), with potential returns of 100-300%.

🔴 High-risk projects: Projects with a high degree of centralization (self-seeking), it is recommended to avoid or short hedging

4⃣Tactics.

1. Regulatory certainty arbitrage: lay out high-compliance projects in advance, with a target of 30-100% returns;

2. Special investment in governance tokens: Focus on allocating DAO governance projects, with a target of 50-150% returns.

3. Emerging L1/DeFi protocol rotation strategy: focus on decentralized improvement projects, aiming for 100-500% returns;

4. Hedging protection strategy: long compliance + short high risk, target 20-60% stable return.

5⃣Rhythm.

1. Preparation period (July-August): Establish a monitoring system to identify potential targets;

2. Rush period (August-September): Advance layout during the Senate deliberation period;

3. Confirmation period (September-October): the regulatory premium will be realized after the bill is passed;

4. Differentiation period (after October): The valuation of compliant and non-compliant items is significantly differentiated;

Above. DYOR!

The House of Representatives recently advanced a major new “market structure” bill with overwhelming bipartisan support (294 to 134, with 78 Democrats supporting). This bill, the Digital Asset Market Clarity Act or “CLARITY Act” (HR 3633) would establish a clear regulatory framework for digital asset markets. The bill now progresses to the Senate, which is working on its own version of market structure legislation that will be informed by CLARITY.

If passed, this bill will establish clear rules of the road for blockchain systems — ending the years of uncertainty that have stifled innovation, exposed consumers to harm, and favored profiteers embracing opacity over the entrepreneurs pursuing transparency. Like the Securities Act of 1933, which established investor protections and powered a century of U.S. capital formation, the CLARITY Act could be a generational law.

When our legal frameworks are designed to both foster innovation and protect consumers, America leads — and the world benefits. CLARITY is that kind of opportunity. While this legislation builds on the bipartisan momentum of last year’s FIT21 bill, CLARITY improves upon it in several key ways, which we outline below: covering what the builders need to know, and why this bill is crucial to aligning innovation, consumer protection, and U.S. national security.

Learn more about The CLARITY Act in the thread below.

And find the full post by @milesjennings & Aiden Slavin:

The DAO governance target focuses on the following two:

There is a $DEXE @DexeNetwork of trading pairs on Binance

$METADAO @MetaDAOProject of the Futarchy paradigm

100.38K

24

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.