The Edge Series: Market Intelligence #18

@0xGeeGee prompts | powered by Chaos AI

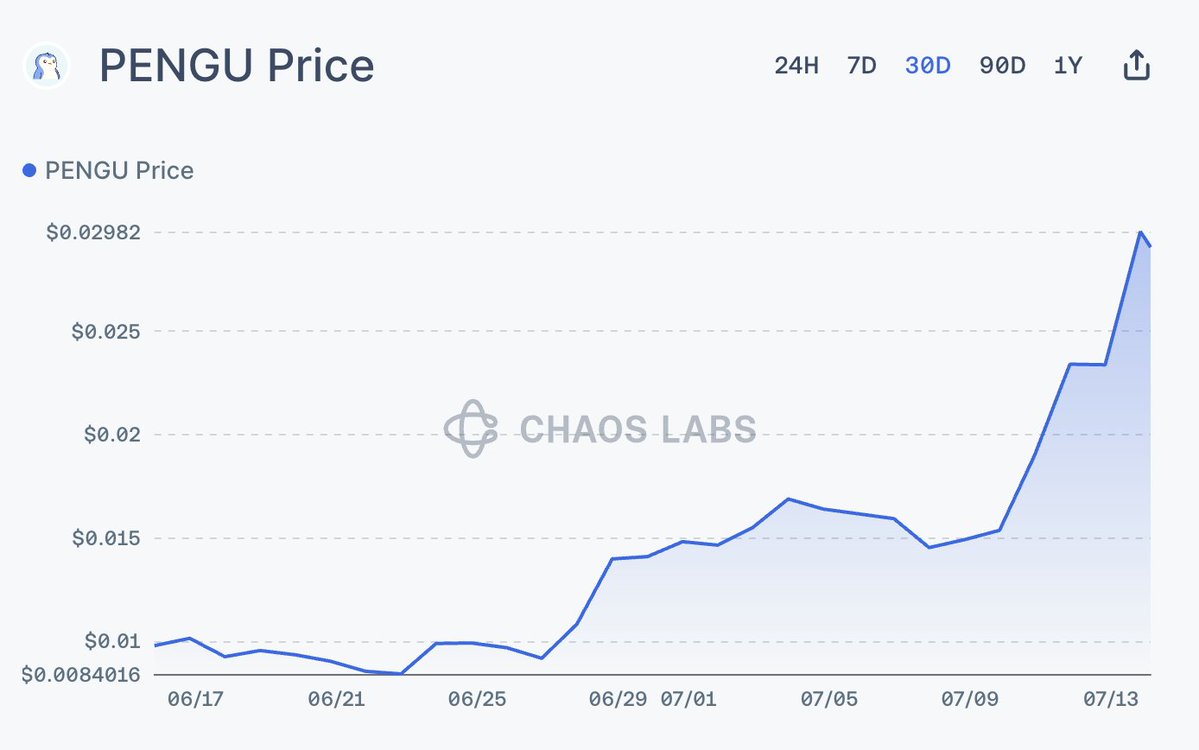

1. PENGU Surges 531% on Retail Momentum, Ecosystem Growth, and Solana Memecoin Boom

$PENGU has rallied 531% over the past 30 days, emerging as a breakout performer in the @solana memecoin space. Fueled by rising trading volume, retail integrations, and broader capital rotation into high-beta assets, the token has climbed to $0.029, just below its recent local high.

Daily volumes have topped $200M, supported by both institutional and retail flows. With bullish technical indicators and strong support at $0.017, PENGU is positioned for further upside, though long-term sustainability remains a key question.

>> Read more on Chaos AI:

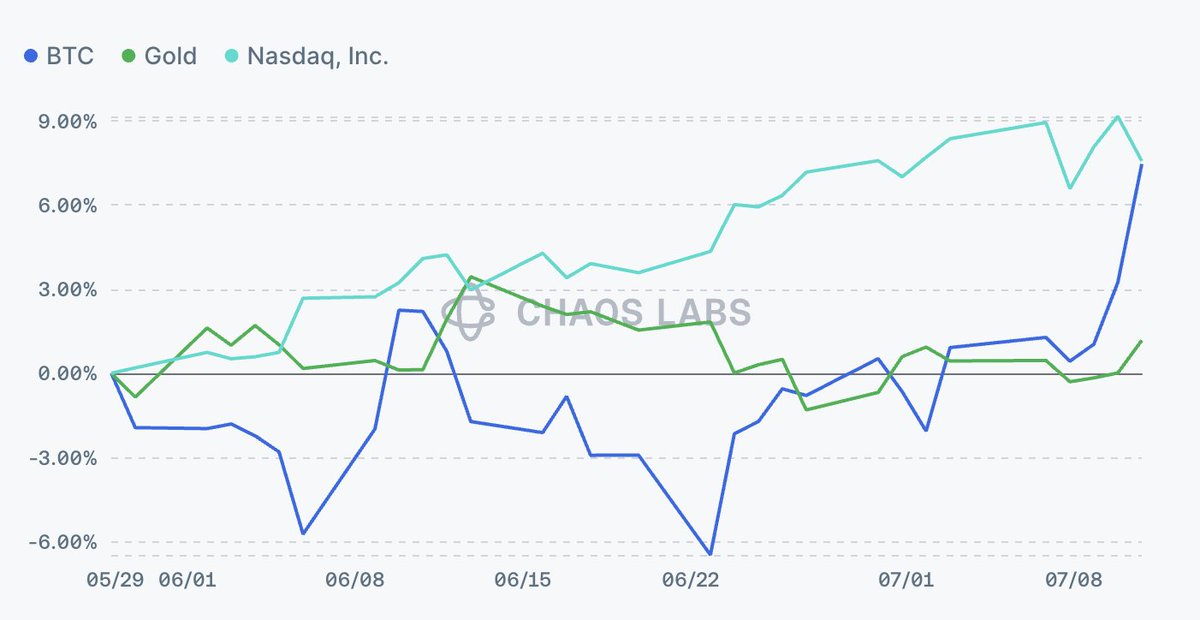

2. Bitcoin’s Identity Shifts as Institutional Demand Drives Store-of-Value Narrative

$BTC is showing signs of a structural transition from speculative risk asset to emerging store of value, according to recent data.

Despite remaining tightly correlated with tech stocks, mirroring the Nasdaq and rallying alongside Nvidia’s $4T milestone, BTC’s volatility has declined meaningfully. Fidelity notes that Bitcoin is now less volatile than 33 stocks in the S&P 500, signaling increased price stability.

Over $196B in BTC is now held by ETFs, public companies, and sovereign entities, led by large buys from @MicroStrategy (10,100 BTC) and @Metaplanet_JP (10,000 BTC). Upcoming U.S. regulatory developments may further legitimize its role as a long-term hedge against fiat devaluation and monetary instability.

>> Read more:

3. SharpLink, Bit Digital, GameSquare Lead ETH Treasury Wave as Corporate Accumulation Accelerates

Public companies are increasingly turning to @ethereum as a strategic treasury asset, marking a broader institutional shift toward onchain capital management. @SharpLinkGaming leads with 205,634 ETH staked, having earned 322 ETH in rewards since June. Bit Digital holds 100,603 ETH after fully pivoting from Bitcoin, while GameSquare is deploying up to $100M in ETH via Dialectic’s yield platform.

SharpLink has filed to raise $1B for further ETH purchases, and GameSquare recently launched an $8M offering for the same purpose. If the trend continues, corporate buyers could reshape ETH’s supply dynamics, governance power, and long-term valuation heading into 2026.

>> Here's more on Chaos AI:

The Edge Series: Market Intelligence #17

✍️ @0xGeeGee with research from Chaos AI

1. Market Reactions: $HOOD vs $ARB

@RobinhoodApp’s EthCC announcement of tokenized US stocks on @arbitrum triggered a sharp divergence in price action.

$HOOD surged 12.7% to a record high of $94.24 on the day, closing just below $93.63. $ARB spiked 20% on pre-announcement rumors but posted more modest gains afterward.

Explore the full $HOOD vs $ARB breakdown on Chaos AI:

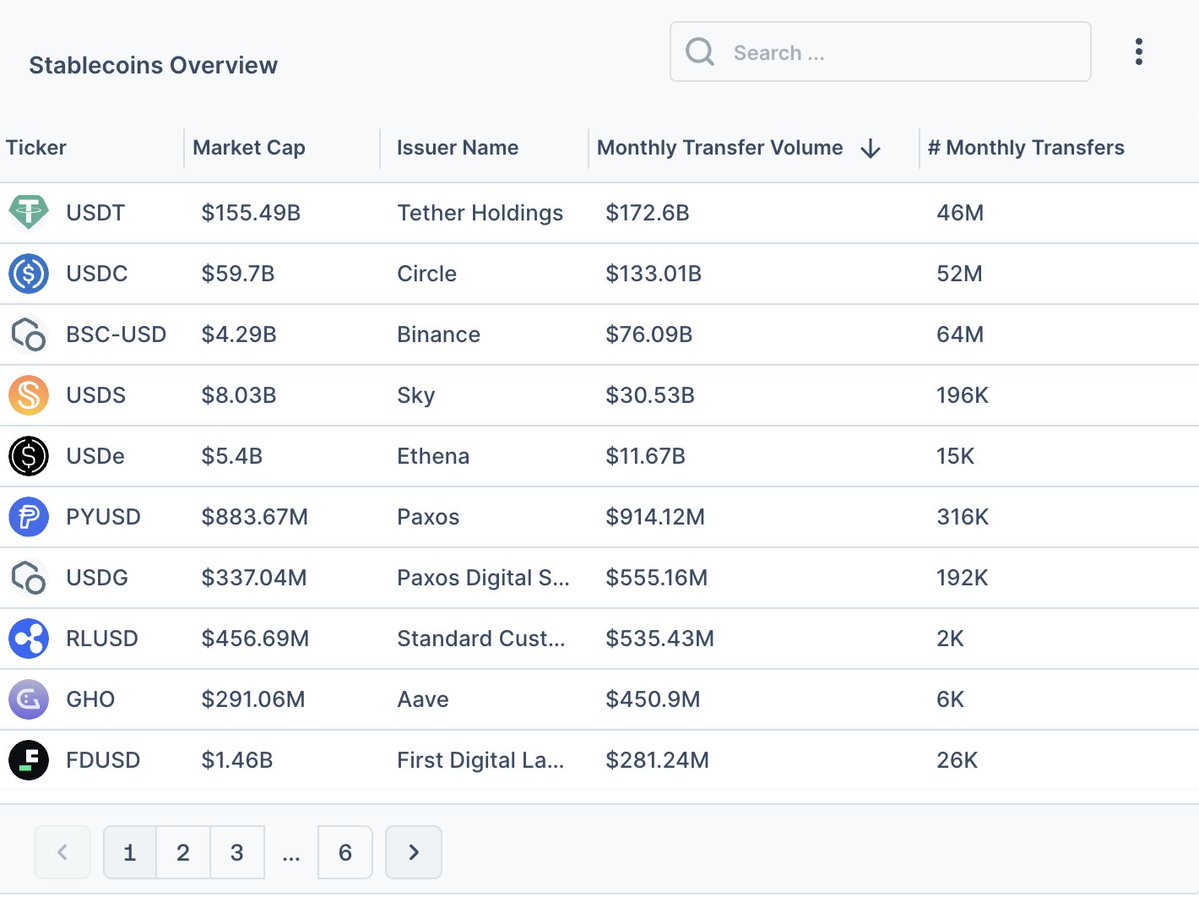

2. Stablecoins in 2025: $260B+ and Growing

Total stablecoin market cap has surged past $260B, with transfer volumes now rivaling Visa and Mastercard. USDT leads with $172.6B in monthly volume, and institutional adoption is accelerating.

@jpmorgan, @DeutscheBank, @Mastercard, and several other TradFi institutions have signaled intent to launch stablecoins as global regulation takes shape.

Here's a stablecoin breakdown from Chaos AI:

3. $TON Surges on UAE Golden Visa News

$TON pumped by over 10% after a program was announced allowing users to stake $100K in TON for UAE Golden Visas. The offer includes residency in 7 weeks, 3–4% annual yield, and smart contract custody.

The news pushed trading volume up 500%, but questions remain around whether the program is officially backed by the UAE government or promoted by third parties.

Read more on Chaos AI:

21.5K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.