Follow A哥 @AveryChing and Movemaker to explore the reasons behind Aptos's strong growth in the RWA sector over the past month👇

In the first half of 2025, the RWA market is expected to experience explosive growth, with a market cap surging over 50%. Private credit and U.S. Treasury bonds dominate, together accounting for nearly 90%.

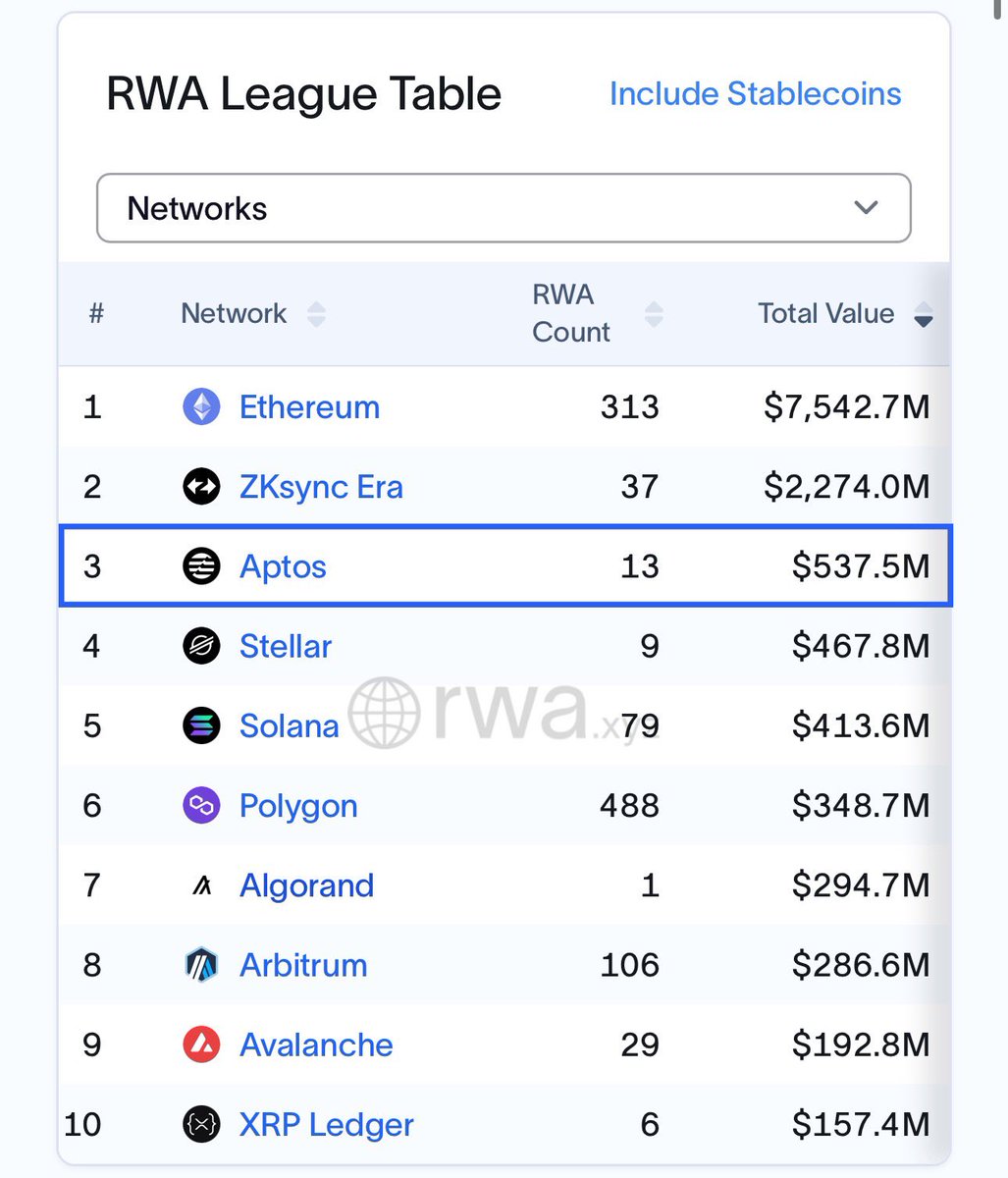

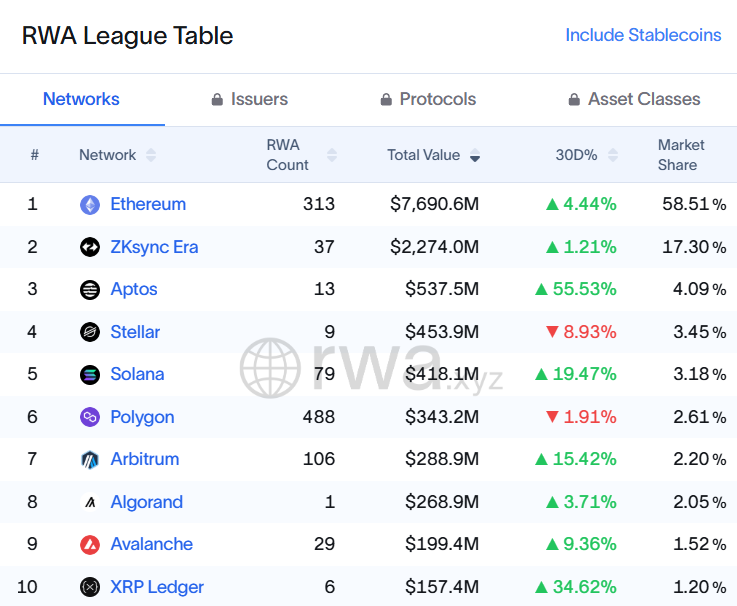

In the competition among public chains, Ethereum still firmly holds the largest share of the RWA market, with a market cap of $7.69 billion, maintaining over 50% of the market share and sitting at the top. ZKsync follows closely, successfully attracting a large number of investors by introducing the Web3 private credit asset management company Tradable.

As it was previously said, "On-chain finance cannot lack an Ethereum," this statement is now being challenged by strong competitors, with more public chains vying for dominance in the RWA battlefield.

🔥 In this competition, @Aptos's performance can be described as a remarkable turnaround: in the past 30 days, the market cap of RWA assets on Aptos has increased by 56.4%, surpassing $537 million, making it the third-largest RWA public chain globally and the only non-EVM public chain in the top three.

This achievement is supported by multiple traditional financial institutions and top RWA protocols, enhancing Aptos's credibility in compliance. For example:

➤ In July last year, Ondo Finance's USDY entered the Aptos ecosystem and integrated with major DEXs and lending applications.

➤ In October last year, Franklin Templeton's on-chain U.S. government money market fund (FOBXX) expanded to Aptos, attracting over $20 million in new subscriptions.

➤ In November last year, the world's largest asset management company BlackRock expanded BUIDL to Aptos.

When discussing Aptos's breakthrough in the RWA sector, we cannot overlook the strong push from the decentralized private credit protocol @pactconsortium.

In traditional finance and emerging markets, private credit attracts a large number of institutional investors due to its flexibility and high returns. However, it also faces pain points such as cumbersome audit processes, high costs, and restricted access due to a lack of credit history.

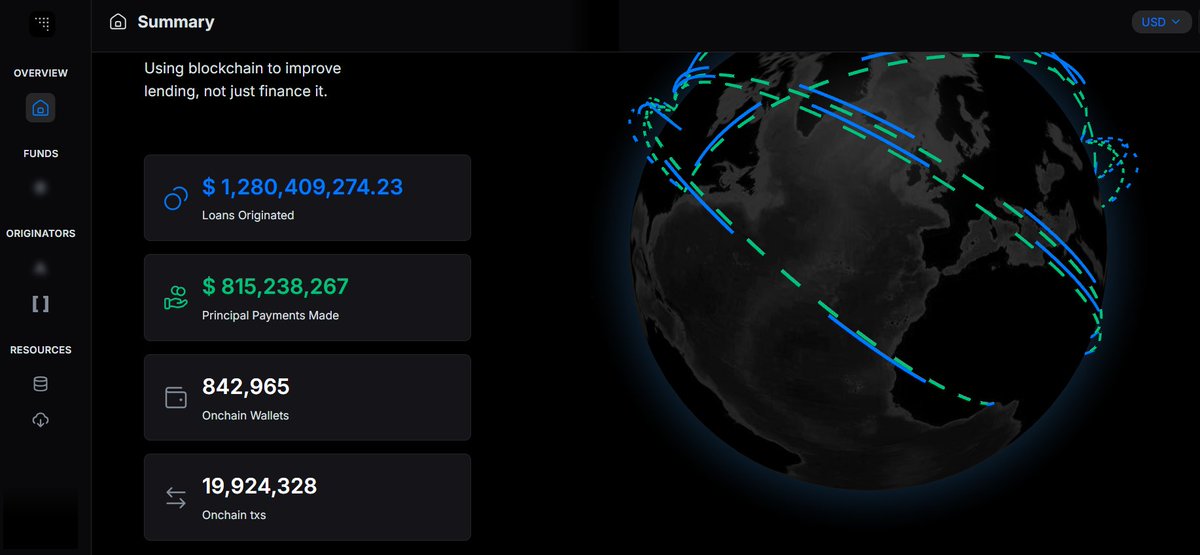

PACT directly addresses these frictions by automating execution on the Aptos chain, providing diversified financing solutions for emerging markets, with a total loan amount exceeding $1.2 billion💵.

To give a direct example, PACT is providing electric vehicle credit services for freight drivers in South America, helping them purchase electric vehicles while allowing investors to gain real-world cash flow returns, all executed entirely on the Aptos chain, ensuring the safety and efficiency of the process.

The PACT protocol has contributed 77% to Aptos's RWA market cap, approximately $420 million.

These numbers not only back the hard power of sub-second transaction confirmations and high-throughput underlying architecture but also serve as a business card for Aptos in financial innovation!

Aptos is getting closer to becoming a dominant force in the RWA sector💪.

10.92K

116

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.