In recent days, @plumenetwork $PLUME has performed well in the secondary market, validating a fact: in today's Crypto market, if you can connect with the Trump family, you can reap steady happiness? What exactly is going on?

Recently, Plume announced an important partnership with World Liberty Finance (WLFI) @worldlibertyfi, founded by the Trump family, becoming the first to integrate USD1 into its native stablecoin pUSD reserve assets on the RWA chain.

USD1 is a stablecoin supported by the Trump family, fully backed by U.S. Treasury bonds at a 1:1 ratio, currently valued at $2.2 billion, with a 24-hour trading volume consistently ranking second in the stablecoin market, only behind USDT.

In other words, USD1 is not just an ordinary stablecoin project; it has the dual backing of the Trump family and the SEC. In the current context of a crypto-friendly government, this is equivalent to the RWA track gaining a "policy express lane."

So, what are the core highlights of this cooperation?

1) The large-scale commercial application of RWA to accommodate institutional-level funds has become a reality: Previously, the UAE-supported MGX has already settled a $2 billion investment in Binance using USD1, validating that the RWA narrative has already seen significant commercial application.

Therefore, for Plume, accessing USD1 brings not just $2.2 billion in liquidity support, but also signifies that RWA has emerged from pure DeFi scenarios to become an infrastructure capable of accommodating massive traditional financial funds. Essentially, it represents a leap for RWA from "proof of concept" to "commercialization."

2) There is uncertainty in the stablecoin market landscape: USD1 has grown from zero to a $2.2 billion market cap, and its 24-hour trading volume can surpass USDC, ranking second. Such rapid growth actually proves that the duopoly competition between USDT and USDC can easily be disrupted by USD1, which has "political backing."

Clearly, Plume's early access to USD1 is aimed at securing a position in the new stablecoin market landscape. While other RWA projects are still debating whether to choose USDT or USDC, Plume has already positioned itself on the side of policy certainty.

To summarize: in the current environment where Crypto is easily influenced by policy, sometimes, "political correctness" can bring more short-term excess returns than technological innovation. The market's enthusiasm for concepts related to the Trump family has already formed a mature investment logic, and this wave of short-term political dividends is likely to be enjoyed for a while.

Of course, a policy-friendly environment can only be considered a short-term catalyst; in the long run, projects still need to return to fundamental tests. Especially, whether the RWA ecosystem can truly accommodate more traditional assets on-chain and whether it can create differentiated product innovations within a compliant framework, etc.

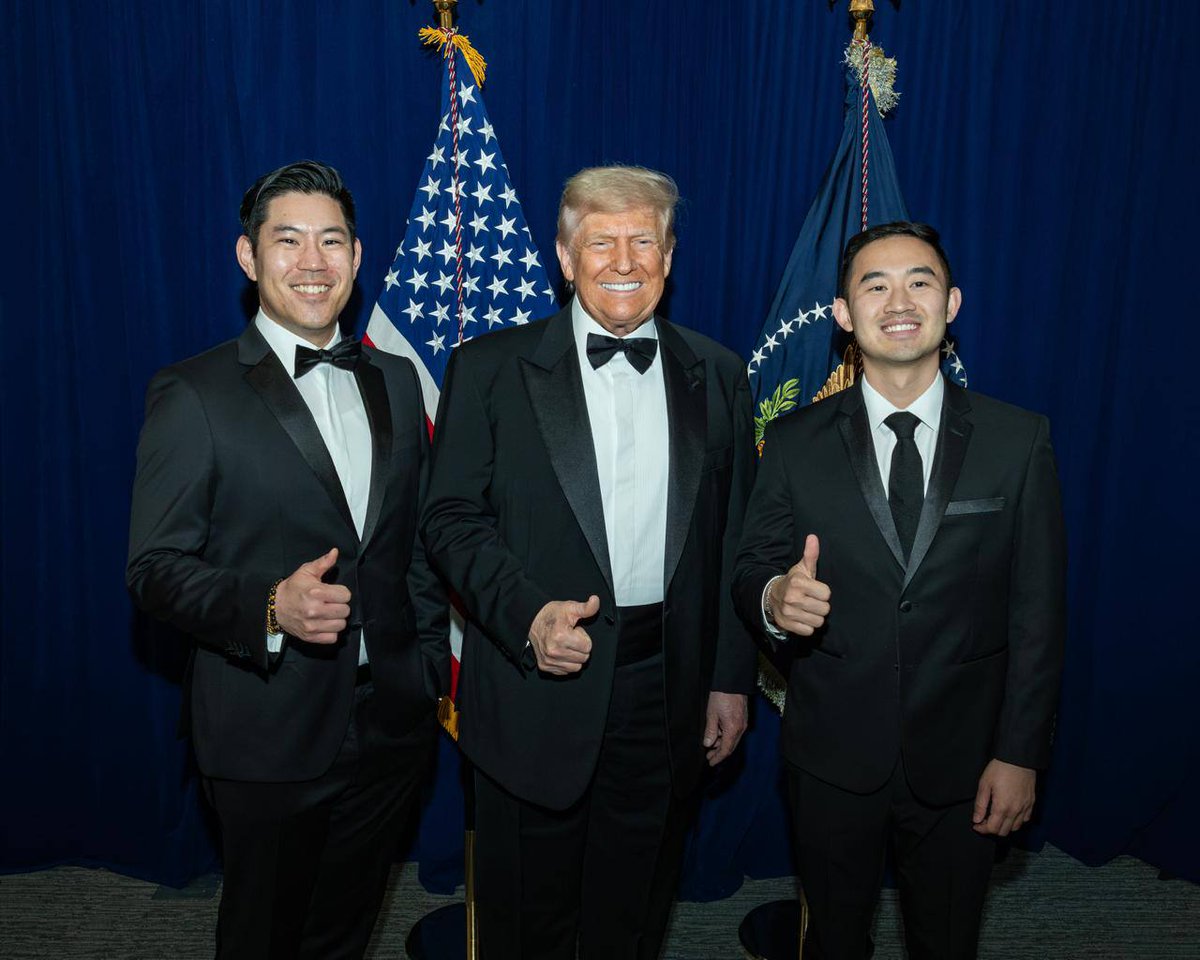

Off the heels of our meetings with Treasury and SEC's Crypto Task Force last month, we are grateful that we got the privilege to spend time with Donald J. Trump, the president of the United States to discuss crypto policy, tokenization, and the future of RWAs in America.

The passing of the GENIUS Act sets the stage for the future of crypto in America. Our meeting with the SEC Crypto Task Force and the announcement from Paul Atkins referencing the innovation exemption that we introduced for onchain products like Nest underscore how serious this is.

We are excited to continue working with the President of the United States, Donald J. Trump, and the rest of the cabinet — including Scott Bessent, Vice President J.D. Vance, the SEC Crypto Task Force, and the Treasury to define and advance crypto policy in America, enabling a free, open, and permissionless world for everyone.

This is the start of much more, where permissionless innovation and regulatory clarity go hand-in-hand. Trillions of dollars of liquidity inbound.

Plumerica 🇺🇸

14.65K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.