Michael is a big 🧠 and a source of great data, but imho there are several problems I see with most DCF models 🧵

1. The most obvious one is they treat protocol revenue (fees) as something that should be maximized, using it as a proxy to derive the fair value of the...

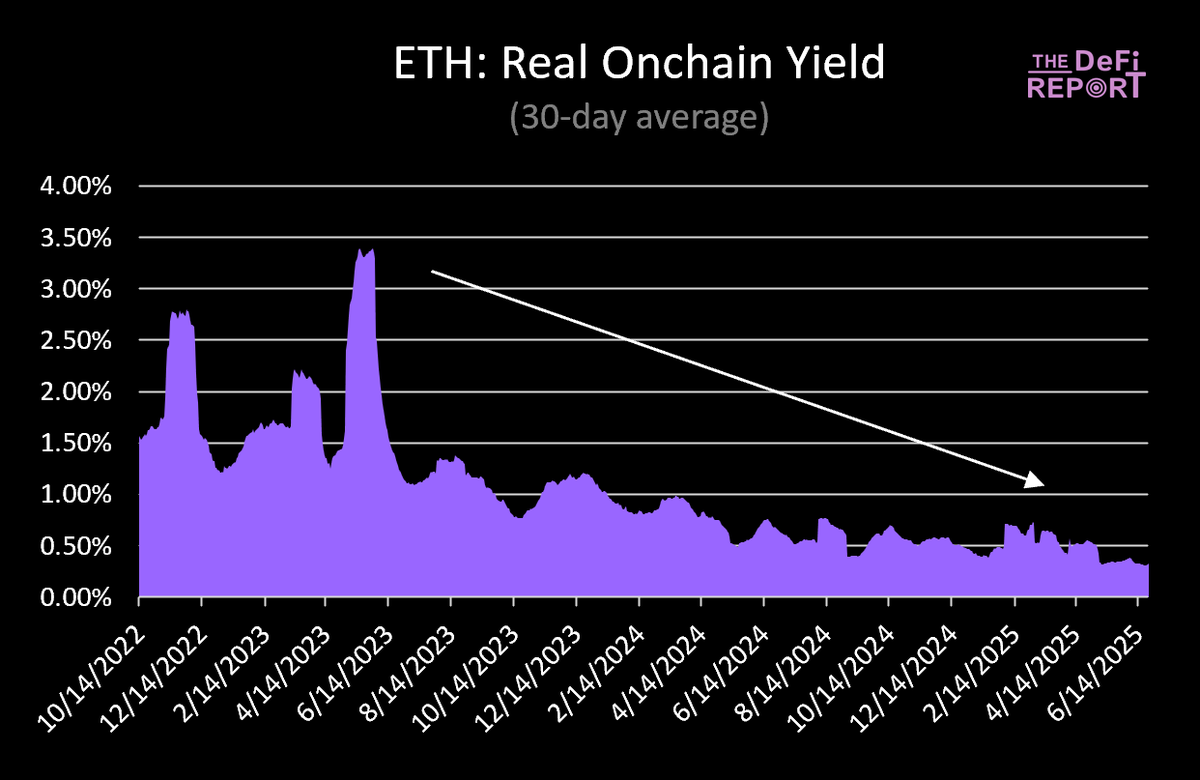

The reason we are debating Finance 101 is that the ETH community doesn't want to admit that this chart is the reason that ETH has underperformed, relative to Solana.

The faster we accept the truth, the faster we force leadership to fix this.

Valuation frameworks for equities in the 1920s *did not come from the companies themselves.*

They came from the bottom up.

If ETH holders don't think the chain should return value to them, guess what?

Neither will leadership.

That doesn't feel like a bright future.

----

P.S. We shared our valuation framework for L1s today with readers of @the_defi_report

If you'd like to check out the latest research, see the comment below 👇

As always, opposing views are more than welcome.

native token—typically via a theoretical optimal REV/Market Cap ratio to judge if a token is over- or undervalued.

But this framework imho is flawed for several reasons:

a. Fees were never "designed" as cash flows. Historically and technically, fees in blockchains weren’t...

conceived as a value accrual mechanism for stakers or validators. At least not as in DCF models. They were more akin to a tax, a free-market self-adjusting tool to regulate access to scarce blockspace. I think interpreting them retroactively as a source of profit is a...

fundamental misreading of their original purpose.

b. The path to maximize fees is paved with good intentions but can be counterproductive. As long as an L1 is economically sustainable—meaning it provides sufficient security to support a thriving ecosystem where users can trade..

build, play and most importantly, store value—there is no need to maximize revenue. What matters is that the protocol provides inflation-adjusted returns attractive enough to maintain optimal staking participation. Beyond that, any excess fee revenue may become a burden on the...

real economy operating atop the chain, akin to over-taxation in traditional economies.

c. L1s are not companies; they’re economic zones. If L1s were corporations, they’d aim to maximize profit for "shareholders" (i.e., stakers). But L1s are more like digital nations or open...

economic systems. The goal should be to maximize sustainable participation, security, & decentralization. In this framing, even if fee revenue peaks at a certain level of blockspace utilization (N), it may still be better to increase capacity to N+2 if it boosts participation...

and utility—even if that lowers median fees and total revenue.

d. Using the relative performance of Eth vs Sol over the past 3 years as a definitive measure of which project is on the "right path" seems inconsistent if we then reject that same criterion—the market’s judgment—...

when it comes to identifying what the market actually values in an L1. Based on current market caps it’s clear that the market does not see revenue (REV) as the primary metric of success for a blockchain. Instead, it appears to value the ability to store value —a use case long...

championed by BTC and ETH, which continue to trade at a premium largely because of this perceived role.

Under that lens, it’s easy to understand why Ethereum’s market cap remains several multiples above Solana’s. Solana hasn’t yet regained even the level of stablecoin supply...

it once hosted, and it lags far behind Ethereum in other key metrics such as real-world asset integrations, DeFi TVL, and the aggregate value of issued tokens and top meme coins. Once again, the market seems to favor a focus on decentralization and security—even at the cost...

of lower short-term REV—so long as the system remains stable and continues to operate smoothly.

Imho, ETH’s relative underperformance vs. SOL is simply the market’s short-term adjustment for the risks Ethereum has taken with its rollup-centric roadmap. A bold but correct bet...

—because incentives trump everything. The momentum of legacy fintech players wanting their own slice of the pie via Ethereum based L2s is unstoppable.

Even if, in theory, there were alternative architectures better optimized for value capture (which I don’t believe, based on...

the earlier argument about what “value capture” and REV truly represent), reality is stubborn. In a world where econ. actors increasingly demand Ethereum-based L2s, ETH is the best-positioned asset—or, for those skeptical of the L2 model, at least the one set to lose the least :)

e. I haven’t fully read the FX-proxy valuation report yet, but one concern is that if we draw a parallel with the Eurozone bond market, most countries pay a premium (vs. German bunds) due to higher perceived risk. That premium isn’t a strength—it’s compensation demanded by...

investors. If L1s are being valued based on similar relative risk premiums, then again, the focus is not on fee revenue but trust, sustainability, and perception of long-term safety.

cc @VivekVentures @sassal0x @RyanSAdams @ryanberckmans

1.07K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.