ArkStream Alpha Daily | 06/19 Hot spots

1. The FOMC is expected to cut interest rates 2 times, but only 1 vote holds it

@federalreserve Yesterday's FOMC meeting, which was supposed to be a release to "stabilize expectations", turned out to make the market even more uneasy.

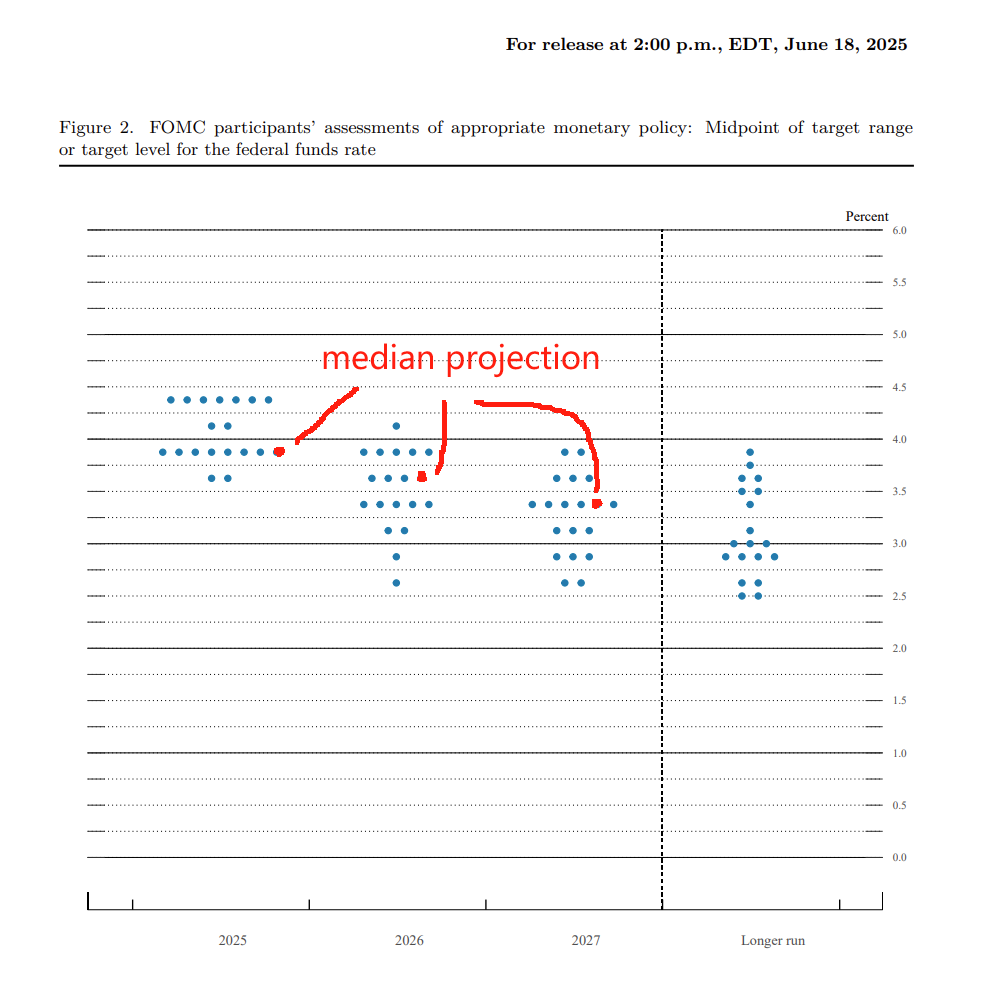

The consensus of two interest rate cuts this year is actually only one vote away from it (see chart), and the internal opinions are seriously torn, and the dot plot is more like the result of a compromise.

The market was already sensitive to uncertainties such as war and tariffs, and the Fed continued to "pretend that everything is normal" this time, which directly caused the mood to slip, and U.S. stocks fell for two consecutive days in advance.

The current market seems to perceive something in advance, the black swan has not yet flown off, and the mood has slid down first. Interestingly, if the FOMC does turn pessimistic next, it may be a positive signal for the market.

You know, the market confidence is not a reflection of interest rates, but "a lack of belief that the Fed really has a direction".

2. JPMG stablecoin ignites base chain, AERO rises 80% in two weeks

@Morgan issuance of JPMG stablecoin + coinbase-related @circle skyrocketing + @coinbase expansion of U.S. stock business, a complete set of combos down, @base ready to go countdown.

JPMorgan plans to deploy JPMG to Base to enable its customers to use compliant stablecoins. At the same time, Coinbase expands its U.S. stock business, and the two form a synergy that is good for the Base ecosystem. At that time, the TVL and liquidity on the Base chain will be significantly enhanced, and DeFi projects will become direct beneficiaries.

JMPG's base deployment is similar to BSC's USD1 moment, which will significantly increase both the depth of funds (tvl) and the trading activity (tx numbers).

The projects that benefit the most are DeFi and Meme, which are exclusive to Base.

Spring River Plumbing Duck Prophet: $AERO, the largest native DEX on the Base chain, has risen by more than 80% ($0.5 → $0.92) in the past two weeks.

3. Circle breaks above 200, structural high?

@circle What will happen after the price rises?

$CRCL The stock price exceeded $200 and the market value once reached $48 billion, a six-fold increase from the IPO, but the company's profits need to be divided into 50% to Coinbase, which is currently only $75 billion, which means that the market's expectations for Circle are obviously premium and misjudged.

Even the rational Ark Invest continuously reduced its position in Circle on Monday and Tuesday this week, cashing out 90 million+ at a high level.

After the fundamentals, no matter how big the bubble blows, it will have to be corrected sooner or later.

But as Arthur Hayes said, don't fomo, and don't rush short.

4. Is Jump back? Zeng LUNA earned 100 million, and Wormhole made up 300 million

@jump_ officially announced its return.

He once filled the pit in full when $320 million was stolen from Wormhole, and also made 100 million in arbitrage in the LUNA/UST operation, and finally paid a fine of 123 million to the SEC to settle.

Now, they take a high-profile inventory of the projects they have led to build in the past few years, including Firedancer (a high-performance Solana client), Wormhole (a cross-chain protocol), DoubleZero, Pyth and other infrastructure, and say that they not only continue to work on technology, but also actively participate in the development of US regulatory policy.

Now in the time window of regulatory relaxation, Jump has transformed from a "market maker" to a "blockchain infrastructure madman" + "compliance pioneer", and is likely to be preparing for the next big move.

The music by Madison Garden is playing again.

Show original

11.44K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.