What happened behind Ethereum's 70% surge in a single month?

Ethereum is making history:

We are witnessing one of the largest short squeezes in crypto history. Ethereum's market capitalization has skyrocketed by $150 billion since July 1 — just days after net short positions hit an all-time high.

What happened? This article explains it for you.

Please see the chart below:

According to Zerohedge data, Ethereum's net leveraged short positions reached an all-time high heading into July. In reality, net short exposure is about 25% higher than February 2025 levels. This directly led to Ethereum's 70% surge in less than a month.

But the story is far from over.

President Trump's World Liberty Financial institution has been increasing its holdings of Ethereum. The latest transaction records show that just 24 hours ago, the institution had just completed a $5 million purchase. This added another handful of firewood to the already fierce bears squeezing the fire.

It is worth noting that most of these short positions come from institutional capital.

What is even more intriguing is:

The Zerohedge report shows that BlackRock ETFs have been increasing their holdings of Ethereum for 29 days in the 30 days leading up to July 1. But as mentioned earlier, prices continued to decline due to a sudden surge in leveraged short exposure. Apparently there is "smart money" who predicted this storm.

Now we are witnessing: billions of dollars in short positions being liquidated. If Ethereum rises by another 10%, another $1 billion in short positions will be liquidated.

Moreover, since most of these short positions are leveraged, the market is facing stronger short squeeze pressure.

Ethereum could hit $4000 soon.

We observed a similar effect on Ripple, where Bitcoin continued to show relative strength. Bitcoin has officially returned to the $120,000 mark, with a $900 billion increase in market capitalization since its April low. After months of downturns, Ethereum and Ripple are finally starting to catch up with Bitcoin's gains.

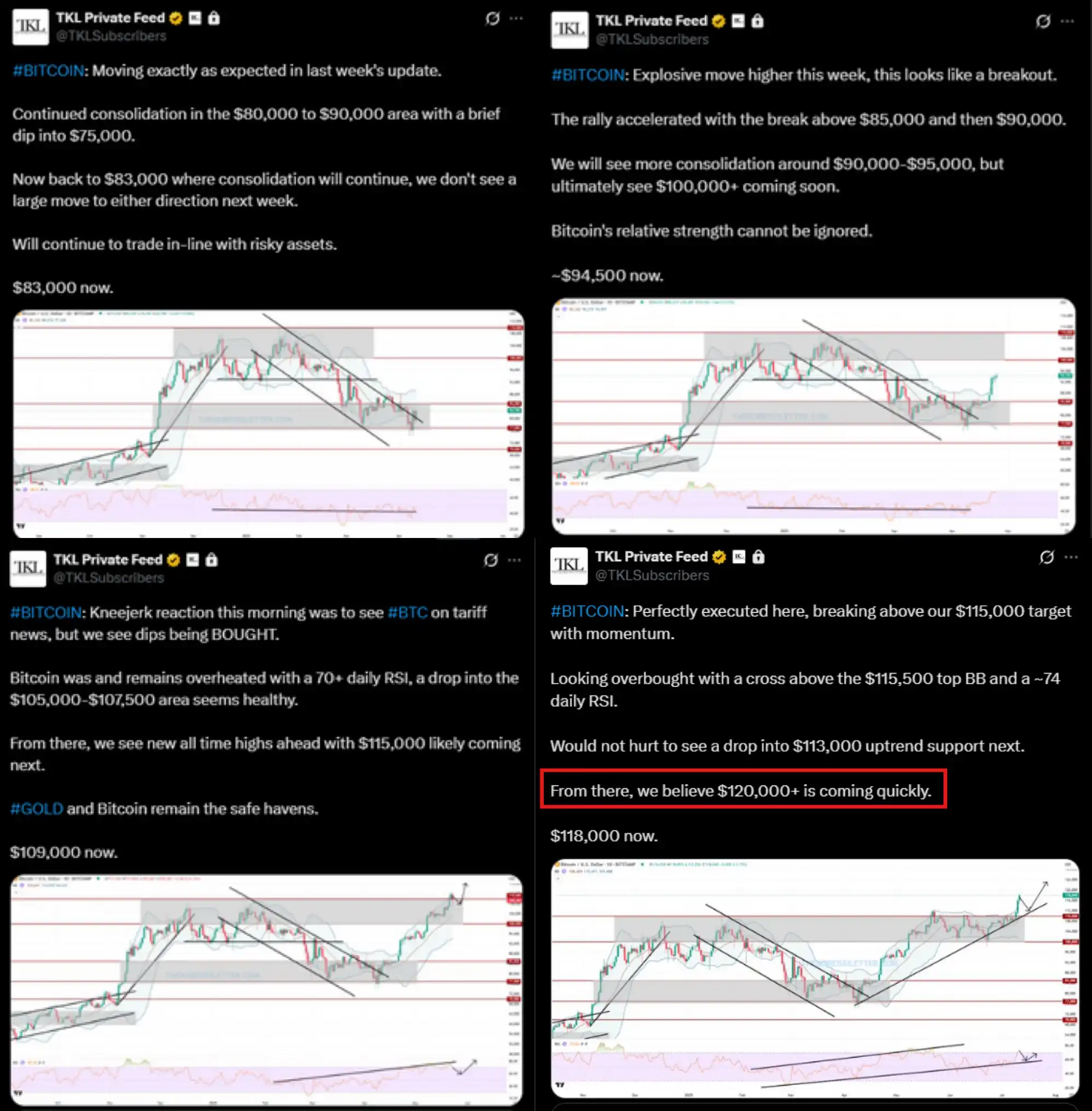

We anticipate this trend in advance. Here are some of the warning tips we provide to premium members: We buy the bottom in batches at 80,000, 90,000, and 100,000 US dollars, and accurately predict the target level of 115,000 US dollars. Last week we raised our target to $120,000+, and we just got there.

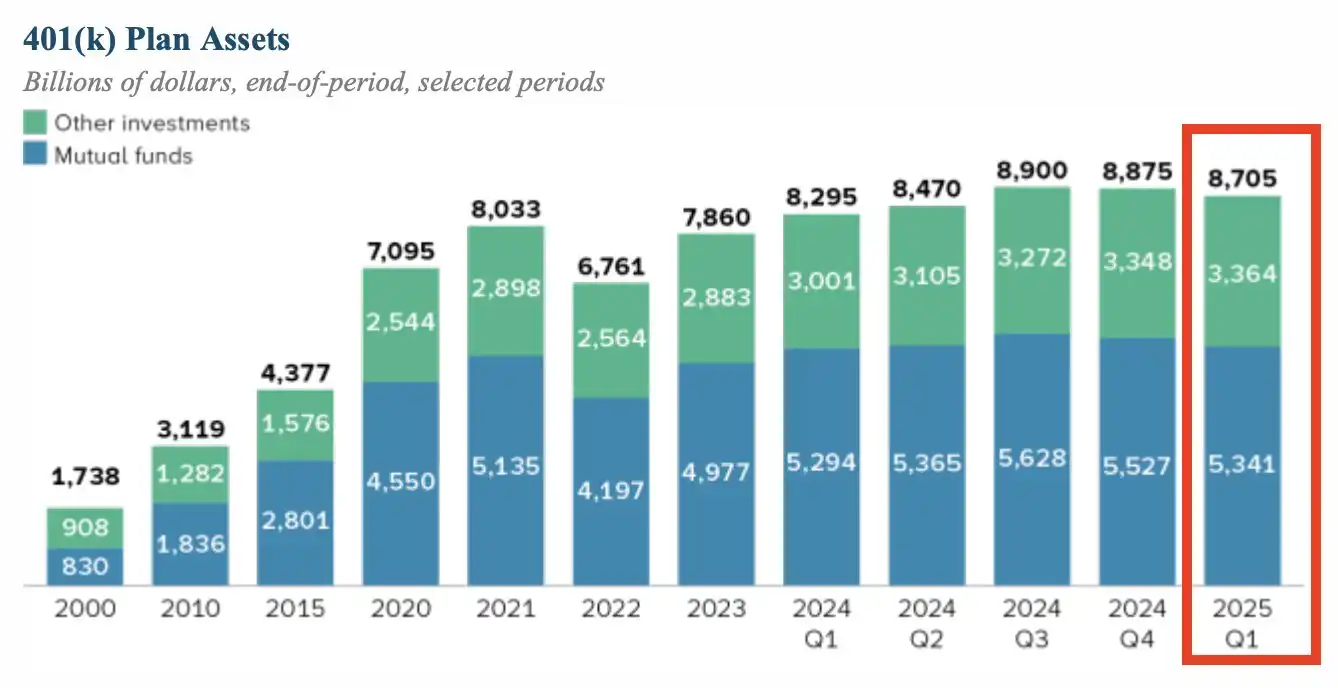

What's more, the market is digesting the blockbuster report released by FT today. President Trump will sign an executive order allowing 401k pension plans to invest in cryptocurrencies as soon as this week. This will be one of the most landmark positives in crypto history.

As of the first quarter of 2025, 401k pensions in the United States are worth $8.7 trillion. The current total cryptocurrency market capitalization is only $3.8 trillion. This means that the equivalent of 2.3 times the size of the entire crypto market is about to gain an entry channel. This is epoch-making.

More importantly, the U.S. House of Representatives passed three important Bitcoin and cryptocurrency bills: the Clarity Act, the Genius Act, and the Anti-CBDC Act.

The biggest win for the crypto industry lies in gaining cross-party support. Candidates who refuse to accept cryptocurrencies can no longer win elections.

As we've always emphasized: institutional capital can no longer ignore cryptocurrencies. Over the past 13 years, Bitcoin has grown at a compound annual growth rate of +90%, outperforming almost all assets in the world.

We continue to receive feedback from institutional investors that their AUM is gradually allocating crypto assets.

Looking ahead, the core logic driving crypto rally will trigger significant macroeconomic changes. This is redefining the paradigm of how financial markets operate.

Finally, let's not forget the most powerful bull engine of cryptocurrencies - the US deficit spending crisis. Not only has Bitcoin risen 55% since April, but the US dollar index has also fallen 10% this year. The dollar has fallen into an eternal bear market.