The risk dilemma behind Ethereum's treasury

Written by James Rubin

Compiled by: Saoirse, Foresight News

Wall Street investment bank Bernstein pointed out in a report on Monday that the Ethereum treasury is significantly different from the Bitcoin treasury in managing assets: the Ethereum treasury earns income through staking, but this process is accompanied by risks such as limited liquidity and smart contract security, and companies need to find a balance between the limitations of capital deployment.

Analysts believe that these factors are key considerations for enterprises when balancing Ethereum asset liquidity with "yield optimization".

"If the Ethereum treasury stakes ETH to earn yield, the staking contract is usually liquid, but sometimes there is a queue for several days to unlock it. Therefore, Ethereum treasury companies must find a balance between ETH's liquidity and yield optimization. In addition, more complex yield optimization strategies such as re-staking (e.g., Eigenlayer re-staking) and DeFi-based yield generation also need to address the security risk management of smart contracts."

Bernstein added: "The advantage of the Ethereum treasury model is that staking income can bring real cash flow to operations, but liquidity risks and security issues still need to be focused."

Staking refers to the process of staking tokens to a network to support its operation. Proof-of-stake networks such as Ethereum and Solana differ from proof-of-work systems such as Bitcoin, which rely on resource-intensive mining operations.

At present, more and more enterprises are starting to build Ethereum treasury. Bernstein mentioned that Ethereum-related companies, including SharpLink Gaming (SBET), Bit Digital (BTBT), and BitMine Immersion (BMNR), have held a total of 876,000 ETH in July.

Last week, BMNR's Ethereum holdings surpassed $2 billion in value, and the company also said it aims to hold and stake 5% of Ethereum's total supply. SharpLink holds more than $1.3 billion worth of ETH.

"Driven by digital dollars and tokenized assets, the growth of the Internet financial economy will drive the expansion of transactions and users in the Ethereum ecosystem (including Layer2 chains operated by platforms such as Coinbase and Robinhood). As the underlying native asset, Ethereum is expected to achieve value appreciation from this growth by relying on the staking income generated by transaction fees and the token buyback and burning mechanism."

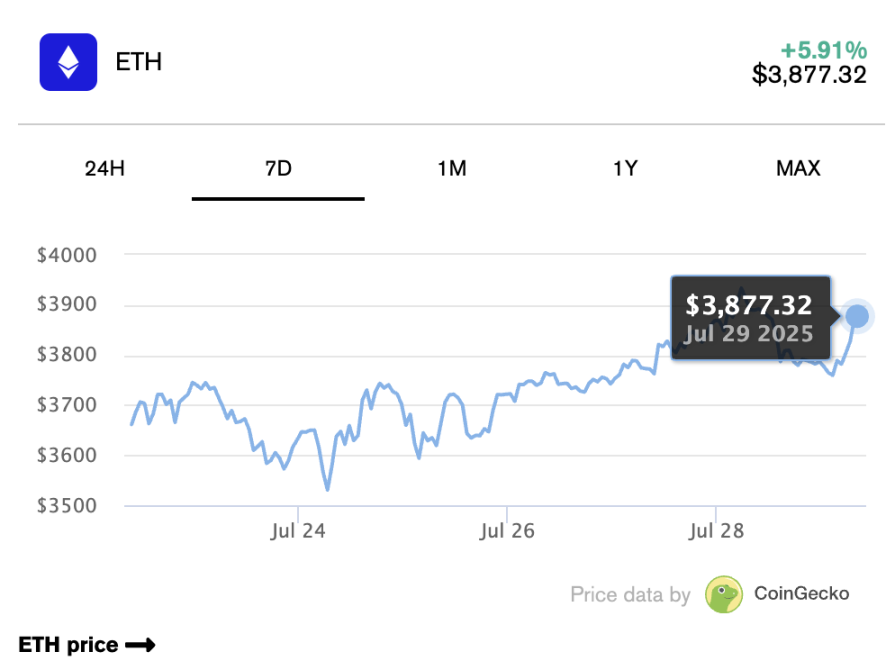

Ethereum briefly surpassed $3,900 in Monday's trading, its highest since early December, before retreating. In the past month, the asset has risen by more than 50%, and its rise is closely related to the rise of the Ethereum treasury, the improvement of the Ethereum ecosystem after the passage of the GENIUS Act, and the market's recognition of its application potential.

Several analysts predict that ETH may break through the previous all-time high of $4,800 this year, and BitMEX founder Arthur Hayes even expects ETH to reach $10,000 this year in the near future.

In a report on the social media platform X, BitMine Immersion chairman Tom Lee said that based on the replacement value provided by research analysts, ETH could reach 18 times the current price, or about $60,000. Of course, BitMine, as a holding company, inevitably has a profit bias in its forecasts.

The Ethereum treasury model draws on the experience of Strategy (formerly MicroStrategy). The company transitioned from software development to Bitcoin purchases in 2020 after years of poor performance and a sluggish stock price, with its Bitcoin holdings worth nearly $72 billion at current prices. But the analyst pointed out, "The risk management of the Ethereum treasury is more complex than the Strategy model. 」

"Michael Saylor insists on keeping Bitcoin on the balance sheet in the form of liquidity and does not generate passive income through lending," the analyst said. Strategy has a strong focus on asset-liability management (ALM) and liquidity management."

"And the Strategy often adjusts between debt financing and equity financing based on market sentiment to maintain conservative debt levels."