Who opened a contract on-chain and lost $100 million?

Written by Bright, Foresight News

At present, the volatility of bitcoin has reached an extremely low point, and it is inevitable that the market will show "dryness".

However, there are always a group of contract leverage experts in the market who want to see the needle and bet on the possible future trend of Bitcoin. All of them are trading giants who have made A8 and A9 in the big market, and they have hundreds of millions of dollars in positions. But recently, several giant whales on the chain that have been closely watched by the market and have stirred up the ups and downs of the market have all chosen to move forward bravely when they should not have worked hard.

James Wynn: From 100 million to 10,000

At 11 p.m. on July 2, according to Lookonchain monitoring, James Wynn's bitcoin long position opened on Hyperliquid has been liquidated four times in a row, and there is currently only $10,600 left in the account. Its down-and-out scene can be called a wake-up call for all contract traders.

James Wynn is a well-deserved traffic star in the first half of the year. He has been operating on Hyperliquid since March 2025, and in the early days, he preferred relatively long (more than 3 days) holds, and was a popular coin and meme. He is adept at making one-way profits in high volatility driven by large market conditions, such as on May 13, his long position on Pepe had more than $23 million in open profit. James Wynn said it himself. At its peak, the total value of its accounts exceeded $100 million.

However, at the end of May, James Wynn fell into "sage mode" after a huge loss. In the previous week, it had retraced more than $96 million in bitcoin due to geopolitical factors and new high pressures, and the overall account lost $14.03 million.

But at the time, James Wynn was very personal, and he posted on X that it was "just $100 million, a drop in the ocean in the world of money." "I didn't even want to close the position."

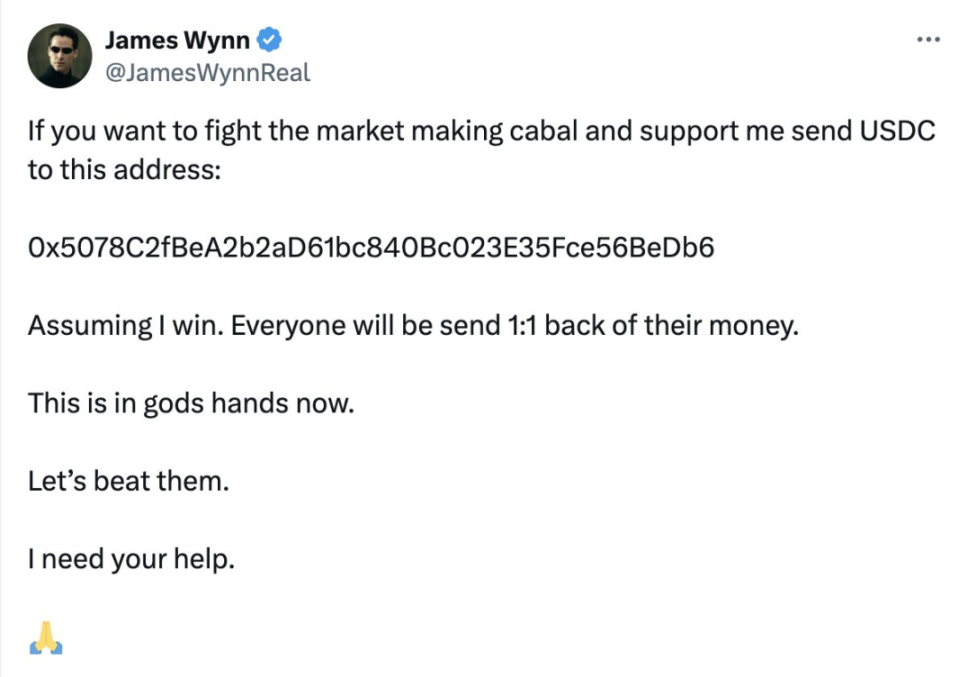

And on June 2, when James Wynn was about to be liquidated again, he directly "begged" to the whole network, and waved the banner against the "market-making group".

Although this order was eventually profitable thanks to the help of well-wishers and the easing of market sentiment. But a few days later, with a "tear" between Trump and Musk's friendship breakdown, James Wynn lost everything again after a night.

Since then, James Wynn has never added a large amount of money to Hyperliquid to re-open the order, but he still stubbornly shouted, "If Hyperliquid readjusts the leverage back to 50x, I will deposit $75 million to open a long position." Let's do it again, and this time I'm ready." "If there is a black swan event, all funds will be invested in the layout."

"Insider Brother": One misstep becomes a thousand hatreds

"Insider Brother" @qwatio also achieved great results in on-chain contract trading in the first half of the year. He is good at "extreme stud", usually checking the highest leverage when opening a position, and the liquidation price is very close to the current market price, and has a keen insight into the market.

His classic "battle" includes: around the Fed's interest rate decision on March 20, 2025, he first shorted BTC when the price was $84,566, closed his position for profit after the price fell to $82,000, and then went long at $82,200 and closed his position when the price rebounded to $85,000. His operation of eating both long and empty also made people give him the nickname "Insider Brother". Since then, he has accurately judged that the bottom of Ethereum to buy spot and take advantage of the results of Sino-US trade negotiations to short the operation has also been full of harvest. During this period, it even caused other big families to form a "whale hunting team" to "snipe" it.

But in the second half of June, the short-selling operation of the "insider brother" suffered a rout. On the evening of June 25, its short positions of $122 million in Bitcoin and $68.3 million in Ethereum were partially liquidated, with a floating loss of $8.32 million at that time. During this period, after being liquidated and liquidated many times, he took advantage of the slight pullback of BTC and ETH in the afternoon of July 1 to increase his short position again, and in the evening, he re-increased his short position worth $50 million, pulling the overall short position to $250 million.

The market did not favor this wishful trader. At 11 p.m. on July 2, as Bitcoin recovered, the "Insider Brother" was liquidated another $50 million. On-chain data shows that when BTC pulled back to about $105,500 during the period, he was actually close to recovering his capital, but he did not stop his loss and close the position.

AguilaTrades: The poor guy whose account was bombarded by Israel

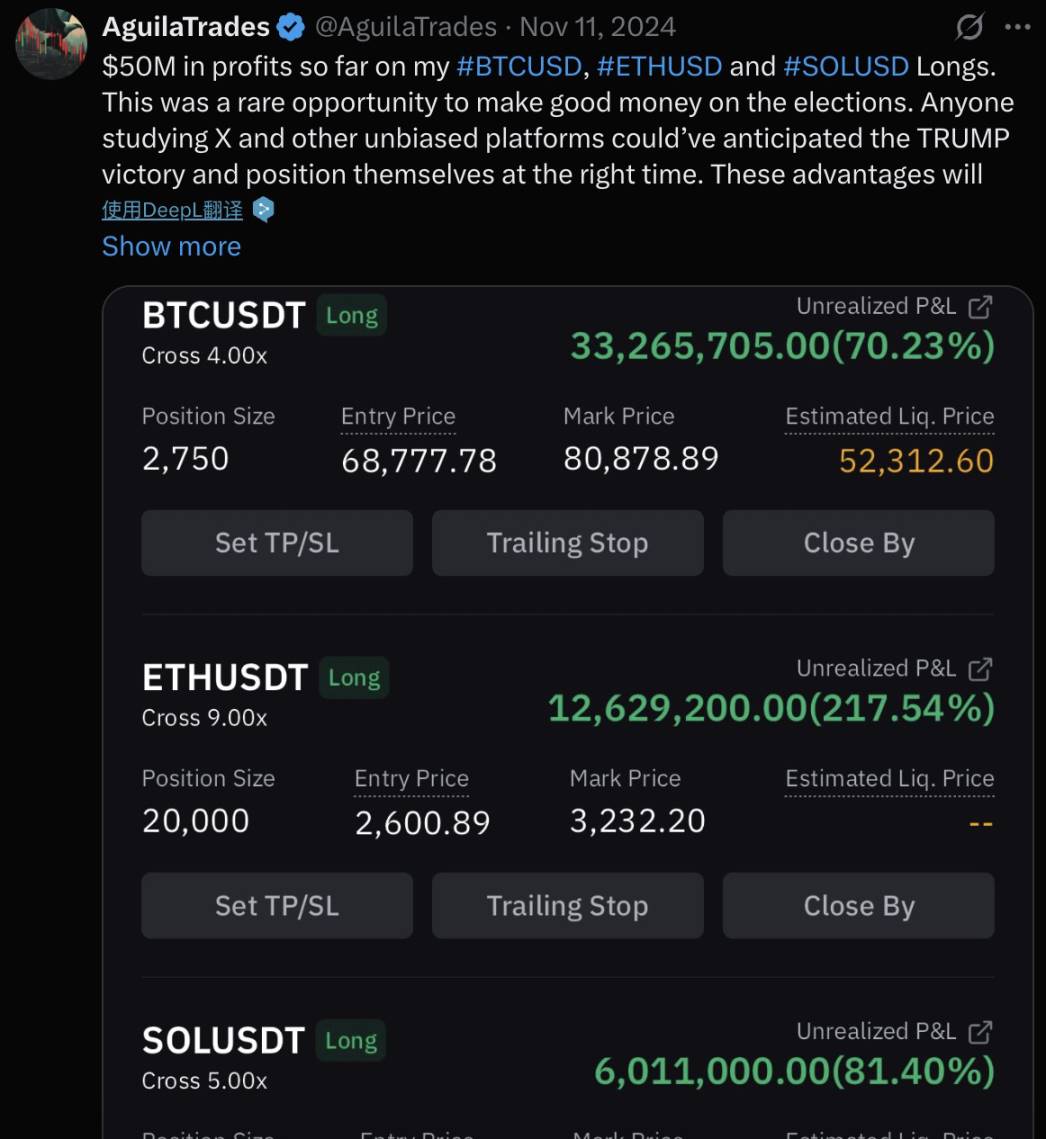

AguilaTrades states in its X profile that he is a veteran swing trader who started trading in 2013 and originally traded futures on Bybit. And in the 2024 U.S. election, he successfully bet on the rally, earning $50 million, and became famous.

In January 2025, AguilaTrades posted a chart of nearly $100 million in profits in the past six months, which shows the sharpness of its operations.

But even such an OG is powerless until the market volatility caused by geopolitics. On June 8, AguilaTrades raised 39.18 million USDC from Bybit and transferred it to Hyperliquid, and used 40X leverage to go long Bitcoin.

He started with a profit of $5.6 million on multiple orders, but it didn't end up. With Israel's strike on Iran's nuclear facilities, he actually lost a whopping $12.47 million after hastily closing his position.

On June 15th and 20th, AguilaTrades made a comeback to go long again. The second time the maximum profit was $10 million, and the third time the maximum profit was $3.2 million, but neither position was closed. Since then, the price of Bitcoin has fallen below $100,000 on the news of a direct U.S. military strike on Iran and a vote to close the Strait of Hormuz. As a result, both trades were liquidated, resulting in a total loss of $20 million.

Sadly, when Bitcoin fell below 100,000, AguilaTrades opened a short with a backhand retaliation, but when Bitcoin rebounded, it lost another $2.33 million, for a total loss of $35 million. It can be seen that even the bigwigs who have made a profit of more than 100 million US dollars are still as calm as little leeks in the face of losses.