A New Round of Financial Revolution: Why Are Cryptocurrency Stocks the Next Future?

By Airis.N

Our regulatory framework should not be stuck in the experience of the past – it is ruthless for the new era. The future is whistling, and the world won't wait. — Paul Atkins for Project Crypto.

We've all witnessed the success of Circle's listing this year, but who remembers that just two years ago, it experienced a major depegging, and USDC was depegged to $0.87.

At that time, Circle had $3.3 billion in reserves deposited with SVB (Silicon Valley Bank), and SVB suffered a financial crisis on March 8, and its stock price plummeted 60% on the same day, triggering a chain panic among Silicon Valley startups and institutional investors. In the next 48 hours, investors in the US stock SVB experienced a series of blows of circuit breakers, trading suspensions, and regulatory takeovers, and finally ushered in the closure of the bank on March 10. This led to Circle being unlucky and USDC being depegged.

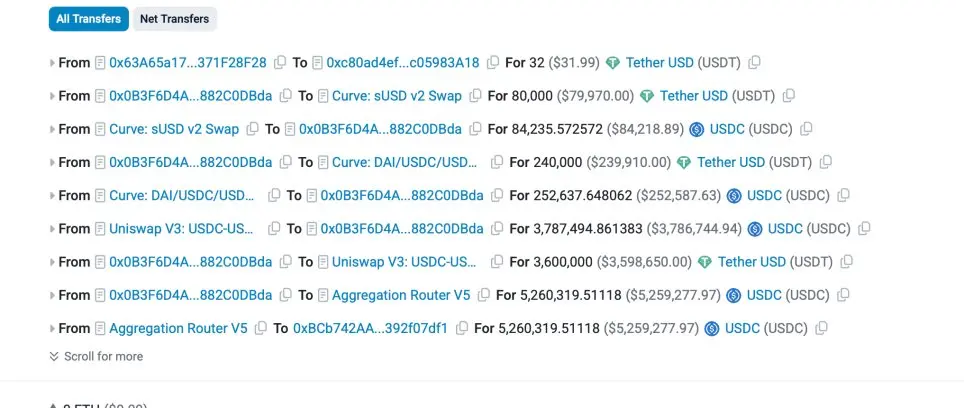

However, those investors who hold SVB shares can only watch the market value in their accounts evaporate every night, and those who react quickly may admit losses on Thursday morning, and those who are slow may be forced to return to zero. On the weekend when SVB was shut down, web3 people were arbitrage frantically through platforms such as AAVE and Curve. For example, a wallet address successfully earned $16.5 million through the USDT/DAI price difference during this period. Oh yes, it's Brother Sun's wallet.

the comparison of this "homologous storm and different endings" is exactly what Paul Atkins wanted to express in the opening introduction, the lack of traditional financial markets and the new round of efficiency revolution in financial markets, yes, I am referring to tokenized stocks.

Traditional stock market restriction

time limit: Taking US stocks as an example, only Monday to Friday 9:30–16:00 (EST) trading is allowed, pre-market and after-market options have limited liquidity, and often many major events occur during non-trading hours, resulting in "opening gaps", Investors simply don't have the opportunity to react at the first time.

Geographical Restrictions: Overseas investors need complex compliance processes and cross-border brokerage accounts to participate in U.S. stocks. Many friends in China should have the deepest understanding of this.

This structure used to make sense because securities trading relied on physical venues and centralized settlement systems. But in front of blockchain? Pull it down.

Why are currency stocks necessarily the future?

1. Higher capital efficiency and liquidity The

biggest breakthrough in cryptocurrency stocks lies in 7x24 hours of uninterrupted trading. This means:

- Global investors can enter or exit the market at any time, and they don't have to stay overnight or even wait until the next day in the face of black swan events Market

- sensitivity has increased significantly, just yesterday, before the US stock market began to pull the market, the E-guards were already on the way to pick up the sports car

Of course, higher liquidity can also lead to overtrading, inducing retail investors to lose money or even losses. But in any case, more efficient pricing and confirmation are the fundamental difference between currency stocks and traditional stocks.

2. Higher leverage and potential returns

Coin trading platforms are likely to offer higher leverage. Traditional brokerages can only open 2-4x leverage, but for web3 friends, 10x leverage is just a bead on the roulette wheel. In other words:

- for risk-loving investors, currency stocks provide a new casino;

- For arbitrage funds and quantitative funds, currency stocks provide more flexible risk hedging methods;

More dangerous? Yes, a gangster brother said -

3. Lower participation threshold

For the majority of investors living in the mainland, it is difficult to open a US stock account. Now, we can already open accounts directly with crypto wallets on platforms like @xStocksFi, @stablestock, etc. This means that

- investors no longer need to go through the cumbersome cross-border brokerage account opening process and access US stocks with one wallet.

- For the United States, global funds can enter U.S. stock trading more easily, thus opening up channels for overseas funds to enter and invest.

and more popular crypto and higher market capitalization.

let's go back to the SVB case, what would it be like if this event happened on the currency platform?

The moment SVB announces a loss, the currency market will not be circuit breaker, and global investors can react immediately, either quickly sell or even short, or use on-chain spreads for arbitrage, etc. The countless trading gods on the chain are living examples of how anyone can move quickly in the 7x24 hour market without passively waiting for the next trading day to open.

Currency stocks are definitely not a digital mapping of traditional stocks, and the new round of financial revolution is definitely not an empty word from the government. It represents faster trading and settlement, higher returns and risks, and a lower barrier to participation.

This is the future that finance needs.

Click to learn about ChainCatcher's recruitment positions

Recommended reading:

Conversation with Wall Street magic operator Tom Lee: The company's treasury model is better than traditional ETFs, and Ethereum will welcome Bitcoin-style explosive growth

Conversation with Oppenheimer Executive Director: Coinbase's Q2 trading revenue fell short of expectations, which businesses will become new growth points?

Backroom: Information Tokenization, a Solution for Data Redundancy in the AI Era?| CryptoSeed