On July 22, the key market information is poor, so you must see it! |Alpha Morning Post

Selected news

1. Chairman of the U.S. SEC: ETH is not a security

2. StablecoinX will spend $260 million to launch the ENA treasury strategy, planning to list on Nasdaq under the symbol "USDE"

3. SPK rose more than 50% in 24 hours, and its market capitalization rose to $117 million

4. FTX's freeze of $470 million in overseas claims sparked fierce opposition and applied for an extension of response to creditors

5. Tornado Cash is considering applying for invalidation of the trial, which challenges the evidence submitted by the government

Articles & Threads

1. "The next round of 100x chance? Inventory of the most outstanding Perp DEX dark horses to watch in 2025"

Currently, the second quarter of Hyperliquid's airdrop is about to launch, and some other new projects with rapid growth, hardcore team backgrounds, and strong coin issuance expectations are also emerging. BlockBeats This article will take stock of five Perp DEX dark horses that have not yet been issued - they either have rapid growth, strong resources, or the blessing of star VCs, and are key projects that cannot be missed by this round of "hair-shaking" army and contract players.

2. "Stablecoin Weekly|Three U.S. Crypto Regulatory Acts Passed, Citigroup and Other Banks Announced Their Involvement in the Stablecoin Business"

For the first time, the U.S. Congress passed three core bills with an overwhelming vote, bringing crypto assets into the federal regulatory system. The GENIUS Act establishes stablecoin reserve and redemption rules, the CLARITY Act defines market structures, and the Anti-CBDC Act restricts central banks from issuing digital currencies. This clear and strategic regulatory mix will open the door for private offerings, draw the line between government and market, and provide an "American template" for global legislation. Policy clarity has also promoted the accelerated entry of traditional finance. Banks such as Citigroup and JPMorgan Chase have begun to evaluate issuing their own stablecoins, making tokenized deposits a priority. At the same time, the capital market began to revalue the fundamentals of on-chain companies. Following Circle's listing, infrastructure companies with real capital flows, compliance paths, and revenue models may become the next alpha.

Market data

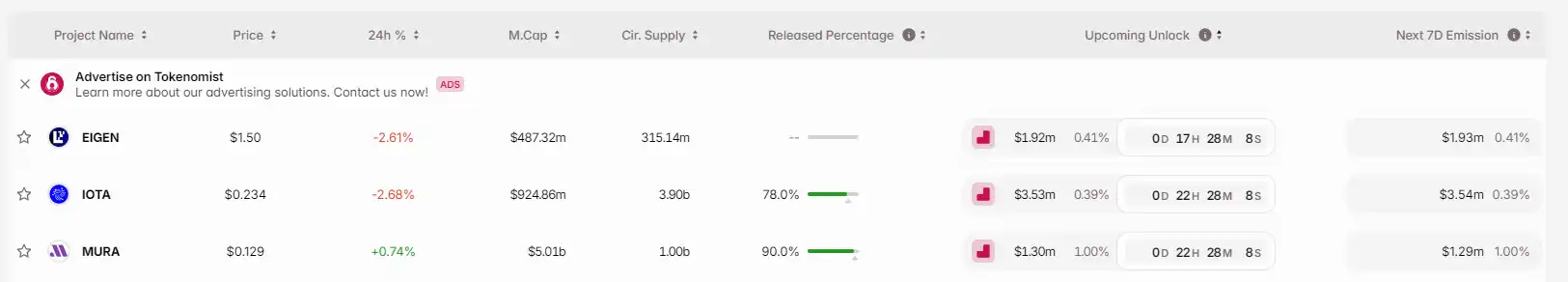

The overall funding popularity of the market (reflected in the funding rate) and token unlocking on a daily basis

Data source: Coinglass, TokenUnlocks

Funding Rate

Token unlocking