Ethereum News: Ethereum Foundation Sending 1,000 ETH Daily to Multisig Wallet—Why?

Key Insights:

- Ethereum News: Ethereum Foundation has transferred 1,000 ETH daily to multisig wallet 0xc061 recently.

- Transfers total 13,000 ETH worth $32 million with no market selling pressure.

- Funds allocated for grants, ecosystem projects, and potential legal defense support.

The Ethereum Foundation has conducted systematic daily transfers of 1,000 ETH to multisig wallet address 0xc061 over recent weeks.

The transfers total 13,000 ETH valued at $32 million while analysts suggest strategic treasury management rather than market dumping activities.

Ethereum Foundation Transfers 13,000 ETH to multisig wallet

The Ethereum Foundation has been doing daily transfers of 1,000 ETH valued at approximately $2.46 million to multisig wallet address 0xc061. With cumulative transfers reaching 13,000 ETH worth $32 million according to Lookonchain analysis. This systematic transfer pattern has continued for approximately one month across multiple transaction cycles.

Wallet 0xc061 operates as a Gnosis Safe multisignature wallet, providing better security protocols for managing large cryptocurrency sums. Multisig wallets are commonly used for organizational treasury management. As well as, grant distribution programs that need multiple authorization signatures for fund movements.

The ETH is kept dormant in the multisig wallet with no sign of redistribution, selling, or engaging in decentralized finance protocols on delivery. The holding behavior reflects strategic treasury positioning instead of liquidation or trading activity.

Blockchain analysis shows that such funds are set aside for external projects, grants, or ecosystem investments to support Ethereum development efforts. There are some transfers that are for legal defense funds for Tornado Cash.

The transfers bypass exchange wallets and direct selling, avoiding downward market pressure against ETH prices. The process stabilizes the market while reconfiguring foundation assets for specific organizational application.

Ethereum News: Analysts Identify Strategic ETH Positioning

Analyst Alva characterizes the Ethereum Foundation transfers as strategic treasury management rather than market dumping, noting funds move into multisig wallets for grants and security purposes instead of exchanges.

Market sentiment remains cautiously bullish according to analysis, with ETF inflows and institutional holdings showing continued confidence in Ethereum’s long-term prospects. However, whale movements to centralized exchanges and short-term technical indicators including bearish MACD crossovers keep traders cautious about immediate price direction.

The CRSI indicator is overbought at 9.56, and rebound chances can be expected in case there is buying interest. Price action remains in midrange positions since the spikes in volume subside, pointing towards consolidation patterns instead of one-way breakouts.

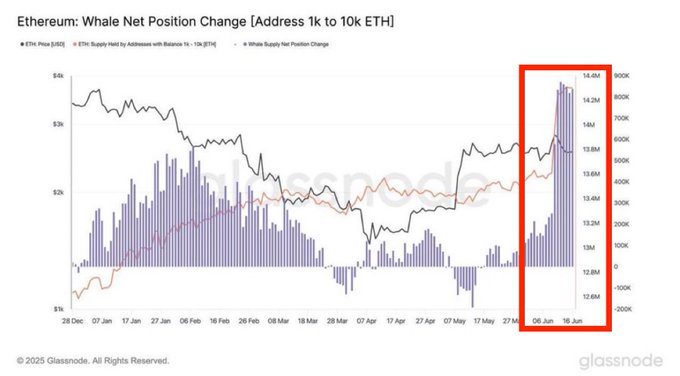

Analyst Merlijn The Trader notes the trend of whale accumulation and described the last period as the biggest ETH accumulation spike since 2018.

Crypto King notes ETH’s six-month range-bound consolidation between $3,000 and $3,000-$4,000, comparing the current situation to 2021-2022 trends that created huge price jumps. The analyst predicts similar breakout potential from the current range-bound levels.

Ethereum News shows ETH Price Breakout Patterns Mirror Historical Breakout Precedents

Ethereum has been consolidating for about six months, producing squeezed price action like it was observed in 2021 and 2022 cycle patterns. Past consolidations were followed by significant price action that set new all-time highs for Ethereum.

Crypto King sees resemblance in the current market setup and previous cycles. These saw huge bull action following long periods of sideways action. The analyst is looking to witness similar breakout potential from current prices.

Whale accumulation activity indicates institutional alignment for future market activity. Merlijn The Trader informs us of ongoing accumulation as the largest spike since 2018.

The above combination of Ethereum Foundation treasury management, whale accumulation, and recognition of past trends sets the stage for analysts to consider as catalysts for major price action. Long-term consolidation normally breaks into breakout situations as market participants set up for direction of action

The post Ethereum News: Ethereum Foundation Sending 1,000 ETH Daily to Multisig Wallet—Why? appeared first on The Coin Republic.