Coinbase vs. Robinhood's Blockchain Stock Layout Competition

Written by Brendan on Blockchain

Compilation: Vernacular blockchain

When Bitcoin breaches $100,000 in December 2024, it's not just another price milestone, but the pinnacle of a much bigger event. In January 2024, the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, fundamentally changing the way institutional money flows into cryptocurrency, and we're witnessing this in real time.

What struck me about this moment was that after years of regulatory resistance, the approval not only legalized Bitcoin, but also created an entirely new layer of infrastructure that traditional finance could access. The result? Bitcoin has gone from a digital spectacle to a necessity for portfolios faster than anyone expected.

It's the transformation of infrastructure that's really interesting. These are not traditional investment products. Spot Bitcoin ETFs hold real Bitcoin, not contracts or derivatives. Think of it as a gold ETF that holds physical gold bars, except that the "vaults" here are digital, and the custodians are crypto-savvy companies that suddenly manage billions of institutional funds.

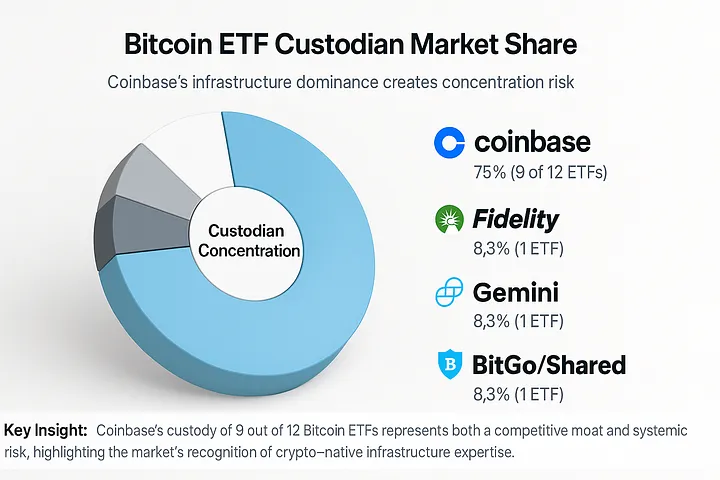

Nine of the 12 spot Bitcoin ETFs currently traded rely on Coinbase for custody.

Coinbase custodian 9/12 Bitcoin ETF, which brings both competitive advantage and concentration risk. The dominance of this infrastructure generates steady revenue, but it also raises questions about single points of failure in the crypto ecosystem.

This is no accident; The market recognizes that crypto infrastructure requires crypto expertise. Traditional banks, which have been talking about "blockchain solutions" for years, suddenly found themselves in need of companies that really know how to protect digital assets at an institutional scale.

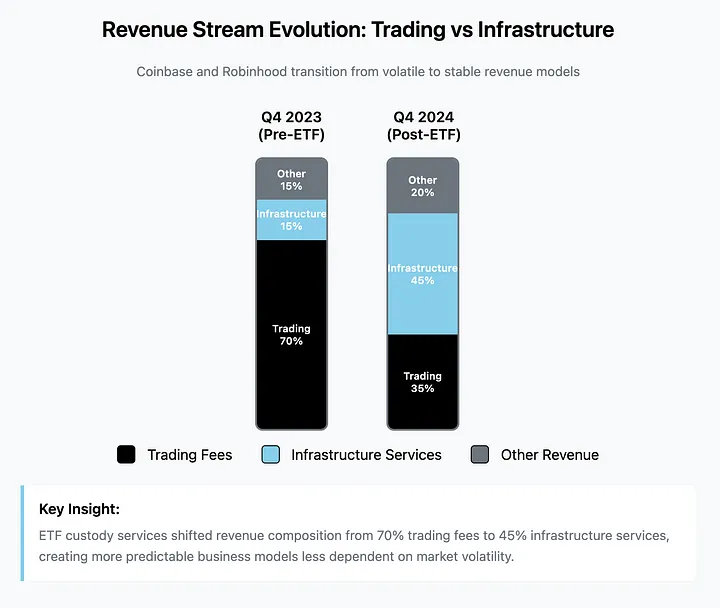

This concentration brings interesting dynamics. Coinbase has transformed from a platform that relies on transaction fees (making big in a bull market and starving in a bear market) to a critical financial infrastructure. ETF custody generates predictable revenue regardless of market sentiment. It's like going from a casino to a bank that handles casino funds.

The numbers speak for themselves. Coinbase recorded its best performance in history in 2024, and analysts expect huge growth in 2025. The company went from following the crypto wave to being the infrastructure that the institutional wave was hitting.

But the role of infrastructure attracts competition, and Robinhood is catching up in a different way. Coinbase focuses on institutional custody and compliance, while Robinhood targets retail investors who are frustrated with crypto complexities.

The ETF revolution has changed the revenue model of crypto platforms. Transaction fees fell from 70% to 35%, while infrastructure services grew from 15% to 45%, creating a more predictable business model and reducing reliance on market volatility.

Robinhood's recent moves exemplify this strategy: the launch of tokenized U.S. stocks in Europe, staking of major cryptocurrencies, perpetual futures trading, and a custom blockchain for real-world asset settlement. Robinhood is building an on-ramp for mass adoption, while Coinbase is managing the vault.

Robinhood's commission-free crypto trading and streamlined user experience have earned market share, especially against the backdrop of reduced friction due to regulatory clarity. Record trading volumes and analysts' optimistic forecasts for 2025 suggest that this retail-focused approach complements institutional infrastructure rather than competes directly.

There's also BTCS Inc., which offers a completely different lesson. As the first cryptocurrency company to be listed on the NASDAQ in 2014, BTCS represents the pure play of the crypto business model. The company pioneered "Bividends" (paying dividends to shareholders in Bitcoin instead of cash) and operates blockchain analytics while holding direct crypto assets.

BTCS currently holds 90 BTC and has expanded to 12,500 ETH through strategic financing. The company shows how crypto-native businesses can adapt in institutional verification without abandoning their basic principles. While the giants are vying for dominance in infrastructure, professional players are also exploring sustainable market segments.

What makes this ecosystem shift fascinating is the speed with which traditional finance has absorbed this supposedly disruptive technology.

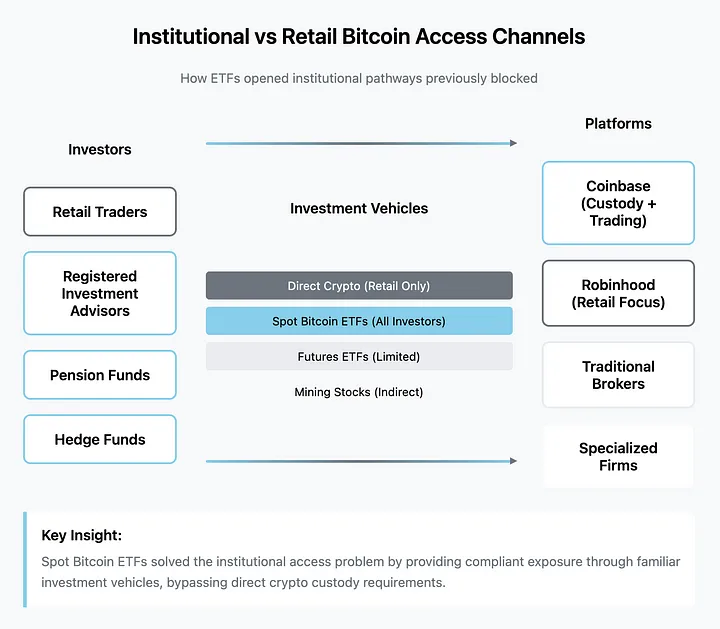

Spot Bitcoin ETFs solve institutional access issues by providing compliant investment vehicles. The chart below illustrates how different types of investors can gain exposure to Bitcoin without having to hold crypto assets directly.

ETFs provide institutional investors with the compliant packaging they need to transform cryptocurrencies from alternative assets into part of their portfolios.

The regulatory environment suggests that this acceptance is permanent. Political leadership's public support for cryptocurrencies as a national strategic infrastructure, coupled with the SEC's ongoing evolution, suggests that the framework will expand, not contract. Ethereum ETFs, multi-crypto funds, and integration with traditional wealth management are logical progressions.

Institutional behaviour confirms this maturity. Recent filings show that amid the volatility in the first quarter of 2025, some asset managers reduced their Bitcoin ETF positions, while others made allocations for the first time. It's not speculation, it's portfolio management. Institutions see cryptocurrencies as an asset class that requires risk assessment and allocation decisions.

The infrastructure to support this transformation continues to be strengthened. Custody solutions have evolved from trading platform wallets to institutional-grade security. The trading infrastructure processes billions of transactions per day, no longer experiencing the glitches that were common in the early crypto market. The regulatory framework provides clarity to compliance officers who are nervous about digital assets.

The structure of the market reflects this evolution. Price discovery takes place on regulated trading platforms with institutional participation, rather than fragmented crypto-specific platforms. Liquidity comes from a variety of sources, including algorithmic trading, institutional arbitrage, and retail engagement through familiar brokers.

But I think what's most striking is that we're witnessing the creation of parallel financial infrastructure, not the replacement of existing systems. Instead of disrupting traditional finance, cryptocurrencies are forcing it to build crypto-compatible systems.

Coinbase acts as a bridge between the Bitcoin network and institutional custody needs. Robinhood has built crypto trading that feels like stock trading. ETF providers package crypto exposures into familiar investment vehicles. Each player solves a specific point of friction, rather than demanding full adoption of the new paradigm.

This infrastructure approach explains why the approval of the Bitcoin ETF has triggered such wild price volatility.

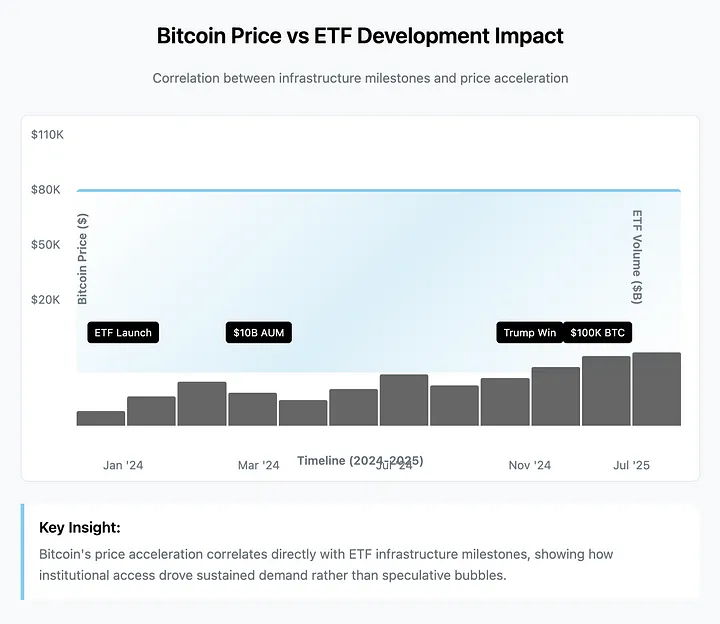

Bitcoin's price acceleration is directly related to ETF infrastructure milestones, not speculative bubbles. The correlation between regulatory developments, ETF trading volumes, and continued price growth suggests that institutional demand is driving the market.

Institutional funds are not waiting for crypto to mature, but for compliant access methods. Once these modalities exist, allocation decisions follow standard portfolio logic rather than speculation.

The winners of this transformation are not necessarily the platforms with the most users or the highest trading volumes. They are those companies that provide a reliable infrastructure for an asset class that institutional investors can no longer ignore.

Success metrics have changed. Income stability is more important than growth rate. Regulatory compliance provides a competitive advantage. Technical reliability determines institutional trust. These factors favor established players with the resources to build a well-developed infrastructure, rather than startups that promise disruption.

Looking ahead, the infrastructure is already in place. The regulatory framework continues to evolve in a supportive manner. Institutions adopt a predictable model that follows a risk tolerance and allocation model. The speculative phase is coming to an end; The infrastructure utilization phase is beginning.

The revolution is not about the Bitcoin price reaching six figures, but about the infrastructure that makes cryptocurrencies a standard part of a diversified portfolio. The companies that build and continue to maintain this infrastructure will control the future of institutional crypto adoption.

That's where the real value is created and captured.