Coin, stock, and chain, an insight into the ultimate ambition behind the expansion of Coinbase's "empire".

Author: Fairy,

ChainCatcher Editor: TB, ChainCatcher

Coinbase has been a bit of a move lately.

On the one hand, it applied to the SEC to launch a stock tokenization transaction; On the one hand, it has partnered with Shopify to allow consumers in 34 countries to make purchases with USDC on the Base chain; At the same time, it also supports all Base ecosystem assets through DEX.

Coins, shares, payments, and contracts are all available, and the closed loop is completed on its own public chain Base. Coinbase's ambitions are in full swing.

"On-chain broker": Coinbase's super entry dream

According to Reuters, Coinbase is seeking SEC approval from the United States to provide users with tokenised trading services for shares. Once approved, users will be able to trade tokenised assets representing U.S. stocks through blockchain technology. Coinbase will compete directly with traditional retail brokerages such as Robinhood and Charles Schwab, and is also expected to open up a new on-chain securities business territory.

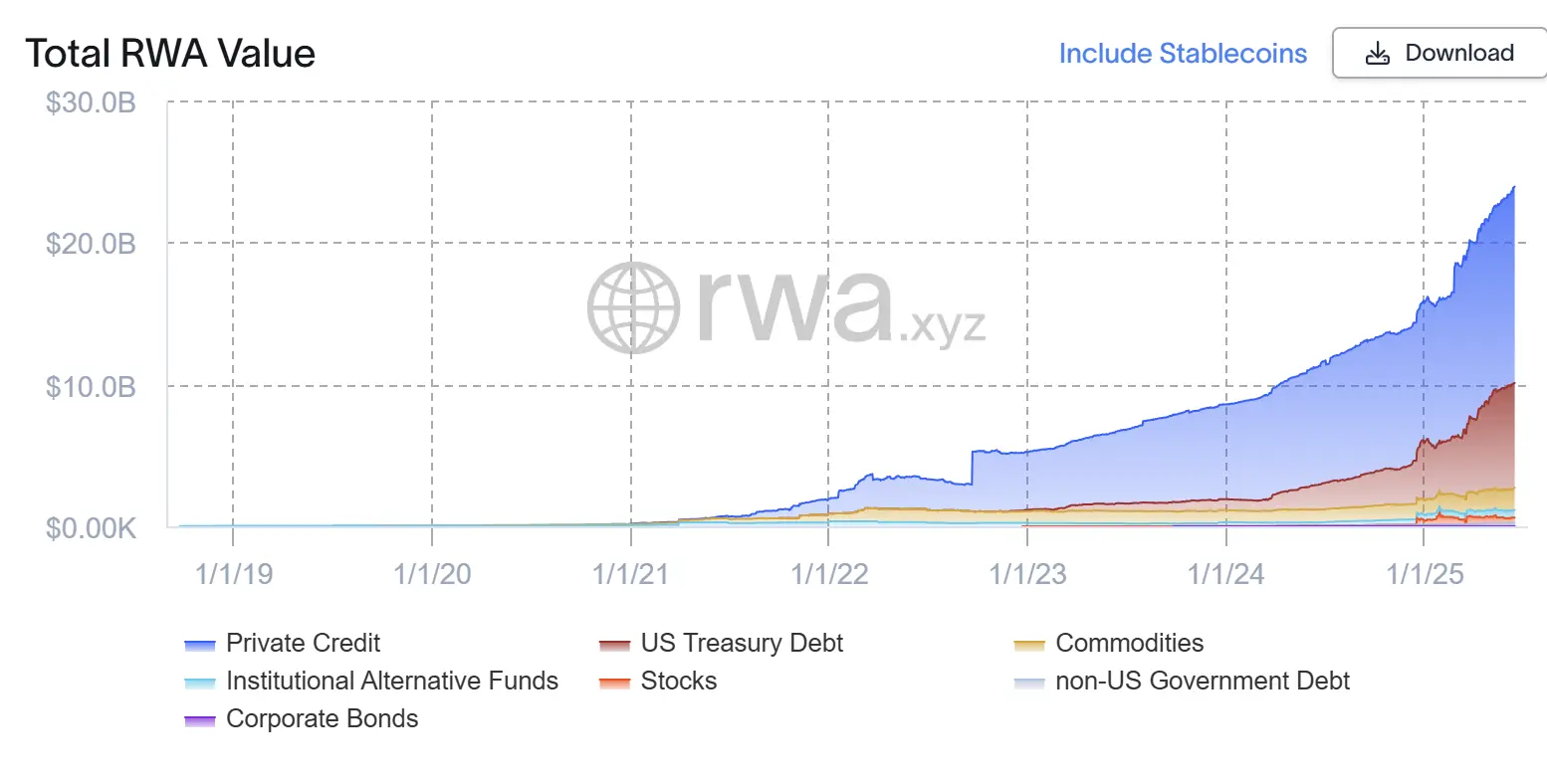

Behind this move is a fast-rising market: the overall market capitalisation of the RWA sector has grown from $15.7 billion in January to $23.9 billion so far this year, an increase of more than 50% in just a few months.

– >

– >

Image: rwa.xyz

Coinbase isn't the only player eyeing this trend. Last month, its main competitor Kraken announced that it would launch its U.S. stock token product "xStocks" outside the U.S., covering more than 50 stocks and ETFs such as Apple, Tesla, Nvidia, etc. The product is deployed on the Solana blockchain and supports 24×7 transactions.

However, Coinbase still needs to cross a high regulatory threshold to implement this model in the United States: it must obtain a "no objection letter" or waiver license from the US SEC. According to current regulations, all institutions that provide securities trading services must hold a brokerage license. Fortunately, Coinbase acquired Keystone Capital, which owns the license, back in 2018, and although the subsidiary has not yet been actually launched, Coinbase is theoretically qualified to provide similar services.

In addition, Coinbase's chief legal officer, Paul Grewal, also made it clear that the stock tokenization business is a "high priority" strategic direction for the company at the moment. If this model is successful, Coinbase is expected to break the traditional brokerage landscape and set off a head-on impact on Wall Street on the chain.

Coinbase's strategic fulcrum: Base

Coinbase is fully promoting the Base chain, trying to build it into the underlying infrastructure and strategic centre of the on-chain financial closed loop.

Recently, Jesse, the head of Base, said that Coinbase has launched all Base ecological assets through the DEX mechanism, and users can directly trade with CEX account funds seamlessly. This means that once a project is launched, it will be able to reach all Coinbase users on all platforms as soon as possible. And this has brought a huge gain to Base, both in terms of liquidity and market attention.

In real-life payment scenarios, Coinbase is also pushing Base to accelerate the breakthrough. On June 13, marketplace Shopify announced a partnership with Coinbase and Stripe to allow merchants to accept USDC as a payment method. Consumers can now use USDC on the Base chain to make checkout purchases in 34 countries.

Traditional financial giants have also incorporated Base into their on-chain experiments. Today, J.P. Morgan announced that it will pilot the issuance of JPMD tokens on Base, which stands for US dollar deposits. JPMD is scalable and may support interest accrual and deposit insurance in the future, and is seen as a compliant alternative to stablecoins. This shows that large institutions are actively exploring the path of compliant issuance, circulation and settlement of on-chain assets, and BASE may become an important foothold for banks, brokerages, payment platforms and other "on-chain".

From a strategic perspective, Base is a key bridge for Coinbase to the on-chain primary market, on-chain brokerage, on-chain payment, and even "on-chain banking". Base carries ecological activity, while Coinbase uses CEXs to recycle entries and assets.

From stock tokenization, to on-chain payments and stablecoins, to the issuance of large-scale institutional assets, Coinbase is trying to build an "on-chain financial empire" that can operate in compliance with the three major tools of coins, shares, and chains. However, the changing regulatory policies, the fierce competition among competitors, and the deep integration of technology and compliance are all unavoidable tests for the expansion of this "empire".