Circle (CRCL) Stock Rebounds Amid GENIUS Act Setback

Key Insights:

- Circle (CRCL) stock rallied by 4.2% in pre-market trading despite setbacks in the GENIUS stablecoin legislation.

- Many House Members voted no to the GENIUS Act based on concerns that the Fed might develop a CBDC.

- The broader crypto stock markets are demonstrating bullishness in the market.

Circle Internet Group stock (CRCL) has demonstrated a bullish performance in the pre-market. Circle CRCL rallied over 4% in pre-market trading, amid heightened discussions surrounding the GENIUS Act.

Some House members temporarily halted the bill due to concerns that the GENIUS legislation might enable the creation of a Central Bank Digital Currency (CBDC).

Circle (CRCL) Stock Exhibits an Uptrend

According to Yahoo Finance data, the value of Circle CRCL increased more than 4% in pre-market trading to $199.38.

On Monday, July 15, the price of CRCL jumped more than 8.52%, pushing the stock to close at $211.98. Circle stock has increased more than sixfold since its Initial Public Offering (IPO).

The growth of Circle shares has remained relatively stable despite slight market volatility. The market capitalization stood at $48.37 billion, while the average daily volume remained at 36,713,710.

The Circle stock is capitalizing on the bullish trend in the crypto market. Bitcoin (BTC), the leading cryptocurrency, surpassed the $123,000 mark this week.

Alcoins, including Ethereum (ETH), Solana (SOL), XRP, Dogecoin (DOGE), and Binance Coin (BNB), also showed a bullish outlook. In the past 24 hours, the ETH price increased by 5.6% to $3,167.

Within the same period, SOL price surged 5.2%, XRP rallied 2.3%, DOGE jumped 5.7%, and BNB increased by 1.8%.

Additionally, the latest rally in Circle shares follows the release of its recent earnings report. The report revealed net income from continuing operations of $64.79 million, while operating revenue reached $557.91 million.

Additionally, the balance sheet showed a robust liquidity position of $61.27 billion in cash and cash equivalents.

GENIUS Act Encounters Setbacks

Amid the rally in the CRCL stock, the US House of Representatives failed to clear the recently introduced GENIUS Act.

The GENIUS Act, introduced by Bill Hagerty on May 21, 2025, is a bipartisan effort to regulate the stablecoin industry.

It is expected to create a clear pathway for banks and other entities to begin issuing stablecoins.

The bill passed the Senate on June 17, with a 68–30 vote, before moving to the House. This marks a milestone for both the crypto industry and for President Donald Trump, who has pushed for favorable crypto regulations.

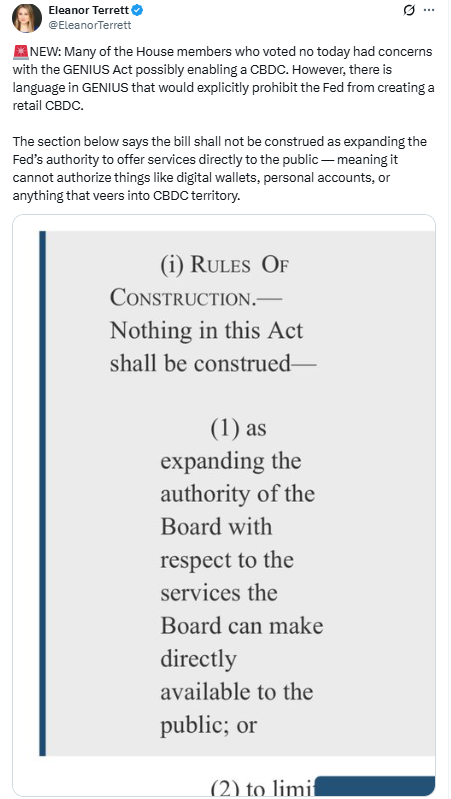

On Tuesday, July 15, 2025, journalist Eleanor Terrett noted that many House members voted no to the GENIUS Act. They criticized the GENIUS Act for lacking a provision to ban CBDCs.

Some lawmakers maintained that the bill should reflect President Trump’s January executive order banning CBDCs across federal agencies.

Eleanor, however, highlighted a section of the legislation that would explicitly prohibit the Fed from creating a retail CBDC.

Despite the concerns from some House members, crypto analyst Dan Gambardello noted that President Trump is moving on with the GENIUS Act.

Reaction from MARA, MSTR, and COIN Stocks

The news of the failed vote on the GENIUS Act has not sparked negative triggers across the broader crypto stock market.

Shares of Mara Holdings (MARA) have climbed 3.7% over the past 24 hours. Over the past 5 days and month, MARA spiked 4.5% and 27.9%, respectively. At press time, MARA is priced $19.5.

As regards Michael Saylor’s Strategy, the stock jumped 1.6% over the previous day to trade at $449.65. This rally came shortly after TD Cowen revised its price target on MSTR stock from $590 to $680.

Similar to MARA and MSTR, the value of Coinbase (COIN) stock increased by more than 2.4% within the same period. At this writing, COIN is priced at $39.57, with a market cap of $100.78 billion.

The post Circle (CRCL) Stock Rebounds Amid GENIUS Act Setback appeared first on The Coin Republic.