The alpha opportunity is still there, sorting out the investment logic of DePIN from scratch

Original title: "IOSG Weekly Brief|DePIN 101 #275"

Original author: Jiawei, IOSG Ventures

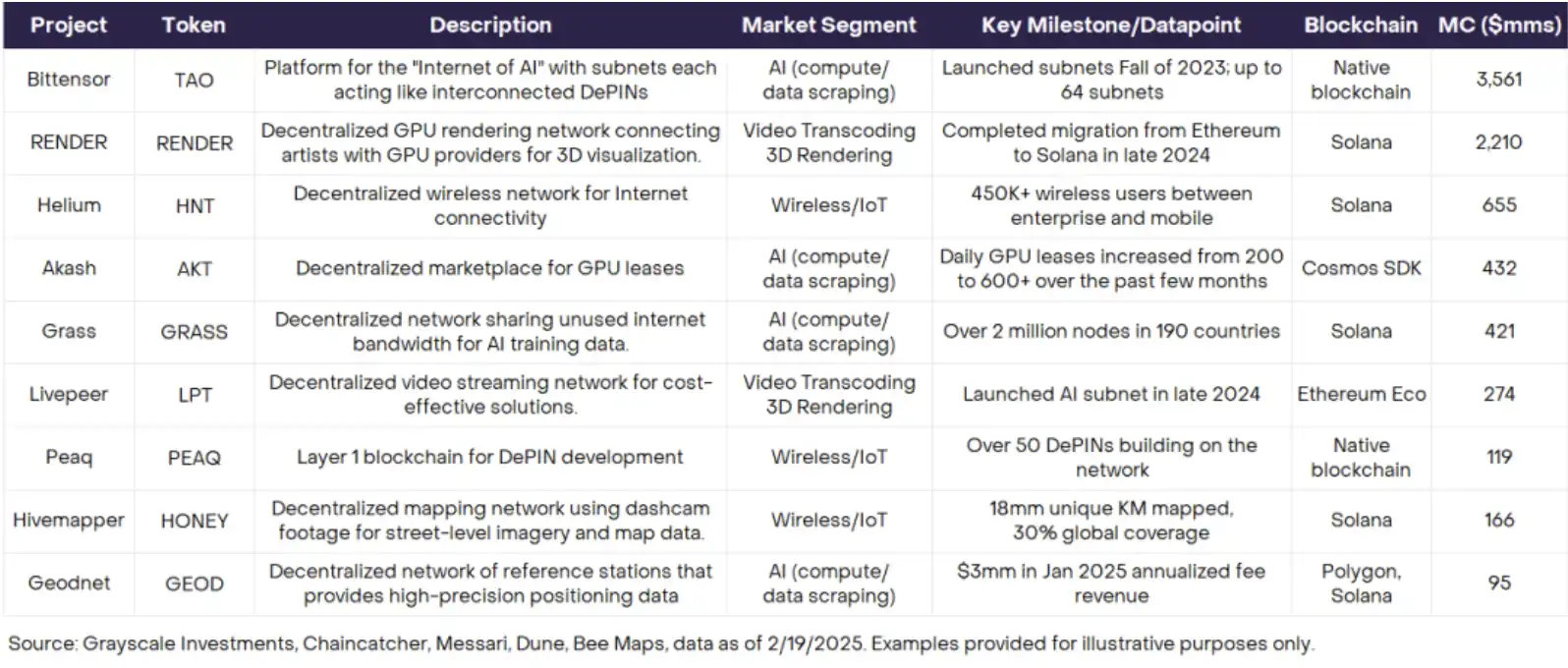

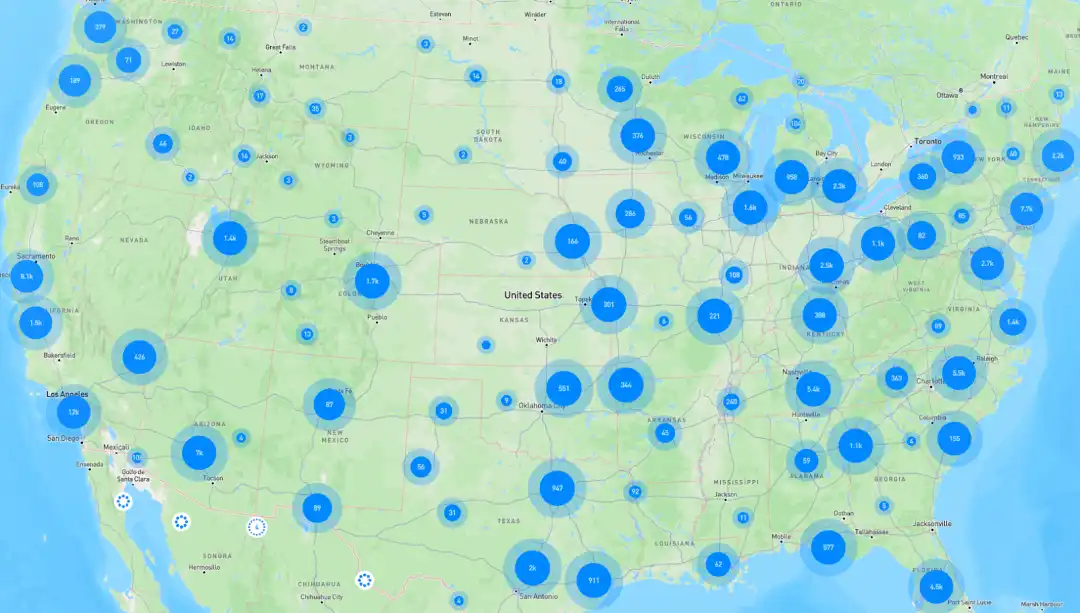

Source: Grayscale

Grayscale wrote a research report on DePIN at the beginning of this year, and the table above shows the top DePIN projects and their market capitalization. Since 2022, DePIN and AI have been compared as two new directions for Crypto investment. However, it seems that there has never been a single iconic project in the DePIN space. (Helium is considered a leading project, but Helium even predates the concept of DePIN; Bittensor, Render, and Akash in the table are more attributed to the AI track)

In this way, DePIN does not have a strong enough leading project to open the ceiling of this track. There may still be some alpha in the DePIN track in the next 1-3 years.

This article attempts to sort out the investment logic of DePIN from scratch, including why DePIN is an investment track worthy of our attention, and proposes a simple analysis framework. Since DePIN is a comprehensive concept that covers a lot of different sub-tracks, this article will zoom out a bit to explain the concept from an abstract point of view, but still give some concrete examples.

Why Invest in DePIN

DePIN is not a buzz word

First of all, it needs to be clear that decentralizing the infrastructure of the physical world is not a fancy idea, let alone a simple "narrative play", but can be implemented. There are indeed scenarios in DePIN where decentralization can "enable" or "optimize" something.

Here are two simple examples:

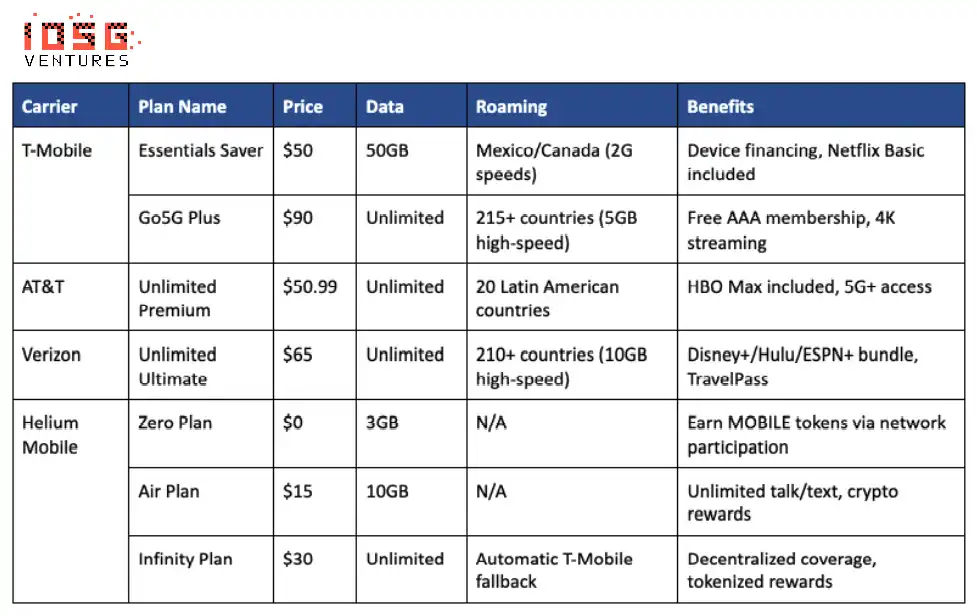

Source: IOSG

In the telecommunications field, which is a major track in DePIN, for example, traditional telecom operators (such as AT&T and T-Mobile) often need to invest billions of dollars in spectrum license auctions and base station deployment, and then pay $20-500,000 for each macro base station with a coverage radius of 1-3 kilometers. In a 22 Federal Communications Commission (FCC) auction for 5G spectrum in the 3.45GHz band, AT&T invested $9 billion, making it the highest-invested operator. This centralized-led infrastructure model has led to high prices for communication services.

Helium Mobile distributes this initial cost to each user through community crowdsourcing, and individuals only need to purchase a hotspot device of $249 or $499 to access the network, becoming a "micro-operator" and driving the community to spontaneously network through token incentives, thereby reducing the overall investment. Verizon costs about $200,000 to deploy a macro base station, while Helium achieves approximate coverage by deploying about 100 hotspot devices (for a total cost of about $50,000), with a cost reduction of about 75%.

In addition, in the field of AI data, traditional AI companies need to pay up to $300 million per year in API fees to platforms such as Reddit and Twitter to obtain training data, and crawl data with the help of Bright Data (residential proxy) and Oxylabs (data center proxy). Not only that, but they are also increasingly facing more and more copyright and technical restrictions, making it difficult to ensure the compliance and diversity of data sources.

Grass solves this dilemma by distributing web scraping, allowing users to download browser extensions to share idle bandwidth, help scrape public web page data, and earn token rewards for it. This model significantly reduces the cost of data acquisition for AI companies while achieving data diversity and geographic distribution. According to Grass statistics, a total of 109,755,404 IP addresses from 190 countries currently participate in the network, contributing an average of 1,000 terabytes of internet data per day.

In summary, a basic starting point for investing in DePIN is that decentralized physical infrastructure has the opportunity to do better than traditional physical infrastructure, even doing things that traditional methods cannot do.

As the intersection

as the two main lines of Crypto investment, Infra and Consumer each face some problems.

Infra projects generally have two characteristics: First, the technical attributes are very strong, such as ZK, FHE, MPC and other technologies have high thresholds, and there is a certain disconnect in market perception. Second, except for the Layer1/2, cross-chain bridges, staking, and other projects we are familiar with, which can directly reach end users, most Infra is actually toB. For example, developer tools, data availability layers, oracles, coprocessors, etc., are relatively user-friendly.

These two points make it difficult for the Infra project to promote users' mindshares, and the dissemination is poor. Although high-quality Infra has a certain PMF and income and is able to self-sufficiency through the cycle, the lack of mindshare makes it difficult to do listing in the later stage in market conditions where attention is scarce.

Conversely, Consumers have a natural advantage in capturing mindshares directly to end users. But new concepts are easy to be falsified by the market, and may even plummet after a hot spot switch. These projects often fall into a cycle from narrative-driven to short-term outbursts to falsified declines, with short lifecycles. Examples include friend.tech and Farcaster, to name a few.

Growth, mindshare, and listing are all issues that have been discussed a lot in this cycle. On the whole, DePIN can better solve the above two dilemmas and find a balance.

DePIN is based on the real needs of the physical world, such as energy, wireless networks, etc., and high-quality DePIN projects have solid PMF and revenue, which are not easy to falsify and easy to be understood by the market. For example, Helium's unlimited data plan of $30 per month is obviously cheaper than the plans offered by traditional carriers. DePIN also has user usage requirements and can capture mindshare. For example, users can download Grass's browser plug-in to contribute their idle bandwidth, and Grass has reached 2.5 million users on the terminal, many of whom are non-crypto-native. The same goes for other tracks such as eSIM, WiFi, in-car data, and more, which are close to the user.

DePIN Investment Framework

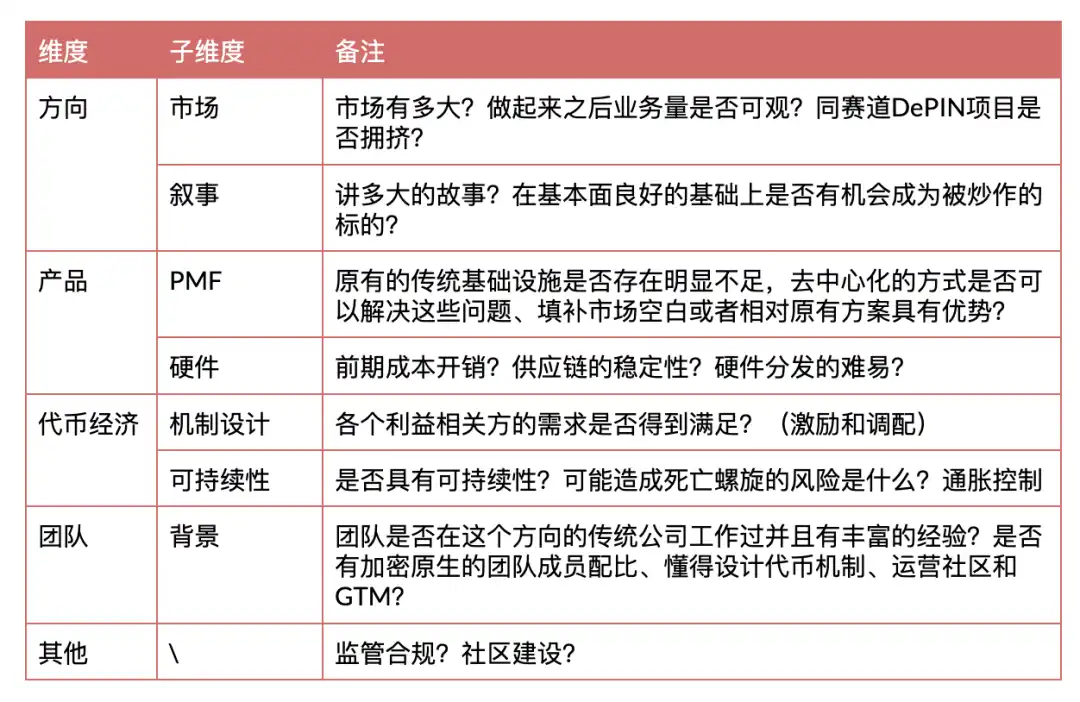

Source: Messari, IOSG

direction

Intuitively speaking, 5G and wireless networks are the big market, and in-vehicle data and weather data are the small ones. From the demand side, whether it is rigid demand (5G) or strong demand. Moreover, since the share of similar 5G in the traditional market is very large, even if DePIN can capture a small part of it, the market capacity is considerable in terms of the volume of Crypto.

Product

According to Grayscale's report, the DePIN model is especially suitable for industries with high capital requirements, high entry barriers, obvious monopoly patterns, and insufficient resource utilization. Answering the PMF question essentially looks at two points.

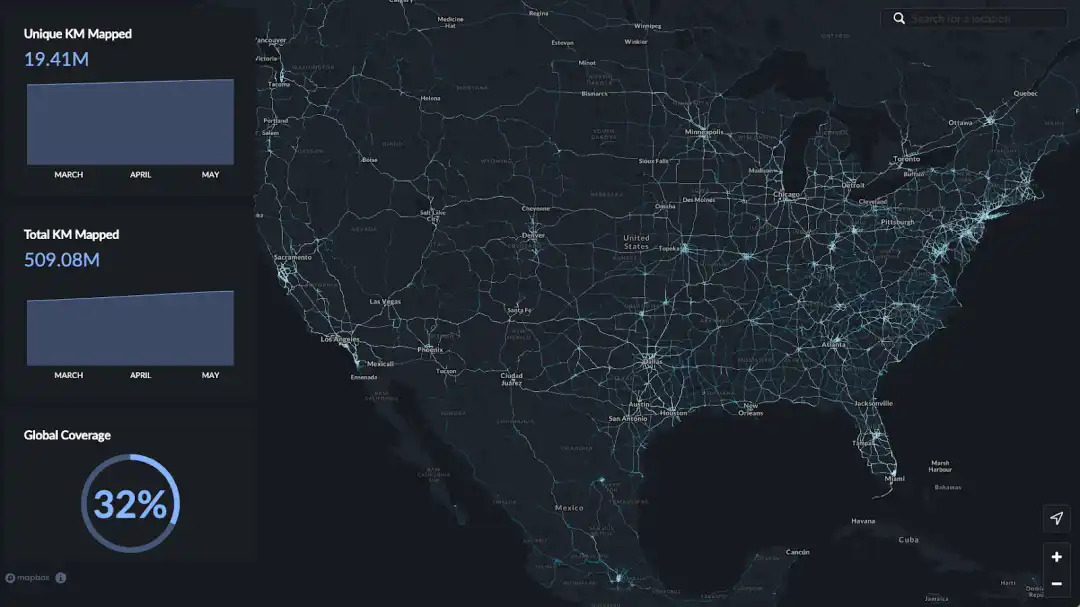

Source: Hivemapper

On the supply side, whether DePIN does something that could not be done before, or has outstanding advantages over the original solution (cost, efficiency, etc.). For example, in the map collection track where Hivemapper is located, there are at least three major problems in traditional map collection:

· Traditionally relying on professional fleets and manual annotation, high cost and poor scalability

· Google Street View has a long update cycle and low coverage in remote areas·

Centralized map service providers monopolize data pricing power

Hivemapper allows users to collect data through the sale of dash cams, and uses the crowdsourcing model to turn data collection into something that users do in their daily driving. Guide users through token incentives and prioritize resources in high-demand areas. On the demand side, the products provided by DePIN must have real market demand, and it is best to have a strong willingness to pay. In the same example, Hivemapper can sell map data to companies such as autonomous driving, logistics, insurance, and municipalities, where critical needs are verified. Regarding hardware, Multicoin began its 2023 article "Exploring The Design Space Of DePIN Networks" about hardware. The author would like to add a few points here.

The timeline of hardware can be summarized as "manufacturing-sales-distribution-maintenance".

· Manufacturing: The project party designs and manufactures the hardware by itself, or does it use the existing hardware? For example, Helium offers both types of its own hotspot and supports integration with existing WiFi networks. Or it can be a computing and storage DePIN project, which can directly use existing graphics cards and hard disks, etc.

· Sales: The clearly marked price of the sale means that the user will calculate the payback cycle based on the potential revenue. Helium's home mobile hotspot costs $249, and DIMO's in-car data collector costs $1,331.

· Distribution: How to distribute? Distribution involves many uncertainties: logistics timeliness, transportation costs, and delivery cycles from pre-sale, to name a few. For projects targeting a global scale, inappropriate distribution designs and means can significantly slow down project progress.

· Maintenance: What does the user need to do to maintain the hardware? Some equipment may be depreciated or worn out. The simplest example of maintenance is Grass, where users only need to download a browser extension and do not require anything else; Or Helium's hotspots, which only need a simple installation to keep running. If it involves solar power generation, etc., it may be more complicated.

Combining the above points, the simplest model is Grass's model - directly using existing network bandwidth, no manufacturing and distribution, no user barriers to start, and no sales, helping to quickly expand the network early in the project. True, the hardware requirements for projects in each direction are different. But hardware is related to the friction of initial adoption. The smaller the friction in the early stage of the project, the better, and as the project matures, some friction can bring retention and a certain degree of binding. For start-up teams, it is necessary to control the path selection and resource investment in hardware, gradually rather than overnight.

Imagine if it is not easy to "manufacture-sell-distribute-maintain", then why should users participate unless there is a very strong and highly certain incentive?

Token economics

Token mechanism design is the most challenging part of a DePIN project. Unlike projects in other spaces, DePIN needs to incentivize various participants in the network early on, so it is necessary to launch tokens at a very early stage of the project. This topic is suitable for a new article to do some case studies, and this article will not be expanded.

In the team

ratio, the founder needs at least one of the following backgrounds: first, they have worked in traditional companies in the field and have rich experience, responsible for practical implementation matters such as technology and products, and second, they are crypto-native, understand token economy and community building, and distinguish between the preferences and mental models of crypto users and non-crypto users.

Other

regulatory issues, such as the collection of road images and data in the country, are clearly sensitive.

Summary

Crypto does not really "break the circle" in this cycle, and it seems that we are still far from being adopted by users outside the circle. Some crypto apps offer short-term incentives that are why users use them, but they don't last. The economics derived from the bottom of DePIN have the potential to replace traditional infrastructure on the user side, thereby achieving application sustainability and mass adoption.

Source: Helium

Although the combination of DePIN and reality makes the development cycle long, we have seen some glimpse of Helium Mobile's development: Helium Mobile has partnered with T-Mobile to seamlessly switch users to T-Mobile's nationwide 5G network, for example, when users leave the Helium community hotspot range, they can automatically connect to T-Mobile base stations to avoid signal interruptions. Earlier this year, Helium began its expansion in South America by announcing a partnership with global telecommunications giant Telefónica to deploy Helium Mobile 5G hotspots in Mexico City and Oaxaca. Telefónica's subsidiary in Mexico, Movistar, has approximately 2.3 million subscribers, and this partnership connects these users directly to Helium's 5G network.

In addition to the above discussion, we also believe that DePIN has two unique advantages:

1. Compared with traditional monopolistic large enterprises, DePIN has more flexible deployment methods and means, and incentives can be aligned within the ecosystem through token models. For example, the traditional telecommunications industry is usually dominated by a few giants and lacks the motivation to innovate. Taking rural areas as an example, traditional operators have no incentive to promote deployment due to the dispersion of regional populations, low return on investment and long time consumption of traditional operators. With proper tokenomics design, the network can be encouraged to deploy in places where hotspots are scarce. The same applies to Hivermapper, where map resources are scarce, to set higher incentives.

2. DePIN has the opportunity to bring positive externalities. From the purchase of Internet data collected by Grass by AI companies, the purchase of street-level map data from Hivemapper by autonomous driving companies, and the low-cost data packages offered by Helium Mobile, it can be seen that DePIN can actually go beyond the realm of crypto, bring value to real life and other industries, and feed back the entire ecosystem through tokenomics. In other words, DePIN tokens are backed by real value behind them, not a Ponzi model.

Of course, DePIN also faces many uncertainties, such as uncertainty in the time frame due to operational hardware, regulatory risks, due diligence risks, etc. In summary, DePIN is our focus in 2025, and we will also output more DePIN-related research in the future.

Original link