The stage is set: Hyperliquid vs Aster.

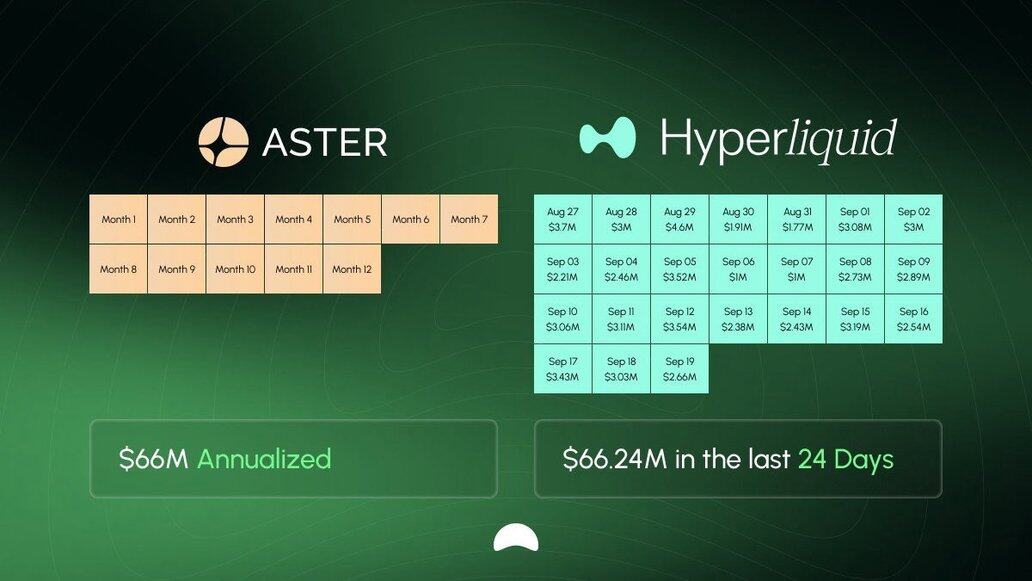

@HyperliquidX, an $18B juggernaut in perpetuals, faces @Aster_DEX, the new DEX backed by CZ that skyrocketed +1,900% in a week.

Can $ASTER really challenge $HYPE ’s dominance? 🧵👇🏻

2/

🆚 Hyperliquid’s Foundations

With ~$15B market cap, ~$500M+ daily volume, and $6B TVL, Hyperliquid built a reputation as the reliable venue for perpetuals.

Its single-chain model offers ultra-low latency & high leverage AND tailor-made for pro traders who value efficiency.

3/

🆚 Aster’s Entrance

Aster, by contrast, launched with fireworks:

— +226% from launch

— $3B cap, and >2M wallets onboarded

— Backed by CZ & Binance Labs,

— Already on Binance Alpha, Bybit & more.

Its multi-chain design (BNB, ETH, Solana) + features like hidden orders show ambition.

4/

🆚 The Incentive Game

Much of Aster’s early momentum came from airdrops, farming rewards, and migration bonuses.

These are powerful growth tools, but history shows retention often fades once rewards cool.

The question: can Aster turn farmers into sticky, real users?

5/

🆚 Tech Philosophies

Hyperliquid bets on a lean single-chain, focusing on speed and simplicity.

Aster takes the opposite route: multi-chain expansion, privacy features, even plans for stock-based derivatives.

It’s a clash of two visions: deep focus vs broad ambition.

20.79K

245

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.