This week we’re highlighting @maplefinance

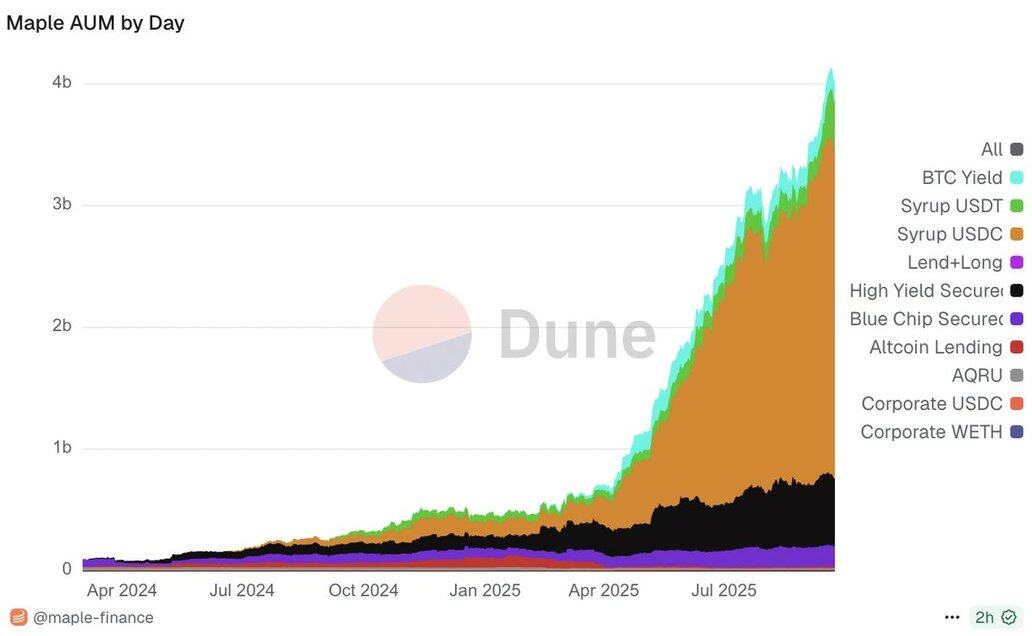

Maple is bringing institutional lending onchain and seeing explosive growth: AUM grew by 10x this year, reaching $4b

More below!

Today, typical DeFi lending protocols often don’t meet the needs of large institutions

Institutions want yield and borrowing opportunities that fit with their operations and compliance requirements

Maple is bridging this gap

In practice, this means:

- Permissioned lending pools to ensure counterparties meet institutional requirements

- Collateral is held by regulated custodians in its unwrapped form (for instance BTC instead of wBTC)

- Offchain legal agreements protecting lenders

So how is Maple still tapping into the power of DeFi?

Its syrupUSDC yield bearing stable is the key: it lets onchain users earn yield from borrowing institutions

By doing so, Maple unlocks:

- Yield from institutions accessible through DeFi protocols like @MorphoLabs and @pendle_fi

- Scalable, compliant capital for institutions

1.26K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.