Today is quite busy, just a brief update on the follow-up.

I plan to take profits in batches within the 114-117 range and probably won't add new positions.

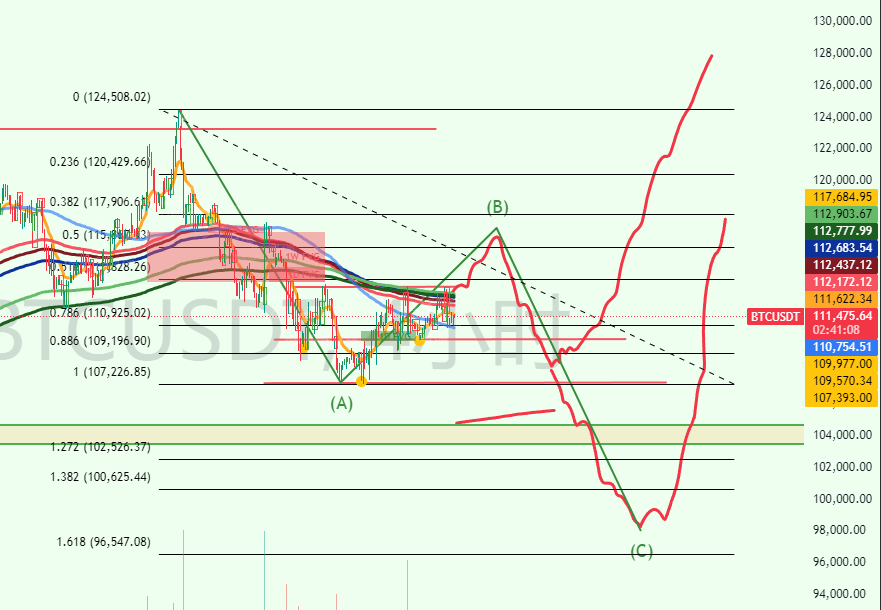

Observe if this rebound breaks above 117900 (0.618); if it does, subsequent pullbacks may not drop below 107, confirming the bottom at 107.

If the top does not break 117900 (0.618), subsequent pullbacks may still fall below 107, meaning the previously mentioned 105 and 93-98 are also possible.

This article is sponsored by #BCGAME|@bcgame @bcgamecoin

Script Update

The next two possible scenarios

Bitcoin has dropped after rebounding to 113,000 as expected, falling to the 110,700 range last night without breaking below it. Currently, it has rebounded to around 111,400.

Yesterday, I mentioned that if the daily close is above 112,000, the tendency would be to see a continuation of bullish momentum. Unfortunately, the daily close did not exceed 112,000, so the variables have increased.

Here are the possible scenarios I currently have in mind, for analysis with everyone.

Scenario one is that under the premise of favorable data in the next couple of days, it continues to rebound before the FOMC on September 17, reaching a maximum of no more than 117,000, filling the upper weekly FVG, and then dropping. Whether the subsequent drop will break below the new low of 107,000 is uncertain, but the focus is on the rebound to 117,000 first. This movement suggests that the FOMC will be a "sell the news" event, and after the FOMC, it will enter a period of correction until the end of September. After hitting the bottom in late September, it will start the final rise from October.

Scenario two is that if it breaks below 110,000, I expect this to be due to unfavorable data in the next couple of days, or other external negative factors, such as the Middle East or the Russia-Ukraine situation. Then it would continue to drop to the previously mentioned 105,000 range and find support to start rebounding. This would currently be at the daily EMA200 level, and it is also the 0.618 of the entire upward segment (from April 7 to August 14), making the likelihood of support very high at 105,000.

Further extrapolating, if scenario one plays out and it rebounds to 117,000 before dropping, it can be subdivided into two situations: not breaking below 107,000 and breaking below 107,000.

If it does not break below 107,000, then we can confirm that 107,000 is the major bottom of the entire correction, and after building a base in the 107-110 range, it will directly start the subsequent rise. This is the most favorable situation for bulls at the moment.

If it breaks below 107,000, then it forms an ABC corrective decline. The drop from 124,600 to 107,000 is the A wave of the decline, the rebound from 107 to 117 is the B wave, and after the rebound ends, it undergoes a "C wave" decline. I believe the key position is at 96,500, corresponding to 1.618, which also aligns with the 0.5-0.382 correction range of 100,000-93,000. Therefore, I think the likelihood of this being the endpoint is quite high.

If scenario two plays out and it breaks below 110,000, I believe the most probable situation is that it drops to 105,000 and then rebounds to at least the 112 range. That is, there will be a significant rebound in the 105-112 range, especially for altcoins (as we can see that altcoins have been relatively strong compared to Bitcoin recently). A low probability is that it directly drops to the double daily Vegas range of 99-96,500, completing the entire adjustment directly.

As for my personal inclination, I tend to favor a rebound to the 117 range first, treating the FOMC as a "sell the news" event for a correction. For me, this is an event with over 60% probability.

If it directly breaks down from here, then after breaking below 110,000, most altcoin long positions will break even, and I will wait to try to go long again in the 105 area.

Currently, the most uncertain aspect is whether there will be a final drop below 100,000, and whether such a correction will occur. Opinions in the market on this issue are very polarized. I believe that if such a drop occurs, it would be a good opportunity to buy the dip. However, if such a drop does not ultimately happen, one must keep up with the rise; otherwise, if the final drop does not occur, it would result in missing out on the subsequent market, which would be a loss.

So right now, I might still have a cautiously bullish mindset, with more aggressive profit-taking and breakeven long strategies.

If the daily closes above 112 for two consecutive days, it will greatly increase my confidence in reaching 117, whereas before that, I only had a 60% confirmation rate.

This article is sponsored by #BCGAME | @bcgame @bcgamecoin.

16.85K

28

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.