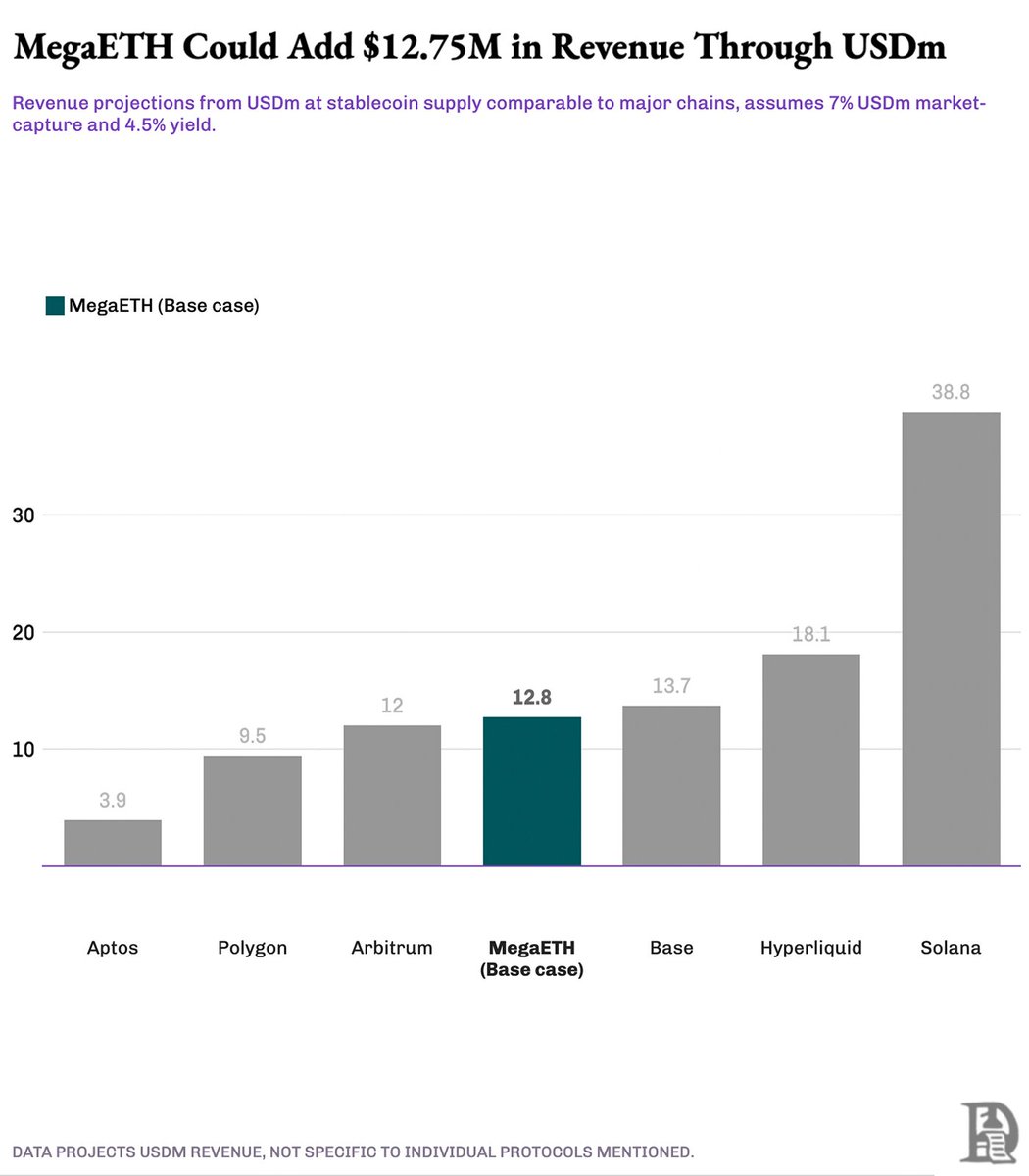

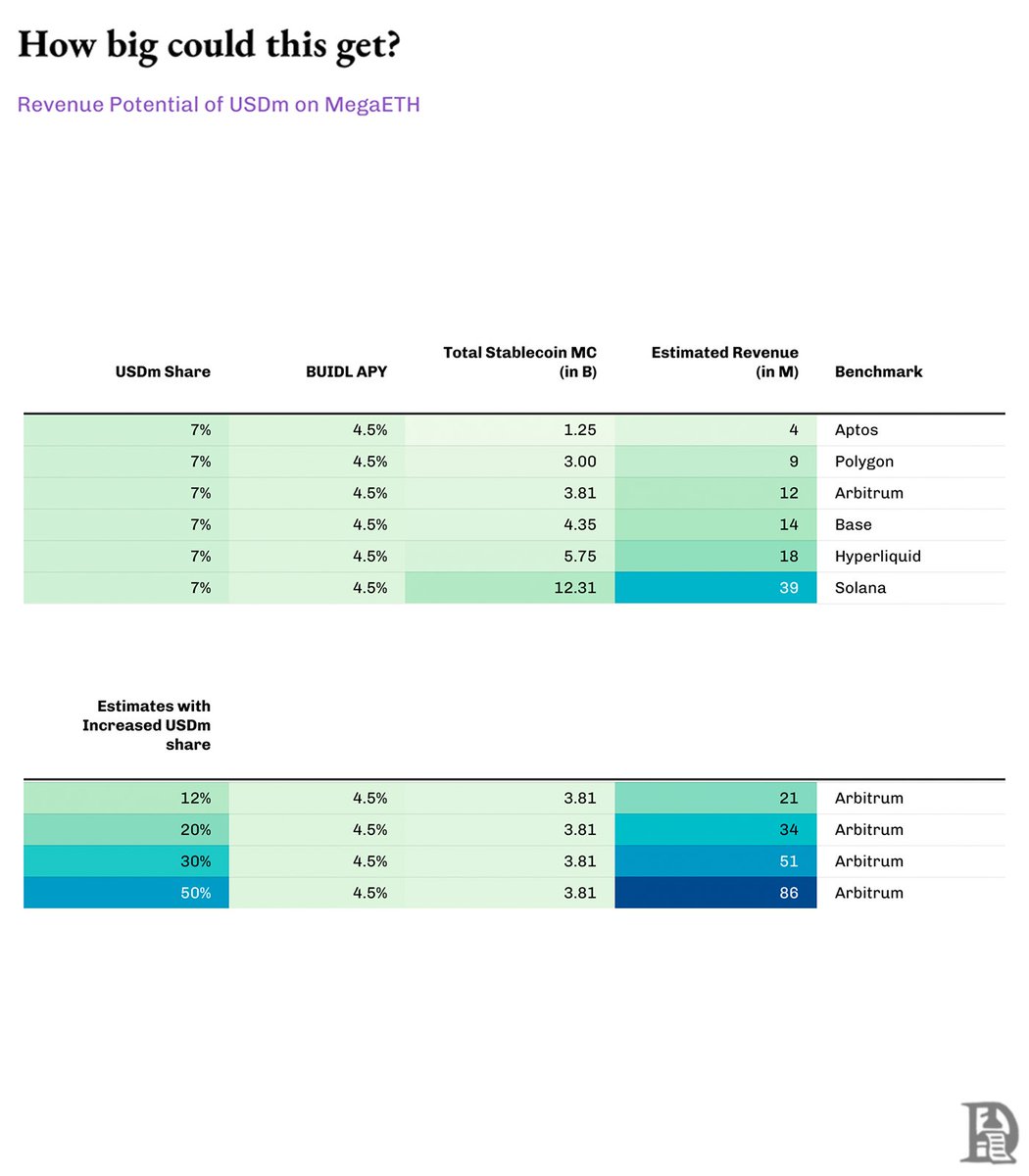

With USDm, MegaETH is borrowing a page from the Fed’s playbook of using seigniorage to cut costs for the US economy. What is seigniorage? Think of it this way: if it costs the U.S. Treasury just 5 cents to print a $1 bill, that leftover 95 cents is pure profit, known as seigniorage. Additionally, when central banks issue $100 of new money, they typically buy $100 worth of Treasuries. The interest earned on those Treasuries is also broadly seigniorage. This “profit” allows governments to earn revenue curbing the need to raise taxes. Ethena captures a similar form of seigniorage through its secondary digital dollar, USDtb. The stablecoin is backed ~2/3rd by BlackRock’s BUIDL fund, ~1/3rd by USDC, and a small amount by USDT. Simply by holding a majority of reserves in BUIDL, Ethena quietly generates yield. USDtb reserves have so far provided $25M in revenue to Ethena, most of it in the last 5-6 months. MegaETH’s new stablecoin, USDm, takes this concept and gives it a network-level...

Show original

7.99K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.