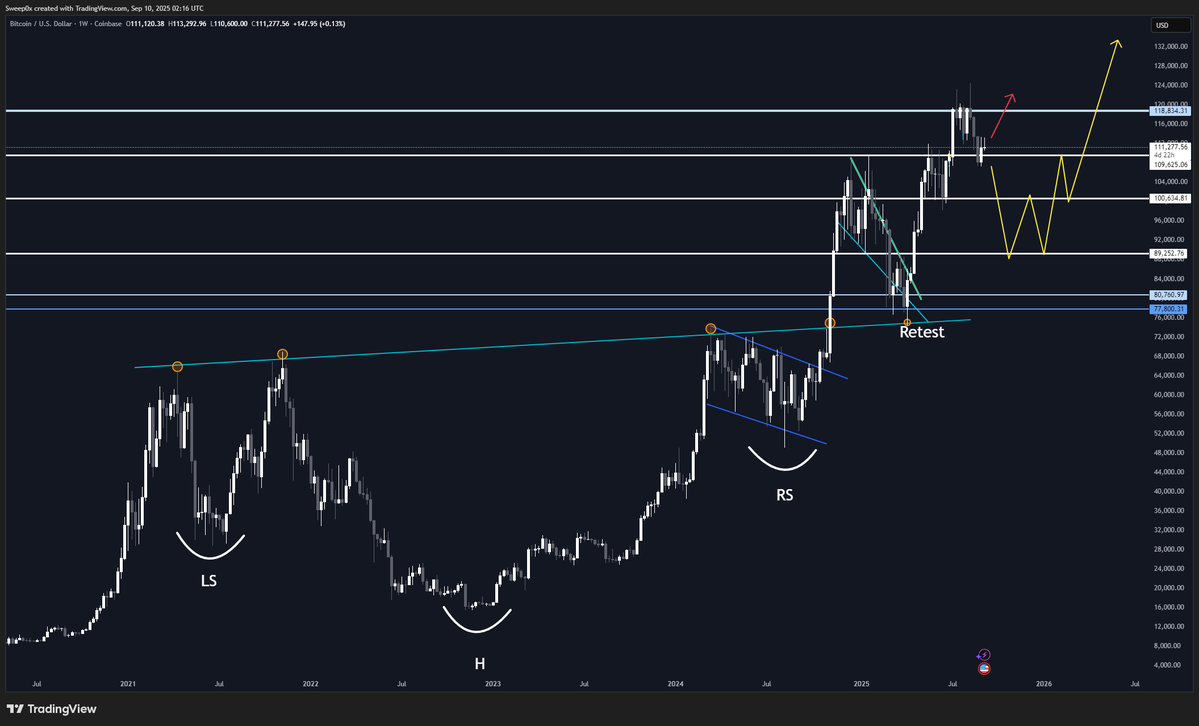

Markets aren’t ready for what rate cuts actually mean. Most people see “rate cuts = bullish.” Reality is the first cuts are usually super messy Volatility first, downside first. They happen when the economy’s already flashing warning signs and liquidity dries before it floods. Stocks are at ATHs. And whether retail feels it or not, BTC is also at cycle highs thanks to ETF flows. In past cycles tops came from retail blowoffs + parabola charts. 2025’s different. Institutions are driving this one. BTC ETFs smashed records, ETH ETFs followed, SOL/ADA/XRP/SUI only bounced because of filings. For all we know, regulation already “saved crypto,” the chosen coins pumped, and a local top is already in. BTC supply shock → steady inflows + leverage build → ETF bid drives institutions in → SOL & L1s revive → perps/derivs liquidity cycle → election narratives + retail chase → local top risk into rate cuts. In order for the US to adopt crypto they need much more time to size in and this is a...

65.91K

166

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.