As mentioned earlier, at the end of August, it was observed that ETH's leading effect was weakening. In the medium and long term, I am still optimistic about ETH, but it seems that there is a lack of momentum recently, and after thinking about it, I gradually exchanged 30% of the ETH long position to several altcoins, which I think the fundamentals are very good and in line with the current mainstream narrative target, to enrich the long portfolio. I chose $XPL, $Hype, $ENA, $Eigen, $Bonk and $Ondo, which I am still watching, and will take the time to write about the reasons why I am optimistic about them, and this article will talk about @eigenlayer first. In the past two months, it can be found that there are many ETH-based copycats in the strong currency, which is very logical. The ETH altits are divided into several categories, mainly L2-related, DeFi-related and Restaking-related, and the first two types of high-quality targets have risen a lot. The launch of EigenCloud has...

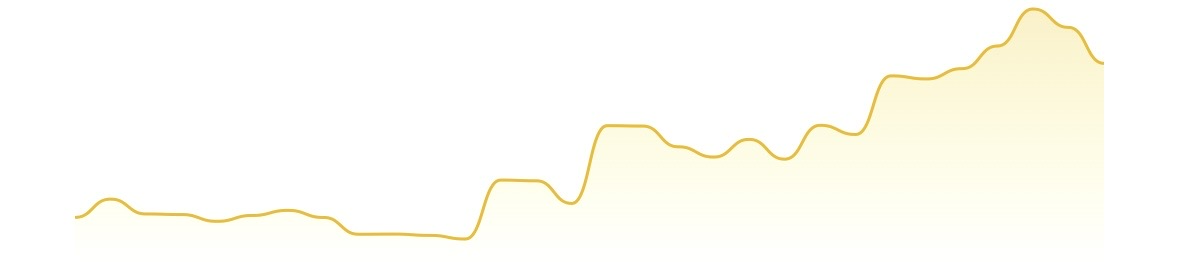

Just in the past month, I will summarize the strategy of "going long ETH and shorting a package of altcotts". Overall, this idea is very successful, ETH continues its strong performance, and for most of the month, other altcoins cannot rise ETH during the rise period, and the decline will exceed ETH during the decline. It can also be seen intuitively from the data that ETH. D has increased from 12% to 14.4%, and only 18 of the top 200 tokens on CMC by market capitalization have surpassed ETH in the past 30 days. The biggest advantage of this strategy lies in its robustness in the face of market fluctuations, even if ETH has experienced three pullbacks of more than 10% during the period, the return curve in Figure 2 still maintains an overall upward trend, which also makes the psychological pressure of hedging much less than unilateral long under the same position size. The key to the hedging strategy is to choose weak altcoins, according to the beginning of August, ETH from 3700 to...

223.09K

430

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.