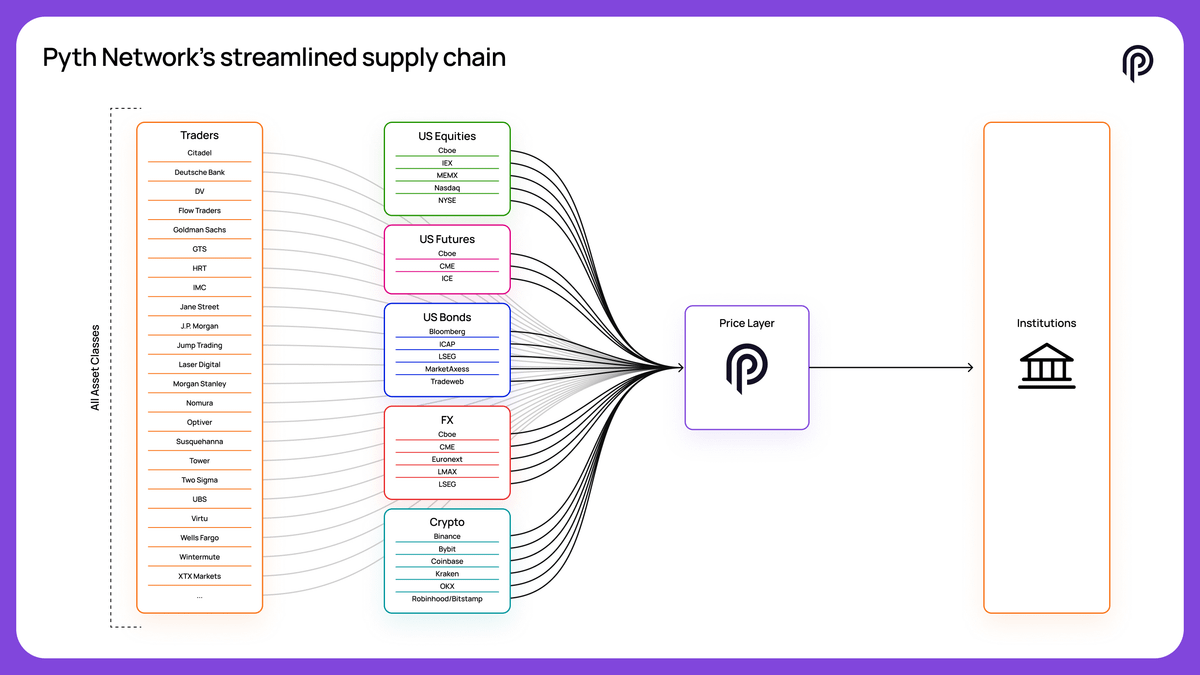

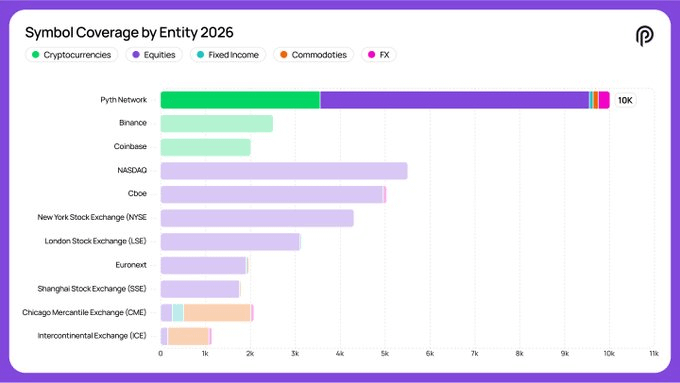

Something interesting is happening in market data ✍️ Everyone in DeFi already knows @PythNetwork It is the oracle layer that powered over $1.6T in trading volume, captured the majority share of DeFi derivatives, and integrated with hundreds of protocols. In many ways, it became the backbone of onchain markets. But that was just the warm-up. The next step is much bigger. $PYTH is now targeting the $50B institutional data market. This space has been controlled for decades by a handful of giants. Most of the value is siphoned by middlemen who repackage and resell the same data. The proposal is simple ➡️ connect directly to the source, remove unnecessary layers, and deliver prices straight into institutional systems. What sets it apart is the quality of the feeds. Instead of recycled data, they come directly from firms like Jane Street, Virtu, Cboe, and LMAX. This is not only useful for DeFi, it is the kind of information that banks, funds, and regulators rely on for risk models,...

30.72K

71

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.