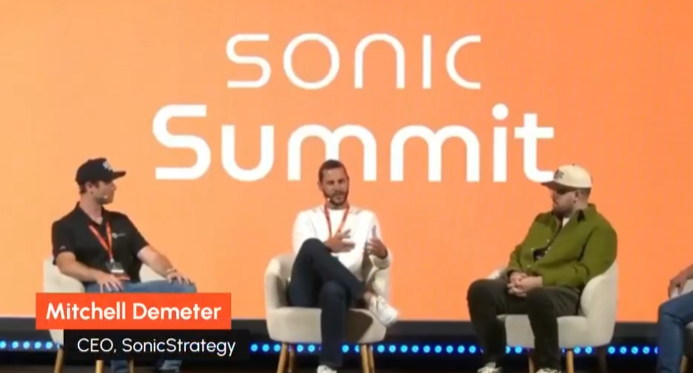

Just saw @SonicLabs share an interview with MitchellDemeter, CEO of Sonic_Strategy. Mitchell explains how DATs help traditional investors access Sonic without worrying about custody. This includes Brokerage Access and Digital Asset Proxy. In addition, there is the opportunity to enjoy Staking/DeFi Yield. Capital that is stuck due to compliance or other barriers can now be used in a “clean” way. Seeing this approach, I think this is a big step forward for bridging between DeFi and traditional finance. I just saw @MavrykNetwork share what they've built. They're building a full-stack Layer-1 for RWAs + DeFi. Mavryk Wallet enables users to self-custody their assets and seamlessly access Web3. Equiteezdotcom offers the opportunity to fractionalize real-world assets. MavenFinanceDAO provides DAO-powered, compliant lending & borrowing. Mavryk Nexus brings it all together, bringing over $10B of RWAs on-chain truly impressive. @SentientAGI just shared about GRID, a network that turns...

2.56K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.