BTC's descending channel is about to break through, but it's still a little bit short...

This situation is more embarrassing, for those who use the standard channel, it has indeed been broken, but for people like me who like to add a ±0.25 expansion channel, the possibility of a false breakthrough cannot be ruled out...

U.S. stocks have been falling yesterday, BTC has risen against the trend, which is really a bit like the feeling of the tariff war, with funds buying spot in advance...

Therefore, I am still more inclined to see the confirmed breakthrough here.

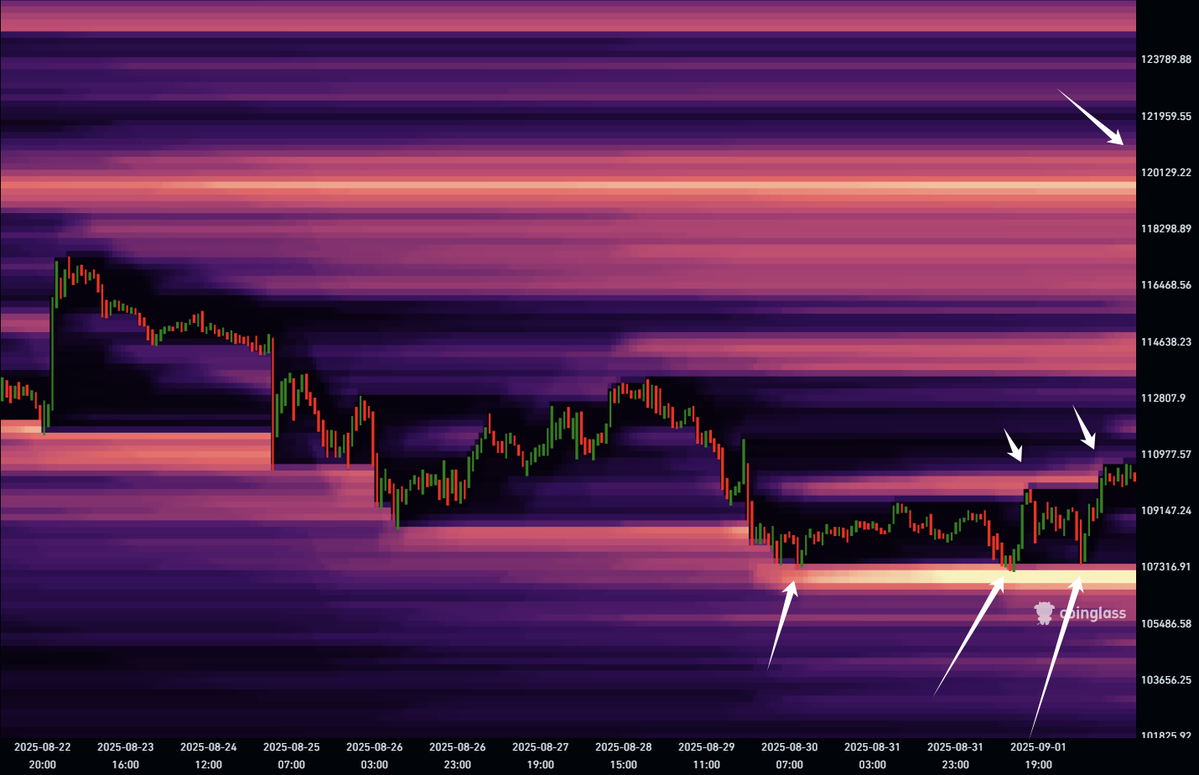

BTC tested downwards at the position of 107k~108k 3 times without triggering a long liquidation market, and turned around and began to liquidate the bears in small amounts...

In my opinion, this is a sign that someone is supporting the spot market, as for the purpose, it is nothing more than seeing a large amount of short liquidity piled up on it, and I didn't want to eat it, but the more I raised it, the fatter it became, and I had to eat...

In the market with frequent futures trading, the emergence of trend markets needs to exhaust futures liquidity, if large funds want to accumulate funds, futures bulls need to be completely desperate, spot bulls are cut at a low level, otherwise there is no opponent.

Similarly, if large funds want to ship, futures shorts need to disappear completely, and spot bulls take over at a high level...

Spot pull, futures set, spot smashing, futures earning, this gameplay is indeed a common means used by market makers.

Therefore, at this stage of BTC, if the ultimate purpose of large funds is to ship, we are likely to see the market inexplicably pull the market, directly penetrate 12w, and then slowly fall down in a few days until it breaks a new low...

In extreme terms, if there are no futures in this market, it may not be able to reach the current price level at all, short losses are equal to buying at a high level, long losses are equal to selling at a low level, in the bull market, in addition to the main force of spot bulls is the leader, futures shorts are often the main contributors to the second rank.

109.6K

87

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.