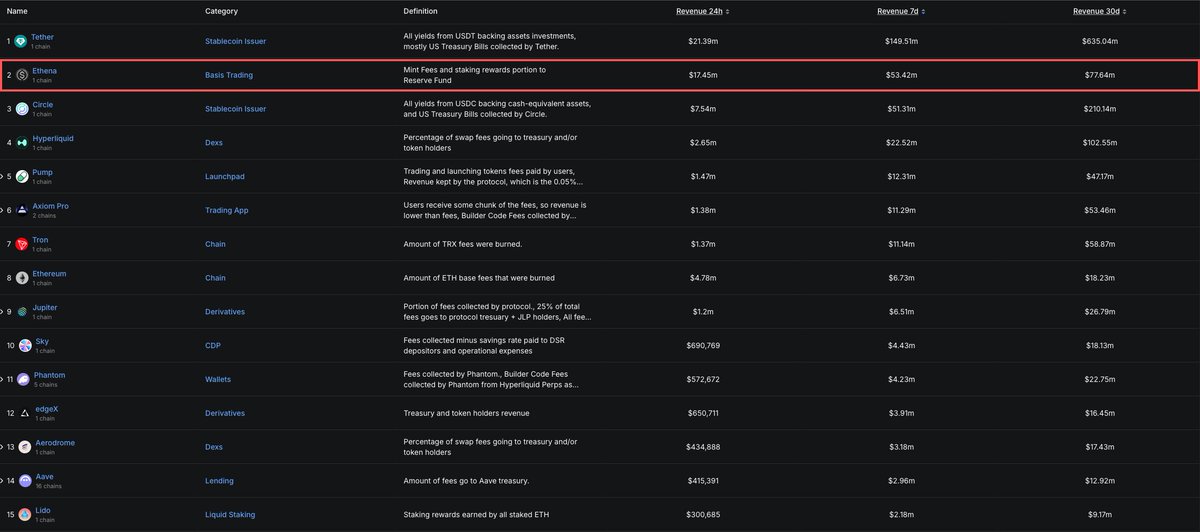

JUST IN: @ethena_labs booked $53.4M in revenue over the past 7 days.

Second only to Tether and ahead of Circle, Ethereum, Hyperliquid, and Pumpfun.

Few protocols have catalysts like these on the horizon:

⇨ Rate cuts are pushing yield-seeking capital out of traditional markets and into USDe.

⇨ USDe supply at an ATH drives revenue directly from staking yields and funding rates.

⇨ An approved fee switch for $ENA stakers creates direct upside from this revenue growth.

⇨ @etherealdex mainnet rollout has started, adding a direct trading venue for USDe and a new source of protocol revenue.

⇨ The @convergeonchain launch will provide an institutional-grade EVM L2 for RWAs, using USDe/USDtb as gas and secured by staked ENA.

4.5K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.