Is this the bull tail?! I haven't even gotten on the train yet 😂

Since being ruthlessly taken down by my shameless family back in May, I haven't been able to regain my trading status, and my position has remained weak at 1/3.

At the beginning of July, while adjusting my positions for the upcoming altcoin season, I didn't stick to the barbell strategy by allocating to JLP, nor did I buy back the Fat Penguin NFT that I sold at a high for profit; I only focused on the technical narrative by allocating to the AI x Crypto sector with $C and $REI, the ZK sector with $LA, and the NFT sector with Degods. Among these, only Degods is in a profitable state.

Fortunately, $SOON had a surge in August, saving my investment portfolio's yield curve during the altcoin season from July to August.

Although I don't quite agree with the "bull tail theory," I believe the altcoin season is likely to come to a sudden stop in September, but it will be a healthy adjustment. Right now, there aren't any risk points like the previous cycle's Luna or FTX that could trigger a chain reaction.

If there is indeed a sharp drop in September, it would precisely provide me, as a sidelined retail investor, with an annual-level opportunity to allocate to altcoins, and this time I will definitely adopt a barbell strategy of Beta (JLP) + Alpha (emerging AI x Crypto projects) to capture the upward opportunities in the autumn market.

Moreover, I will learn from the previous experience of "narrative is king" subjective trading and introduce a self-built and continuously iterated Multi-Agent market analysis system as an aid for selecting investment targets.

From the perspective of the big cycle, the bull market is definitely not over, and Biden Sr. has a good saying: "You can't just say it's a bull market when Bitcoin rises"

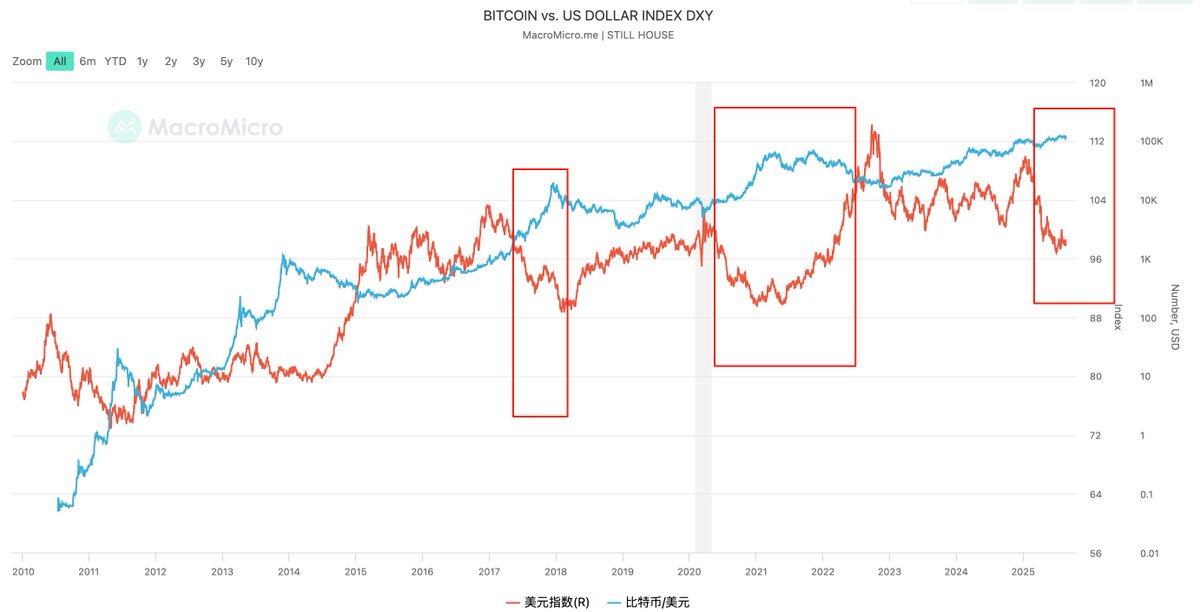

Bitcoin and the US dollar index often show a negative correlation: the US dollar is strong, Bitcoin is weak; The dollar is weak, Bitcoin is strong.

2017 bull market: The US dollar index fell from 103 to below 90, and Bitcoin rose from $1,000 to nearly $20,000 in the same period.

2020–2021 bull market: The US dollar index fell from 103 to 90 after the pandemic, and Bitcoin rose from more than 10,000 to 69,000.

2022 bear market: The Fed raised interest rates aggressively, the US dollar index hit a 20-year high (114), and Bitcoin fell below $20,000.

Strong dollar cycle (Fed interest rate hikes, global capital flows back to the US): Emerging market capital outflows, risk assets under pressure, and Bitcoin tends to weaken.

Weak dollar cycle (Fed rate cuts, dollar depreciation): Global funds look for income opportunities, liquidity is flooded, and Bitcoin, gold and US stocks tend to strengthen at the same time.

At present, the Federal Reserve is in the process of shifting from tightening to easing, and the US dollar index is at a relatively high level but has entered a volatile downward range, which is good for Bitcoin in the medium and long term.

41.49K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.