Previously, we discussed that the price difference between $ZRO and $STG is essentially a measure of the market's confidence in whether LayerZero can successfully acquire Stargate. However, the plot has thickened in the past couple of days, as Wormhole has jumped in, turning this from a mere acquisition into a full-blown bidding war. So let's continue with our previous line of thought and pull out the timeline to review how the market has been pricing this step by step.

➤ Phase One: LayerZero's Offer

LayerZero's terms are 1 $STG = 0.08634 $ZRO.

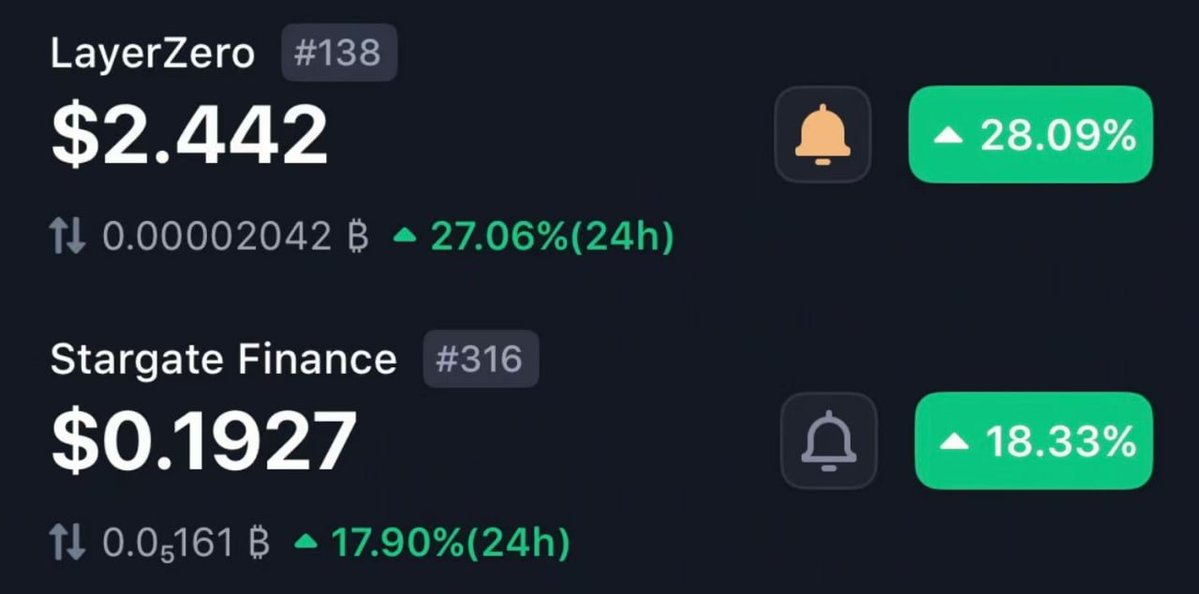

At that time, $ZRO was around $2.44, which implies an intrinsic price for $STG of $0.21.

In the actual market, $STG was around $0.19, indicating an 8.5% discount.

👉 The signal is clear: everyone thinks the deal is likely to go through, but there's still some risk buffer.

➤ Phase Two: Convergence of Price Difference

Later, $ZRO dropped to $2.25, which changed the implied price of $STG to $0.194, while $STG itself also fell to $0.18, narrowing the gap to 7.4%.

👉 This step is quite intuitive: the smaller the price difference, the more the market believes this can be resolved.

➤ Phase Three: Wormhole Suddenly Enters the Scene

Just as the market was beginning to accept LayerZero's logic, Wormhole suddenly announced:

① They believe LayerZero's offer undervalues Stargate;

② They provided data support—$4 billion in bridging volume in July, a tenfold year-on-year increase, with a $TVL of $345 million, and an expected annual revenue of $2 million;

③ They also demanded a pause in voting to submit a higher bid themselves.

👉 At this point, the anchor set by LayerZero was directly broken, and the market began to calculate another equation: is there a possibility of even higher bids?

➤ The pattern is quite clear:

1) Initially, the price difference serves as a barometer;

2) However, once bidding begins, the price difference becomes irrelevant, and the core question shifts to who is willing to offer a higher price.

In other words, this is no longer a simple arbitrage game, but a standard merger auction logic.

🔹 My own perspective:

1) In the short term, the volatility range of $STG will be much larger than before, with the focus of arbitrage shifting from monitoring price differences to monitoring premiums. Early movers may directly push up the price.

2) In the medium to long term, Stargate itself is cross-chain infrastructure with solid data growth, so buyers will not be lacking. Even if LayerZero fails to acquire, Wormhole's involvement effectively provides a floor for token holders.

So now, the play with $STG has changed:

👉 Either bet on short-term premiums,

👉 Or wait for the merger to finalize and see how long-term value is reassessed.

I just saw the news that LayerZero wants to acquire Stargate, with an offer of 1 $STG for 0.08634 $ZRO. Based on the prices of $ZRO yesterday and today, we can use the price difference to gauge the market's confidence in this acquisition, which is quite interesting.

Yesterday, the price of $ZRO was about $2.44, which translates to an implied price of about $0.21 for $STG, while the actual price of $STG was around $0.19, resulting in a price difference of about 8.5%. This gap reflects that the market still has some doubts about the acquisition going through smoothly, but overall confidence is still relatively good.

Today, $ZRO dropped to $2.25, corresponding to an implied price of about $0.1943 for $STG, while the actual price of $STG fell to $0.18, narrowing the price difference to 7.4%. The smaller gap indicates that the market's recognition of this acquisition has increased, and investors are more inclined to believe that the proposal will pass smoothly.

This price difference is actually a pretty good indicator: a large gap means the market is worried about high risks; a small gap suggests that the transaction is more likely to succeed. Both 7.4% and 8.5% price differences are not considered large, indicating that most people believe this acquisition will ultimately proceed under the current terms.

Of course, risks still exist, such as uncertainty in the voting results and fluctuations in the ZRO price, which could all affect the final outcome. In the short term, the emotional fluctuations brought by such news are significant, and there is considerable room for speculation, but ultimately, we still need to focus on the voting and actual market feedback.

To summarize: the price difference has narrowed from 8.5% to 7.4%, indicating that the market's confidence in LayerZero's acquisition of Stargate is gradually increasing. Everyone can take this as a reference indicator, combining voting dynamics and market conditions to flexibly adjust their strategies.

The left side of the chart is yesterday's, and the right side is today's.

5.69K

18

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.