Yesterday, @Lighter_xyz's AMA confirmed that the Private beta phase will end in 3-5 weeks, after which it will officially enter the Public stage, and the TGE is definitely set for Q4.

Currently, Lighter's TVL is close to 300M, and Open Interest has been steadily increasing. The opening FDV of 1B is also quite a conservative estimate.

Additionally, the project team commented the day before yesterday that "the airdrop to the community will be substantial." The airdrop ratio of 20% might be underestimated; if they generously give 30% like @HyperliquidX, then there will likely be a group of people getting rich.

If you're looking to score points, you need to seize the time. There are basically three methods to score points:

The first method is normal trading; just trade contracts on Lighter as you would on an exchange. Currently, the opening and closing costs are both 0, so everyone can actively bring their contracts over to play and score points at the same time.

The second method is to open contracts on two exchanges simultaneously, going long on one and short on the other, which allows you to score points with almost no loss. A more advanced strategy could involve some arbitrage to earn funding rates.

The third method is a very extreme and aggressive approach, where you can exchange money for points. Some people got rich on Hyperliquid because of this, but I won't disclose everything here, as there is indeed a possibility of losing money. I only use small amounts for testing.

I'll send out three more Invite Quotas~

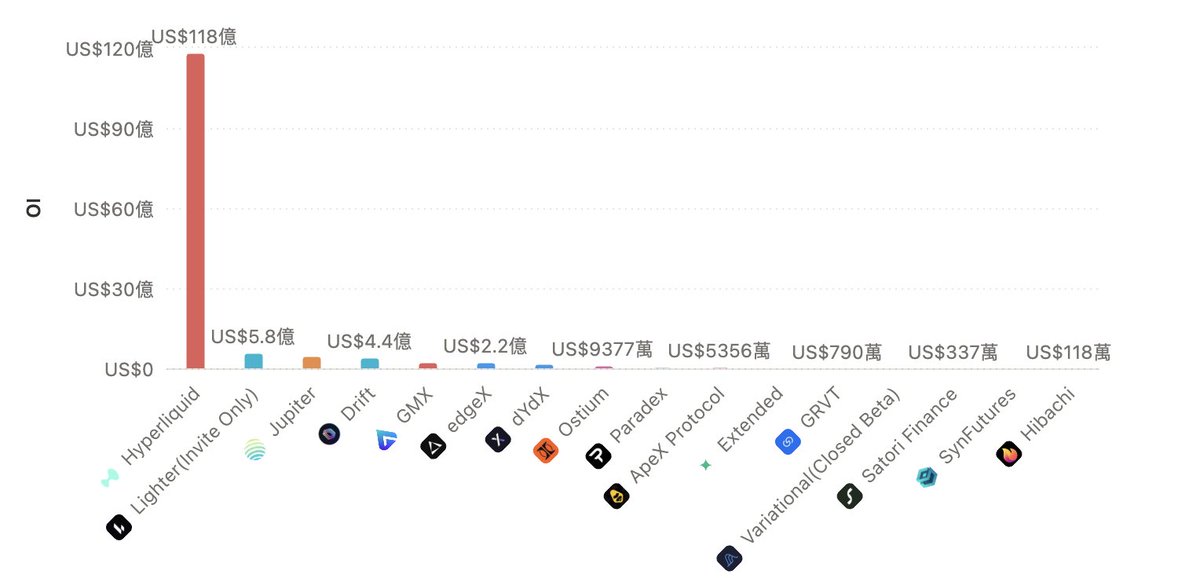

Currently, @Lighter_xyz's Open Interest has climbed to the second place in the market, only behind the leader @HyperliquidX. Although there is still a long way to go to catch up with Hyperliquid, their growth rate has indeed been very fast recently.

Lighter previously mentioned that they would allocate 50% of the tokens to the community, so let's assume 20% will be airdropped to users.

Currently, they distribute 250k points weekly, assuming the TGE at the end of the year, the total points would be 12 million.

If the opening FDV is 1B, then each point would be worth 17 dollars. The distribution formula for points changes weekly, but it is adjusted based on your Open Interest and PnL.

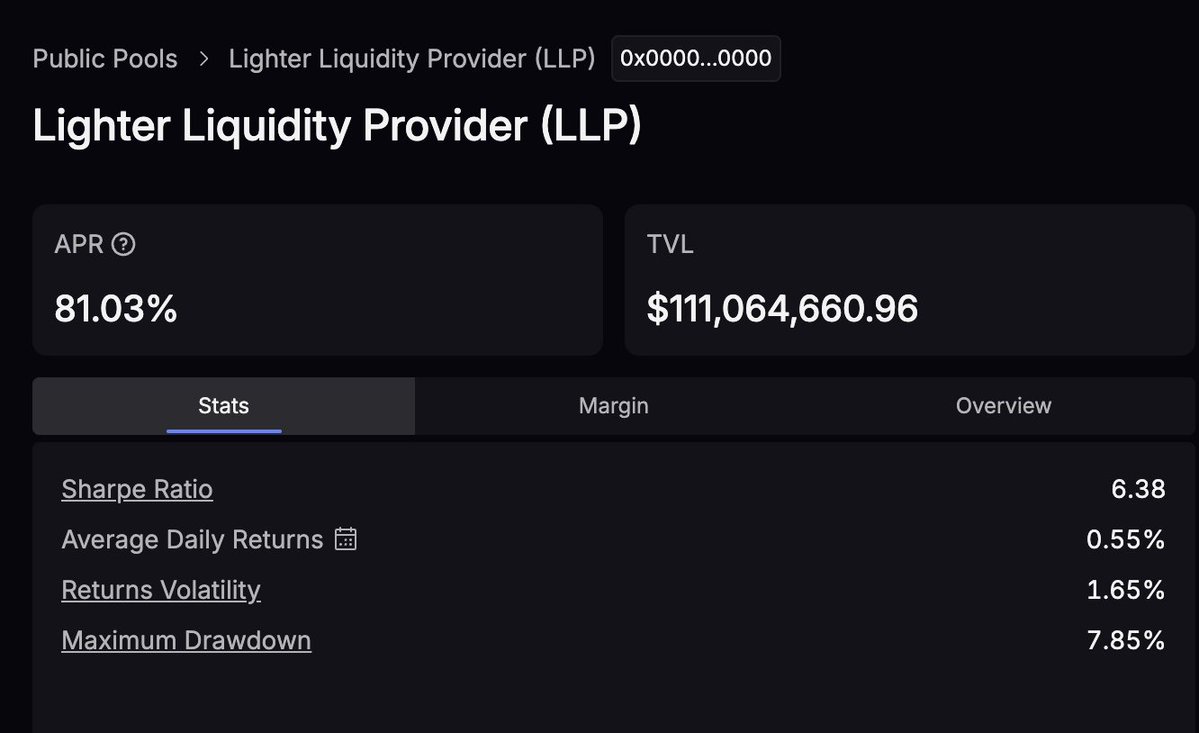

Additionally, their LLP returns are performing very well, with an 81% APR, a Sharpe Ratio of 6.38, and a maximum drawdown of only 7.8%, which basically outperforms all the funds in the market.

Whether Lighter can replicate Hyperliquid's success is hard to say, but for now, it is still in an Invite-only phase, and it hasn't reached a very competitive level yet, making it relatively easier to earn points.

7.84K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.